Global Dog Dental Chews Market Forecast, Growth Factors, and Competitive Analysis 2025 to 2035

Overview:

The global market for dog dental chews is projected to reach USD 2,731.2 million in 2025. The sector is expected to experience steady expansion, driven by increasing consumer focus on pet health and well-being. Throughout the forecast period from 2025 to 2035, global sales are anticipated to rise at a compound annual growth rate (CAGR) of 5.2%. This consistent growth trajectory is expected to culminate in a market valuation of USD 4,529.6 million by the end of 2035.

Dog dental chews have emerged as a key component in canine oral care, effectively addressing issues such as plaque accumulation, gum inflammation, and suboptimal breath. As pet owners increasingly seek convenient yet effective methods for maintaining their dogs’ dental hygiene, these chews offer a practical and appealing solution. The growing emphasis on pet health longevity is a significant factor propelling consumer interest in products like dental chews that support improved quality of life for companion animals.

A major contributor to market growth is the ongoing trend of pet humanization, where pets are viewed and treated as integral family members. This perspective encourages pet parents to invest in premium and specialized products designed to enhance their pets’ health. Leading brands, including Greenies, Pedigree Dentastix, and Virbac, have introduced formulations specifically approved by veterinarians and tailored to meet the distinct needs of different breeds and age groups. Additionally, the market is seeing increased demand for dental chews featuring clean labels, incorporating organic, natural, and grain-free ingredients, reflecting broader consumer preferences for healthier options.

| Attribute | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 2,731.2 million |

| Projected Industry Value (2035F) | USD 4,529.6 million |

| Value-based CAGR (2025 to 2035) | 5.2% |

Continued urbanization globally, coupled with a rise in pet ownership, particularly in developing regions in Asia and South America, presents substantial opportunities for market expansion. To meet ascending demand, brands and retailers are enhancing their presence through e-commerce platforms and subscription services, improving product visibility and accessibility. Key distribution channels such as specialized pet retailers, online marketplaces, and veterinary clinics are experiencing increasing traction and are becoming crucial points of sale for dental chew products.

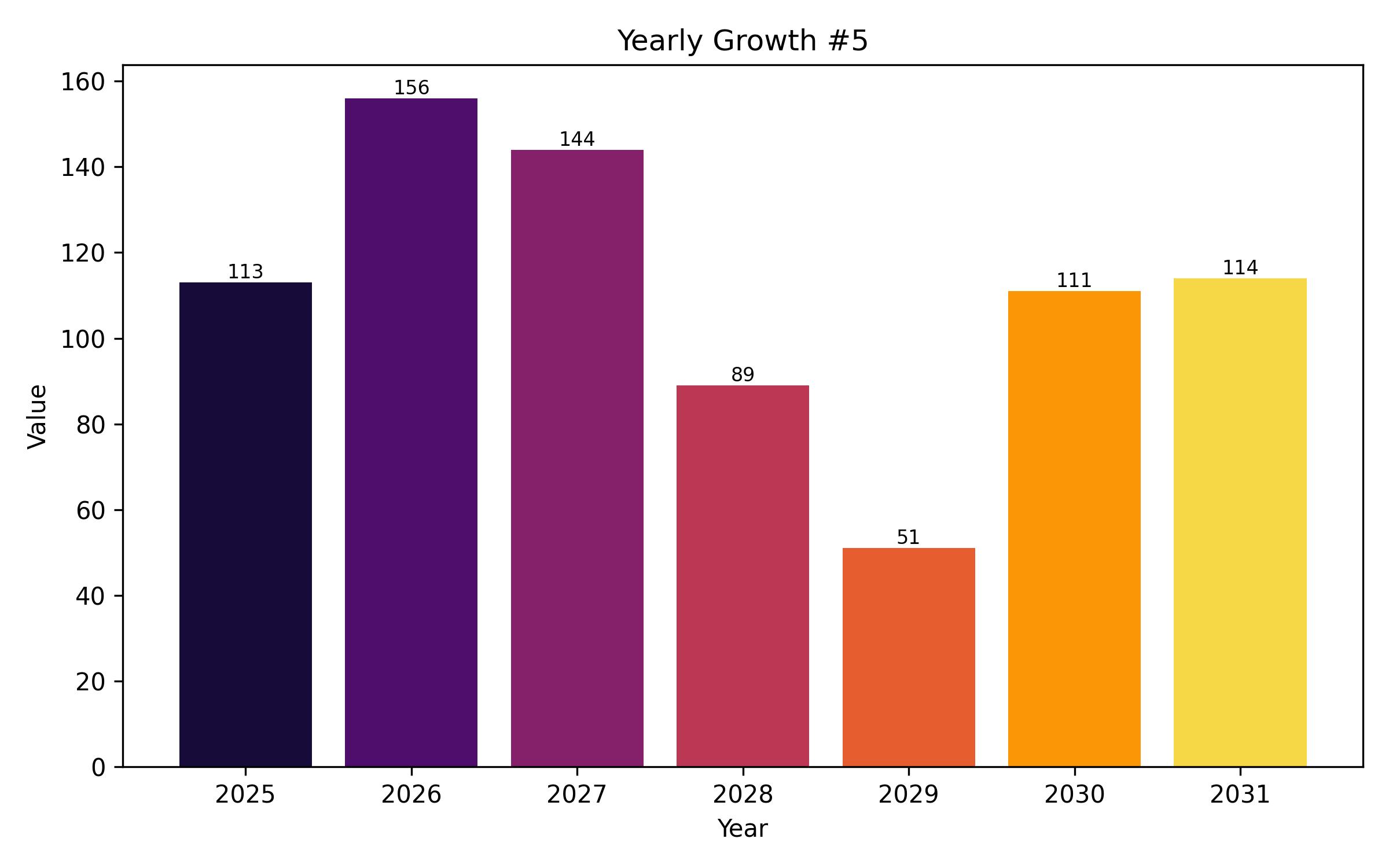

An analysis of recent market performance indicates sustained positive momentum. The first half of 2025 is projected to register a year-on-year CAGR of 5.1%, showing a slight increase from the base year. This is expected to accelerate further in the latter half of 2025, with the market forecasted to achieve a CAGR of 5.3%. These figures represent an improvement over baseline performance, suggesting a favorable response to market dynamics such as a reinforced focus on preventive pet healthcare and the emergence of innovative treat formats.

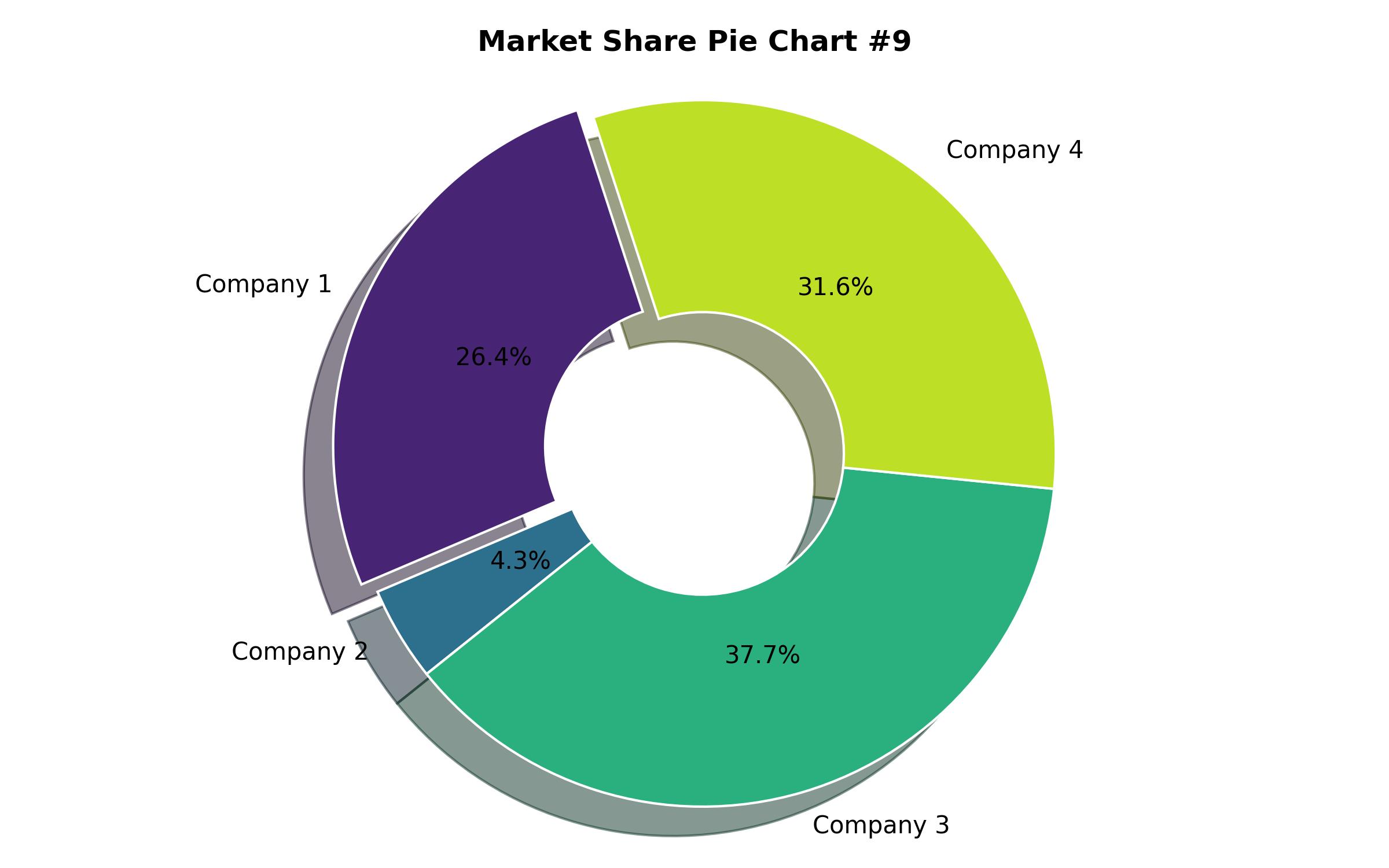

The market landscape demonstrates varying degrees of concentration. Tier 1 companies predominantly comprise major international pet food enterprises known for their extensive distribution networks and strong brand recognition. These firms frequently engage in data-driven wellness campaigns and offer a diverse array of products to maintain their competitive positioning. Tier 2 consists of well-established, specialized brands with a focus on functional dental treats, often backed by research and professional endorsements. Tier 3 includes newer market entrants and niche brands capitalizing on demand for natural ingredients and sustainable product attributes, often utilizing direct-to-consumer strategies to approach environmentally conscious and younger pet owner demographics.

Recent trends highlight the growing emphasis on pet oral health as a vital aspect of preventive care, driving demand for chews designed for daily hygiene. The shift towards natural and grain-free pet diets is also influencing product development, with brands focusing on formulations without synthetic additives to address allergies and sensitivities. Premiumization is evident, with pet owners increasingly willing to invest in dental chews offering additional health benefits like digestive support or improved breath. Furthermore, there’s a clear trend towards personalized solutions, with rising demand for products tailored to specific dog sizes, breeds, and life stages, promoting individualized care plans.

The expansion of e-commerce and subscription services is reshaping distribution, providing pet owners with convenient access to a variety of dental chew options and facilitating recurring purchases. Veterinarians continue to play a significant role as trusted advisors, with their recommendations heavily influencing consumer choices, leading brands to seek professional endorsements and conduct clinical trials to validate product effectiveness. Finally, sustainability has become a growing consideration, influencing purchasing decisions as consumers seek products with eco-friendly packaging and ethically sourced ingredients, driving brands to adopt more sustainable practices.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 2,731.2 million |

| Revenue Forecast for 2035 | USD 4,529.6 million |

| Growth Rate (CAGR) | 5.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, market share analysis, competitive landscape, growth drivers, and emerging trends |

| Covered Segments | Product Type, Age, Flavor, Application, Sales Channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Country Scope | USA, Germany, China, Japan, India, UK, France, Canada, Brazil |

| Key Companies Analyzed | Jinx, Redbarn, PetDine, The Missing Link®, Earthly, Inc., Greenies, Luscious Pet Food, Purina, Blue Buffalo Company, Virbac, Pedigree, Wellness Pet Company, Spectrum Brands, Hills Pet Nutrition, Mars Petcare |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Dental Sticks

- Chew Toys

- Edible Bones

- Other Chewable Treats

- By Age Group

- Puppy

- Adult

- Senior

- By Flavor

- Chicken

- Beef

- Vegetable

- Peanut Butter

- Other Flavors

- By Application

- Plaque & Tartar Control

- Bad Breath Control

- Teeth Strengthening

- Gum Health

- By Sales Channel

- Pet Stores

- Veterinary Clinics

- Online Retail

- Supermarkets & Hypermarkets

- Other Channels

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Dynamics

- Drivers of Market Growth

- Market Restraints and Challenges

- Market Opportunities

- Value Chain and Supply Chain Analysis

- Pricing Analysis

- Market Size and Forecast (Value) 2025-2035

- Historical Market Analysis 2019-2024

- Market Analysis by Product Type 2025-2035

- Dental Sticks

- Chew Toys

- Edible Bones

- Other Chewable Treats

- Market Analysis by Age Group 2025-2035

- Puppy

- Adult

- Senior

- Market Analysis by Flavor 2025-2035

- Chicken

- Beef

- Vegetable

- Peanut Butter

- Other Flavors

- Market Analysis by Application 2025-2035

- Plaque & Tartar Control

- Bad Breath Control

- Teeth Strengthening

- Gum Health

- Market Analysis by Sales Channel 2025-2035

- Pet Stores

- Veterinary Clinics

- Online Retail

- Supermarkets & Hypermarkets

- Other Channels

- Regional Market Analysis 2025-2035

- North America Market Analysis 2025-2035

- Europe Market Analysis 2025-2035

- Asia Pacific Market Analysis 2025-2035

- Latin America Market Analysis 2025-2035

- Middle East & Africa Market Analysis 2025-2035

- Competition Analysis

- Company Profiles of Key Players

- Research Methodology

- Assumptions and Disclaimer