Thorough Analysis and Future Projections for the Global Frozen Seafood Market, Examining Key Trends Across Product Categories, Consumer Behavior, and Geographic Regions Through 2035

Overview:

The frozen seafood market recorded a valuation of USD 21,995.1 million in 2024. Projections for 2025 indicate continued market expansion, with an estimated value of USD 23,380.7 million. Looking ahead to the period between 2025 and 2035, industry analysts predict a robust compound annual growth rate (CAGR) of 5.7%, which is expected to drive global sales to USD 45,094.4 million by the close of 2035.

Significant advancements in cold chain logistics, coupled with improvements in freezing technology, are critical factors influencing the evolution of the frozen seafood sector. Furthermore, a growing consumer preference for convenient, protein-rich food items plays a substantial role in market dynamics. The demanding pace of modern lifestyles globally has positioned frozen seafood as a practical and time-efficient substitute for traditional seafood preparation at home, mirroring the quality of restaurant offerings.

The increasing focus on healthy eating habits and dietary consciousness has propelled frozen seafood into a favored protein choice. Items such as frozen salmon portions, shrimp, and even tuna are increasingly being chosen as a contemporary alternative to red meat options. Moreover, heightened awareness surrounding sustainable fishing practices worldwide is directing consumers towards frozen seafood brands that hold certifications and demonstrate a commitment to marine environment preservation and traceability.

Several prominent brands are active in this market, presenting a diverse selection of frozen seafood products ready for preparation. These include marinated fillets, pre-seasoned shrimp, and sushi-grade items, catering to a broad spectrum of consumers from conventional buyers to those seeking gourmet options.

A notable driver of consumer adoption is the ability of frozen seafood to mitigate food waste and offer an extended shelf life compared to fresh seafood. The retail landscape is adapting, with expanding frozen sections in grocery stores. Simultaneously, the foodservice and hospitality sectors are increasingly incorporating frozen seafood due to its cost-effectiveness and simplified storage requirements.

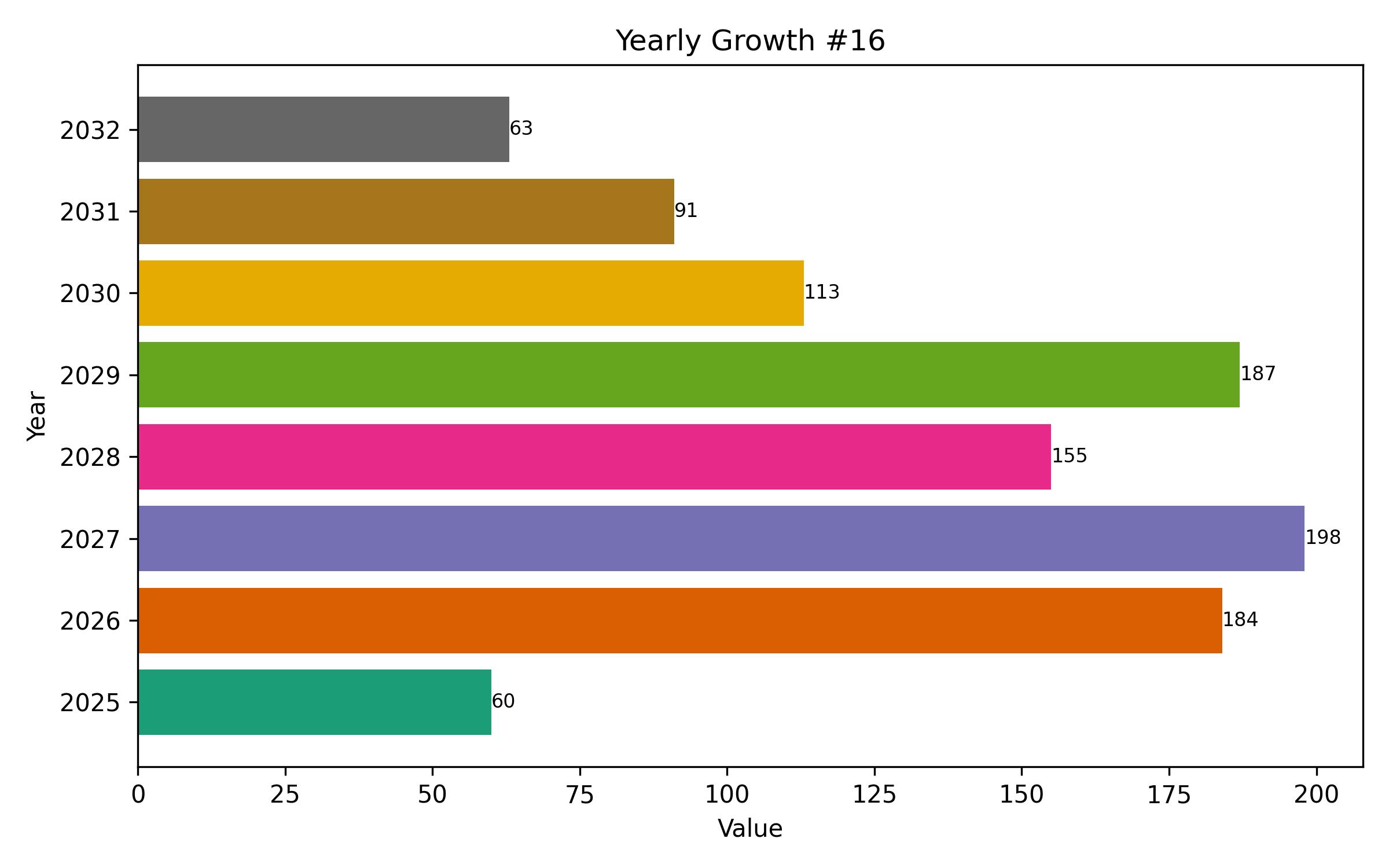

Examining the semi-annual performance reveals shifts in growth trajectory. The data provides a comparative overview of the CAGR for the base year (2024) and the current year (2025), illustrating performance variances across the first half (H1) and second half (H2) of the year. This semi-annual analysis offers stakeholders insights into revenue trends and overall market growth patterns for the respective years.

During the initial five-year span (H1) from 2025 to 2030, the market is anticipated to expand at a CAGR of 5.6%. This is expected to be followed by a slightly accelerated growth rate of 5.7% in the latter five-year period (H2) of the same decade. This projected stronger performance is attributed to factors including deeper retail penetration, an uptick in international trade activities, and the sustained popularity of dietary patterns emphasizing high protein and low fat intake. Year-over-year growth comparisons show H1 increasing by 30 basis points and H2 by 20 basis points.

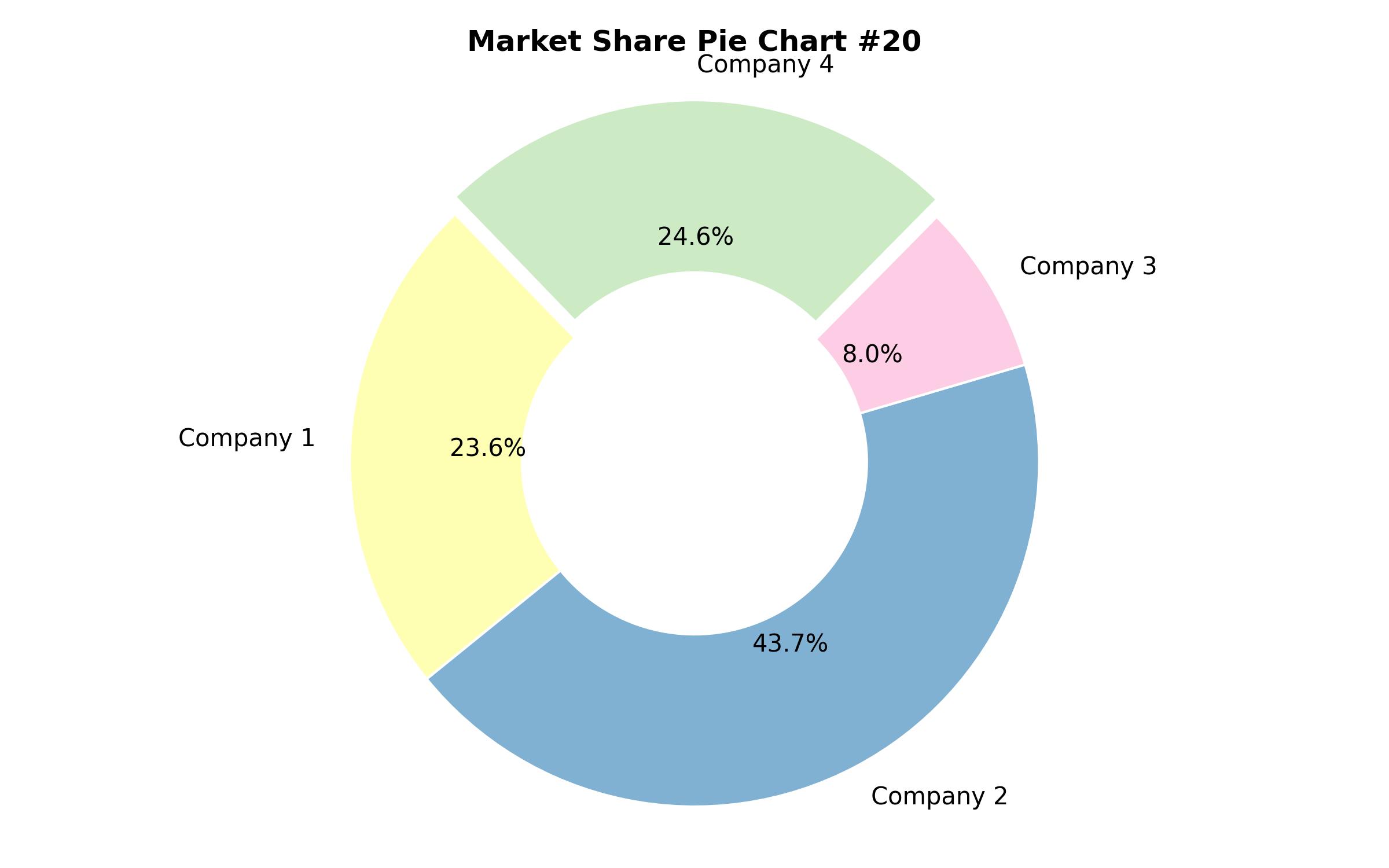

The competitive environment is characterized by distinct tiers of players. Tier 1 comprises large, multinational corporations with extensive global reach and significant market presence. These companies leverage substantial investments in aquaculture, supply chain optimization, and international brand building to exert considerable influence within the frozen seafood sector. Their strategies often involve vertically integrated operations, providing control over pricing and product standards.

Tier 2 includes companies with a strong regional footing and established brand recognition, although with generally lower revenue levels than Tier 1 entities. These players often specialize in specific product categories or geographic markets, gaining traction through quality certifications, demonstrable sourcing traceability, and fostering regional consumer loyalty. This tier contributes significantly to the market by catering to specific consumer preferences and regional demands.

Tier 3 encompasses emerging and specialized companies that are making inroads through product innovation, emphasizing sustainable practices, or targeting premium and niche market segments. These agile players often utilize customized service models, online sales platforms, and narratives centered on sustainable sourcing to build market share, particularly within high-end retail and specific foodservice channels.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 23,380.7 million |

| Revenue Forecast for 2035 | USD 45,094.4 million |

| Growth Rate (CAGR) | 5.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Nature, Form, End Use, Distribution Channel, Product Type |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Germany, China, Japan, India, UK, France, Australia, South Korea, Norway, Sweden, Canada, Denmark, Singapore |

| Key Companies Analyzed | Mitsubishi Corporation, Trident Seafoods, SalMar, Coast Seafood, Charoen Pokphand Foods, Fortune Fish & Gourmet, Maruha Nichiro, Norway Royal Salmon, Mowi ASA, Austevoll Seafood ASA |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Nature

- Wild-Caught

- Farmed

- By Form

- Fillet

- Whole

- Processed

- Shrimp

- Other Forms

- By End Use

- Foodservice

- Retail/Household

- Industrial

- By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail

- Other Channels

- By Product Type

- Fish

- Mollusks

- Crustaceans

- Other Product Types

Table of Content

- Executive Summary

- Market Synopsis

- Key Market Dynamics

- Factors Driving Market Growth

- Restraints on Market Expansion

- Future Market Opportunities

- Key Trends Shaping the Market

- Frozen Seafood Market Value in 2025

- Projected Market Value by 2035

- CAGR Forecast (2025-2035)

- Market Segmentation Analysis

- Market Analysis by Nature

- Wild-Caught Seafood

- Farmed Seafood

- Market Analysis by Form

- Fillet Frozen Seafood

- Whole Frozen Seafood

- Processed Frozen Seafood

- Frozen Shrimp

- Other Frozen Seafood Forms

- Market Analysis by End Use

- Frozen Seafood for Foodservice

- Frozen Seafood for Retail/Household Use

- Frozen Seafood for Industrial Applications

- Market Analysis by Distribution Channel

- Frozen Seafood through Hypermarkets/Supermarkets

- Frozen Seafood through Specialty Stores

- Frozen Seafood through Convenience Stores

- Frozen Seafood through Online Retail

- Frozen Seafood through Other Channels

- Market Analysis by Product Type

- Frozen Fish

- Frozen Mollusks

- Frozen Crustaceans

- Other Frozen Seafood Product Types

- Regional Market Analysis

- Analysis of Top 5 Performing Countries

- United States Frozen Seafood Market Outlook

- Germany Frozen Seafood Market Outlook

- China Frozen Seafood Market Outlook

- Japan Frozen Seafood Market Outlook

- India Frozen Seafood Market Outlook

- Emerging Market Opportunities

- Competitive Landscape Assessment

- Market Share Analysis of Leading Players

- Company Profiles

- Research Methodology

- Assumptions and Disclaimers