Splicing Tape Market: Global Trends and Demand Forecast (2025-2035)

Overview:

The market for splicing tape is projected to reach a value of USD 685.5 million in 2025, climbing to USD 940.1 million by 2035. The market is anticipated to see a compound average growth rate (CAGR) of 3.3% over this ten-year timeframe. In 2024, revenue from splicing tape stood at approximately USD 665 million.

Expansion in the splicing tape market is propelled by a rising need for efficient bonding and joining, particularly across industries such as printing, packaging, paper and pulp, electronics, and the automotive sector. Splicing tapes are recognized for their reliable performance, including high adhesion, resistance to heat, and durability, which are essential for minimizing downtime in continuous manufacturing processes and enhancing operational efficiency.

Current demand trends are closely tied to the increased adoption of automated manufacturing, the growth of flexible packaging, and advancements in electronics manufacturing. Innovations in high-performance and environmentally conscious adhesives are also significant contributors to the evolution of the splicing tape sector. These developments enhance efficiency across numerous industries, suggesting continued growth for splicing applications.

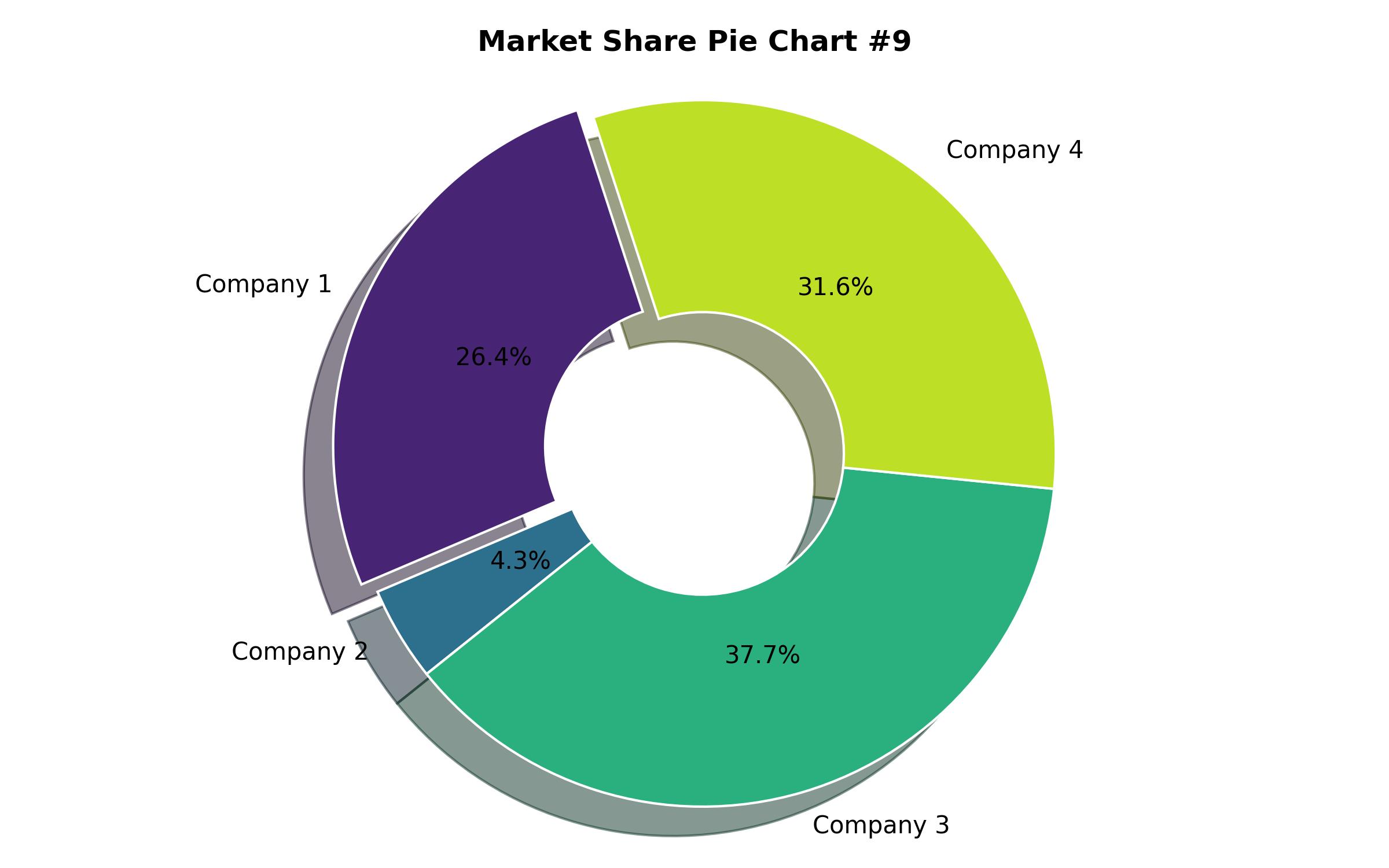

The application segment focusing on joining and insulation holds a dominant position, accounting for around 40% of the market share. This high demand stems from infrastructure expansion and growth in power distribution networks, driving the need for solutions in cable joining, electrical insulation, and industrial bonding.

Industries including construction, electronics, and telecommunications rely heavily on precise splicing to ensure secure and durable connections. Additionally, the push for energy savings and sustainability influences the adoption of high-quality insulation materials, reinforcing this segment’s leading market position.

Over the forecast period, the splicing tape market expects substantial expansion opportunities, projected to offer an incremental opportunity worth USD 270 million and approximately doubling its current value by 2035.

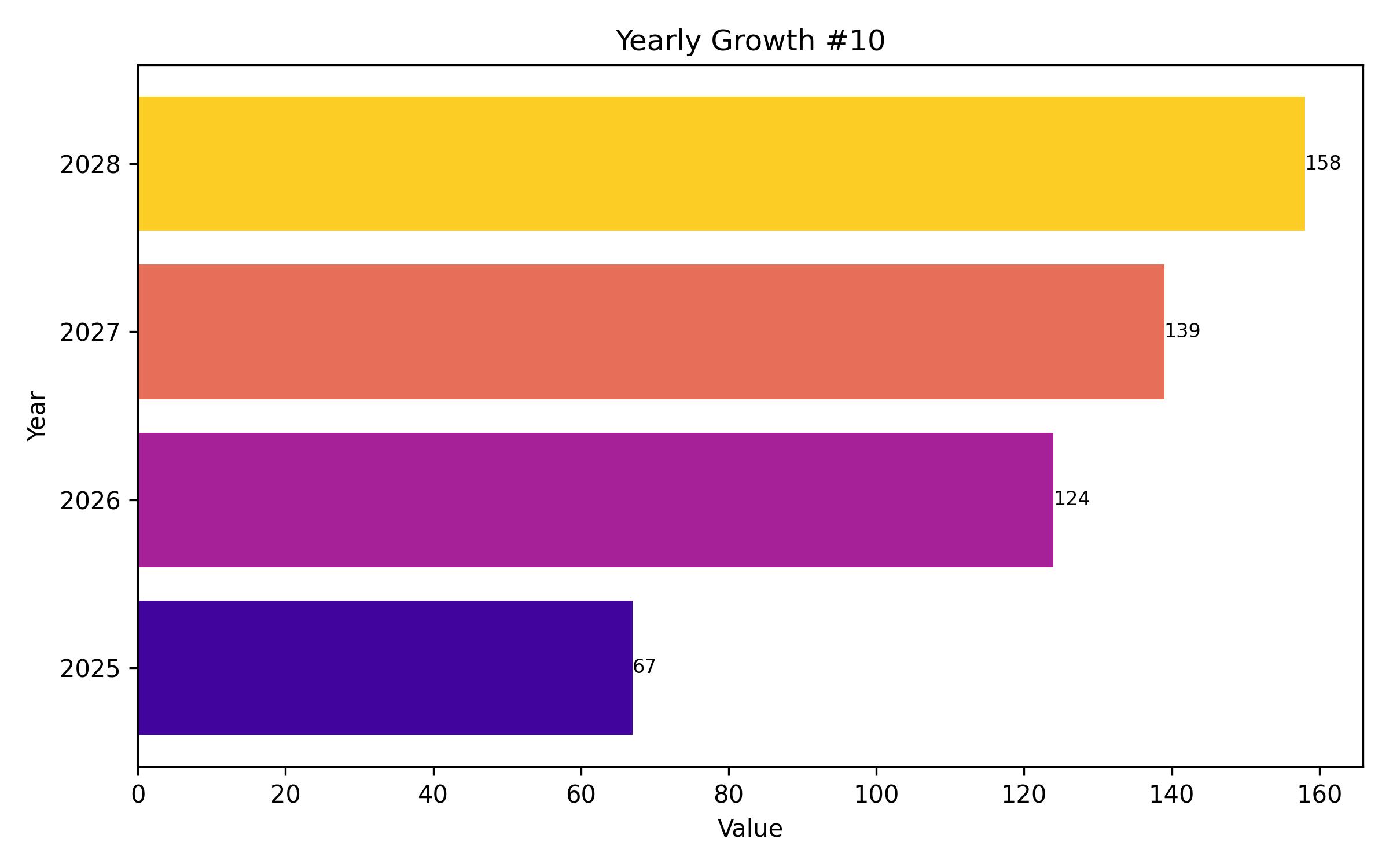

An analysis of the semi-annual growth trajectory highlights varied patterns. For the decade spanning 2024 to 2034, the market is predicted to expand at a CAGR of 3.2% in the first half and 3.4% in the second half. Looking at the period from 2025 to 2035, the CAGR is estimated to be 2.1% in the first half, accelerating to 4.3% in the latter half. There was a noticeable decrease of 100 basis points in the first half compared to the previous period, while the second half saw a gain of 120 basis points.

Factors such as increasing industrial automation, rising use of lightweight materials, expansion of flexible packaging, and initiatives for eco-friendly adhesives and conductive tapes for electronics are expected to drive the demand for splicing tape from 2025 to 2035. Furthermore, growth in renewable energy projects, aerospace, and sustainable paper production will likely enhance demand for splicing tapes based on their performance, durability, and environmental benefits.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 685.5 million |

| Revenue Forecast for 2035 | USD 940.1 million |

| Growth Rate (CAGR) | 3.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Backing material, adhesive type, application, and region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Scope | USA, Canada, Germany, UK, Spain, China, India |

| Key Companies Analyzed | 3M Company, Nitto Denko Corporation, Tesa SE, Avery Dennison Corporation, Scapa Group plc, Intertape Polymer Group Inc., Shurtape Technologies, LLC, Lohmann GmbH & Co. KG, Lintec Corporation, Berry Global, Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Backing Material

- Polyester

- Paper

- Non-woven

- Other Materials

- By Adhesive Type

- Silicone

- Acrylic

- Rubber-based

- Other Adhesives

- By Application

- Paper & Printing

- Packaging & Labelling

- Electronics

- Automotive

- Textile

- Other Applications

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Industry Adoption: Key Areas of Investment 2025 to 2035

- 2020 to 2024 Splicing Tape Sales Outlook Compared to Demand Forecast from 2025 to 2035

- Consumer Priorities vs. Manufacturer Priorities 2019 to 2024 vs. 2025 to 2035

- Market Concentration

- Region-Wise Trends: Past Analysis 2019 to 2024 and Future Projections 2025 to 2035

- Country-wise Insights

- Market Driver in Germany: Robust Expansion in the Paper and Flexible Packaging Sector

- Market Driver in USA: Growth in Demand for High Performance Tapes in Automotive and Aerospace

- Category-wise Insights

- Chemical Stability of Silicon Boost the Market Growth

- High Tensile Strength of Polyester Accelerate the Market Growth

- Competitive Outlook

- Market Share Analysis by Company

- Key Company Offerings and Activities

- Key Company Insights

- Other Key Players

- Regulatory Landscape

- Supply Chain Analysis

- Recommendations

- Research Methodology

- Assumptions and Acronyms Used

- Disclaimer