Protein Hydrolysate Components Industry: Market Dynamics and Outlook

Overview:

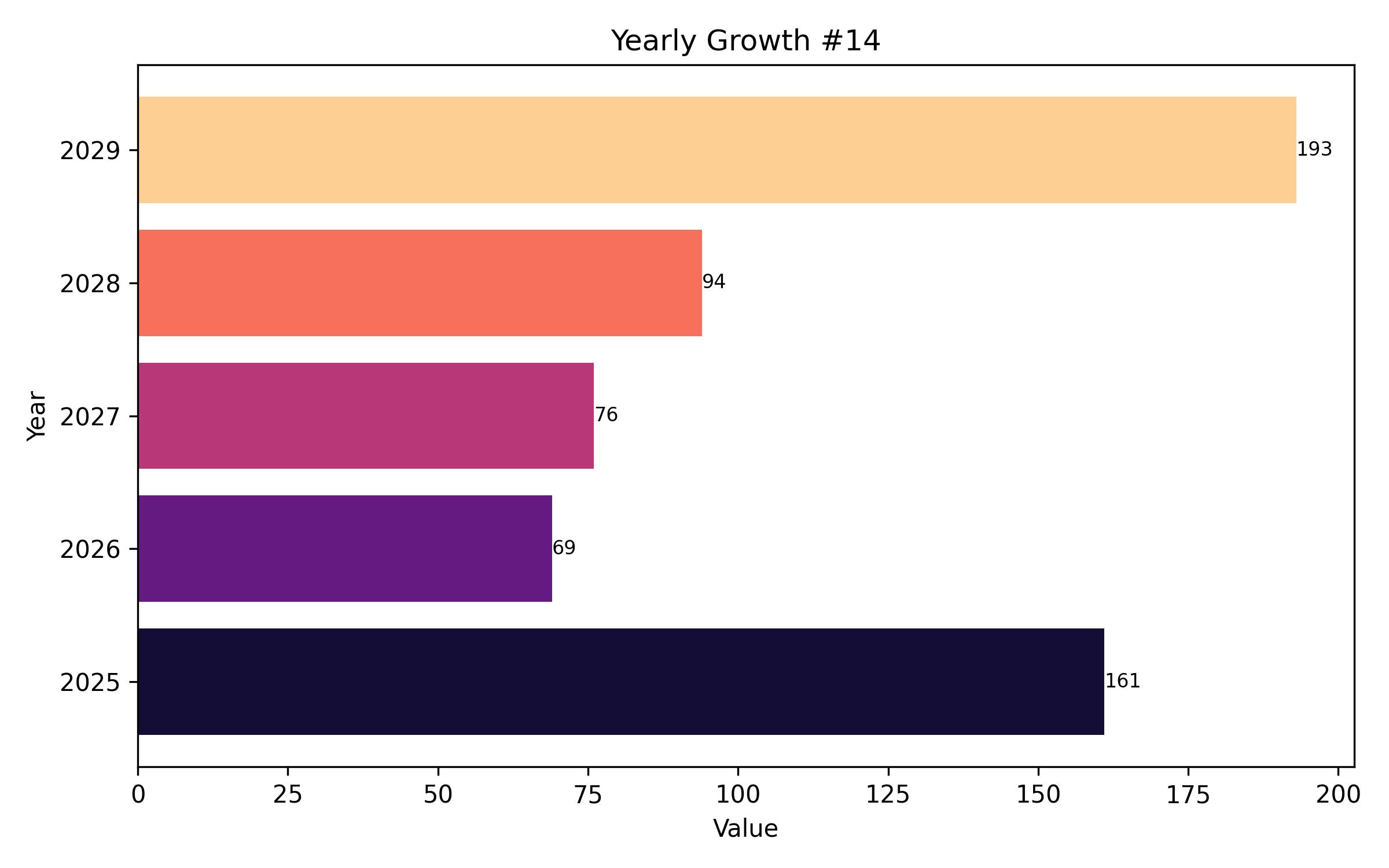

The protein hydrolysate ingredients sector is experiencing robust expansion, with future projections indicating significant growth. Future Market Insights (FMI) has analyzed the market, estimating its value at USD 718.15 million in 2025. The market is poised for sustained growth, with a projected Compound Annual Growth Rate (CAGR) of 7.3% from 2025 to 2035. By the end of this forecast period, total revenue is expected to reach USD 1452.83 million.

Driving this market forward is the increasing consumer awareness regarding the importance of health and balanced nutrition, particularly the benefits of diets rich in protein. As understanding of protein’s crucial role in health improves, interest in consuming protein hydrolysate-based products is also rising. Protein hydrolysate ingredients are produced through enzymatic hydrolysis, a process that breaks down native proteins into smaller peptides and amino acids, thereby enhancing their digestibility and absorption by the body.

These ingredients find widespread use across several key industries, including clinical nutrition, sports nutrition, infant formula, and functional foods. A notable factor contributing to the market’s expansion is the global rise in lifestyle-related health conditions and a corresponding increase in the recognition of protein’s positive impacts on well-being.

Demand for protein hydrolysate components continues its upward trajectory worldwide. Enzymatic treatment is the primary method utilized to produce protein hydrolysates, resulting in compounds with improved digestive and absorptive properties. In the functional foods sector, these ingredients contribute benefits that go beyond basic nutrition. For athletes and individuals engaged in strenuous physical activity, protein hydrolysates are viewed as essential for enhancing performance and supporting post-exercise muscle recovery.

Clinical nutrition products often incorporate protein hydrolysates to meet the specific dietary needs of patients requiring specialized medical diets. Additionally, these ingredients are valuable components in infant formulas designed for babies who require nutrient sources other than breast milk. As consumers increasingly make health a priority, demand for protein hydrolysate ingredients is expected to follow suit. The primary catalysts for market growth are amplified public understanding of protein’s health advantages and a rise in conditions associated with modern lifestyles.

A significant shift is occurring within the market due to the growing adoption of plant-based and flexitarian diets, leading to a surge in the use of plant-derived protein hydrolysates. Hydrolysates sourced from plants such as pea, rice, hemp, and soy are gaining traction, partly due to their perceived environmental advantages. Their incorporation into food and beverage items is increasing, driven by consumer preference for ‘clean label’ products free from common allergens. The functionality and quality of protein hydrolysates are consistently improving, largely thanks to ongoing advancements in enzymatic hydrolysis and production techniques, broadening their potential applications across various sectors.

| Report Attribute | Details |

|---|---|

| Estimated Global Industry Size (2025) | USD 718.15 Million |

| Projected Global Industry Value (2035) | USD 1452.83 Million |

| Value-based CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

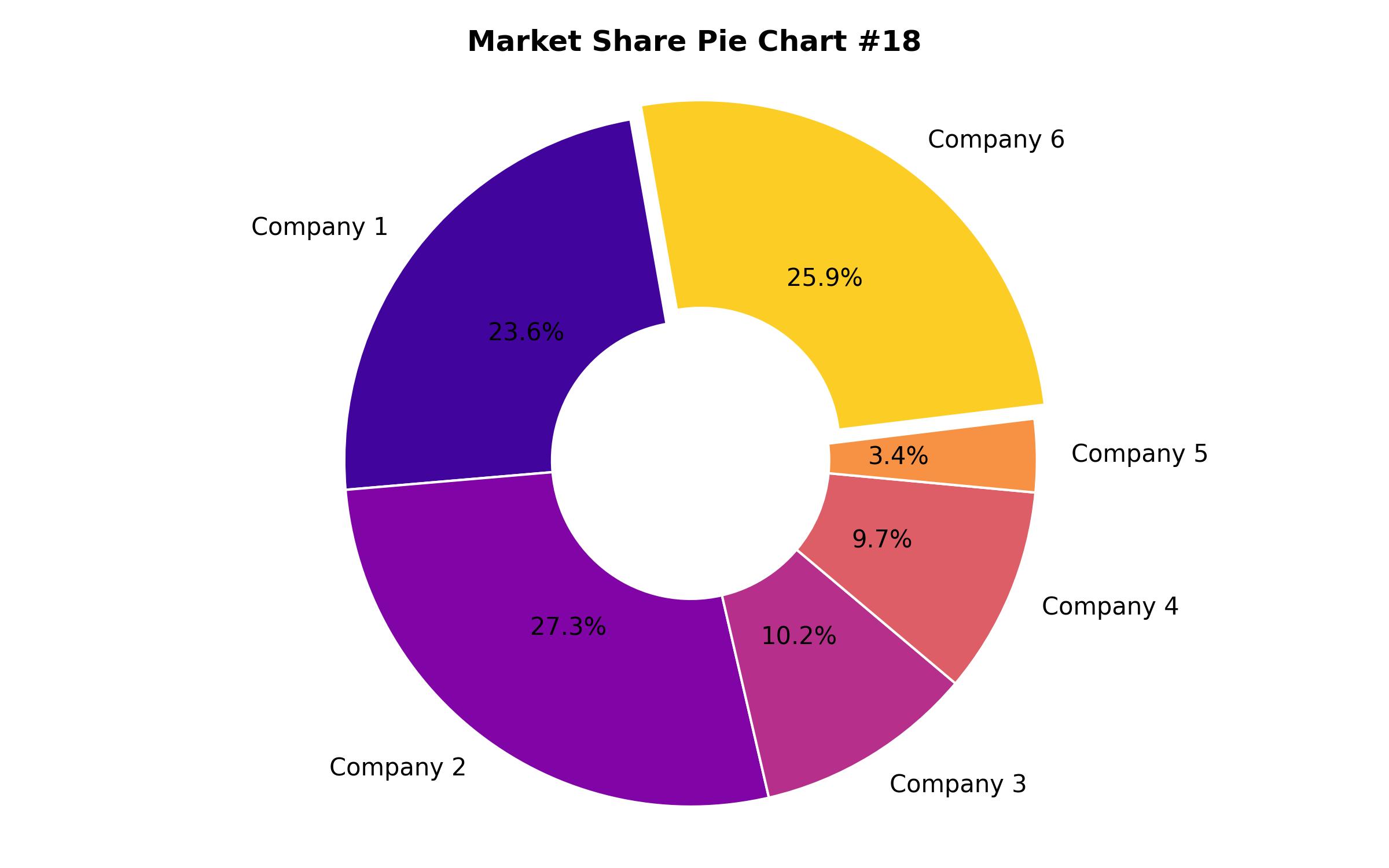

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Form, Ingredient type, End Use Application, and Region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Scope | USA, Germany, India, Canada, Mexico, UK, France, Italy, Japan, China, South Korea, Australia, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Arla Food Ingredients, Costantino & C. Spa, Armor Proteins, Kerry Group Plc, Glanbia Plc, Carbery Group Limited, Davisco Foods International, Inc., Hilmar Ingredients, Friesland Campina N.V., Tate & Lyle plc, Abbott Laboratories, Agropur Inc., Danone S.A., Fonterra Co-operative Group Limited |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

-

By Form

- Powder

- Liquid

- Paste

-

By Ingredient Type

- Animal Based

- Milk

- Egg

- Meat

- Fish

- Plant Based

- Soy

- Pea

- Rice

- Wheat

- Other

-

By End Use Application

- Sports Nutrition

- Infant Formula

- Clinical Nutrition

- Functional Foods & Beverages

- Dietary Supplements

- Animal Feed

- Other

-

By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Value Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Value (in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Form

- Powder

- Liquid

- Paste

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Ingredient Type

- Animal Based Proteins

- Milk Based Proteins

- Egg Based Proteins

- Meat Based Proteins

- Fish Based Proteins

- Plant Based Proteins

- Soy Based Proteins

- Pea Based Proteins

- Rice Based Proteins

- Wheat Based Proteins

- Other Plant Proteins

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End Use Application

- Sports Nutrition Applications

- Infant Formula Applications

- Clinical Nutrition Applications

- Functional Food & Beverage Applications

- Dietary Supplement Applications

- Animal Feed Applications

- Other Applications

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region Wise Market Value Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Assumptions and Acronyms

- Research Methodology