Western Europe Stevia Market Analysis by Extract, End-use Industry, and Country, 2025-2035

Overview:

The Western Europe market for stevia products is projected to be valued at USD 184.5 million in the year 2025. Analysis indicates a projected compound annual growth rate (CAGR) of 7.3% between 2025 and 2035, reaching an anticipated value of USD 378.9 million by the conclusion of that period.

Key drivers fueling the expansion within Western Europe include a rising awareness of health and wellness among consumers, increasing demand for sweetening alternatives derived from nature, and shifting lifestyles focusing on healthier choices.

The surge in market momentum is closely tied to the growing understanding of potential health implications associated with excessive sugar consumption. With the prevalence of conditions such as obesity and diabetes escalating across several Western European nations, individuals are actively seeking healthier substitutions for traditional sugar.

Stevia, recognized as a naturally sourced, zero-calorie sweetener, is becoming a preferred alternative to artificial sweeteners and refined sugar. It offers a viable option for individuals aiming to reduce their caloric intake while still enjoying sweet foods and beverages.

Furthermore, the increasing embrace of plant-based dietary patterns and a general preference for natural ingredients are contributing factors to the industry’s growth. As consumers lean towards products with natural origins, stevia, extracted from the plant’s leaves, is experiencing heightened demand.

The food and beverage industry plays a significant role in this expansion. Companies are incorporating stevia into a wider array of products, spanning from soft drinks and dairy items to baked goods and snack foods, to cater to the health-conscious consumer base. Regulatory approval within the European Union has further supported stevia’s market penetration and popularity.

Another influencing factor is the growing environmental consciousness. Stevia possesses a notably smaller environmental footprint, requiring less water and land for cultivation compared to conventional sugar crops. Given the increasing importance of sustainability in both consumer priorities and corporate strategies, stevia’s role as a sustainable solution appeals broadly to consumers in Western Europe.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 184.5 million |

| Industry Value (2035F) | USD 378.9 million |

| CAGR (2025 to 2035) | 7.3% |

Sales Dynamics and Consumer Preferences Across Application Areas

The Western European stevia market’s dynamics and purchasing patterns are significantly shaped by various end-use sectors, including food and beverages, pharmaceuticals, and personal care.

Within the food and beverages segment, there is a pronounced increase in the demand for products that are healthy, low in calories, and free from added sugar. Consumers are generally exhibiting greater health awareness, leading them to seek products characterized by clean labels and natural compositions. This trend is evident in the expanding application of stevia in items such as soft drinks, confectionery, and dairy products.

Achieving the right balance of natural taste and sweetness is critical, as is the ability to provide sweetness without compromising flavor quality. Some consumers perceive an aftertaste in stevia that is less appealing than that of sugar, prompting efforts by manufacturers to refine the taste profile of stevia-based products.

In the pharmaceutical and nutraceutical industries, stevia’s adoption as a natural sweetening agent for health-focused products and supplements is on the rise. Its perceived health advantages, particularly concerning blood sugar regulation and weight management, are important considerations for consumers in these sectors. Product functionality, safety standards, and regulatory compliance are paramount factors influencing purchasing decisions here.

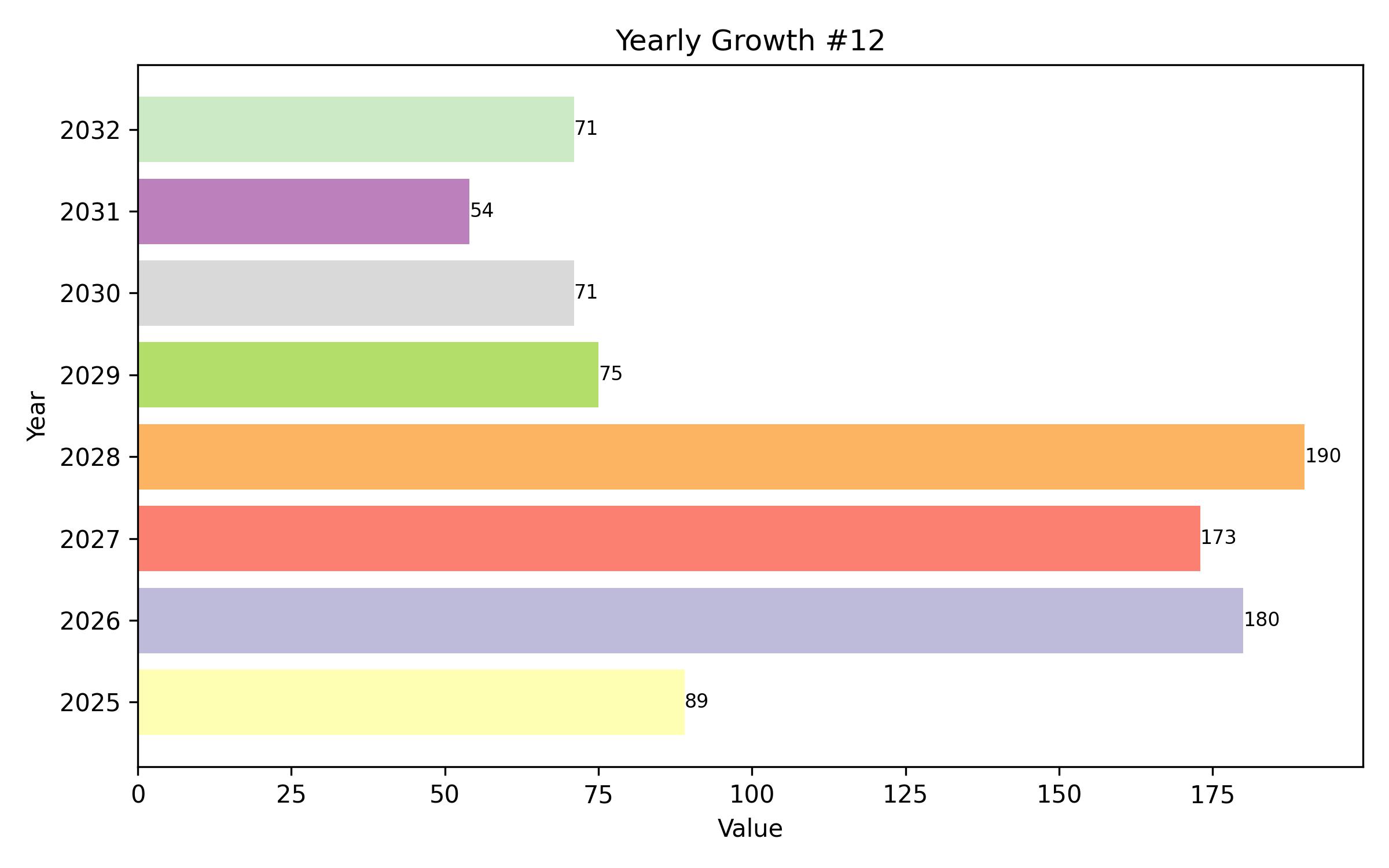

Market Evolution from 2020 to 2024 and Future Projections 2025 to 2035

The Western European market experienced notable transformations between 2020 and 2024, influenced by evolving consumer preferences, regulatory adjustments, and advancements in production methods. A primary shift was the heightened demand for natural, reduced-calorie sweeteners, driven by increased health awareness among consumers, largely in response to the rising incidence of lifestyle-related health issues such as obesity and diabetes. This was particularly apparent within the food and beverage industry, as businesses scaled up the incorporation of stevia into their product lines to address the growing need for sugar substitutes.

Looking ahead from 2025 to 2035, a reinforced emphasis on sustainability is anticipated to further amplify the demand for plant-based sweeteners like stevia. As sustainability considerations increasingly guide both consumer behavior and corporate strategies, stevia’s positioning as an environmentally friendly alternative is expected to strengthen its market presence.

Moreover, ongoing research efforts are directed towards developing methods to yield higher-quality stevia at reduced costs. It is foreseen that advancements in biotechnology may eventually lead to genetically engineered varieties of the plant, potentially making stevia an even more economically viable sweetener option. Such progress could result in significant price reductions, accelerating stevia’s adoption across new industry sectors.

Comparative Industry Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 (Past Trends) | 2025 to 2035 (Future Trends) |

|---|---|

| Increasing health concerns regarding obesity, diabetes, and other lifestyle diseases spurred a demand for healthier, low-calorie sugar alternatives, prompting increased usage of stevia in the food and beverage sector. | A growing global focus on sustainable options will boost interest in stevia as an ecologically friendly alternative to conventional sugar. |

| Regulatory bodies, notably the European Food Safety Authority (EFSA), reaffirmed stevia’s safety, facilitating its market entry and wider consumer acceptance. | As stevia use broadens, more stringent regulations on its production and application are anticipated. Transparency in sourcing and clean-label certification will become crucial to meet evolving consumer expectations. |

| Technological advancements in biotechnology and agricultural practices led to better yields, lower production expenses, and improved flavor profiles, enhancing consumer acceptance. | Biotechnology is set to improve stevia production efficiency, ultimately lowering costs and enhancing the product’s quality and taste, opening doors to wider applications. |

| The product saw increasing popularity across a range of sectors including beverages, baked items, dairy, nutraceuticals, and personal care products. | Stevia is expected to see greater use in plant-based food and beverage products, such as alternative dairy and meat substitutes, as manufacturers cater to the growing trend of plant-centric diets. |

Risk Assessment of the Western Europe Stevia Market

A significant potential risk in the market is the challenge posed by regulatory shifts. Although the European Food Safety Authority (EFSA) has approved stevia as a safe sweetener, changes in regulatory frameworks remain a possible obstacle. The process for approving new sweeteners and food additives can be time-consuming and subject to modifications at both national and EU levels. Alterations in regulations, such as new restrictions or labeling requirements, could influence market access and create compliance challenges for producers.

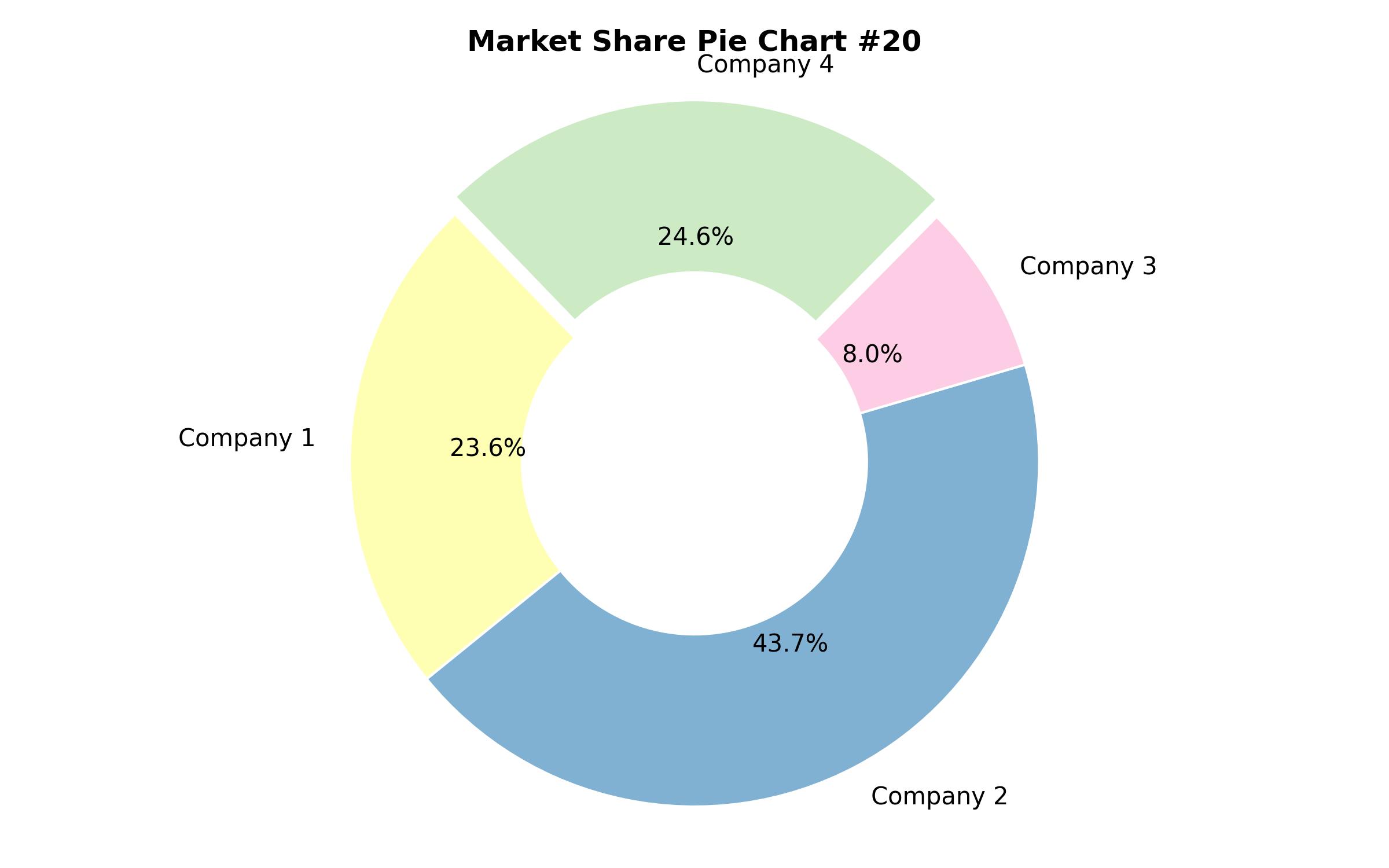

Another potential risk arises from escalating competition as the demand for natural sweeteners grows. Other alternatives, such as monk fruit and erythritol, could potentially capture market share as consumers and manufacturers seek diverse sweetening options. This intensifies the competitive environment and may lead to price reductions, potentially impacting profit margins for stevia producers. Additionally, major players in the artificial sweetener market might expand into offering natural variants, bringing increased competition from established industry participants.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 184.5 million |

| Revenue Forecast for 2035 | USD 378.9 million |

| Growth Rate (CAGR) | 7.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Extract, end-use industry, and country |

| Regional Scope | Western Europe |

| Country Scope | Germany, United kingdom, France, Italy, Spain, Netherlands, Benelux, Russia |

| Key Companies Analyzed | Koninklijke DSM NV, Natura, Tate and Lyle Plc., SAS, Evolva Holding SA, Cargill Incorporated, Ingredion Incorporated, Sunwin International, Inc., GLG Life Tech Corp, Archer Daniels Midland Company |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Extract

- Powdered Stevia

- Liquid Stevia

- By End-use Industry

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Other Applications

- By Country

- Germany

- United kingdom

- France

- Italy

- Spain

- Netherlands

- Benelux

- Russia

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Extract

- Powdered Stevia

- Liquid Stevia

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-use Industry

- Food and Beverages

- Pharmaceuticals

- Personal Care

- Other Applications

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Country

- Germany

- United kingdom

- France

- Italy

- Spain

- Netherlands

- Benelux

- Russia

- Germany Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- United kingdom Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- France Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Italy Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Spain Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Netherlands Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Benelux Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Russia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Some Key Players

- Assumptions and Acronyms Used

- Research Methodology