Mobile Wallet Market: Sizing, Trends, and Future Growth Avenues (2025-2035)

Overview:

The mobile wallet market, representing digital applications for managing financial transactions, continues its trajectory of significant expansion. Functioning as secure repositories for payment credentials, mobile wallets facilitate a wide array of touchless transactions including point-of-sale purchases, peer transfers, and online shopping.

Fueled by the increasing prevalence of smartphones, a growing preference for secure and expedited cashless payments, and broader adoption of digital finance tools, the market is experiencing robust growth.

Key technological advancements such as Near-Field Communication (NFC), biometric authentication, and distributed ledger technologies are also contributing significantly to market momentum, enhancing security and user convenience.

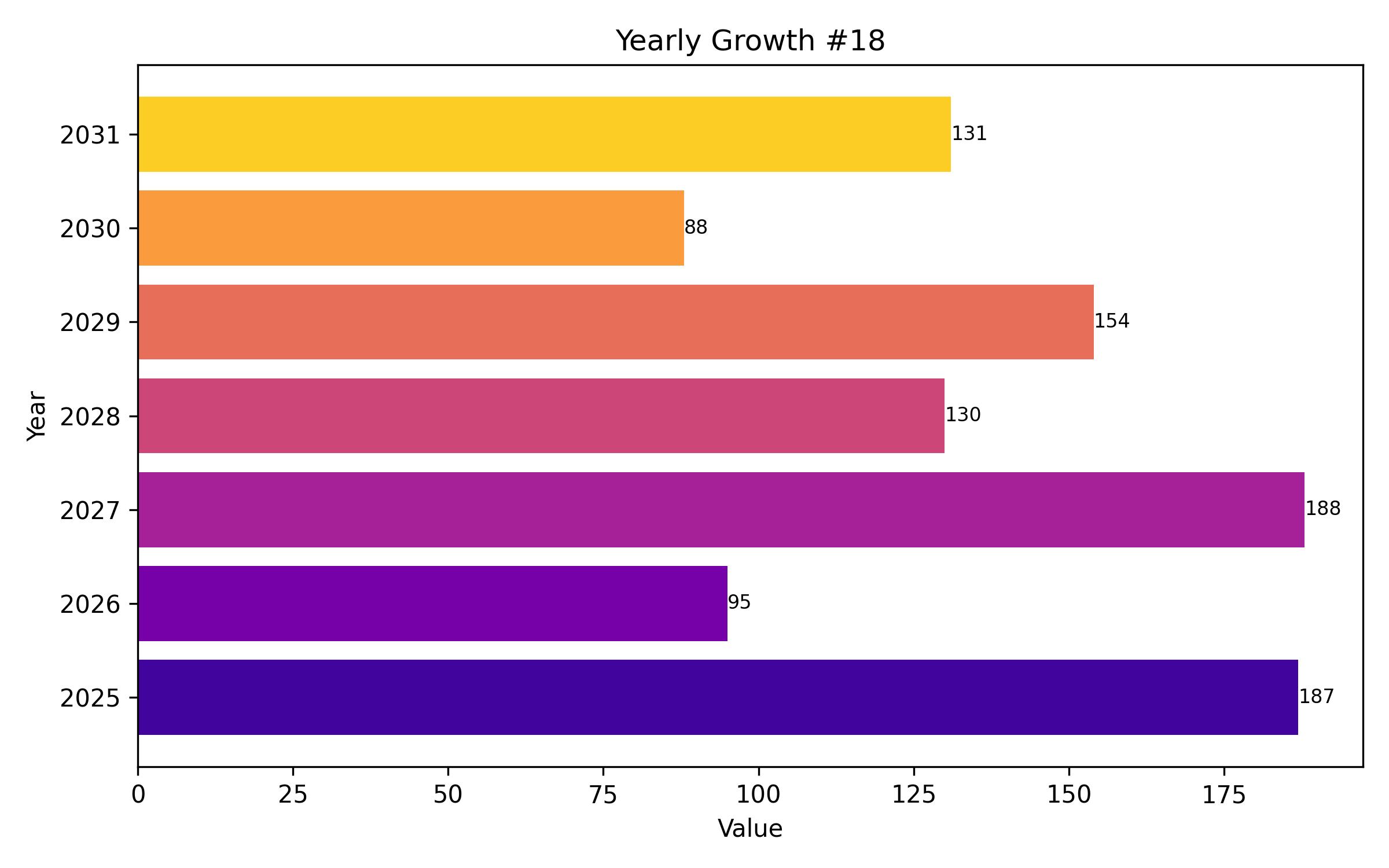

Starting at an estimated value of approximately USD 350 billion in 2025, the market is forecast for dynamic growth, projected to reach around USD 3,850 billion by 2035. This represents a substantial compound annual growth rate (CAGR) of over 27% across the forecast period.

This strong growth rate underscores the increasing role of mobile wallets in promoting financial inclusion, the widespread embrace of quick response (QR) code systems for payments, and substantial investments being directed into artificial intelligence platforms for detecting financial irregularities.

Furthermore, supportive shifts in digital banking regulations and streamlining of procedures for cross-border transactions are expected to create an environment favorable for further market penetration and expansion.

Key regions like North America, Europe, and Asia-Pacific are at the forefront of this growth, driven by technological infrastructure, regulatory support, and evolving consumer payment habits. The market sees dominant players alongside a surge in innovative startups.

While challenges persist regarding robust cybersecurity measures and evolving regulatory frameworks, the significant potential offered by the rise of super applications integrating diverse services, advancements in contactless technologies, and the deployment of AI for enhanced security and financial management capabilities underscore promising future pathways for the mobile wallet market.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 349.66 billion |

| Projected Market Size in 2035 | USD 3,846.83 billion |

| Growth Rate (CAGR) | 27.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Technology type, industry verticals, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, UK, Germany, France, China, India, Japan, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Apple Inc., Google LLC, PayPal Holdings, Inc., Samsung Electronics Co., Ltd., Alibaba Group, Tencent Holdings, Amazon Pay, Revolut, PhonePe, Zelle |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Technology Type

- Remote Payment

- Proximity Payment

- By Industry Verticals

- Retail & E-Commerce

- Banking & Financial Services

- Healthcare

- Transportation

- Entertainment

- Others

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Growth Drivers and Restraints

- Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Value Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Technology Type

- Remote Payment

- Proximity Payment

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Industry Verticals

- Retail & E-Commerce

- Banking & Financial Services

- Healthcare

- Transportation

- Entertainment

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Country-wise Outlook

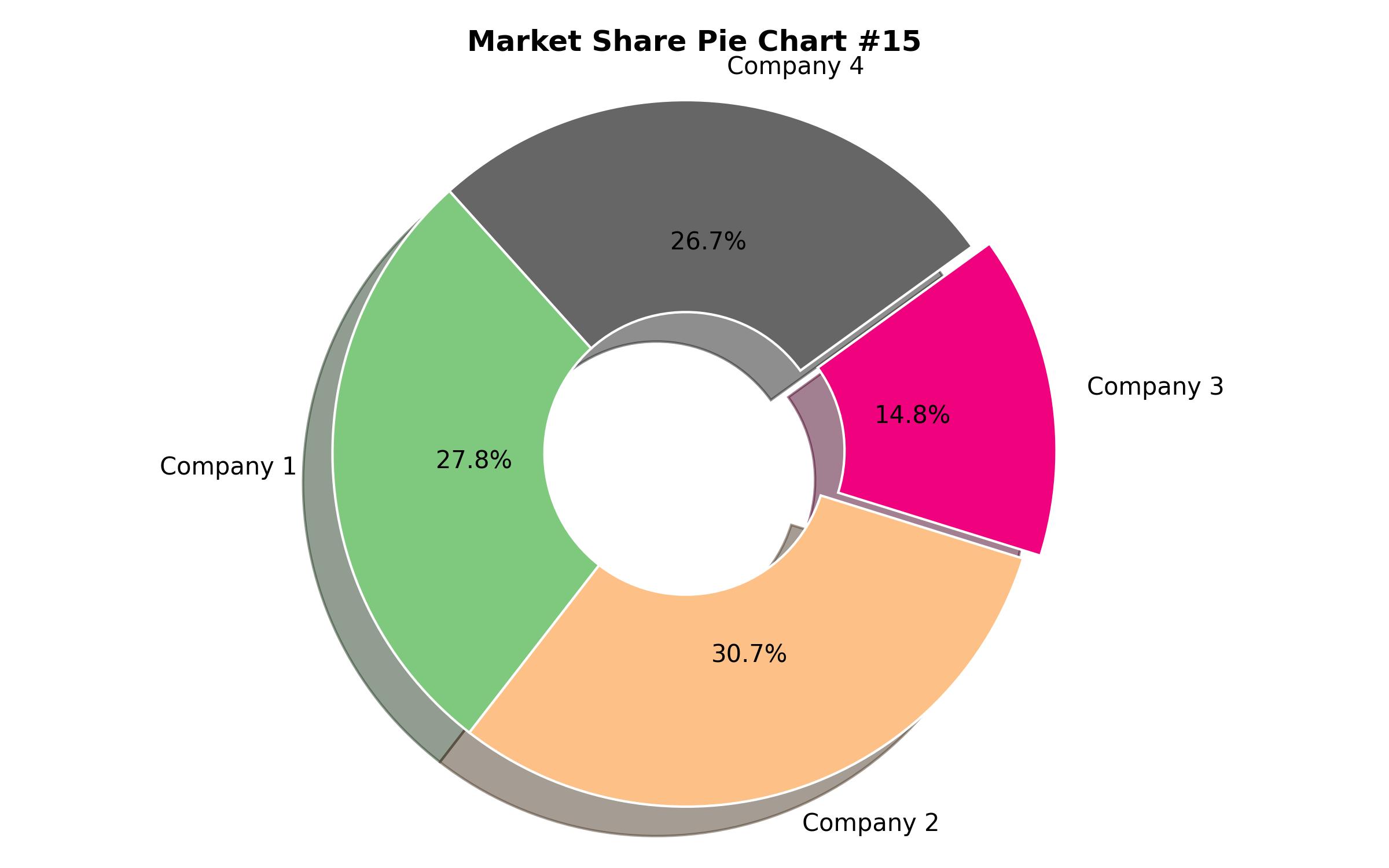

- Competitive Landscape

- Company Market Share Analysis

- Key Company and Market Offerings

- Competition Analysis

- Assumptions and Acronyms Used

- Research Methodology