Global Outlook for Tire Inspection System Market, 2025 to 2035

Overview:

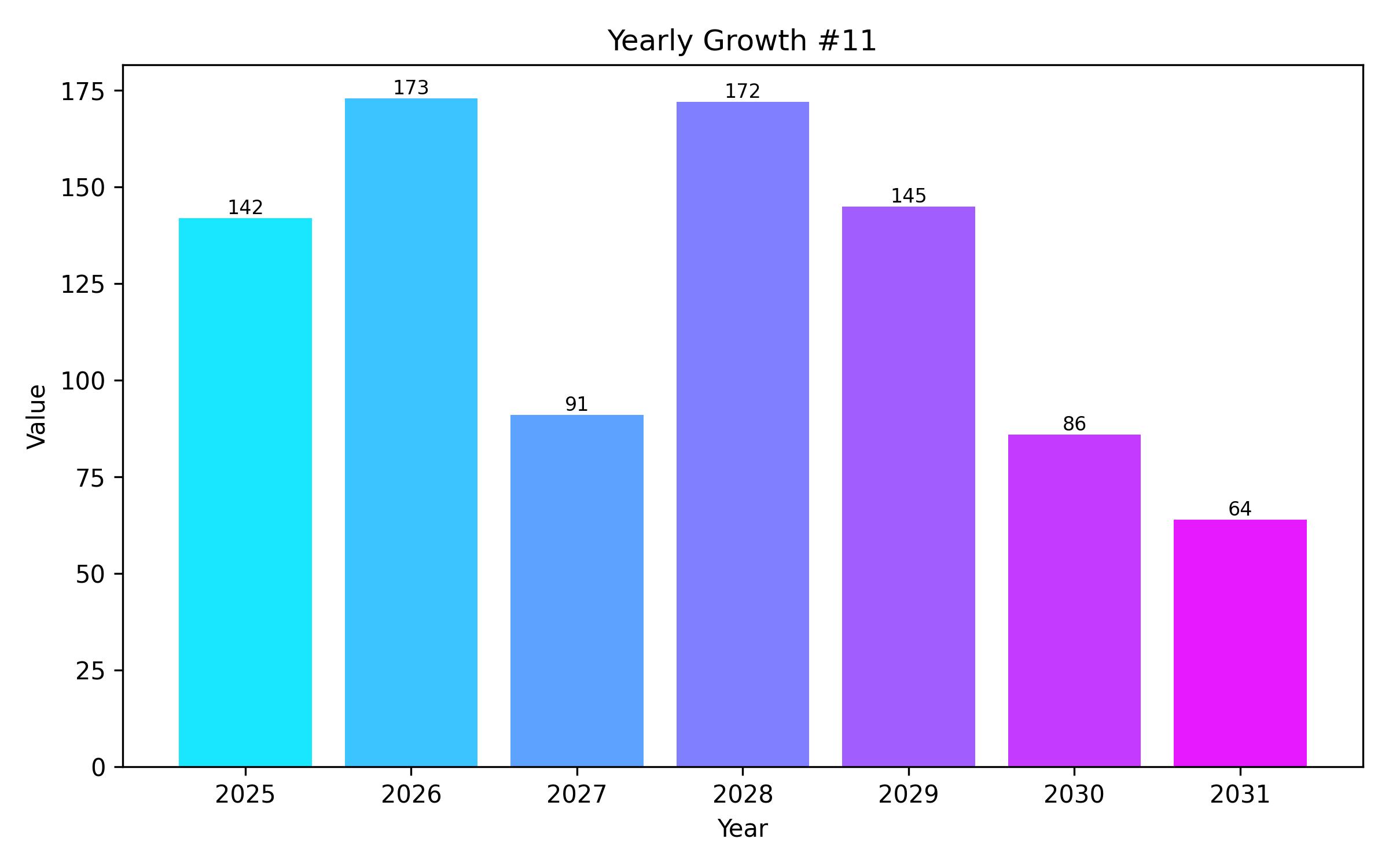

The global market for tire inspection systems is forecast for robust expansion, anticipated to reach a valuation of USD 238.6 million by 2025. Projected to surge further to USD 336.6 million by 2035, this represents a compound annual growth rate (CAGR) of 3.5% over the ten-year period. Key drivers for this growth include increasingly stringent safety regulations within the automotive industry, greater emphasis on enhancing tire performance, and a widespread adoption of automated manufacturing processes across tire production facilities. Leading manufacturers are actively investing in sophisticated inspection technologies to mitigate costly tire recalls and reduce warranty claims.

Technological advancements are significantly shaping the market landscape, with emerging solutions such as AI-powered defect detection and glue insertion prediction systems. Coupled with sophisticated machine vision and laser scanning techniques, these innovations are streamlining inspection workflows, minimizing errors, ensuring product consistency, and accelerating production cycles. This ultimately leads to enhanced operational efficiency and tires of superior quality. Furthermore, the growing prevalence of electric and autonomous vehicles is driving the need for advanced inspection tools capable of analyzing complex tire designs, intricate structures, and meeting higher durability standards.

North America maintains a strong market position, largely due to its proactive adoption of automation and established safety standards. The United States, in particular, shows significant growth stemming from substantial investments in modern manufacturing lines and the presence of numerous automotive OEMs and key suppliers. The region’s focus on fault-free production and preventative maintenance is fostering the adoption of high-performance 3D inspection systems. Additionally, the increasing demand for replacement tires in commercial vehicle fleets is spurring the use of inline inspection technologies in service centers and retreading facilities.

In Europe, market expansion is linked to reinforced vehicle safety regulations and comprehensive tire labeling requirements. Countries like Germany, Italy, and France are extensively integrating high-speed inspection systems within their manufacturing and aftermarket operations. The industry’s shift towards producing more sustainable tires and adhering to standardized EU labeling norms is compelling manufacturers to invest in automated, environmentally conscious inspection solutions. The region’s premium automotive sector is also incorporating advanced laser and surface scanning technologies for enhanced quality control.

The Asia-Pacific region stands out as a rapidly developing market, with countries including China, Japan, India, and South Korea demonstrating strong potential. The continuous expansion of tire manufacturing facilities and the surging demand for both passenger and commercial vehicles are creating ample opportunities for system providers. Both local and international companies are contributing to the growth by investing in automated production sites that increasingly utilize AI and machine vision for inspection. The necessity of meeting international quality benchmarks is a vital factor driving the adoption of high-throughput and error-free inspection systems within this region.

While the significant capital expenditure and inherent complexity of installing advanced inspection systems pose a challenge, particularly for smaller enterprises, the integration of artificial intelligence and predictive analytics presents substantial opportunities. Leveraging AI and machine learning algorithms offers the potential to detect minor defects, decrease false positives, and forecast potential tire failures even before they occur. Connecting real-time inspection data with manufacturing execution and enterprise resource planning systems allows for more responsive quality management, leading to reduced waste and improved overall efficiency.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 238.6 Million |

| Revenue Forecast for 2035 | USD 336.6 Million |

| Growth Rate (CAGR) | 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Technology, End-Use, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, Japan, South Korea, China, India, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | YXLON International GmbH; Micro-Poise Measurement Systems LLC; CyXplus SA; Alfamation Global; MTS Systems Corporation; A&D Technology; Burke Porter Group; AMETEK Inc.; Kistler Group; TMSI LLC |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Technology

- Camera-Based

- Vision-Based

- Laser Scanning

- X-Ray Inspection

- Infrared Testing

- Ultrasonic Inspection

- By End Use

- Tire Manufacturers

- Automotive OEMs

- Component Suppliers

- MRO Centres

- Vehicle Service Centers

- Testing Facilities

- Government Agencies

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Russia, Spain, Nordics, BENELUX, Poland)

- Asia Pacific (China, Japan, India, ASEAN, Australia and New Zealand, South Korea)

- Latin America (Brazil, Mexico, Argentina, Rest of Latin America)

- Middle East & Africa (GCC, South Africa, Israel, Rest of MEA)

Table of Content

- Executive Summary

- Market Overview

- Key Trends in Tire Inspection Systems

- Driving Factors for Market Growth

- Market Dynamics: Opportunities and Challenges

- Market Size Analysis (2025 to 2035)

- Historical Market Performance (2018 to 2024)

- Market Forecast (2025 to 2035)

- Segmental Analysis: Technology

- Camera-Based Inspection Systems

- Vision-Based Inspection Systems

- Laser Scanning Systems

- X-Ray Inspection Technology

- Infrared Testing Methods

- Ultrasonic Inspection Techniques

- Segmental Analysis: End Use Industry

- Tire Manufacturers

- Automotive OEMs

- Component Suppliers

- MRO (Maintenance, Repair, and Overhaul) Centres

- Vehicle Service and Repair Centres

- Testing and Certification Facilities

- Government and Regulatory Agencies

- Regional Market Analysis

- North America Market Outlook

- Europe Market Dynamics

- Asia Pacific Growth Landscape

- Latin America Market Overview

- Middle East and Africa Trends

- Country-Level Analysis

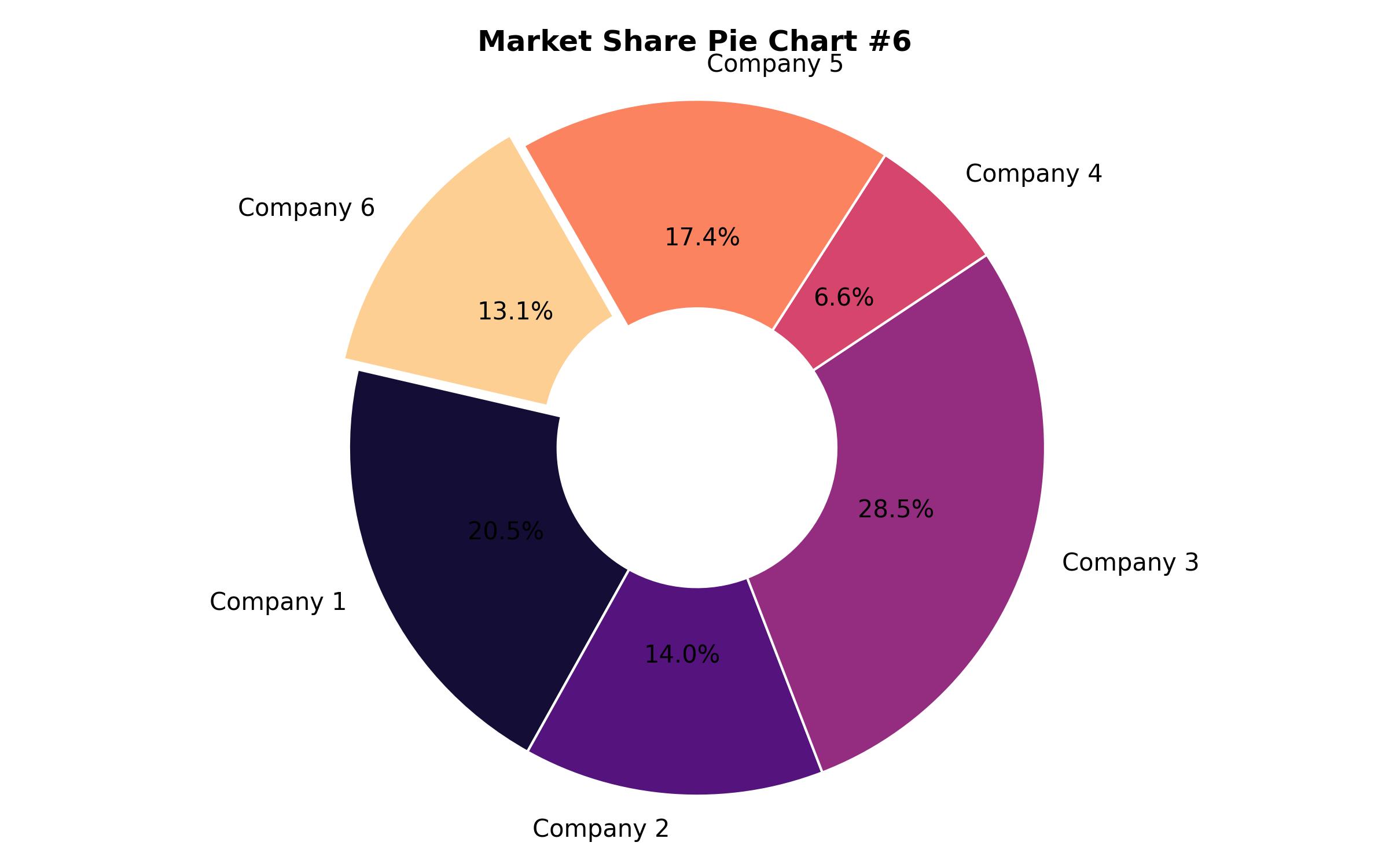

- Competitive Landscape and Market Share

- Key Company Profiles

- Research Methodology and Data Sources