High Performance Barrier Films: Market Innovations and Growth Outlook from 2025 to 2035

Overview:

The global high performance barrier films market is poised for substantial expansion, with projections indicating robust growth throughout the forecast period. The market is estimated to attain a valuation of USD 14.4 billion in 2025, and is anticipated to reach USD 29.4 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.4% from 2025 to 2035. This expansion is underpinned by increasing demand for advanced packaging solutions across diverse industries.

High performance barrier films are critical in extending the shelf life of products, reducing spoilage, and maintaining product integrity. Their superior barrier properties against moisture, oxygen, and other gases make them indispensable in the food and beverage, pharmaceutical, and healthcare sectors.

The food and beverage industry is a primary driver of market growth, propelled by the need to preserve the freshness and quality of perishable goods. Simultaneously, the pharmaceutical sector requires high barrier films to protect medications and healthcare products from environmental contaminants.

Geographically, the high performance barrier films market demonstrates a global presence, with North America, Europe, and Asia-Pacific representing key regions. Asia-Pacific, in particular, is expected to witness rapid growth, driven by expanding manufacturing activities and increasing consumer demand in countries such as China and India.

The competitive landscape is characterized by the presence of numerous established players and emerging companies, all striving to innovate and offer advanced barrier film solutions. Strategic collaborations, product development, and capacity expansions are common strategies employed by these companies to strengthen their market positions.

Technological advancements are also playing a pivotal role in shaping the market. Developments in materials science, film manufacturing processes, and coating technologies are enabling the production of films with enhanced barrier properties, improved mechanical strength, and greater sustainability.

The market is also influenced by stringent regulations concerning food safety, packaging standards, and environmental sustainability. These regulations are encouraging the development and adoption of eco-friendly barrier films, such as bio-based and recyclable materials.

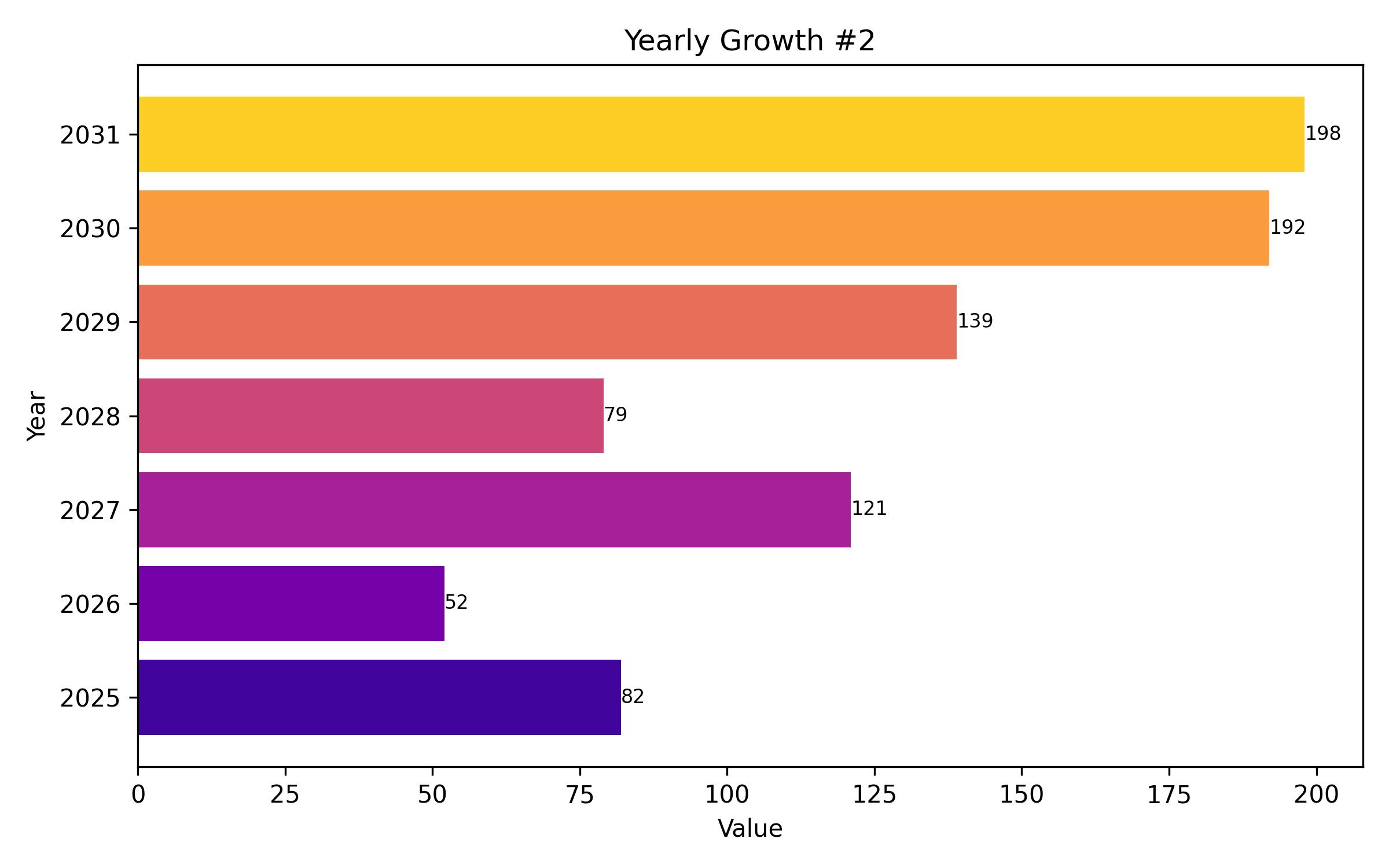

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 14.4 billion |

| Revenue Forecast for 2035 | USD 29.4 billion |

| Growth Rate (CAGR) | 7.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, Material, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Amcor, Berry Global, Sealed Air Corporation, Toppan Printing, Uflex Ltd. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

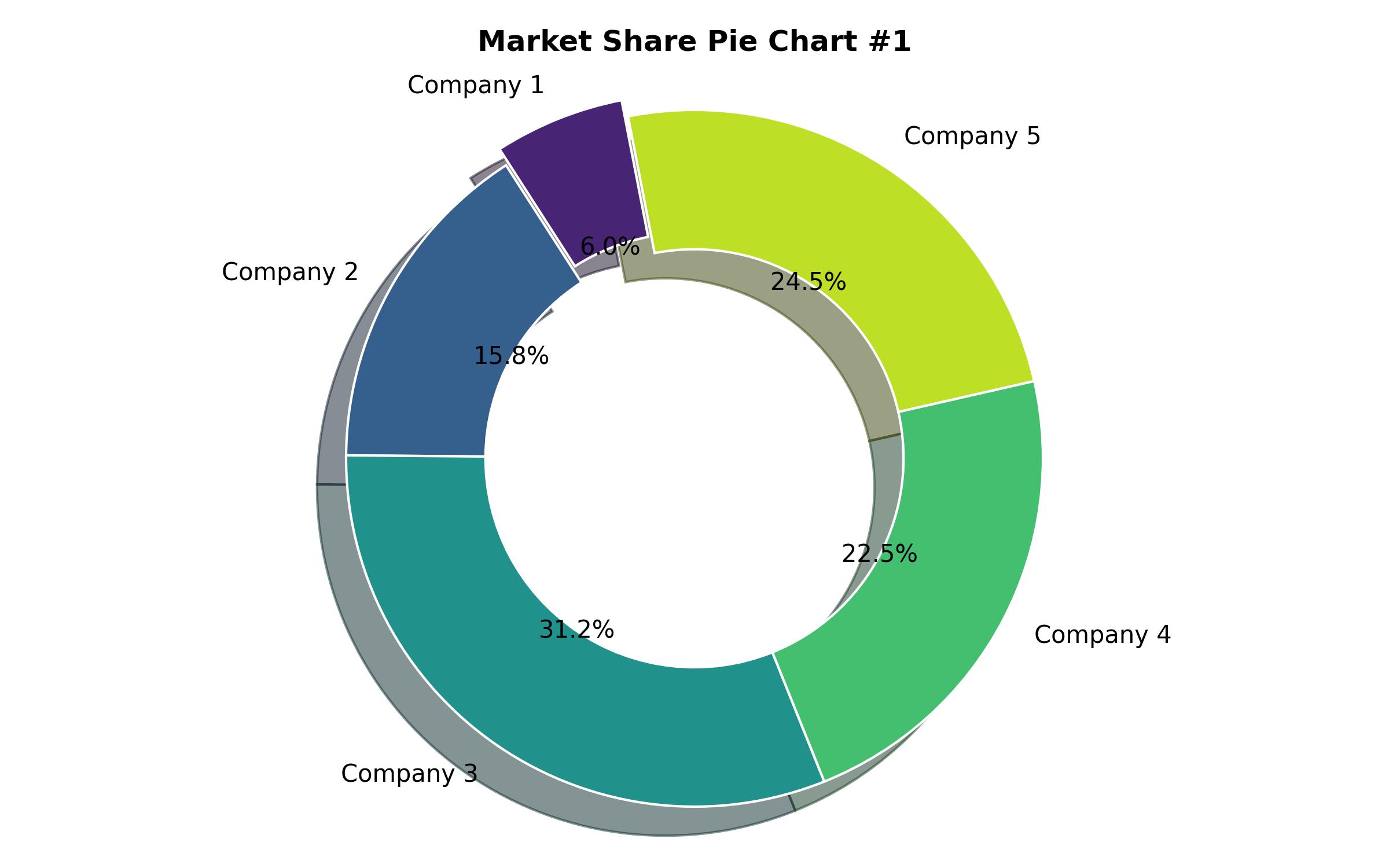

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polylactic Acid (PLA)

- By Application

- Food Packaging

- Pharmaceutical Packaging

- Industrial Packaging

- Consumer Goods Packaging

- By End-Use Industry

- Food and Beverage

- Healthcare

- Chemicals

- Agriculture

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Market Dynamics

- Market Drivers

- Restraints and Challenges

- Opportunities in the Market

- Porter’s Five Forces Analysis

- Market Analysis 2025 to 2035, By Material

- Polyethylene (PE)

- Polypropylene (PP)

- Polyethylene Terephthalate (PET)

- Polystyrene (PS)

- Polyvinyl Chloride (PVC)

- Polylactic Acid (PLA)

- Market Analysis 2025 to 2035, By Application

- Food Packaging

- Pharmaceutical Packaging

- Industrial Packaging

- Consumer Goods Packaging

- Market Analysis 2025 to 2035, By End-Use Industry

- Food and Beverage

- Healthcare

- Chemicals

- Agriculture

- Market Analysis 2025 to 2035, By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2025 to 2035

- Europe Market Analysis 2025 to 2035

- Asia-Pacific Market Analysis 2025 to 2035

- Latin America Market Analysis 2025 to 2035

- Middle East & Africa Market Analysis 2025 to 2035

- Competitive Landscape

- Key Company Profiles

- Strategic Initiatives

- Market Outlook

- Assumptions and Acronyms Used

- Research Methodology