Global Macadamia Milk Market Trajectory by Product Attributes and Distribution Channels (2025-2035)

Overview:

The macadamia milk sector demonstrates substantial growth potential, having reached a market size of around USD 40 million by the close of 2023. Projections indicate that the market valuation will increase to approximately USD 44 million in 2025. Looking ahead, the market is anticipated to expand significantly, with forecasts suggesting a value of roughly USD 71 million by the end of 2035. This expansion is supported by an estimated solid compound annual growth rate (CAGR) of 5.1% across the decade from 2025 to 2035.

A primary driver for the increasing popularity of macadamia milk is the surging consumer shift towards plant-based dairy substitutes. As individuals increasingly opt for lactose-free and vegan alternatives, macadamia milk stands out due to its rich, creamy consistency and perceived health benefits, positioning it as a strong competitor in the non-dairy beverage segment.

Rich in monounsaturated fats and low in sugars, macadamia milk appeals strongly to health-conscious consumers, those following ketogenic diets, and individuals seeking premium alternative beverage options. Leading brands within the market are actively capitalizing on this trend by expanding their product lines to include organic, unsweetened, and nutrient-enhanced variants.

The market currently offers a diverse product portfolio, including chilled, shelf-stable (ambient), and specialized barista formulations. The rising popularity of macadamia milk in professional coffee settings and for crafting specialty drinks is a significant contributor to its demand growth. Additionally, a prominent focus on ethical and sustainable sourcing practices is playing a key role in market expansion, with companies increasingly highlighting regenerative farming and environmentally friendly packaging solutions.

| Attribute Data | Market Specifics |

|---|---|

| Projected Global Market Size (2025) | USD 44.1 million |

| Estimated Global Market Value (2035) | USD 71.3 million |

| Calculated CAGR (2025 to 2035) | 5.1 % |

Macadamia milk’s ascent in consumer preference is largely attributed to its positioning as an upscale non-dairy option. Its naturally smooth, buttery flavor makes it a favored ingredient in various applications, including blended drinks, hot beverages, and culinary uses.

Its market acceptance has been further solidified by the growing inclination towards products that are natural, minimally processed, and nutrient-dense within the plant-based category. Continued innovation in product formulations, the inclusion of added nutritional components, and enhanced focus on sustainable production methodologies are expected to drive sustained market growth moving forward.

Semi-Annual Market Performance Overview

The subsequent table provides a comparative view of the compound annual growth rate variations over a span of six months, contrasting data from the base year (2024) with the current year (2025) for the worldwide macadamia milk industry. This comparison offers insights to stakeholders regarding shifts in market trends and revenue progression, providing a clearer perspective on growth trajectories.

| Period | Value-Based CAGR |

|---|---|

| First Half | 4.8 % (2024 to 2034) |

| Second Half | 4.9 % (2024 to 2034) |

| First Half | 5.0 % (2025 to 2035) |

| Second Half | 5.1 % (2025 to 2035) |

Within the timeframe of 2025 through 2035, the market is anticipated to expand with a CAGR of approximately 5.0% during the first half of each year and 5.1% during the second half. The projected CAGR for the comprehensive period from the first half of 2025 through the second half of 2035 suggests a consistent pattern of growth. This market expansion is expected to be propelled by increasing consumer preferences for premium plant-derived beverages, a wave of product innovations focusing on macadamia, and consumer behaviors increasingly oriented towards sustainability.

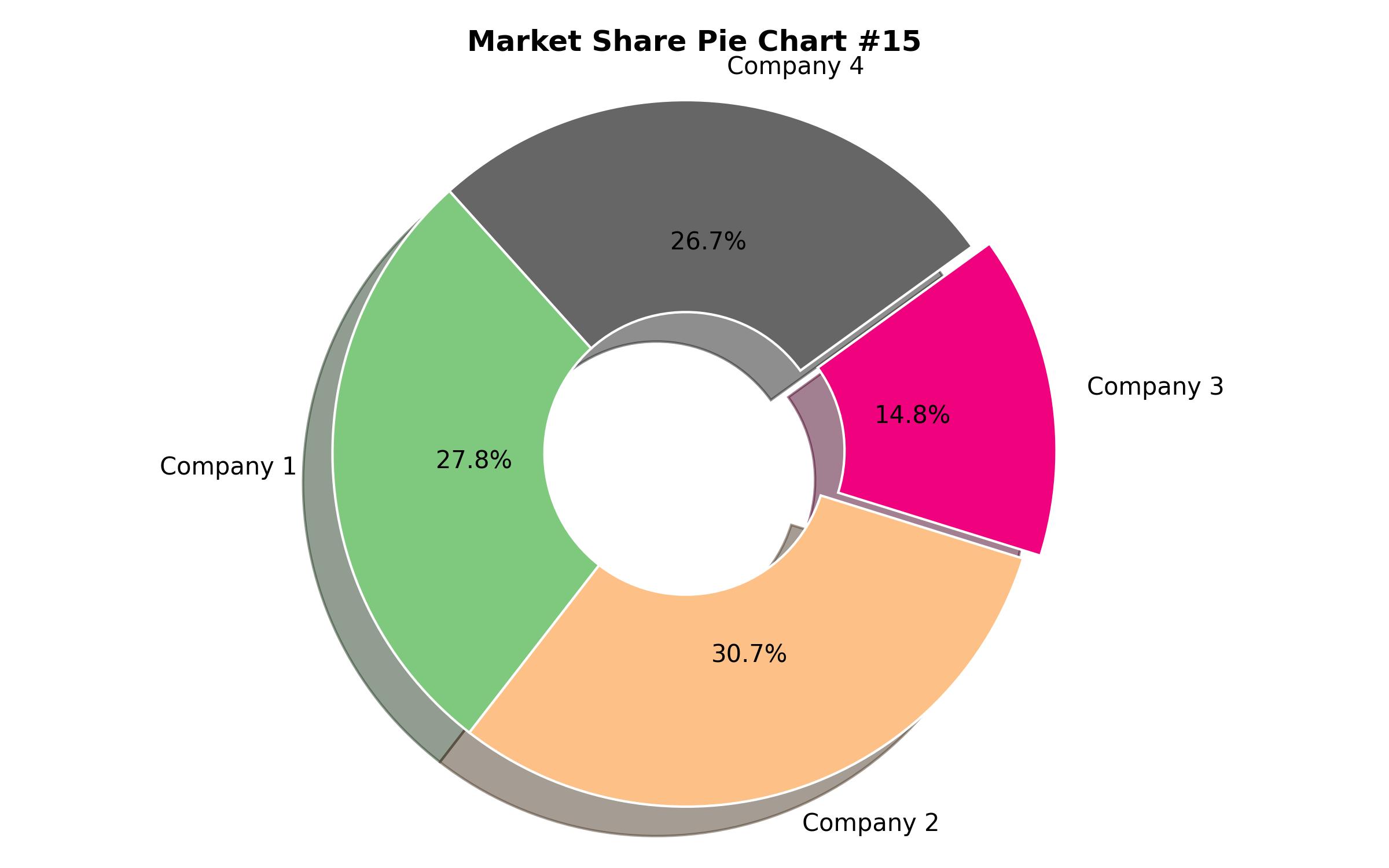

Market Participant Landscape

Tier 1 participants represent leading enterprises characterized by significant market presence, established revenue streams, extensive distribution networks, and strong brand recognition. These corporations typically allocate considerable resources to marketing efforts, product innovation, and retail expansion to maintain their market dominance. Prominent examples include major brands offering comprehensive ranges of macadamia milk products, from specialized coffee blends to low-sugar options, with widespread availability across mainstream grocery, cafes, and digital platforms.

Tier 2 encompasses medium-sized entities that, while substantial players, often focus on specific market niches, emphasizing the quality of ingredients, sustainable practices, and consumers prioritizing health. These brands distinguish themselves through factors like clean ingredient lists, formulations free from additives, production methods that preserve nutritional value without standard thickeners, and a commitment to transparency regarding ingredients and sourcing. Their appeal is strong among consumers favoring natural, wholesome products over mass-market offerings.

Tier 3 consists of emerging and smaller enterprises often utilizing direct-to-consumer channels, specialized distribution, and unique product propositions to gain market entry. These businesses frequently leverage organic certifications, non-GMO labeling, and distinctive packaging as means of differentiation in a competitive environment. Some focus on direct ties to macadamia cultivation, promoting traceability and local production, often reaching consumers through e-commerce, social media engagement, and local markets to build brand identity and customer loyalty.

Adapting to Evolving Macadamia Milk Industry Dynamics and Brand Approaches

Escalating Demand for Non-Dairy and Plant-Derived Alternatives

Industry Shift: The trend towards eliminating dairy and choosing plant-based milk substitutes continues its upward trajectory, driven by consumers focused on wellness seeking options free from lactose, suitable for vegan diets, and addressing allergen concerns. Macadamia milk, noted for its smooth texture, rich flavor, and beneficial monounsaturated fats, is emerging as a significant alternative to established options like almond, oat, and soy milk. Interest is also expanding into less urbanized areas, particularly concerning non-GMO, simple ingredient, and organic macadamia milk variations in key regions where plant-focused eating is increasingly prevalent.

Brand Responses: In alignment with this trend, major brands have broadened their product portfolios to include organic and unsweetened versions of macadamia milk, observing a reported increase in sales among health-conscious consumers. Other significant brands have developed specialized macadamia milk products designed for optimal performance in coffee beverages, targeting consumers who value a creamy texture in their lattes and cappuccinos but prefer plant-based ingredients. Local producers in key macadamia-growing regions are leveraging their supply chain proximity to market traceable, single-origin macadamia milk to consumers seeking premium quality.

Expansion into Ready-to-Drink and Flavored Offerings

Industry Shift: Consumers are increasingly seeking convenient, pre-packaged plant-based beverages containing macadamia milk for easy consumption away from home. Flavored macadamia milk, featuring varieties such as vanilla, chocolate, and green tea (matcha), is gaining favor, particularly among younger adult demographics who are drawn to more exciting and indulgent dairy-free choices.

Brand Responses: Seizing this market opportunity, some brands have launched flavored macadamia milk in ready-to-drink carton formats, including vanilla and gently sweetened options, leading to reported sales increases in convenience retail settings. Other companies have introduced beverage blends combining macadamia milk with chocolate or coffee, venturing into the category of café-style ready-to-drink products. Several brands have also extended their range of individual-serving macadamia milk products, targeting urban professionals and consumers interested in healthy options on the go.

Increasing Adoption within the Professional Coffee and Food Service Sectors

Industry Shift: The specialized coffee and broader food service industry is increasingly adopting macadamia milk as a premium, dairy-free alternative to more common options like oat and almond milk. Its ability to froth effectively is making macadamia milk a preferred choice for baristas and serious coffee enthusiasts. The demand for plant-based milks specifically formulated for professional use is particularly strong in regions with developed third-wave coffee scenes.

Brand Responses: In response, some companies have partnered with prominent cafe chains to introduce macadamia milk specifically designed for baristas, contributing to reported growth in demand from coffee establishments. By integrating macadamia milk into their dairy-free beverage menus, various coffee retailers have observed an increase in the sales of plant-based lattes. Local coffee roasters in macadamia-producing regions are incorporating locally-sourced macadamia milk options, appealing to consumers who prioritize sustainability in their coffee choices.

Growth in Digital Commerce and Subscription Service Channels

Industry Shift: With the expansion of online grocery shopping, a larger number of consumers are purchasing macadamia milk through e-commerce platforms and direct-to-consumer subscription services. Online sales of plant-based milks have significantly increased in major markets, reflecting the convenience of digital purchasing and the option to buy in larger quantities.

Brand Responses: To capture this expanding market segment, some brands have launched direct-to-consumer subscription services offering discounted bundles of macadamia milk, leading to an increase in returning customers. The availability of macadamia milk varieties on major online retail and grocery delivery platforms has also boosted online sales. Several brands have introduced bulk ordering options not only for professional customers but also targeting home consumers seeking economical and long-lasting plant-based milk solutions.

Emphasis on Environmental Responsibility and Ethical Sourcing

Industry Shift: Consumers concerned with environmental impact are paying close attention to the sustainable credentials of plant-based milks, evaluating ingredient sourcing, water usage, and carbon footprint. Macadamia milk is frequently viewed as a more sustainable option compared to counterparts with potentially higher water footprints or greater reliance on pesticides, as macadamia cultivation is often associated with lower environmental impact.

Brand Responses: Some companies are promoting initiatives highlighting sustainable farming practices and positioning macadamia milk as having a positive environmental impact, focusing on soil health and carbon neutrality; this strategy has reportedly contributed to increased sales among environmentally conscious buyers. Producers in key macadamia regions are increasing transparency about their sustainable farming methods, which has supported growth in premium retail segments. Other brands have transitioned to fully recyclable packaging, appealing to consumers focused on waste reduction and leading to reported increases in sales driven by sustainability concerns.

Strategy of Competitive Pricing and Broader Market Accessibility

Industry Shift: While macadamia milk is often positioned as a premium choice, some price-sensitive consumers are seeking more budget-friendly non-dairy options. Given the competitive pricing dynamics, particularly among almond and oat milk products, macadamia milk brands are adapting their pricing approaches to improve affordability.

Brand Responses: Some brands have adjusted their pricing downward for certain macadamia milk products, leading to reported sales increases among consumers sensitive to cost. The introduction of more affordable macadamia milk options under private-label supermarket brands has reportedly expanded household penetration. Additionally, several brands are offering multi-pack discounts, making macadamia milk more economical for regular consumers and families.

Region-Specific Market Adaptation Strategies

Industry Shift: While macadamia milk enjoys established popularity in key macadamia-producing regions, interest is demonstrating distinct growth patterns across various international markets where plant-based dairy alternatives are gaining traction.

Brand Responses: To address diverse regional preferences, specific strategies have been implemented: In major North American markets, brands have introduced barista-focused macadamia milk products tailored to the strong coffee culture. In Australia, several brands emphasize local sourcing of macadamias to resonate with consumers prioritizing regional products. In European markets, brands are expanding distribution through major retail chains, targeting consumers interested in organic and vegan options. In Asian markets, some brands are positioning macadamia milk as a premium, easily digestible dairy alternative for individuals with lactose intolerance, leveraging e-commerce for market entry.”

Regional Market Insights

The subsequent table provides estimated growth rates for the top five geographical areas expected to demonstrate notable consumption of macadamia milk through the year 2035.

| Geographical Area | Estimated CAGR, 2025 to 2035 |

|---|---|

| United States | 4.8% |

| Germany | 5.1% |

| China | 5.5% |

| Japan | 4.9% |

| India | 5.3% |

United States Industry Expansion Fueled by Appetite for Upscale Plant-Derived Milk Options

The growing consumer preference for sophisticated, plant-based alternatives to conventional dairy is acting as a significant catalyst for the macadamia milk market within the United States. As awareness of plant-based nutrition becomes more widespread, macadamia milk is finding favor with individuals dedicated to fitness, those with sensitivities to lactose, and consumers choosing vegan or flexible dietary approaches. Demand for macadamia milk variants that are unsweetened, certified organic, and augmented with nutrients is also contributing to market expansion, as shoppers increasingly seek products with straightforward ingredient lists and embedded health benefits.

Industry growth is also being bolstered by the trend towards minimally processed labels and advancements in macadamia milk formulation technology. New product developments are entering the market, offering selections specifically designed for high protein content, enriched with omega-3 fatty acids, and versions optimized for use in coffee beverages, catering to avid coffee drinkers, fitness enthusiasts, and health-oriented consumers broadly.

The U.S. food service industry is poised for significant adoption of macadamia milk in the coming years, particularly within specialized coffee shops and upscale cafes, positioning macadamia milk as a premium alternative to traditional milk options. Retail outlets, health-focused grocery stores, and digital sales channels remain vital distribution points, with brands highlighting environmentally friendly packaging and organic certifications to appeal to consumers focused on sustainability.

Germany’s Robust Demand for Organic and Environmentally Conscious Nut-Based Milk Varieties

Regulatory frameworks within the European Union promoting organic, non-genetically modified, and sustainably produced plant-based items have consistently supported the steady expansion of Germany’s macadamia milk sector. Macadamia milk, appealing due to its creamy texture and beneficial nutrient profile, attracts German consumers particularly interested in high-quality, less processed alternatives to dairy. The market’s growth and future projections are significantly influenced by the increasing adoption of plant-centric eating patterns and heightened concerns regarding animal welfare and ecological impact.

Macadamia milk enriched with supplements like vitamin D, calcium, and omega fatty acids is quickly gaining traction through health food stores, online retail channels, and specialized grocery outlets. Functional macadamia milk products, for instance, those containing added beneficial live cultures for digestive wellness, are increasingly appealing to consumers seeking enhanced nutritional value.

In Germany, where there is a strong emphasis on clean labeling and minimally altered non-dairy options, companies producing macadamia milk are directing investment into the development of macadamia milk products utilizing fermentation processes and formulations optimized for professional coffee preparation. Market growth in this segment is also being stimulated by the proliferation of supermarket own-brand macadamia milk items and strategic partnerships between plant-based beverage producers and retail chains.

China’s Expanding Market for Nut-Based Dairy Alternatives and Enhanced Beverages

China represents one of the most rapidly expanding markets globally for macadamia milk, driven by the burgeoning trend towards plant-based diets, the increasing purchasing power of the middle class, and the flourishing market for functional beverages. A growing recognition of lactose intolerance and the adoption of healthier eating habits, influenced partly by Western dietary trends, are also contributing factors. Macadamia milk enriched with nutrients, macadamia-based products for coffee and tea, and blended nut-based milk products high in protein are experiencing substantial growth rates in urban centers and among young working professionals seeking convenient, nutrient-dense drink choices.

China’s accelerating plant-based dietary movement and supportive governmental policies are encouraging investment in both domestic macadamia nut cultivation and the development of sustainable non-dairy products. Both international and local brands operating within China are leveraging digital commerce platforms and employing sophisticated digital marketing strategies to connect with Chinese consumers. Limited edition flavors of macadamia milk, collaborations with local internet personalities, and ready-to-drink macadamia-based beverages are increasing in popularity.

As the category of functional beverages continues to grow, macadamia milk is increasingly being integrated into plant-based protein mixes, meal replacement products, and specialized tea preparations. China is anticipated to contribute significantly to annual market volumes as demand for premium and internationally sourced plant-derived products escalates, supported by ongoing investment in environmentally responsible agricultural practices.

Specific Segment Insights

Growing Interest in Low-Sugar Macadamia Milk Among Health-Focused Consumers

| Market Slice | Market Percentage (2025) |

|---|---|

| Low-Sugar Milk (By Product Category) | 56.1% |

Macadamia milk with no added sugars is gaining considerable traction among consumers focused on health who are seeking non-dairy options that are lower in sugar content. Driven by increasing awareness regarding the health impacts of excessive sugar intake, a greater number of individuals are opting for plant-derived milk products without sweeteners. This category is particularly favored by those adhering to diets such as ketogenic, low-carbohydrate, or diabetic-friendly lifestyles, as well as consumers looking for products with uncomplicated, clean ingredient lists.

Simultaneously, unsweetened macadamia milk serves as a versatile ingredient in blended drinks, coffee, and baking, providing users the ability to adjust sweetness according to personal taste. The broader interest in plant-based eating patterns and the rising demand for minimal processed foods have also contributed to the expansion of this particular segment.

Smaller manufacturers are also enhancing unsweetened macadamia milk with essential nutrients like calcium, vitamin D, and B12, aiming to replicate the nutritional profile of traditional dairy milk. Ongoing advancements in packaging technology and a focus on environmentally responsible sourcing practices suggest continued growth for this segment in the foreseeable future.

Residential and Commercial Retail Channels Driving Macadamia Milk Sales

| Market Slice | Market Percentage (2025) |

|---|---|

| Residential/Commercial Retail (B2C) (By Sales Avenue) | 61.7% |

The household and retail sector (Business-to-Consumer) represents the primary channel for macadamia milk sales, fueled by escalating consumer demand for plant-based dairy substitutes. Major retail outlets, such as large supermarkets, hypermarkets, and online retail platforms, are crucial distribution points, providing consumers access to a wide selection of macadamia milk brands and varieties. The expansion of dedicated sections for plant-based products within prominent retail chains has further enhanced visibility and availability.

The ease of having products delivered to homes and subscription-based models have significantly boosted online sales, enabling consumers to receive regular supplies of macadamia milk without needing to visit physical stores. Digital marketing approaches, including endorsements by social media personalities and online promotional activities, are also effectively raising consumer awareness and building brand loyalty.

The increasing use of macadamia milk in coffee shops and as an ingredient in home cooking has solidified its importance within the consumer household sector. With brands continuing to launch novel flavors and organic options, the household and retail segment is projected to experience steady expansion over the forecast period.

Competitor Landscape Analysis

Key participants in the macadamia milk industry are strategically engaged in securing sustainably sourced nuts, developing sophisticated processing techniques for high-quality nuts, and broadening the applications of macadamia-derived products into niche areas like specialty coffee formulations, wellness beverages, and functional nutritional products. Companies are also allocating resources towards innovations in cold-extraction processing methods, creating dairy-free options specifically tailored for baristas, and developing macadamia-based protein products.

Leading entities in this market include well-known names, all actively involved in advancing plant-based milk technologies, adhering to clean labeling standards, and offering superior macadamia nut-derived dairy replacements. To accommodate the increasing demand for nut-based milk alternatives, numerous companies are enhancing their distribution capabilities, particularly across the North American and Asia-Pacific regions.

Core Strategies Employed: These involve fostering collaborations with businesses specializing in plant-centered coffee products, investing in the development of macadamia milk products that are stable at room temperature, and expanding the range of dairy substitutes that are free from common allergens. Additionally, manufacturers are concentrating on utilizing sustainable packaging materials, sourcing macadamias from farms employing regenerative practices, and ensuring ingredients are verified as non-GMO.

Illustrative actions include:

- A leading brand is actively expanding its selection of organic macadamia milk options designed for professional baristas and the functional beverage market.

- Another prominent company is developing macadamia milk products formulated to be low in sugar and fortified with calcium for regular consumer use.

- A key player is concentrating efforts on developing macadamia milk blends characterized by high protein content and enriched with omega-3 fatty acids.

Prominent Market Participants

- Milkadamia Products

- Califia Farms Group

- Danone Dairy Alternatives

- Suncoast Gold Nuts

- Marquis Macadamias Holdings

- Golden Macadamias (Proprietary) Limited

- Mauna Loa Macadamia Nut Operations

- Buderim Group Operations

- Kenya Nut Processing Company

- Nambucca Macnuts Producers

- Ivory Macadamias Cultivation

- Eastern Produce Marketing

- Hamakua Macadamia Nut Company Limited

- Additional Emerging Competitors

Frequently Asked Questions Relevant to the Market

What is the approximate valuation of the macadamia milk sector in the year 2025?

The global macadamia milk sector is projected to attain a value of approximately USD 44.1 million in 2025.

What was the rate of sales increase for macadamia milk between the years 2020 and 2024?

The market experienced a compound annual growth rate (CAGR) of roughly 4.4% during the period from 2020 to 2024.

Which entities are recognized as key producers of macadamia milk?

Primary market entities include Milkadamia, Califia Farms, Danone, Suncoast Gold, and Pacific Foods, among others.

By 2025, which geographical territory is anticipated to hold the largest share of the market?

North America is expected to lead the market share, attributed to significant consumer demand for plant-derived milk alternatives and upscale nut-based dairy substitutes.

What is the projected compound annual growth rate for the macadamia milk market spanning 2025 to 2035?

The market is forecasted to expand at a CAGR of roughly 5.1% from 2025 through 2035.

What primary elements are stimulating the expansion of the macadamia milk market?

Leading factors stimulating growth involve the increasing preference for dairy-free alternatives, the rise of plant-focused diets, burgeoning trends in functional beverages, and advancements in clean nut milk processing techniques.

| Report Parameter | Specifics |

|---|---|

| Market Size in 2025 | USD 44.1 million |

| Market Value Projection for 2035 | USD 71.3 million |

| Growth Drivers (CAGR) | 5.1% spanning 2025 to 2035 |

| Foundation Year for Estimates | 2024 |

| Historical Data Coverage | 2019 – 2024 |

| Projection Period | 2025 – 2035 |

| Measurement Units | Value in USD million/billion and CAGR from 2025 to 2035 |

| Report Scope | Revenue projections, market share distribution, competitive environment, growth catalysts, and prevailing trends |

| Included Market Segments | Flavor categories, product forms, and sales channels |

| Geographical Coverage | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Specific Country Data | USA, Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, China, Japan, South Korea, India, Australia, New Zealand, UAE, South Africa |

| Analyzed Key Entities | Milkadamia, Califia Farms, Danone, Suncoast Gold, Marquis Macadamias, Golden Macadamias, Mauna Loa Macadamia Nut Corp, Buderim Group, Kenya Nut Company, Nambucca Macnuts |

| Customization Features | Complimentary customization of the report (up to 8 analyst days) with purchase. Adjustments to country, regional, and segment analyses |

| Pricing and Acquisition Options | Flexible purchase choices for tailored research requirements |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Flavor

- Unsweetened

- Sweetened

- Vanilla

- Chocolate

- Other Flavors

- By Product Type

- Chilled

- Ambient

- Barista Blend

- By Sales Channel

- Household/Retail (B2C)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

- Other Retail Channels

- Foodservice (B2B)

- Cafes and Coffee Shops

- Restaurants

- Hotels

- Institutional

- Household/Retail (B2C)

- By Region

- North America

- USA

- Canada

- Latin America

- Brazil

- Mexico

- Europe

- Germany

- UK

- France

- Spain

- Italy

- East Asia

- China

- Japan

- South Korea

- South Asia & Pacific

- India

- Australia

- New Zealand

- ASEAN Countries

- Middle East & Africa

- GCC Countries

- South Africa

- North Africa

- Turkey

- North America

Table of Content

- Executive Summary

- Market Introduction

- Global Market Analysis and Forecast

- Key Market Trends

- Market Drivers and Restraints

- Detailed Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Flavor

- Unsweetened Macadamia Milk

- Sweetened Macadamia Milk

- Vanilla Flavored Macadamia Milk

- Chocolate Flavored Macadamia Milk

- Other Flavored Macadamia Milk

- Detailed Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Chilled Macadamia Milk

- Ambient Macadamia Milk

- Barista Blend Macadamia Milk

- Detailed Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Household/Retail (B2C) Sales Analysis

- Foodservice (B2B) Sales Analysis

- Geographical Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- North America Market Analysis

- Latin America Market Analysis

- Europe Market Analysis

- East Asia Market Analysis

- South Asia & Pacific Market Analysis

- Middle East & Africa Market Analysis

- Competition Landscape

- Company Profiles of Key Players

- Market Structure and Tier Analysis

- Key Players Strategies

- Research Methodology

- Assumptions and Definitions