Global Market Analysis for Pesticide Detection Systems

Overview:

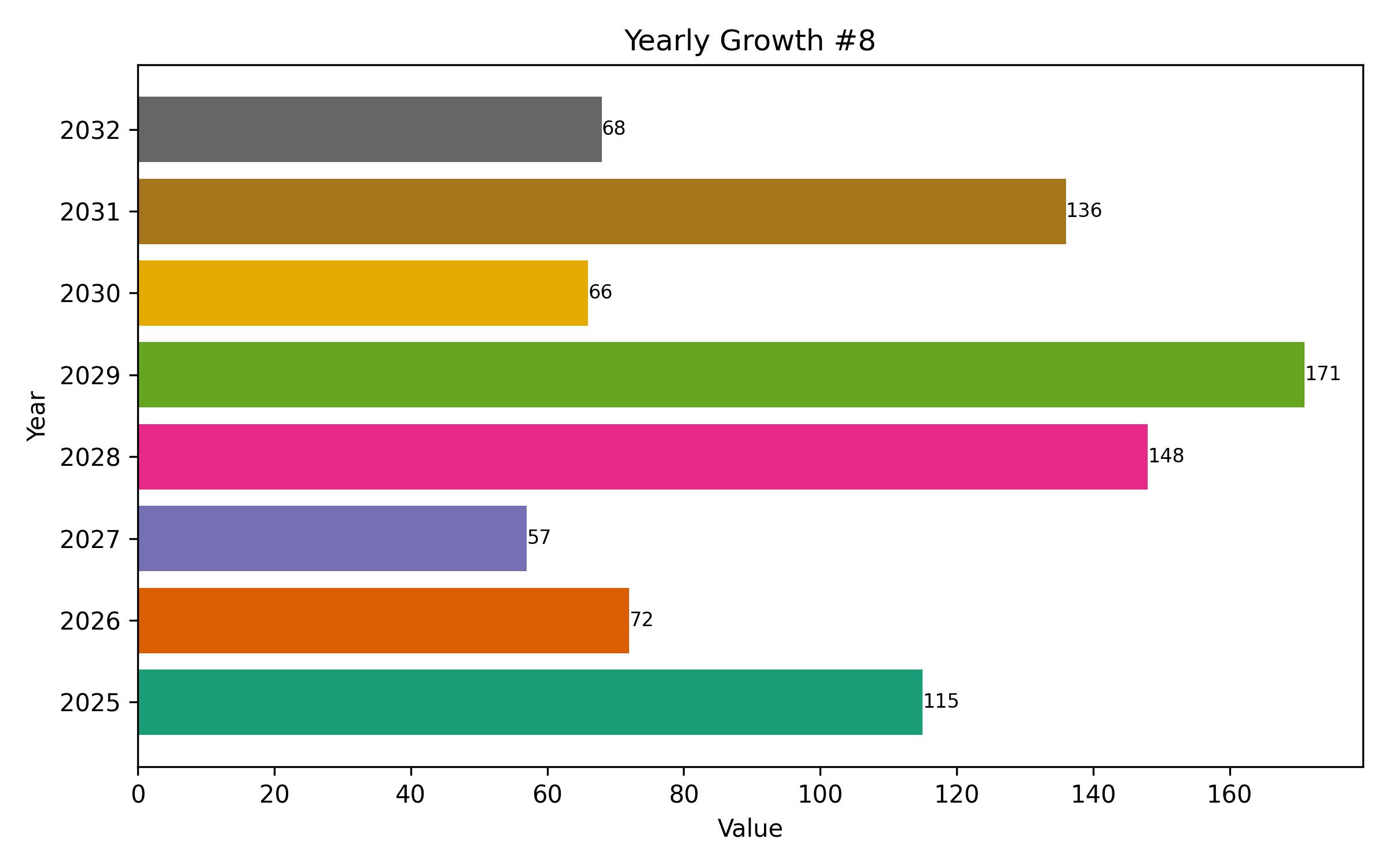

The global market for pesticide detection systems is poised for significant expansion, anticipating a rise in value from USD 1.507 billion in 2025 to an estimated USD 2.432 billion by 2035. This forecast indicates a compound annual growth rate (CAGR) of 4.9% over the ten-year period.

Heightened awareness regarding food safety and the environmental consequences of pesticide use is a key driver for this market. Governments and regulatory bodies across the world are implementing stricter limits on acceptable pesticide residue levels, necessitating more precise and reliable detection methods.

Technological advancements are playing a crucial role in the market’s growth. Sophisticated analytical techniques such as High-Performance Liquid Chromatography (HPLC) and Gas Chromatography-Mass Spectrometry (GC-MS) offer increased sensitivity and accuracy in identifying and quantifying minute traces of pesticides in diverse samples.

The increasing complexity of pesticide formulations and the need to screen for a wider range of compounds are further accelerating the adoption of advanced detection solutions. Laboratories and testing facilities are investing in cutting-edge instruments and methodologies to meet these evolving demands.

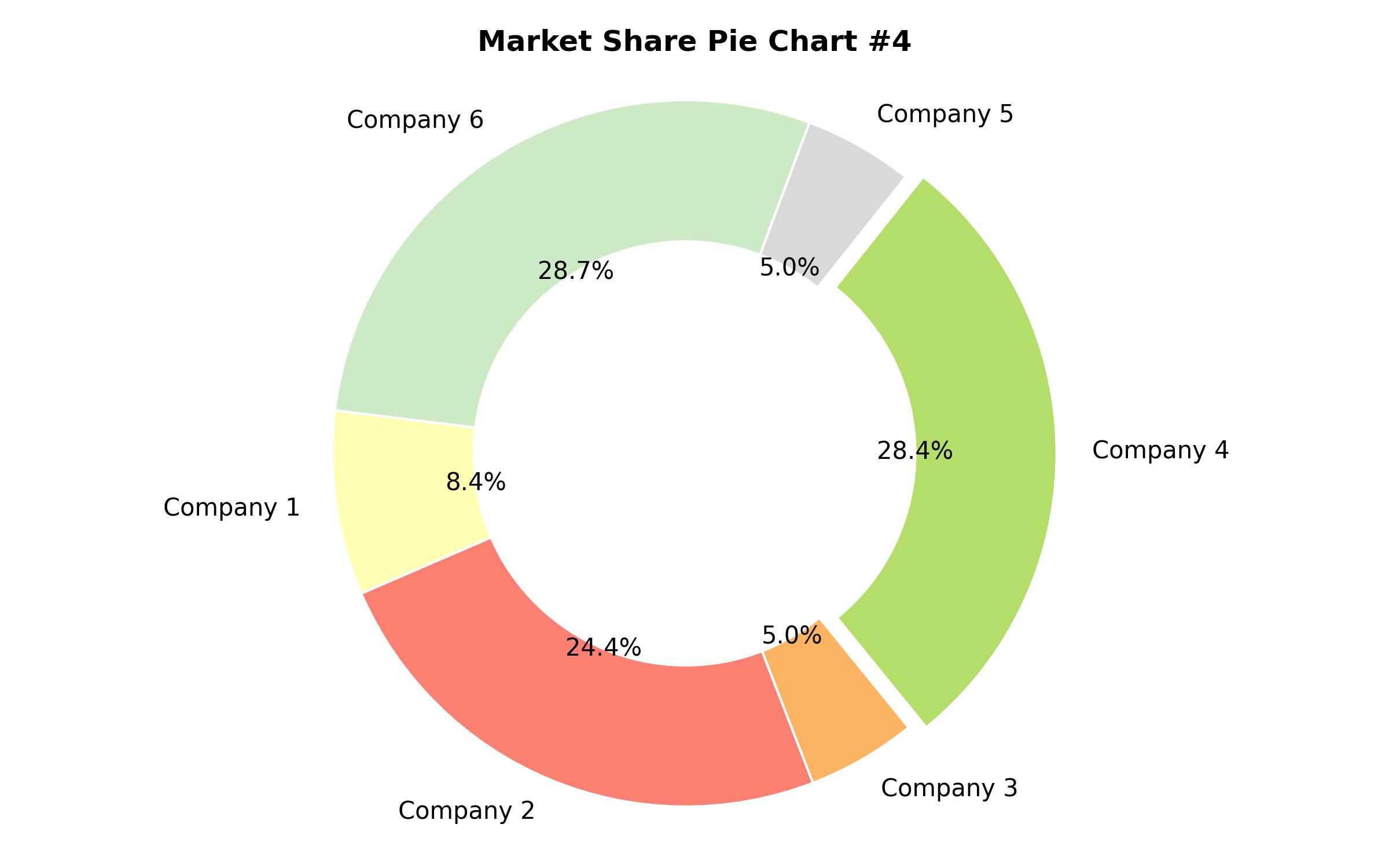

Regional dynamics heavily influence the market landscape. Developed regions like North America and Europe currently hold a dominant position, reflecting strong regulatory frameworks and advanced technological infrastructure. These regions have established comprehensive testing protocols to ensure compliance with strict safety standards.

Emerging economies in the Asia-Pacific region are also demonstrating substantial growth potential. Driven by expanding agricultural sectors and a rising focus on enhancing food quality standards for both domestic consumption and international trade, countries in this region are increasingly investing in modern pesticide detection capabilities.

While Latin America and the Middle East & Africa present smaller market shares currently, growing awareness about food security and strengthening regulatory environments are expected to contribute to steady progress in these regions.

The competitive environment is characterized by the presence of several global leaders in analytical instrumentation alongside specialized firms offering niche detection solutions. Continuous innovation in terms of speed, portability, and multiplexing capabilities is a key differentiator among market players.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1.507 billion |

| Revenue Forecast for 2035 | USD 2.432 billion |

| Growth Rate (CAGR) | 4.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Method, technology, sample type, end user, and region |

| Regional Scope | North America, Europe, Asia-Pacific, Latin America, MEA |

| Country Scope | USA, Germany, India, China, Japan, UK, France, Italy, Brazil, Mexico, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Agilent Technologies, Thermo Fisher Scientific, PerkinElmer Inc., Waters Corporation, Renka Bio, Sciex, Merck, Shimadzu Corporation, ALS Limited, SpensaKarlabs, AsureQuality Ltd., SCS Global Services, Microbac Laboratories Inc., Symbio Laboratories, Eurofins Scientific, Intertek Group plc, SGS SA, Fera Science Limited |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Method

- Single-residue methods

- GC-MS

- HPLC

- Multi-residue methods

- GC-MS/MS

- LC-MS/MS

- Single-residue methods

- By Technology

- Chromatography-based

- Spectroscopy-based

- Immunoassay-based

- Other Technologies

- By Sample Type

- Food & Beverage

- Environmental Samples

- Agricultural Samples

- Other Sample Types

- By End User

- Food Testing Laboratories

- Environmental Testing Laboratories

- Agricultural Laboratories

- Government Agencies

- Research Institutes

- By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Overview

- Market Introduction and Definition

- Market Dynamics

- Pestle Analysis

- Porter’s Five Forces Analysis

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Value Chain Analysis

- Trends and Opportunities

- Market Analysis 2025-2035, By Method

- Single-residue methods

- GC-MS

- HPLC

- Multi-residue methods

- GC-MS/MS

- LC-MS/MS

- Single-residue methods

- Market Analysis 2025-2035, By Technology

- Chromatography-based

- Spectroscopy-based

- Immunoassay-based

- Other Technologies

- Market Analysis 2025-2035, By Sample Type

- Food & Beverage

- Environmental Samples

- Agricultural Samples

- Other Sample Types

- Market Analysis 2025-2035, By End User

- Food Testing Laboratories

- Environmental Testing Laboratories

- Agricultural Laboratories

- Government Agencies

- Research Institutes

- Market Analysis 2025-2035, By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2025-2035

- Europe Market Analysis 2025-2035

- Asia-Pacific Market Analysis 2025-2035

- Latin America Market Analysis 2025-2035

- Middle East & Africa Market Analysis 2025-2035

- Competition Landscape

- Key Player Profiles

- Research Methodology

- Assumptions and Disclaimer