Global Mycoprotein Market Analysis: Form, Sales Channel, Type, and Regional Forecast to 2035

Overview:

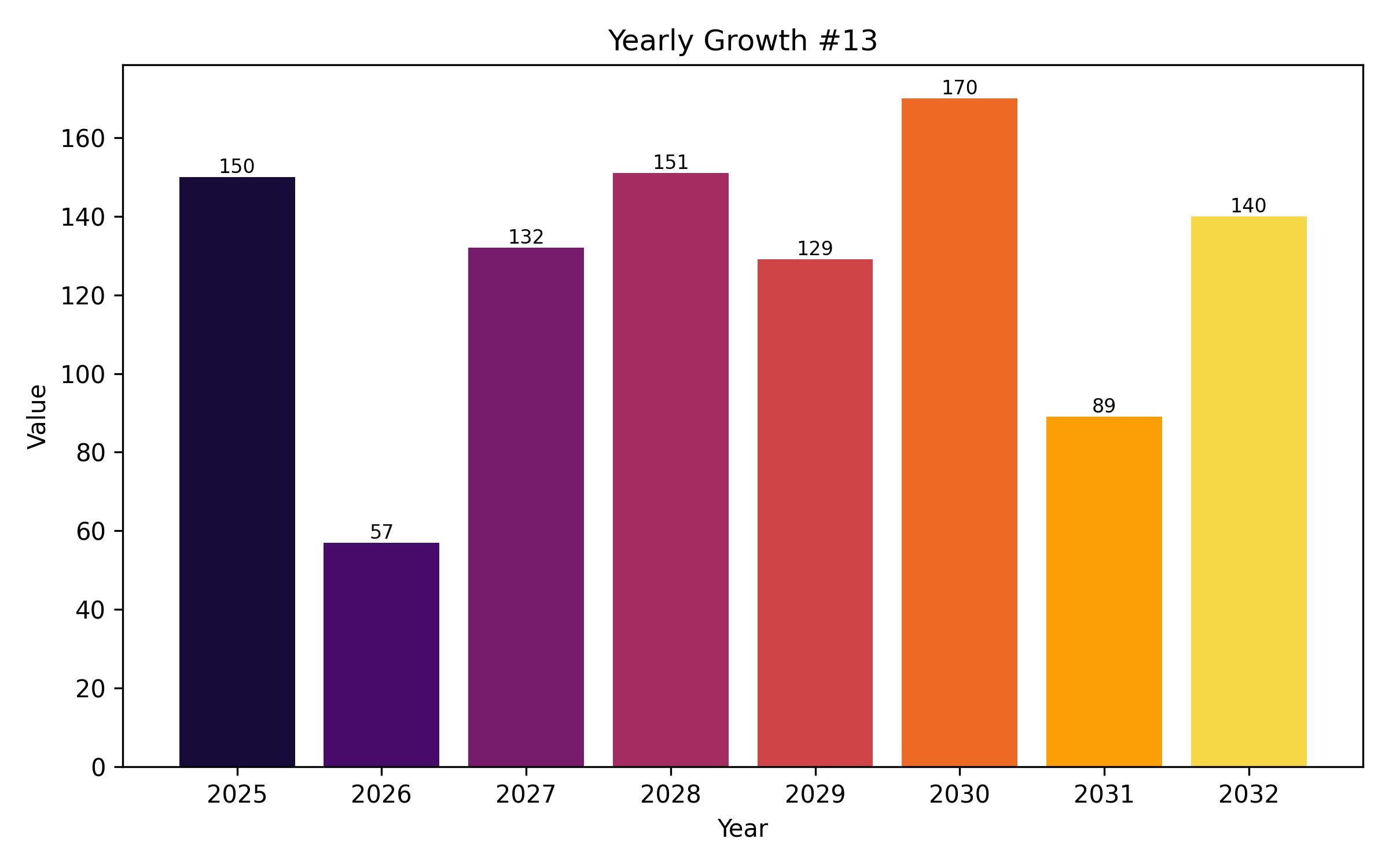

The global market for mycoprotein was valued at USD 720 million in 2024. Anticipated to reach USD 755 million in 2025, the market is projected to grow significantly over the forecast period. From 2025 to 2035, the demand for mycoprotein is expected to rise at a compound annual growth rate (CAGR) of 6.1%, propelling the market size to an estimated USD 1,370 million by 2035.

This expansion is supported by several market drivers. Increasing consumer awareness of sustainable food choices positions mycoprotein advantageously as an innovative and environmentally friendly protein source. Derived from the fungus Fusarium venenatum, mycoprotein offers a balanced protein profile and is rich in fiber while being low in saturated fat and cholesterol, appealing strongly to health-conscious consumers.

Its unique fibrous texture allows for the creation of meat-like products, enabling food manufacturers to develop convincing alternatives such as mycoprotein-based burgers, sausages, and meatballs.

Leading companies are advancing in this sector by improving taste and texture profiles and developing tailored packaging solutions for diverse consumer groups. Mycoprotein is also gaining interest for its processing efficiency compared to traditional protein sources.

Producing mycoprotein requires significantly less land, water, and energy than animal proteins, aligning with global sustainability goals. The growing trend of ethical consumerism, which favors products with minimal environmental impact, further boosts the demand. Additionally, the rise of flexitarian diets broadens the potential consumer base for mycoprotein.

| Attribute | Details |

|---|---|

| Estimated Global Mycoprotein Market Size (2025) | USD 755 million |

| Projected Global Mycoprotein Market Value (2035) | USD 1,370 million |

| Value-based CAGR (2025 to 2035) | 6.1% |

Foodservice establishments are increasingly adopting mycoprotein products to cater to evolving consumer preferences, while research initiatives focus on enhancing mycoprotein with added nutrients and functional ingredients. This combination of sustainability, health benefits, and versatility is a key factor in the expansion of the worldwide mycoprotein market.

For the first half of the 2024 to 2034 forecast period, the market registered a CAGR of 5.7%. Growth accelerated slightly in the second half of 2024, reaching a CAGR of 5.9%, indicating a positive shift in market dynamics.

Analyzing the 2025 to 2035 period, the trend continued with a CAGR of 6.0% in the first half and 6.1% in the latter half, showing continued market momentum. Factors contributing to this include increased investment confidence in alternative proteins, greater focus on research and development in this area, and wider availability of mycoprotein in retail and food service sectors.

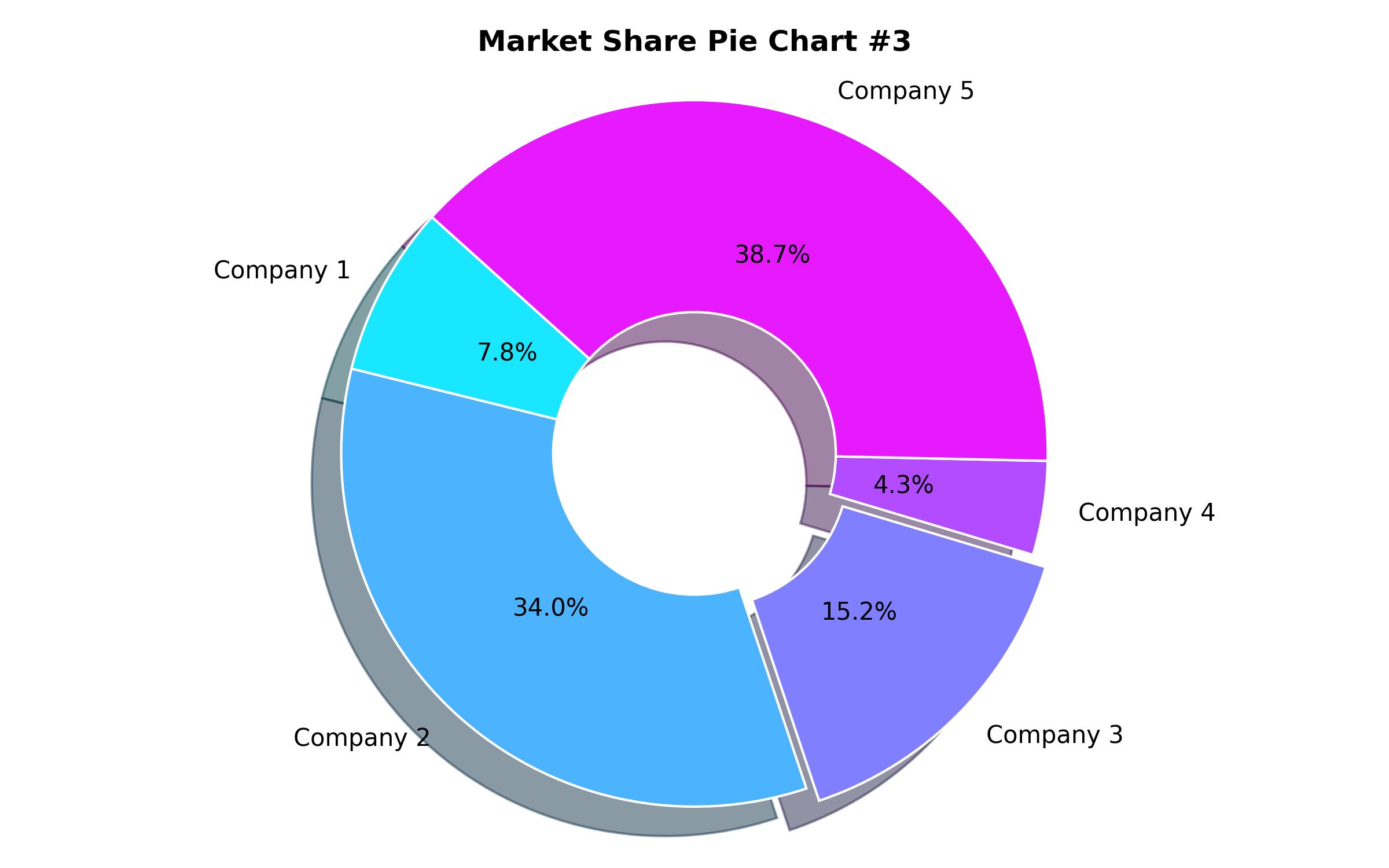

Leading firms with substantial market share, extensive operational scale, and strong brand recognition constitute Tier 1 players. These companies have established supply chains, invest heavily in R&D, and possess vast retail networks. A prominent Tier 1 entity, the owner of a major mycoprotein brand, is widely recognized as a pioneer, having developed and globally popularized the ingredient. With a significant presence across Europe, North America, and Asia-Pacific, this brand has become a mainstream alternative, supported by consistent innovation and marketing.

Tier 2 companies are characterized by a notable market presence and high levels of innovation, though their revenue and geographical reach are less extensive than Tier 1 players. A notable example is a US-based firm that cultivates protein from a unique fungal source and is expanding its reach with a focus on sustainability and novel food applications. These companies leverage strategic collaborations and R&D to grow market share and appeal to consumers seeking environmentally conscious options.

Tier 3 comprises emerging businesses and startups entering the mycoprotein sector. These firms often concentrate on specific applications or B2B support, providing niche ingredients or producing finished goods for particular markets. While smaller in scale and scope, these companies introduce fresh approaches, emphasizing unique environmental benefits, cultural relevance, and innovative food formats. Their strategies often involve direct-to-consumer sales, partnerships, and targeted digital marketing.

Adapting to Market Dynamics in the Mycoprotein Sector

Key shifts in consumer behavior and technological advancements are reshaping the mycoprotein market. Companies are responding with targeted strategies in product development, market entry, environmental positioning, sales channels, cost management, online presence, and regional adaptation to effectively address these evolving trends.

Product Innovation and Health Focus: Consumers increasingly seek healthy, sustainable proteins. Mycoprotein’s nutritional profile makes it attractive, particularly in developed markets. Manufacturers are reformulating products to be cleaner label and allergen-friendly, introducing fortified options for health and fitness enthusiasts.

Expansion in Meat Analogues: The demand for meat substitutes with comparable taste and texture is rising. Mycoprotein’s natural fibrous structure is ideal for creating realistic burgers, sausages, and ready meals. Companies are expanding product lines to meet this demand in retail and foodservice sectors.

Sustainability Appeal: Young consumers are particularly influenced by environmental impact. Mycoprotein’s low resource footprint is a strong selling point. Businesses highlight fermentation technology and eco-credentials through branding and digital media, engaging environmentally conscious demographics.

Accessibility and Partnerships: Mainstreaming alternative proteins increases the expectation for wider availability. Quick service restaurants and major retailers are stocking mycoprotein products. Strategic collaborations are key to expanding the presence of mycoprotein items in various retail formats and food service outlets.

Circular Economy Integration: Fungal fermentation aligns with circular economy principles by utilizing waste streams. Some companies are adopting processes that use waste biomass, promoting zero-waste models. This is communicated through branding and packaging to appeal to eco-aware consumers and investors.

Pricing Strategies: Affordability is a factor in broader adoption, especially in price-sensitive markets. Companies are developing single-serve and value-sized mycoprotein products and working with local partners to tailor offerings and distribution to lower-income segments and institutional settings.

E-commerce Channels: Online platforms are crucial for reaching consumers seeking specific dietary options. Direct-to-consumer models and specialized online stores are increasingly used for mycoprotein products, offering subscription services and curated bundles to enhance customer loyalty and engagement.

Regional Product Customization: Demand varies by local food traditions and regulations. Companies are developing region-specific mycoprotein products and flavor profiles to cater to diverse markets, including applications in traditional dishes and ensuring compliance with local dietary requirements like halal certification.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 755 million |

| Revenue Forecast for 2035 | USD 1,370 million |

| Growth Rate (CAGR) | 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Form, sales channel, type, and region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, MEA |

| Country Scope | U.S., Canada, Mexico, Brazil, Argentina, U.K., Germany, France, China, India, Japan, Australia, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Marlow Foods Ltd. (Quorn Foods), 3F Bio Ltd. (ENOUGH), Tyson Ventures, MycoTechnology Inc., Temasek Holdings, General Mills, Beyond Meat Inc., Impossible Foods Inc., Yutong Industrial Co. Limited, Shouguang FTL Bio Co., Ltd., Symrise, Kernel Mycofoods, Atlast Food Co., and Others. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Form

- Minced

- Blocks

- Strips

- Other Forms

- By Sales Channel

- B2B

- B2C

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- By Type

- Food Grade

- Feed Grade

- By Region

- North America (including the U.S., Canada, Mexico)

- Latin America (including Brazil, Argentina)

- Europe (including the U.K., Germany, France, Italy, Spain)

- East Asia (including China, Japan, South Korea)

- South Asia & Pacific (including India, Australia, New Zealand)

- Middle East & Africa (MEA) (including UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Opportunities in Mycoprotein Market

- Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Value Chain Analysis

- Market Pricing Analysis

- Market Size (in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Form

- Minced

- Blocks

- Strips

- Other Forms

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- B2B

- B2C

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Food Stores

- Online Retail

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Type

- Food Grade

- Feed Grade

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East and Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Country-wise Analysis

- Market Structure Analysis

- Competition Analysis

- Marlow Foods Ltd. (Quorn Foods)

- 3F Bio Ltd. (ENOUGH)

- Tyson Ventures

- MycoTechnology Inc.

- Temasek Holdings

- General Mills

- Beyond Meat Inc.

- Impossible Foods Inc.

- Yutong Industrial Co. Limited

- Shouguang FTL Bio Co., Ltd.

- Symrise

- Kernel Mycofoods

- Atlast Food Co.

- Other Players

- Assumptions and Acronyms

- Research Methodology