United States Vehicle Rental Market Analysis by Automobil Type, Consumer Goal, Service Access Method, and Industry Segment – Trends, Prospects, and Outlook 2025 to 2035

Overview:

The car rental industry in the United States is set for consistent expansion, with the market expected to reach USD 35.4 billion in 2025 and grow to USD 56.9 billion by 2035. This growth, projected at a Compound Annual Growth Rate (CAGR) of 4.85% over the coming decade, is primarily fueled by increasing demand for agile transport options and the wide adoption of digital booking platforms.

Both domestic and international travel contribute significantly to market dynamics. The rising preference for renting vehicles over ownership, particularly among business and leisure travelers, is a key demand driver. Furthermore, the convenience offered by mobile application-based rentals and their compatibility with ride-sharing services is enhancing customer experience and boosting industry growth.

Car rentals offer a compelling alternative to vehicle ownership, helping urban residents avoid costs associated with maintenance, insurance, and depreciation. Despite strong potential, the market faces challenges such as high operating costs and volatile fuel prices.

Rising costs for fleet upkeep and vehicle purchases negatively impact rental operators and reduce profitability. Additionally, the increasing popularity of ride-hailing services and car subscription schemes intensifies market competition, potentially hindering expansion.

Environmental concerns and more stringent emission standards are pushing rental companies toward electric vehicle (EV) fleets, which require substantial capital investment. Significant opportunities lie in technological innovation and sustainability. The expanding availability of electric and hybrid rental vehicles is a direct response to growing environmental awareness and is expected to drive segment size.

Moreover, the application of artificial intelligence (AI) and data analytics in fleet management is improving operational efficiency and enhancing customer satisfaction. Expansion into suburban and rural areas with limited current rental services presents another growth avenue, providing convenient options for travelers seeking last-mile solutions.

Emerging trends include the rise of contactless rental services, facilitated by mobile applications and self-service systems. Another trend gaining momentum is the shift toward subscription-based rental models, offering flexible, long-term vehicle access.

Collaborations between vehicle manufacturers and rental firms focused on developing autonomous rental cars are poised to shape the future of transport in the United States, offering consumers seamless and innovative mobility solutions.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 35.4 billion |

| Revenue Forecast for 2035 | USD 56.9 billion |

| Growth Rate (CAGR) | 4.85% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, End-Use, Booking Mode, Sector |

| Regional Scope | United States |

| Country Scope | United States |

| Key Companies Analyzed | Enterprise Holdings, Hertz Global Holdings, Avis Budget Group, Turo, Getaround, Sixt, Fox Rent A Car, Silvercar by Audi, Maven, Kyte |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Economy Cars

- Intermediate Cars

- Standard Cars

- Full-size Cars

- Luxury Cars

- SUVs

- Vans

- Trucks

- By End-Use

- On-Airport

- Off-Airport

- Intercity

- Local Usage

- Leisure

- Business

- By Booking Mode

- Online

- Offline

- By Sector

- Organized

- Unorganized

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Value Chain Analysis

- Key Success Factors

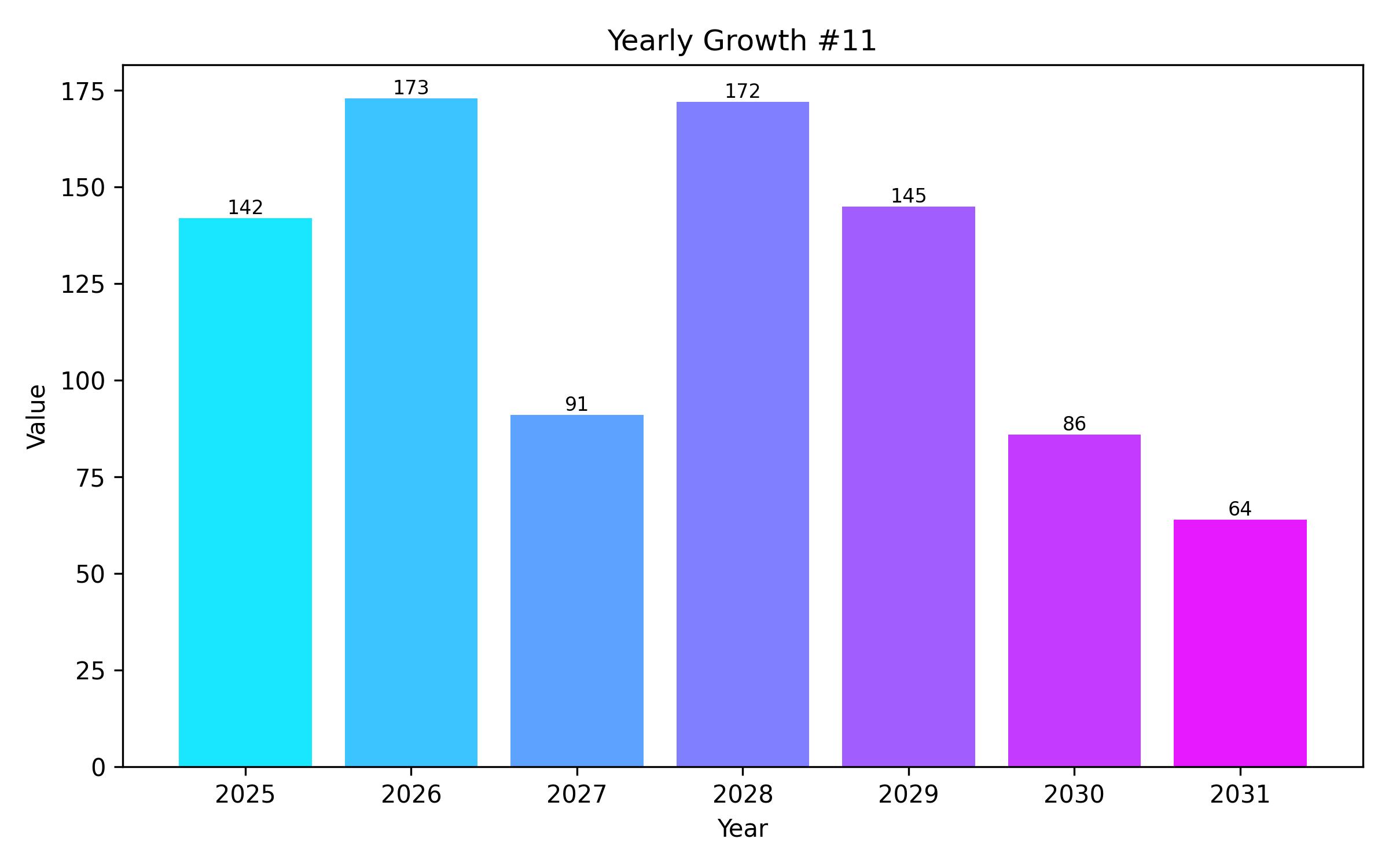

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Billion) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Economy Cars

- Intermediate Cars

- Standard Cars

- Full-size Cars

- Luxury Cars

- SUVs

- Vans

- Trucks

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-Use

- On-Airport

- Off-Airport

- Intercity

- Local Usage

- Leisure

- Business

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Booking Mode

- Online

- Offline

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sector

- Organized

- Unorganized

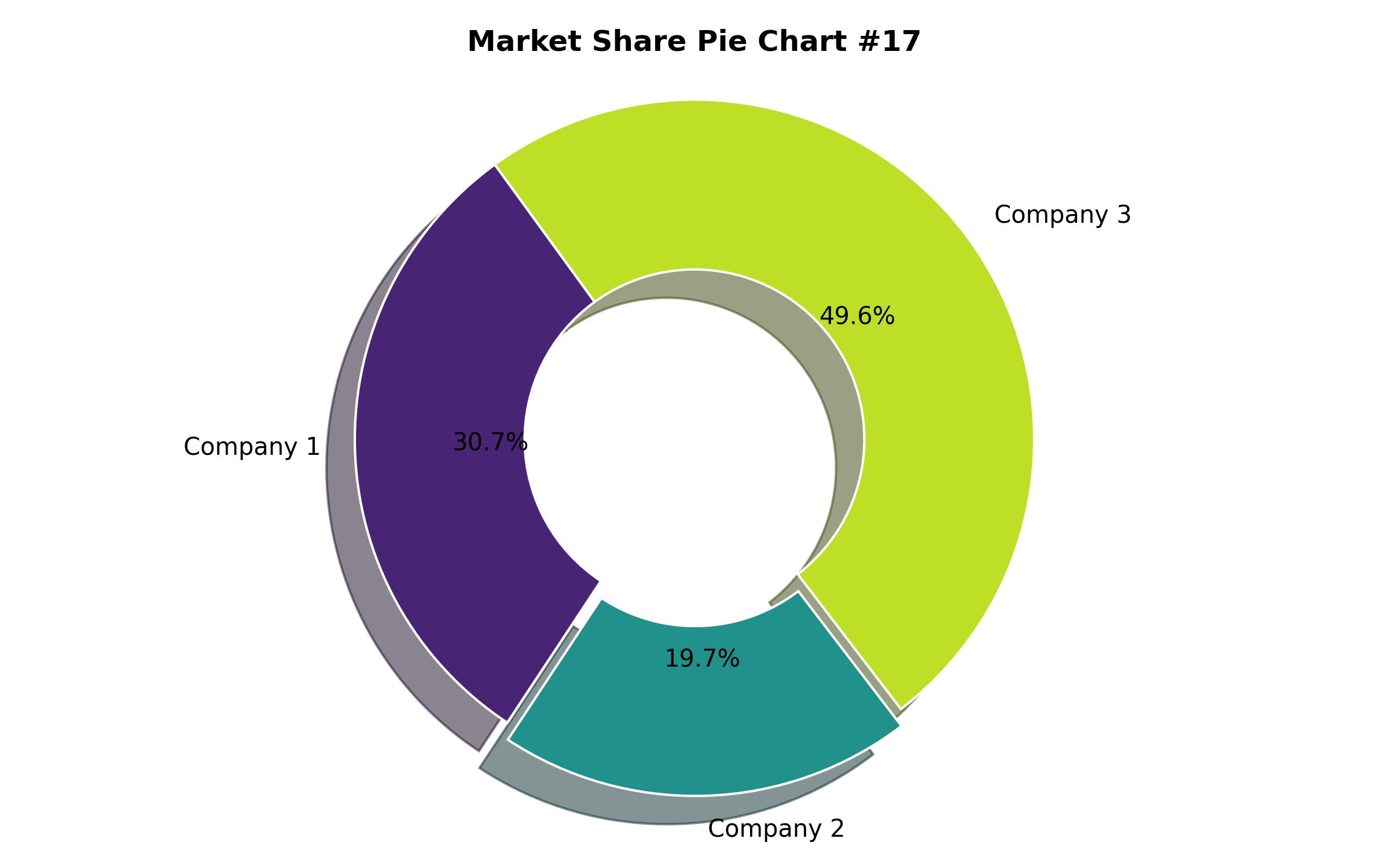

- Market Structure Analysis

- Competition Analysis

- Enterprise Holdings

- Hertz Global Holdings

- Avis Budget Group

- Turo

- Getaround

- Sixt

- Fox Rent A Car

- Silvercar by Audi

- Maven

- Kyte

- Assumptions and Acronyms Used

- Research Methodology