Global Tocopherol Market Expansion Driven by Antioxidant Applications and Industry Demand (2025-2035)

Overview:

The global tocopherol market is anticipated to demonstrate stable expansion throughout the period leading up to 2035. This growth trajectory is fueled by the increasing global need for safe, naturally sourced antioxidants across critical sectors including the food, pharmaceutical, personal care, and animal nutrition industries. Tocopherol, a natural variant of vitamin E, is highly valued for its significant ability to counteract oxidative stress and effectively prolong product shelf life.

Within the processed food sector, tocopherol functions as a crucial natural preservative, extending freshness and preventing spoilage. Simultaneously, in the personal care and cosmetics industry, it is prized for its potent anti-aging benefits and its capacity to enhance skin health and appearance. The market’s valuation stood at approximately USD 18,455.0 Million in 2025. Projections indicate a substantial rise to about USD 35,980.5 Million by 2035, reflecting a robust compound annual growth rate (CAGR) of 7.1% over the ten-year period.

Key market metrics underscore this positive outlook:

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 18,455.0 Million |

| Projected Market Size in 2035 | USD 35,980.5 Million |

| CAGR (2025 to 2035) | 7.1% |

Furthermore, the growing consumer inclination towards ingredients that are natural and possess clean-label certification, as opposed to their synthetic counterparts, is significantly accelerating the widespread adoption of tocopherol in diverse product formulations. With its broadening application spectrum in dietary supplements and functional food products, coupled with continuous innovative advancements in extraction methods, the tocopherol marketplace is securely positioned for sustained growth through the end of 2035.

Key Regional Market Dynamics

North America

North America represents a significant market for tocopherol, driven by strong demand for natural food additives, extensive use in the nutraceutical sector, and elevated consumer awareness regarding the health advantages associated with antioxidants. Innovation in this region is prominently led by the functional foods and skincare sectors, with the United States being the dominant country.

Europe

Europe constitutes another vital market, characterized by considerable demand for clean-label solutions, supportive regulatory frameworks for natural preservatives, and a well-established structure in the cosmetics industry. Key countries contributing to the tocopherol use in food and personal care include Germany, France, and the United Kingdom.

Asia-Pacific

The Asia-Pacific region is experiencing the most rapid expansion in the tocopherol market. This acceleration is largely attributed to a substantial and growing middle class, increasing health consciousness among populations, and swift progress in both the food processing and cosmetics industries. Rising demand for tocopherol-enriched supplements and natural food preservation agents across economies like China, India, and Japan, exemplified by increased investments in food and pharmaceutical manufacturing, is expected to propel regional growth.

Market Challenges and Potential Opportunities

Challenges: Supply Variability, Synthetic vs. Natural Considerations, and Regulatory Nuances

The tocopherol market faces primary challenges related to its reliance on raw materials. Since natural tocopherols are commonly sourced from oils derived from soybeans, sunflowers, and corn, the industry is subject to fluctuations influenced by agricultural yields, regional trade patterns, and overall market volatility.

Concurrently, the distinction between synthetic and natural tocopherols remains a significant factor. Natural variants, particularly d-α-tocopherol, are preferred in high-value applications, leading to price differentials and complexities in regulatory labeling.

Manufacturers navigate a complex global regulatory environment for tocopherol use across varying applications such as food, cosmetics, pharmaceuticals, and animal feed. Differences in permitted concentration levels, guidelines for making antioxidant claims, and requirements for GMO labeling present considerable challenges for businesses operating internationally.

Opportunities: Embrace of Clean Labels, Demand for Natural Antioxidants, and Nutraceutical Growth

Despite these challenges, the tocopherol market stands to benefit from promising opportunities driven by escalating worldwide demand for natural antioxidants, functional food products, and clean-label cosmetics. There is an increasing trend towards utilizing tocopherols as non-synthetic alternatives to substances like BHA and BHT in applications involving edible oils, dietary supplements, and personal care product formulations.

Within the nutraceutical and dietary supplement sector, the demand for products such as soft gels, capsules, and fortified beverages containing vitamin E continues to rise. Increasing global meat consumption coupled with the trend of fortifying livestock feed is also contributing to tocopherol market growth in the animal nutrition segment. Furthermore, the rising consumer preference for plant-based and organic food options is expected to sustain momentum for broader consumption of natural mixed tocopherols as effective agents for extending shelf life.

Comparative Analysis: Market Dynamics (2020-2024) vs. Projections (2025-2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Focused on GRAS status, EU novel food regulations, and INCI labeling standards. |

| Consumer Trends | Demand for clean-label antioxidants in food and cosmetics. |

| Industry Adoption | Used in food oils, dietary supplements, skincare, and animal feed. |

| Supply Chain and Sourcing | Dependent on soy, sunflower, and corn-based distillates , primarily from North America, South America, and Asia. |

| Market Competition | Led by BASF, DSM, ADM, Wilmar Nutrition, and Zhejiang Medicine. |

| Market Growth Drivers | Driven by natural antioxidant substitution, health-conscious diets, and oxidative stability in oils. |

| Sustainability and Environmental Impact | Focus on waste stream utilization from edible oil refining. |

| Integration of Smart Technologies | Limited to batch monitoring in oil refining processes. |

| Advancements in Tocopherol Blends | Basic mixes of alpha, beta, gamma, and delta tocopherols. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Greater emphasis on GMO traceability, organic certification, and region-specific functional claims. |

| Consumer Trends | Shift toward plant-based tocopherols in vegan, fortified, and functional wellness products. |

| Industry Adoption | Expansion into pet nutrition, infant formula, functional beverages, and natural preservative systems. |

| Supply Chain and Sourcing | Move toward non-GMO, organic oil distillates and vertically integrated tocopherol extraction systems. |

| Market Competition | Entry of natural antioxidant startups, clean-label ingredient providers, and Asia-based refiners. |

| Market Growth Drivers | Accelerated by personalized nutrition, bio-preservation in packaged foods, and vegan supplement demand. |

| Sustainability and Environmental Impact | Emphasis on low-carbon tocopherol production, circular bioeconomy integration, and solvent-free extraction. |

| Integration of Smart Technologies | Growth of AI-assisted formulation design and enzyme-based tocopherol extraction for higher yields. |

| Advancements in Tocopherol Blends | Innovation in application-specific blends for cosmetics, infant care, and oxidation-sensitive formulations. |

Country-Specific Insights

United States

The market in the United States is propelled by an increasing preference for ingredients with clean labels and a growing desire for plant-derived vitamin E, boosting its adoption in both nutraceuticals and commercially processed food products. Heightened consumer focus on personal health is anticipated to create significant opportunities within segments such as vitamin E-fortified functional foods and specialized skincare formulations.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

United Kingdom

Growth in the United Kingdom’s tocopherol market is being fueled by a growing health-conscious consumer base, expanding use in organic cosmetic lines, and increased incorporation into fortified food products. Natural food preservation methods are becoming more favored over synthetic options, driving demand for mixed and alpha-tocopherol blends in packaged goods.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 6.9% |

European Union

The market across the European Union is further strengthened by its focus on clean-label nutrition, rising consumer demand for anti-aging skincare products, and a preference for natural additives, all underpinned by governmental regulations across food and beverage sectors. Tocopherol sees increasing application in items like processed meats, bakery goods, milk alternatives, and pharmaceutical products requiring antioxidant stability.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 6.7% |

Japan

Ongoing strong demand for functional food and premium skincare items contributes to consistent gains within Japan’s tocopherol market. As individuals increasingly seek vitamin E through both topical application and ingestion from natural sources, there is expanding innovation in anti-inflammatory and anti-aging products featuring tocopherol.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 6.8% |

South Korea

South Korea’s market is predicted to experience a significant uptick driven by trends in nutricosmetics, wider application of tocopherol in dermatological products, and increased fortification in health beverages and supplements. The growing popularity of K-beauty and the rising prescription of skincare formulations centered on antioxidants are notably boosting the demand for tocopherol in high-end cosmetic items.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.1% |

Market Segmentation Overview

Soybean Oil as Primary Source and Dietary Supplements as Key Application Fuel Market Expansion Amid Growing Consumer Interest in Natural Vitamin E

The market for tocopherol is experiencing growth across numerous sectors, driven by the global demand for naturally sourced antioxidants and broadened vitamin E fortification efforts. As a fat-soluble antioxidant, tocopherol is widely incorporated into nutritional supplements, enriched food items, cosmetic formulations, animal feed, and pharmaceutical compounds to support immune function, promote skin wellness, and ensure oxidative stability.

Characterized as health and wellness components with crucial bioactive properties, tocopherols are extracted from various types of vegetable oils. The market can be delineated by: Source (including Soybean Oil, Rapeseed Oil, Sunflower Oil, Corn Oil, and Other sources) and Application (encompassing usage in Food & Beverages, Feed, Pharmaceuticals, Cosmetics, and Dietary Supplements).

Leading Market Share for Soybean Oil in Source Segment Due to Extensive Availability and High Tocopherol Content

| Source | Market Share (2025) |

|---|---|

| Soybean Oil | 43.1% |

Soybean oil remains the primary source for tocopherol procurement and is forecast to secure approximately 43.1% of the global market share by 2025. This preference stems from its notable concentration of tocopherols, particularly alpha- and gamma-tocopherols, making it an ideal feedstock for large-scale commercial extraction operations.

Attributes such as global accessibility, favorable cost-effectiveness, and a high concentration of tocopherols collectively position soybean oil as a preferred raw material for producers focusing on dietary supplements, food preservation solutions, and cosmetic product development. Furthermore, the origin from soybeans allows for tocopherol products frequently marketed with non-GMO or organic certifications, aligning with increasing consumer interest in clean-label options within functional wellness items.

Dietary Supplements Segment Dominates Applications Driven by Emphasis on Preventive Health

| Application | Market Share (2025) |

|---|---|

| Dietary Supplements | 37.3% |

In terms of end-use, the dietary supplements category holds a substantial portion of the tocopherol market, with a projected share of 37.3% by 2025. Essential for maintaining cellular health, supporting immune functions, and contributing to cardiovascular well-being, these forms of vitamin E are fundamental components in multi-vitamin products, immune-support formulations, and antioxidant supplements.

Global demand for supplements incorporating tocopherol is stimulated by heightened awareness of preventive health strategies, an expanding elderly population, and a rise in prevalent nutritional deficits. Consumers frequently seek naturally derived vitamin E, prompting supplement manufacturers to develop offerings in various forms like capsules, soft gels, powders, and liquids that feature non-synthetic tocopherol ingredients.

Competitive Environment Analysis

The marketplace for tocopherol is demonstrating consistent advancement, propelled by the increasing trend favoring clean-label food preservation methods, amplified demand for natural antioxidants, and the expanded role of vitamin E fortification in sectors including functional foods, cosmetics, and animal nutrition.

Primarily sourced from oils such as soybean, sunflower, and rapeseed, tocopherols are experiencing increasing adoption in functional food items and dietary supplements, anti-aging skincare formulations, and animal feed applications. Companies operating in this arena are directing investments towards ensuring non-GMO sourcing, developing diverse mixed tocopherol compounds, and advancing sustainable extraction methods.

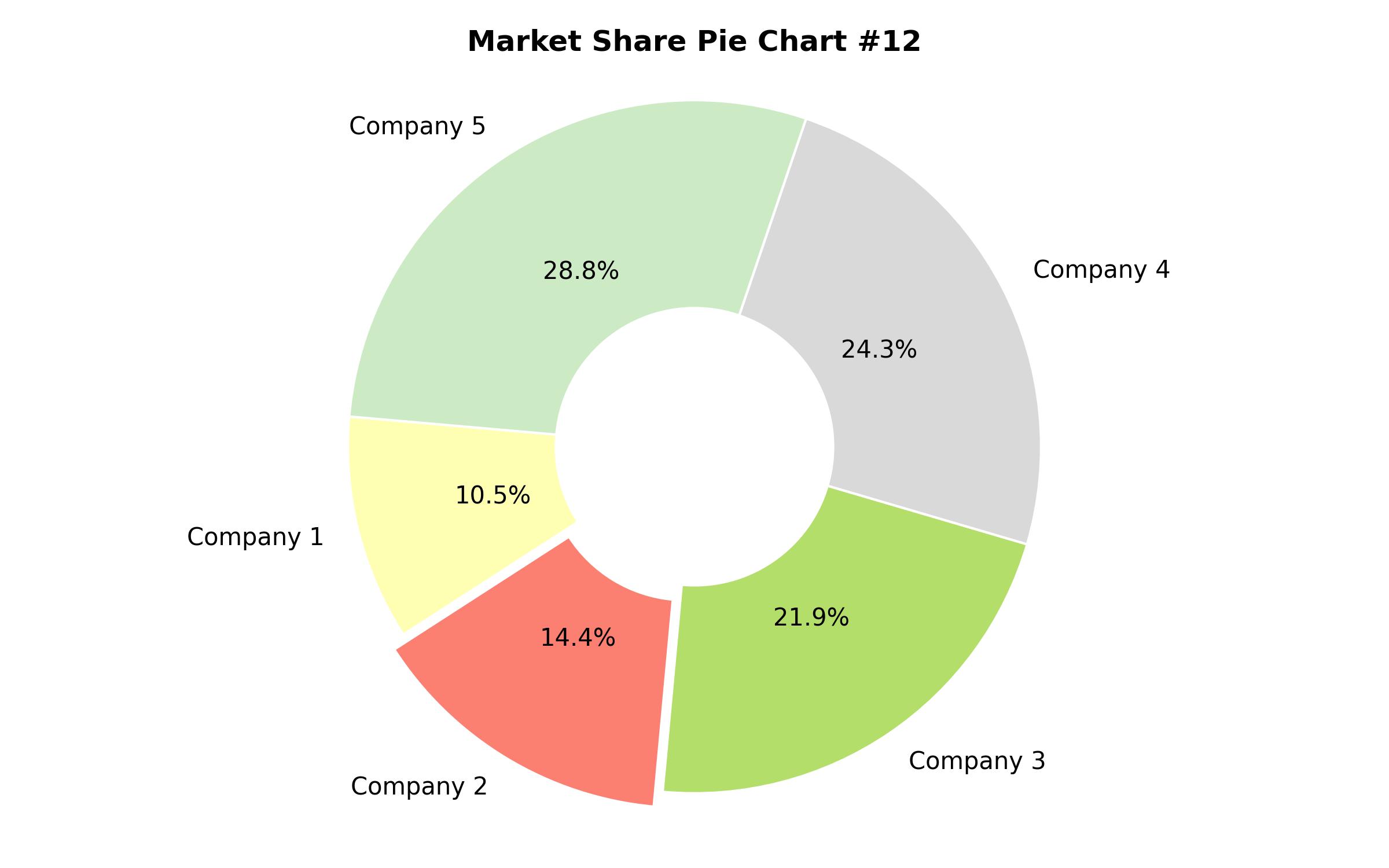

Market Share Distribution by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| BASF SE | 20-24% |

| DSM Nutritional Products | 16 to 20% |

| Archer Daniels Midland Co. | 12-16% |

| Davos Life Science Pte. Ltd. | 6-10% |

| Vitae Naturals | 5-8% |

| Other Companies (combined) | 25-30% |

Details on Key Company Operations and Offerings (2024-2025)

| Company Name | Key Offerings/Activities |

|---|---|

| BASF SE | Introduced non-GMO mixed tocopherol formulations for use in food and personal care products in 2024. Expanded production of refined alpha- and delta-tocopherol concentrates aimed at the pharmaceutical and nutraceutical industries in 2025. |

| DSM Nutritional Products | Launched vitamin E formulations derived from vegetable sources tailored for plant-based dietary supplements in 2024. Directed efforts towards developing persistent tocopherol varieties for applications in preserving dairy and meat products in 2025. |

| ADM (Archer Daniels Midland) | Enhanced its tocopherol extraction capabilities from soybean and sunflower sources in 2024. Progressed in formulating bespoke tocopherol antioxidant blends designed for application in feed and pre-packaged food categories in 2025. |

| Davos Life Science | Offered high-grade combinations of tocotrienol and tocopherol specifically for the cosmetics sector in 2024. Released microencapsulated forms to enhance bioavailability in liquid consumables and capsules in 2025. |

| Vitae Naturals | Increased the scale of its natural tocopherol manufacturing utilizing non-GMO European agricultural outputs in 2024. Debuted mixed tocopherol in powdered format targeted towards producers of baked goods and snacks in 2025. |

Insights into Major Industry Participants

BASF SE (20-24%)

BASF holds a leading position in the tocopherol market, offering a comprehensive range of antioxidant systems that includes both naturally sourced and synthetically produced types. The company supplies sectors such as food, pharmaceuticals, animal feed, and cosmetics, providing products with high levels of standardization that conform to regulations in key markets like the EU and US.

DSM Nutritional Products (16 to 20%)

DSM provides vitamin E solutions sourced sustainably and not derived from animal products. The company has a strong market presence in areas such as functional food items, dietary supplements, and plant-centric formulations, supported by an extensive global distribution network.

ADM (12-16%)

Leveraging its substantial operations in processing soybean and sunflower products, ADM effectively produces natural tocopherols that are cost-competitive. The company serves major manufacturers of food and animal feed, offering customized antioxidant mixtures for various applications.

Davos Life Science (6-10%)

Davos specializes in producing fractions rich in tocotrienol and extracts of tocopherol, primarily targeting the nutricosmetics sector and the development of bioactive formulations. The company focuses on enhancing product bioavailability and suitability for applications related to skin wellness.

Vitae Naturals (5-8%)

Vitae is a prominent European provider of natural tocopherols and formulations based on sterols, serving brands focused on clean labels in the food industry and developers of functional ingredients within European and North African markets.

Other Key Companies (25-30% Combined Estimated Share)

- Nature’s Bounty (a part of Nestlé Health Science)

- Zhejiang Medicine Co., Ltd.

- Wilmar Spring Fruit Nutrition Products Co., Ltd.

- BTSA Biotecnologías Aplicadas S.L.

- KLK OLEO (a subsidiary of Davos Life)

- AOM (Advanced Organic Materials S.A.)

- ILSI Health Ingredients

- Shaanxi Green Bio-Engineering Co., Ltd.

- Xi’an Healthful Biotechnology Co., Ltd.

- Fenchem Biotek Ltd.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 18,444.0 Million |

| Revenue Forecast for 2035 | USD 35,944.6 Million |

| Growth Rate (CAGR) | 6.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Source, end-use industry, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | BASF SE, DSM Nutritional Products, Archer Daniels Midland Co., Davos Life Science Pte. Ltd., Vitae Naturals, Zhejiang Medicine Co., Ltd., Wilmar Spring Fruit Nutrition Products Co., Ltd., BTSA Biotecnologías Aplicadas S.L. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Source

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Corn Oil

- Others

- By Application

- Food & Beverages

- Feed

- Pharmaceuticals

- Cosmetics

- Dietary Supplements

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Billion) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Soybean Oil

- Rapeseed Oil

- Sunflower Oil

- Corn Oil

- Others

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Food & Beverages

- Feed

- Pharmaceuticals

- Cosmetics

- Dietary Supplements

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa (MEA)

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- BASF SE

- DSM Nutritional Products

- Archer Daniels Midland Co.

- Davos Life Science Pte. Ltd.

- Vitae Naturals

- Zhejiang Medicine Co., Ltd.

- Wilmar Spring Fruit Nutrition Products Co., Ltd.

- BTSA Biotecnologías Aplicadas S.L.

- KLK OLEO

- AOM (Advanced Organic Materials S.A.)

- ILSI Health Ingredients

- Other Key Players

- Assumptions and Acronyms Used

- Research Methodology