In-depth Analysis of the South Korean Anti-Aging Skincare Market: Market Dimensions, Competitive Landscape, and Projected Developments, with Forecasts Spanning 2025 to 2035

Overview:

The South Korean anti-wrinkle product market is projected to command value of around USD 555.3 million in 2025. This sector is on track to see a robust expansion at a compound annual growth rate of 6.1% between 2025 and 2035, with projections indicating it will reach approximately USD 1,020.5 million towards the end of the forecast period. This upward trajectory is significantly influenced by the nation’s deep-seated appreciation for beauty and aesthetic upkeep, its rapidly aging demographics, and a strong consumer inclination towards preventative skincare measures.

Historically, South Korea has been at the forefront of skincare innovation and consumer adoption, placing premium value on maintaining a youthful and healthy complexion. Consequently, anti-aging and specifically anti-wrinkle solutions are increasingly being sought out not only by older consumers but also by younger demographics, including those in their 20s and 30s, as a critical element of proactive skin maintenance.

This shift reflects a broader understanding that anticipating and preventing signs of aging is more effective than attempting only to reverse them later. This resonates with Korea’s overall cultural emphasis on luminous skin and comprehensive beauty rituals. Furthermore, South Korea is home to one of the world’s fastest-growing elderly populations. As the proportion of residents aged 65 and over is anticipated to surpass 20% in the early 2030s, the demand for products designed to address visible aging signs like fine lines, wrinkles, and loss of skin firmness is set to experience significant growth.

This pronounced demographic transition provides a substantial consumer base for a variety of anti-wrinkle creams, specialized serums, and other treatment options. In addition, rising disposable incomes coupled with heightened consumer awareness regarding personal wellbeing and health are propelling individuals to invest more in high-efficacy skincare products that incorporate scientific formulations to yield tangible results.

Advancements in technology also play a pivotal role in the market’s expansion. South Korean consumers show a high degree of receptiveness to cutting-edge product formulations featuring active ingredients such as various peptides, forms of retinol, hyaluronic acid, and other compounds with proven benefits.

Coupled with the ingrained appreciation for multi-step skincare regimens, products that offer composite benefits, including wrinkle treatment, moisture replenishment, skin firming, or complexion brightening, are in substantial demand. Finally, the pervasive influence of popular media, including the global reach of K-pop culture and the impact of online beauty personalities, continues to powerfully motivate both male and female consumers to incorporate advanced anti-wrinkle products as a foundational element of their skincare practices.

Trends and Consumer Behavior in Key Market Segments

Within South Korea, the market dynamics for anti-wrinkle products are distinctly shaped by the unique behaviors observed across primary end-user categories which include individual households, professional dermatology and aesthetic clinics, and beauty salons. Among individual consumers, particularly within urban centers, there is a marked and increasing focus on preventative skincare. This has led to a growing number of individuals initiating anti-aging regimens in their early to mid-twenties, recognizing the long-term benefits of proactive care.

Consumers place high value on products that offer multiple functionalities, addressing concerns such as hydration, skin brightening, and UV protection alongside their primary anti-wrinkle effects. Purchase decisions are significantly influenced by social media evaluations, the recommendations of online figures, and the promise of visible outcomes. There is a strong preference for products containing well-recognized and scientifically supported active ingredients like peptides, various retinoids, and niacinamide.

Furthermore, the burgeoning acceptance of gender-neutral skincare approaches and an increase in the number of male consumers reflect evolving societal attitudes towards personal grooming and self-care. Within the professional sector, encompassing dermatology clinics and beauty salons, the focus shifts towards highly-targeted needs. These establishments typically recommend medical-grade anti-wrinkle products for use both during in-clinic treatments and for client home care.

Clinics critically evaluate products based on their scientifically validated effectiveness and safety profile, ensuring compatibility with other procedures such as injectables or laser therapies. Similarly, beauty salons also prioritize products that offer immediate, noticeable improvements, seeking out formulations with wrinkle-smoothing and firming properties that complement their in-salon services. Across both professional segments, critical factors steering purchasing decisions include brand reputation, demonstrable product efficacy, and a guarantee of safety. Collectively, for all end-use segments, the effectiveness of the product, clear and accurate ingredient information, and confidence in the brand are the primary drivers shaping consumer expectations in South Korea’s highly demanding beauty and health-conscious market landscape.

Market Evolution from 2020 to 2024 and Emerging Trends for 2025 to 2035

Between 2020 and 2024, the South Korean market for anti-wrinkle products underwent considerable shifts, largely driven by evolving consumer preferences and ongoing breakthroughs in skincare technology. A key trend that solidified its position was the emphasis on preventative skincare, where younger consumers adopted early anti-aging strategies, prioritizing sustained skin health over primarily corrective measures. This period also saw a noticeable increase in the demand for ‘clean beauty’ products; consumers became more attentive to ingredient transparency, clear product labeling, and sustainable packaging solutions.

The expansion of online retail channels and the amplifying impact of social media personalities also intensified during this time, as consumers increasingly relied on digital platforms for product discovery, detailed reviews, and procurement. Moreover, there was a notable rise in the preference for multi-functional products that offered a combination of anti-wrinkle benefits with features such as hydration, skin tone enhancement, and sun protection. Looking ahead, from 2025 to 2035, the Korean anti-wrinkle market is anticipated to continue its evolution, shaped by several significant trends.

Firstly, technological integration is expected to deepen significantly, with sophisticated smart skincare technologies and personalized offerings supported by artificial intelligence becoming more prevalent. Consumers will increasingly seek products that provide tailored wrinkle care based on their specific skin characteristics and concerns. Companies will leverage data analytics and AI to deliver highly customized skincare experiences. Sustainability concerns will reach new prominence, making eco-friendly ingredients, biodegradable packaging, and ethical testing practices increasingly vital purchasing criteria.

Additionally, the market is poised for greater diversification, with skincare products specifically targeting the male demographic growing into a more significant and emphasized sector as more men actively engage in anti-aging routines. The future will likely also witness a convergence of products offering both preventive and restorative capabilities. Products formulated with advanced active ingredients designed to provide long-term repair, proactive prevention, and overall skin renewal will gain wider acceptance, enabling consumers to achieve visible results without necessarily resorting to more invasive procedures.

Challenges and Risks in the Korean Anti-wrinkle Product Market

The South Korean anti-wrinkle product market is subject to several potential challenges that could influence its growth trajectory. A significant risk factor is the potential for market saturation. As the category of wrinkle care and anti-aging products attains wider appeal, particularly among younger demographics, the market faces the prospect of becoming crowded with similar product offerings. This could potentially lead to intense price competition and create obstacles for newer or smaller brands attempting to establish a foothold.

Such saturation would likely impact profitability for manufacturers and make it challenging for brands to differentiate themselves effectively within a densely packed marketplace. Furthermore, with a greater proliferation of product choices, it may become more difficult for brands to cultivate lasting consumer loyalty, and consumers’ sensitivity to price could increase, putting further pressure on profit margins. Another key risk area involves regulatory frameworks and product safety considerations.

South Korea maintains stringent standards for cosmetic products, and any changes or updates to these regulations could potentially influence the formulation, marketing, and sale of anti-wrinkle products. Products containing certain active ingredients might face increased scrutiny, especially as consumers become more discerning about product safety and demand greater transparency regarding ingredient lists and source origins.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 555.3 million |

| Revenue Forecast for 2035 | USD 1,020.5 million |

| Growth Rate (CAGR) | 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Nature, End-user, Sales Channel, and Region |

| Regional Scope | South Korea |

| Country Scope | South Korea |

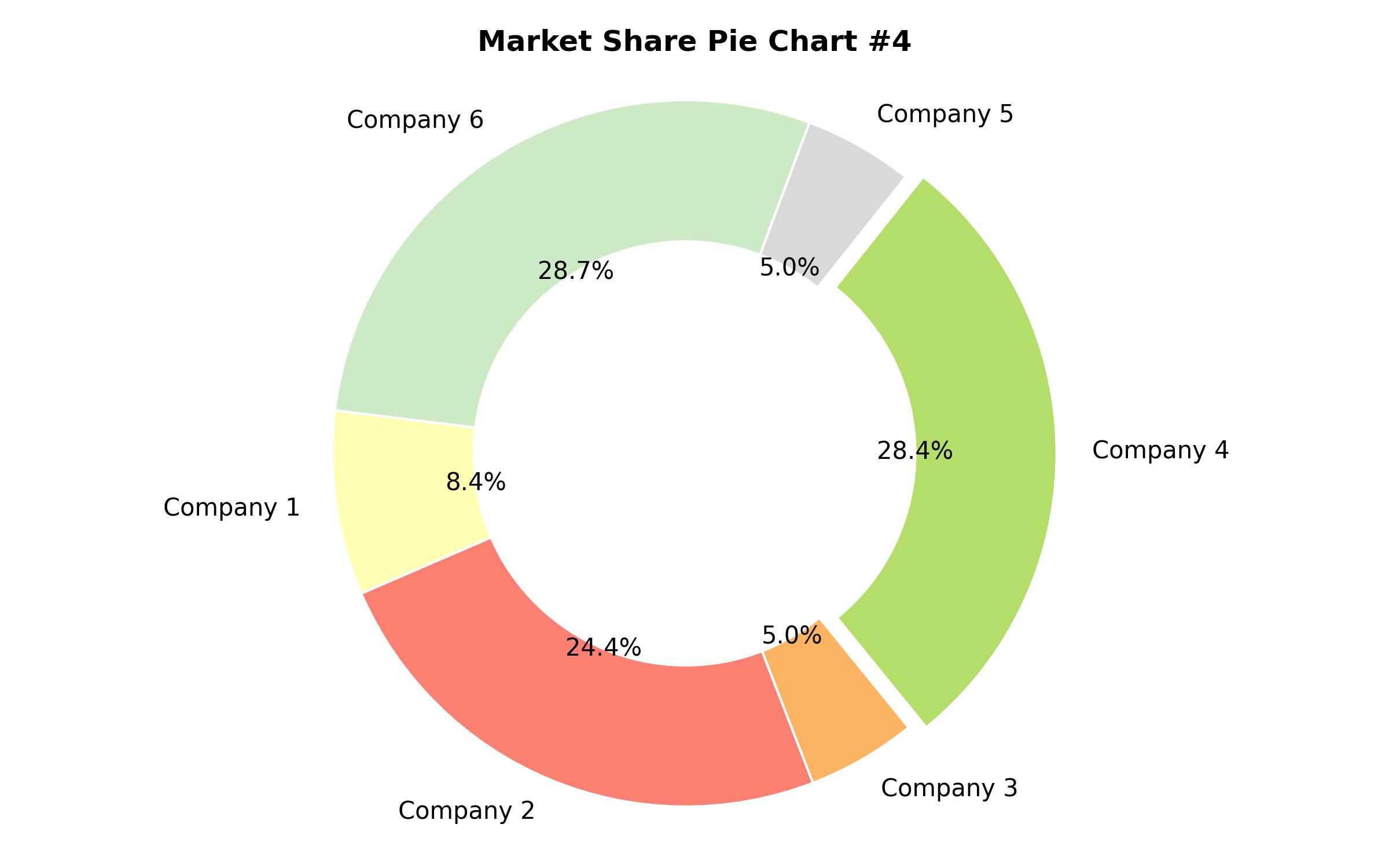

| Key Companies Analyzed | Nature Republic, COSMAX INC., Kolmar Korea, Cosmecca Korea, Co. Ltd., KBL Cosmetics, Black Bird Skincare, Lotus Herbals Limited, L’Oréal S.A., Kao Corporation, Coty, Inc., Colgate Palmolive Company, Clarins Group, Biomod Concepts, Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Creams

- Moisturizers

- Serums

- Cleansers

- Masks

- By Nature

- Natural

- Synthetic

- Organic

- By End-User

- Household/Individual

- Dermatology Clinics

- Beauty Salons

- By Sales Channel

- E-retailers

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Direct Sales

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

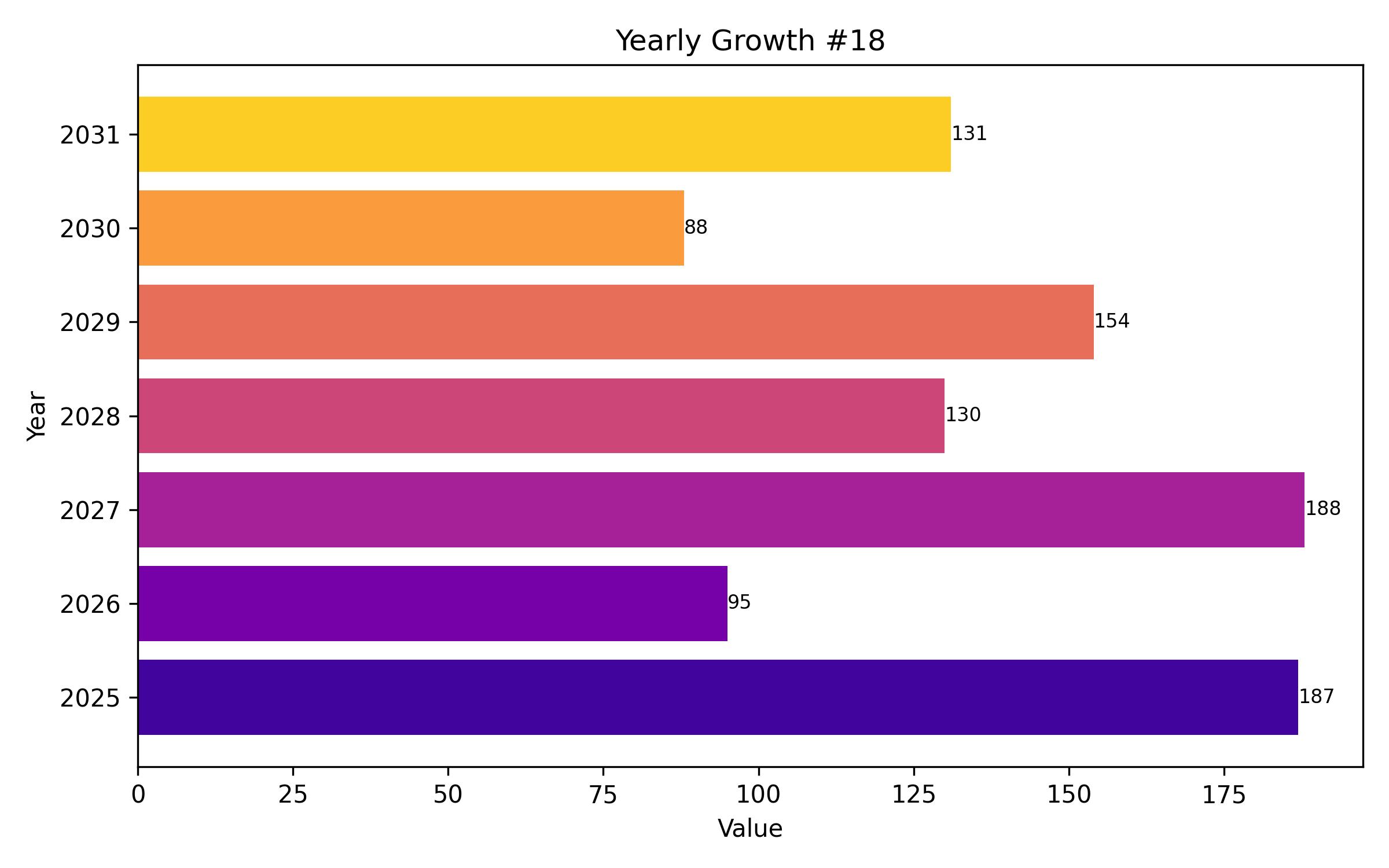

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Creams

- Moisturizers

- Serums

- Cleansers

- Masks

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Nature

- Natural

- Synthetic

- Organic

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By End-User

- Household/Individual

- Dermatology Clinics

- Beauty Salons

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- E-retailers

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Stores

- Pharmacies

- Direct Sales

- Regulatory Landscape

- Competitive Landscape

- Key Company Profiles

- Strategic Recommendations

- Assumptions and Acronyms Used

- Research Methodology