Wavelength Division Multiplexing (WDM) Systems Market: Analysis and Forecast by Type, Application, and Geography Through 2035

Overview:

The global wavelength division multiplexing (WDM) equipment market is poised for substantial expansion in the coming years. In 2025, the market is anticipated to reach a valuation of USD 48.9 billion, driven by increasing demands for higher bandwidth and data transmission capacities. Projections estimate a compound annual growth rate (CAGR) of 6.0% from 2025 to 2035, culminating in a market size of approximately USD 84.4 billion by 2035. This growth is primarily fueled by the expansion of cloud computing infrastructure, the ongoing rollout of 5G networks, and the proliferation of artificial intelligence (AI) applications, each contributing to escalating data traffic.

Advancements in optical networking technologies and the growing adoption of WDM equipment in various industries are significantly shaping the market landscape. WDM technology’s ability to efficiently increase the capacity of fiber optic cables by transmitting multiple wavelengths of light simultaneously makes it a critical component in modern communication networks.

Regionally, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa (MEA) are witnessing robust demand. Countries such as the United States, China, Germany, and Japan are at the forefront of this demand, driven by their advanced technological infrastructure and increasing data consumption.

Key industry players, including Ciena Corporation, Huawei Technologies, Nokia, and Infinera, are leading the market through continuous innovation and strategic collaborations. These companies are focused on developing cutting-edge solutions to meet the evolving needs of the market.

The market’s future trajectory is also influenced by the continuous need for enhanced network performance and the increasing investments in telecommunications infrastructure. These factors are expected to sustain the upward momentum of the global WDM equipment market in the forecast period.

Furthermore, the rising adoption of the Internet of Things (IoT) and the subsequent data explosion are necessitating greater bandwidth capacities, thereby fostering the demand for WDM equipment. This trend is expected to persist, ensuring that the WDM equipment market remains a vital part of the global communication infrastructure.

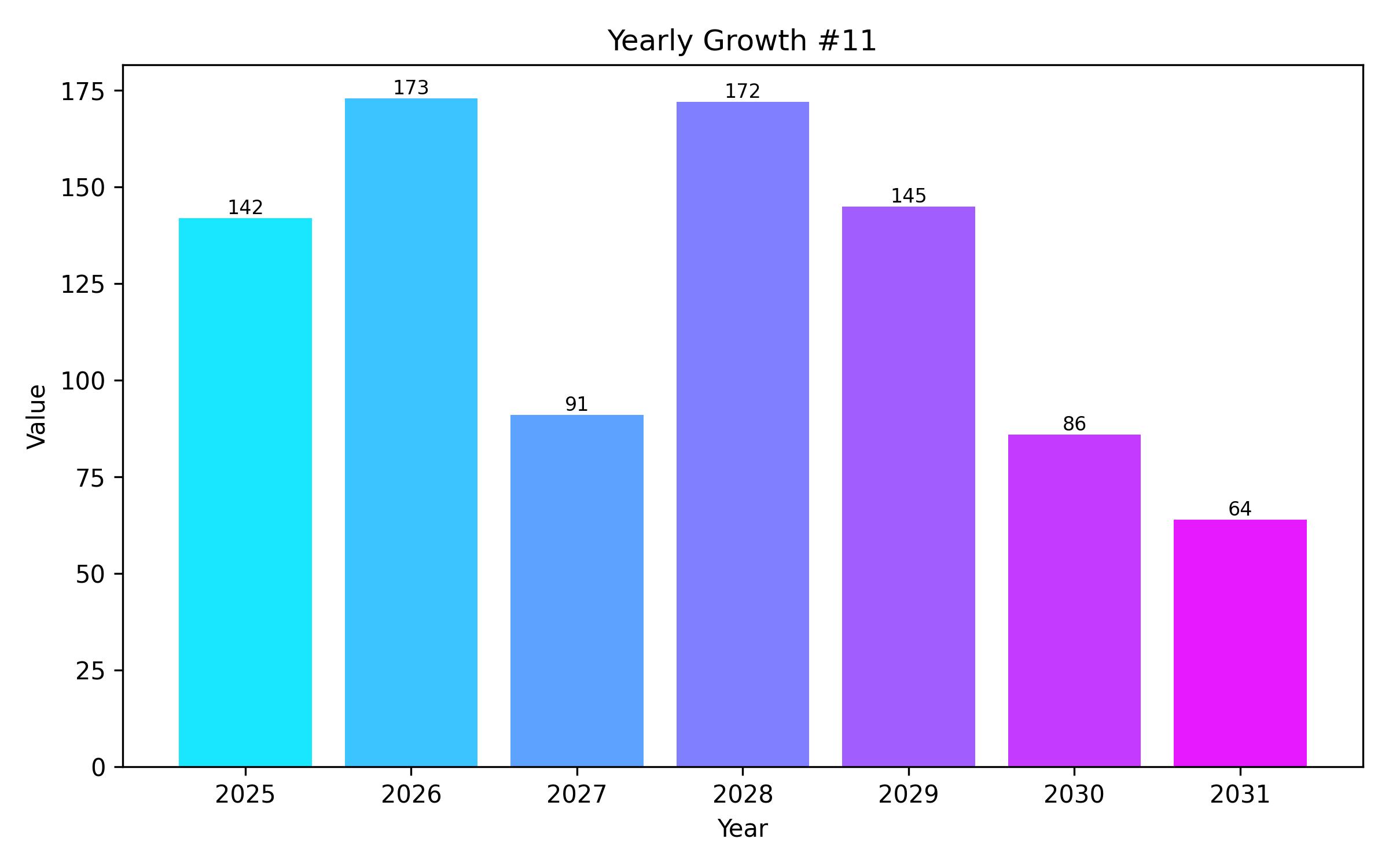

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 48.9 billion |

| Revenue Forecast for 2035 | USD 84.4 billion |

| Growth Rate (CAGR) | 6.0% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, vertical, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Ciena Corporation; Huawei Technologies; Nokia; Infinera; Cisco Systems; ZTE Corporation; Ericsson; ADVA Optical Networking; FiberHome Networks; Juniper Networks; ADTRAN, Inc.; Aliathon Technology Ltd; Fujitsu Ltd.; ALCATEL-LUCENT |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

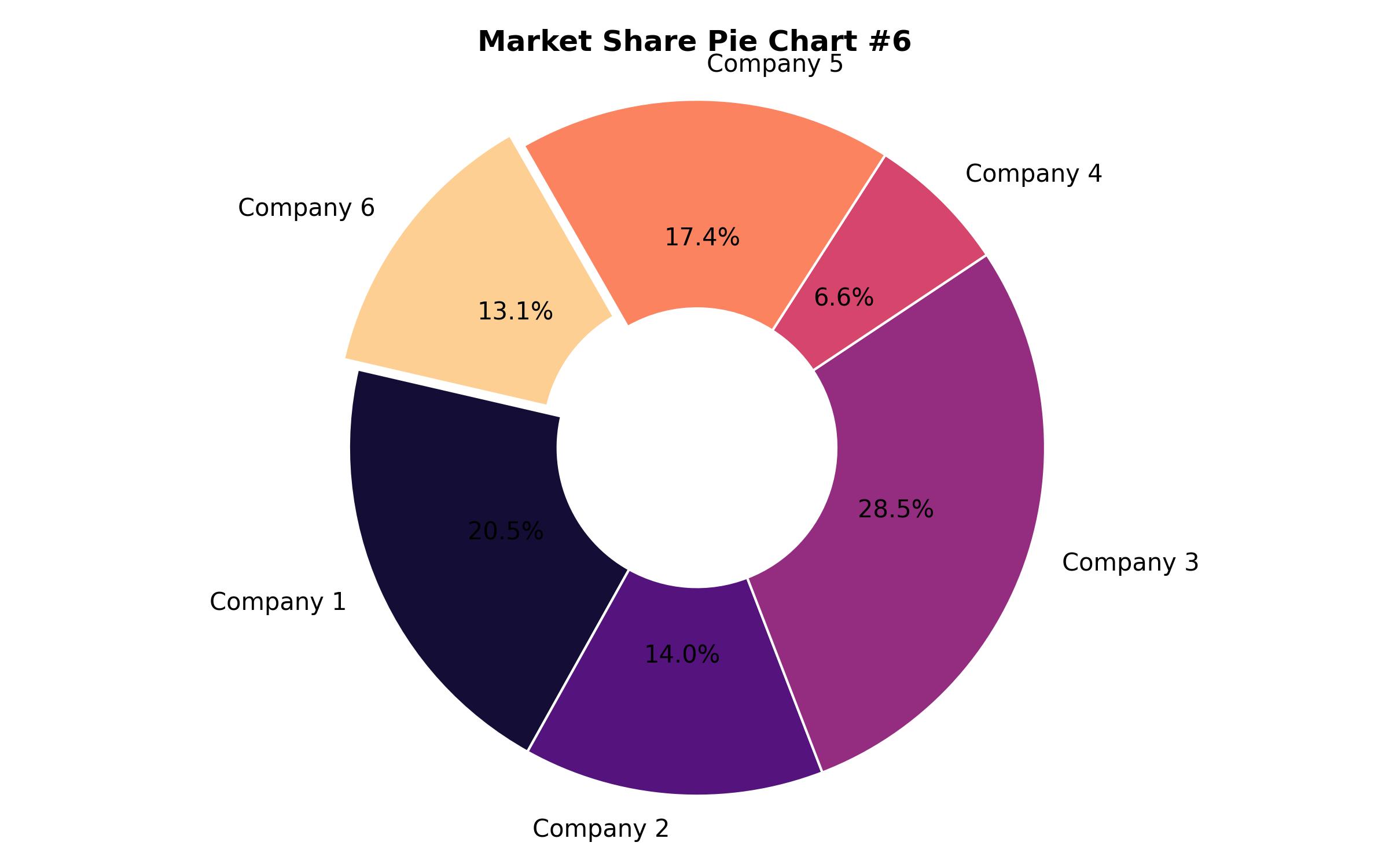

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Multiplexer Type

- Transponders

- Muxponders

- Optical Add-Drop Multiplexers (OADMs)

- Fixed OADMs

- Reconfigurable OADMs (ROADMs)

- By Vertical

- Telecommunications

- Data Centers

- Enterprise Networks

- Government & Defense

- Research & Development

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- WDM Equipment Market Analysis, by Multiplexer Type, 2025-2035

- Transponders

- Muxponders

- Optical Add-Drop Multiplexers (OADMs)

- WDM Equipment Market Analysis, by Vertical, 2025-2035

- Telecommunications

- Data Centers

- Enterprise Networks

- Government & Defense

- Research & Development

- WDM Equipment Market Analysis, by Region, 2025-2035

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America WDM Equipment Market Analysis, 2025-2035

- U.S.

- Canada

- Mexico

- Europe WDM Equipment Market Analysis, 2025-2035

- U.K.

- Germany

- France

- Italy

- Poland

- Asia Pacific WDM Equipment Market Analysis, 2025-2035

- China

- India

- Japan

- Australia

- South Korea

- Latin America WDM Equipment Market Analysis, 2025-2035

- Brazil

- Argentina

- Middle East & Africa WDM Equipment Market Analysis, 2025-2035

- UAE

- Saudi Arabia

- South Africa

- Competitive Landscape

- Market Share Analysis

- Key Player Profiles

- Strategic Recommendations

- Research Methodology

- Assumptions and Acronyms