Testing, Inspection, and Certification Market Expansion Analysis and Outlook from 2025 through 2035

Overview:

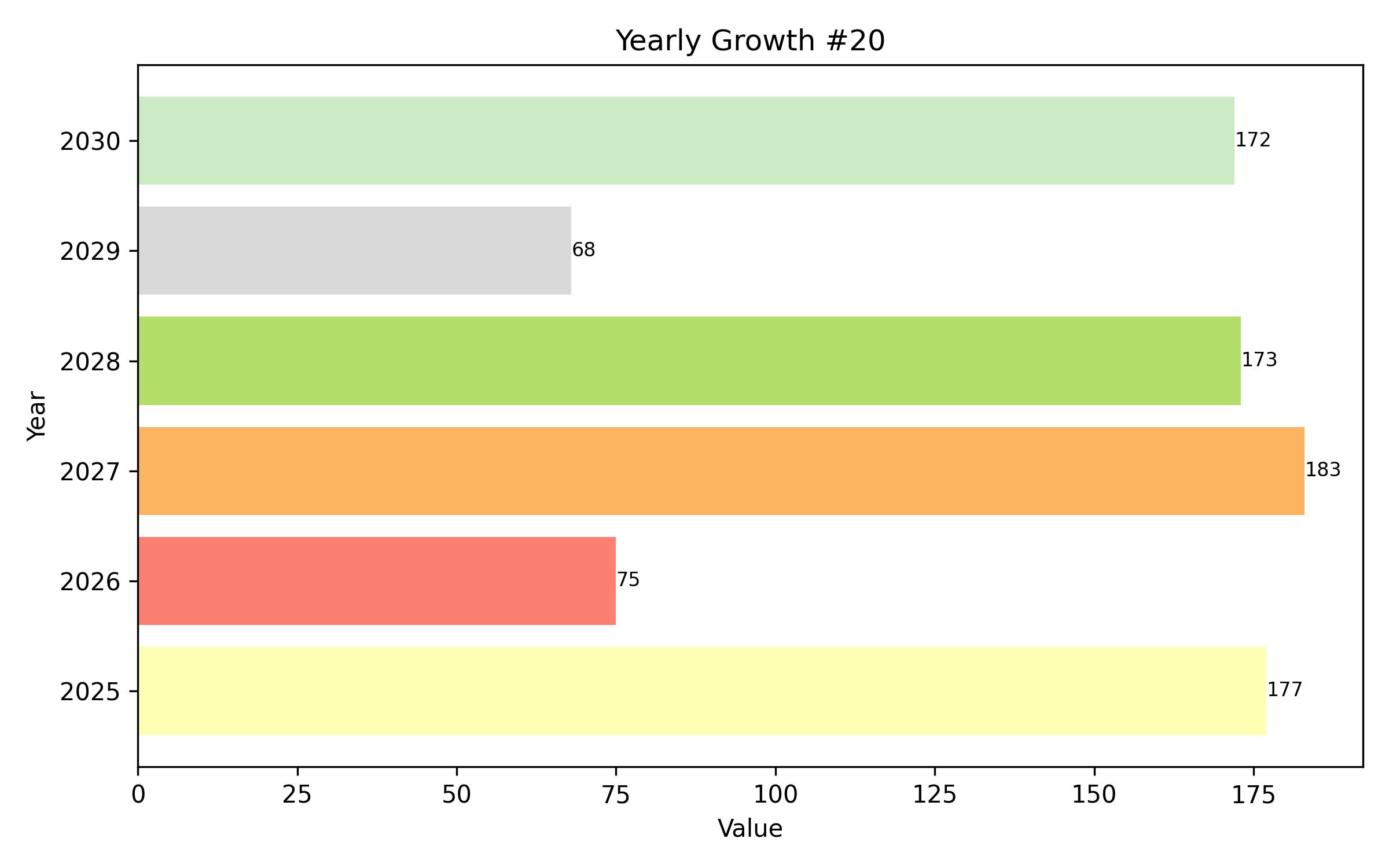

The testing, inspection, and certification (TIC) market is poised for significant expansion over the next decade, driven by escalating global regulatory requirements, increased international trade, and a heightened focus on product quality and safety. Valued at USD 278.94 billion in 2025, the market is expected to reach USD 474.86 billion by 2035, demonstrating a consistent compound annual growth rate (CAGR) of 5.3% during the forecast period.

Demand for reliable quality assurance, effective risk mitigation, and third-party certification services is surging across diverse sectors like automotive, healthcare, food and beverage, energy, and manufacturing. The implementation of stringent global standards and the rapid growth of e-commerce platforms are amplifying the necessity for robust TIC services.

Furthermore, the integration of cutting-edge technologies such as artificial intelligence, automation, and blockchain is revolutionizing TIC processes, enhancing their speed, accuracy, and overall effectiveness. These technological adoption trends are streamlining workflows and improving service delivery.

A notable driver of market growth is the increasing trend towards outsourcing of TIC services, particularly evident in emerging economies. Businesses are strategically partnering with external TIC providers to ensure compliance with international benchmarks while simultaneously optimizing operational expenditures.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 278,940 million |

| Market Value (2035F) | USD 474,860 million |

| CAGR (2025 to 2035) | 5.3% |

The testing, inspection, and certification market is set for sustained growth, propelled by growing global emphasis on product safety, regulatory adherence, and industrial risk management across numerous sectors. The widespread implementation of digital solutions and integration of smart technologies over the upcoming years will undoubtedly support continued market expansion.

Regionally, North America is projected to maintain a leading position, supported by robust regulatory frameworks and high consumer expectations regarding quality. Europe also represents a mature market driven by EU directives and a strong industrial base. The Asia-Pacific region is anticipated to exhibit the fastest growth propelled by rapid industrialization and increasing export activities.

Challenges persist, including adapting to the continuous evolution of regulatory landscapes and managing variable compliance costs. However, significant opportunities are emerging with the widespread integration of AI, automation, and digital tools that offer enhanced efficiency and accuracy in service delivery.

Looking forward, the period from 2025 to 2035 is expected to see major shifts with the broad adoption of AI-enabled systems, digital certifications, and robotic inspections. Blockchain technology will play a crucial role in ensuring data integrity and traceability, enabling more secure and transparent certification processes. Remote and virtual auditing solutions will also become more prevalent, supporting global compliance management.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 278.94 billion |

| Revenue Forecast for 2035 | USD 474.86 billion |

| Growth Rate (CAGR) | 5.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Sourcing Type |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | SGS Group; Bureau Veritas; Intertek Group; TÜV SÜD; Dekra SE; Eurofins Scientific; DNV GL; UL Solutions |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Sourcing Type

- In-house

- Outsourced

Table of Content

- Executive snapshot

- Market Overview & Analysis

- Major Market Trends

- Key Growth Drivers

- Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Pricing Insights

- Market Scenario 2020 to 2024 and Future Projections 2025 to 2035

- Market Dynamics and Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sourcing Type

- In-house

- Outsourced

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia-Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

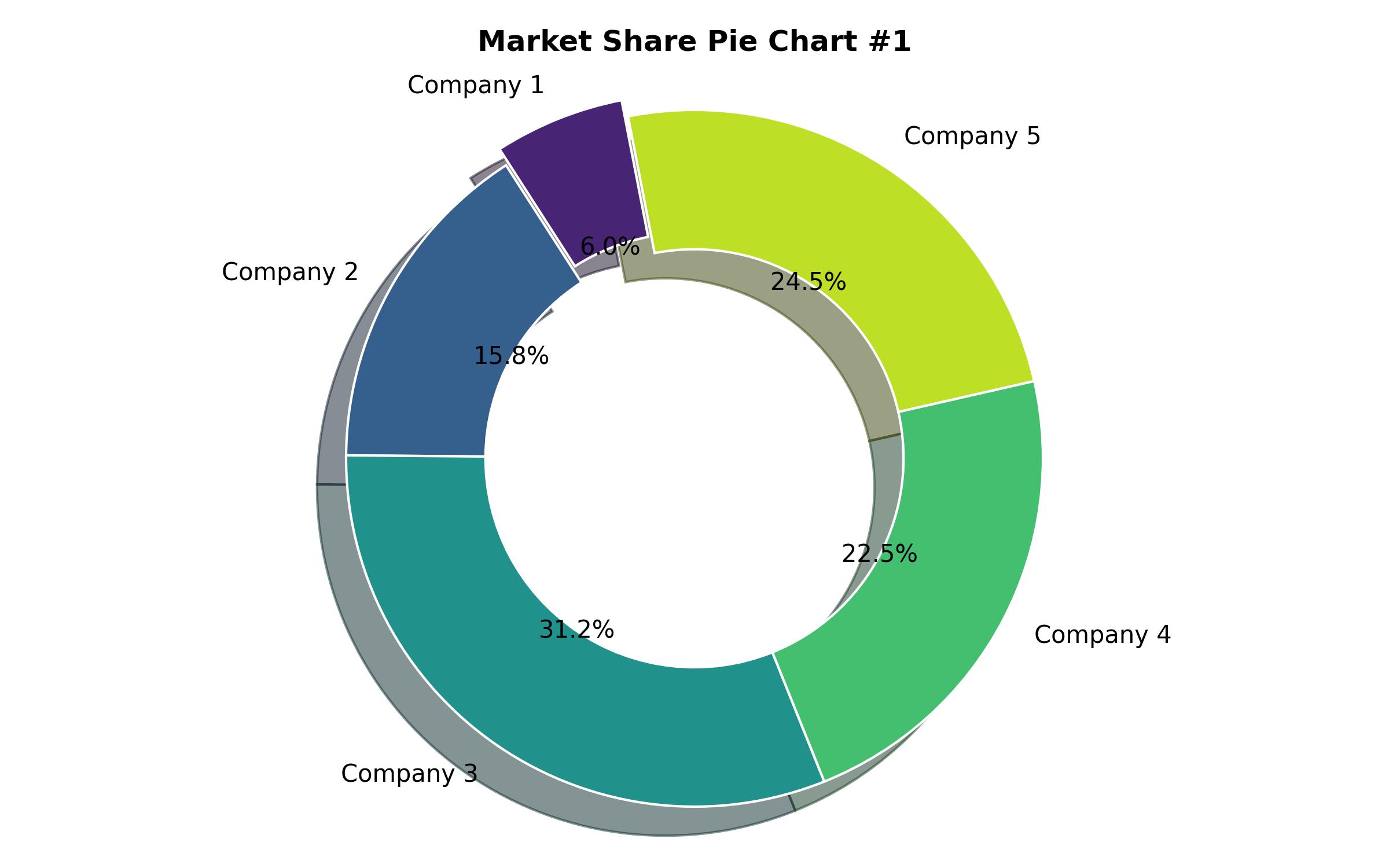

- Region Wise Market Share Analysis 2025 & 2035

- Market Structure Overview

- Competitive Landscape Assessment

- Key Company Profiles & Offerings

- Assumptions and Definitions

- Research Methodology