Surface Protection Film Market Outlook by Technology, Thickness, Material, Color, Application and End Use: Global Analysis Through 2035

Overview:

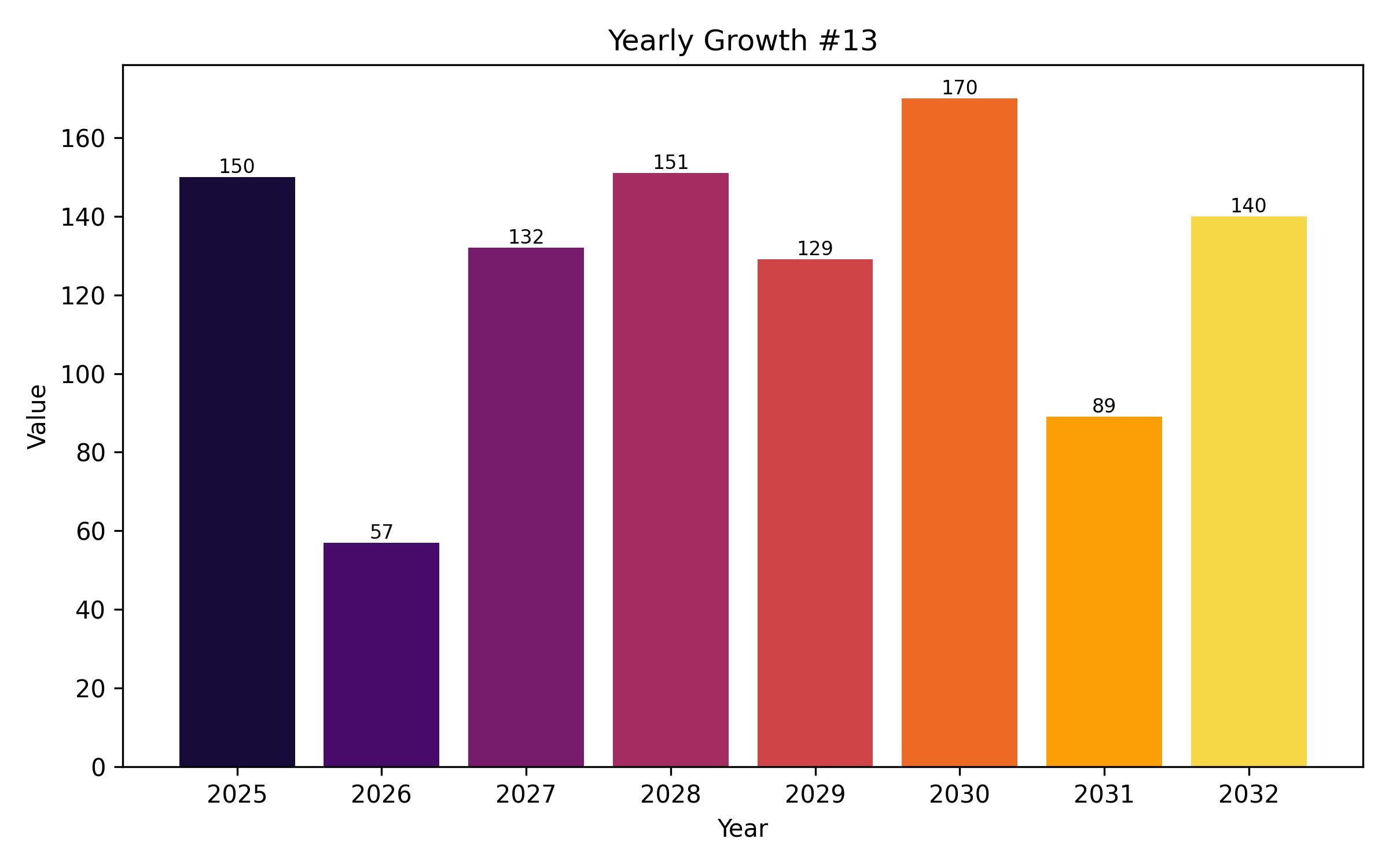

The market for surface protection film is estimated to generate a market size of USD 1,569 million in 2025 and would increase to USD 2,460 million by 2035. It is expected to increase its sales at a CAGR of 4.6% over the forecast period 2025 to 2035. Revenue generated from surface protection film in 2024 was USD 1,500 million.

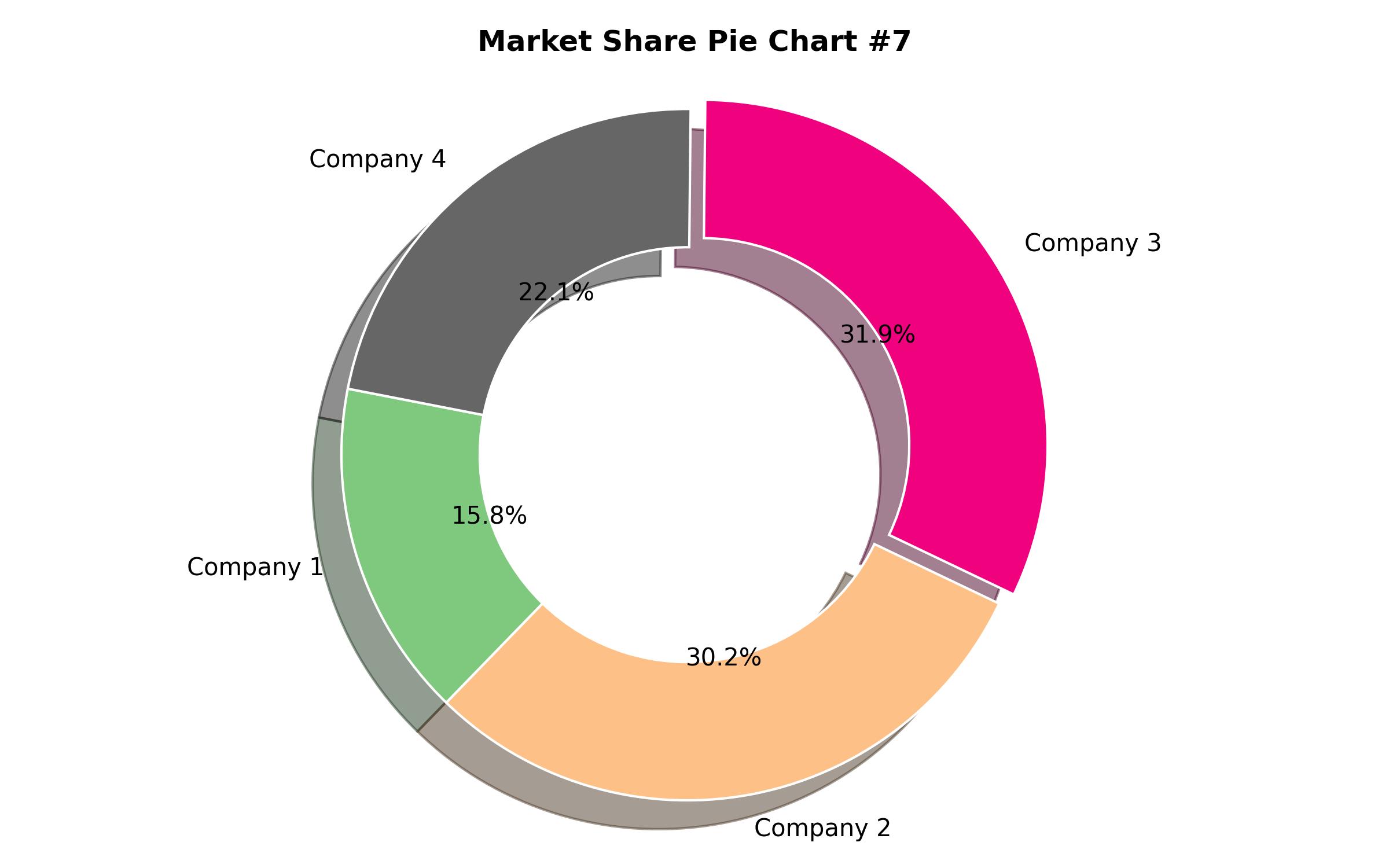

Interior and construction industries captures 44% of the end-use markets because of the systematic demand for protective films against metal sheets, PVC profiles, surface furniture, and glass panels. Increased urbanization, ongoing real estate development, and local infrastructure projects have fueled the demand for temporary protection solutions to prevent damage during shipping, storage, and installation. The trend toward modular furniture and decorative interiors has also strengthened the position held by this segment when it comes to operating in the market.

Glass and mirror protection has heavy demand from the construction, automotive, and interior decoration sectors. It captures one third of the market. Basically, these films guard glass against scratches, dust deposition, and damages while in transit and installation. The use of smart glass and luxury mirror applications in contemporary infrastructure projects has only helped to balloon the other blow on this part of the glass protection film.

The surface protection film market will expand with lucrative opportunities during the forecast period, as it is estimated to provide an incremental opportunity of USD 960 million and will increase 1.6 times the current value by 2035.

The global surface protection film market achieved a CAGR of 3.6% in the historical period of 2020 to 2024. Overall, the surface protection film market performed well since it grew positively and reached USD 1,500 million in 2024 from USD 1,302 million in 2020.

Demand for surface protection films will grow from 2025 to 2035 with the increase in infrastructure projects, automotive manufacturing growth, and rising usage of sustainable and biodegradable protective films.

Development in eco-friendly polymer technologies, anti-static coating, and smart protective films with the help of nanotechnology will further drive the market growth. Demand will also be supported by growing use of flexible display technology, solar energy uses, and cost-effective, recyclable, and long-term surface durability high-performance building materials.

The surface protection film market is expected to witness consistent growth over 2020 to 2024, driven by increasing demand from end-user industries including automotive, electronics, construction, and packaging industries for scratch-resistant, long-lasting, and easy-to-peel protective films.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1,569 Million |

| Revenue Forecast for 2035 | USD 2,460 Million |

| Growth Rate (CAGR) | 4.6% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data Range | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, market share analysis, industry trends, competitive landscape, growth factors |

| Covered Segments | Technology, Thickness, Material, Color, Application, End Use, Region |

| Regional Scope | North America, Latin America, Western Europe, Eastern Europe, Asia Pacific Excluding Japan, Japan, Middle East & Africa |

| Country Scope | USA, Canada, Germany, UK, France, Spain, Italy, Russia, Poland, India, China, Brazil, Mexico, GCC Countries, South Africa |

| Key Companies Analyzed | Chargeurs S.A., Nitto Denko Corp., Tredegar Corporation, Polifilm GmbH, Bisch of + Klein SE & Co. KG, DUNMORE Corporation, Grafix Plastics, Surface Armor LLC, LAMIN-X Protective Films, Pelloplast OY, MacDermid Autotype Ltd, DUTE Industrial Group, 3M Company, Avery Dennison Corporation, Pregis LLC, Toray Industries Inc., Lintec Corporation, Ecoplast Ltd., DuPont de Nemours, Inc., Saint-Gobain Performance Plastics. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Technology

- Adhesion Lamination

- Coextruded Films

- By Thickness

- Up to 50 microns

- 50 to 100 microns

- Above 100 microns

- By Material

- Polyethylene (PE)

- LLDPE (Linear Low-Density Polyethylene)

- LDPE (Low-Density Polyethylene)

- HDPE (High-Density Polyethylene)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others

- Polyethylene (PE)

- By Color

- Transparent

- White

- Blue

- Black

- Others

- By Application

- Scratch Protection

- Temporary Bonding

- Dirt & Dust Prevention

- Surface Masking

- UV Resistance

- Chemical Resistance

- Others

- By End Use

- Automotive

- Electronics

- Construction

- Appliances

- Medical

- Printing & Graphic Arts

- Others

- By Region

- North America (U.S., Canada)

- Latin America (Brazil, Mexico)

- Western Europe (Germany, UK, France, Spain, Italy, Nordic Countries, BENELUX)

- Eastern Europe (Russia, Poland)

- Asia Pacific Excluding Japan (India, China, ASEAN Countries, Oceania)

- Japan

- Middle East & Africa (GCC Countries, South Africa, Northern Africa, Turkey, Other MEA)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Technology

- Adhesion Lamination

- Coextruded Films

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Thickness

- Up to 50 microns

- 50 to 100 microns

- Above 100 microns

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Color

- Transparent

- White

- Blue

- Black

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Scratch Protection

- Temporary Bonding

- Dirt & Dust Prevention

- Surface Masking

- UV Resistance

- Chemical Resistance

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use

- Automotive

- Electronics

- Construction

- Appliances

- Medical

- Printing & Graphic Arts

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Western Europe

- Eastern Europe

- Asia Pacific Excluding Japan

- Japan

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Western Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Eastern Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Excluding Japan Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Japan Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Country-wise Analysis

- Market Structure Analysis

- Competition Analysis

- Key Company Profiles

- Assumptions and Acronyms Used

- Research Methodology