Global Bead Winding Machine Market Outlook Based on Configuration, Application, and Region from 2025 to 2035

Overview:

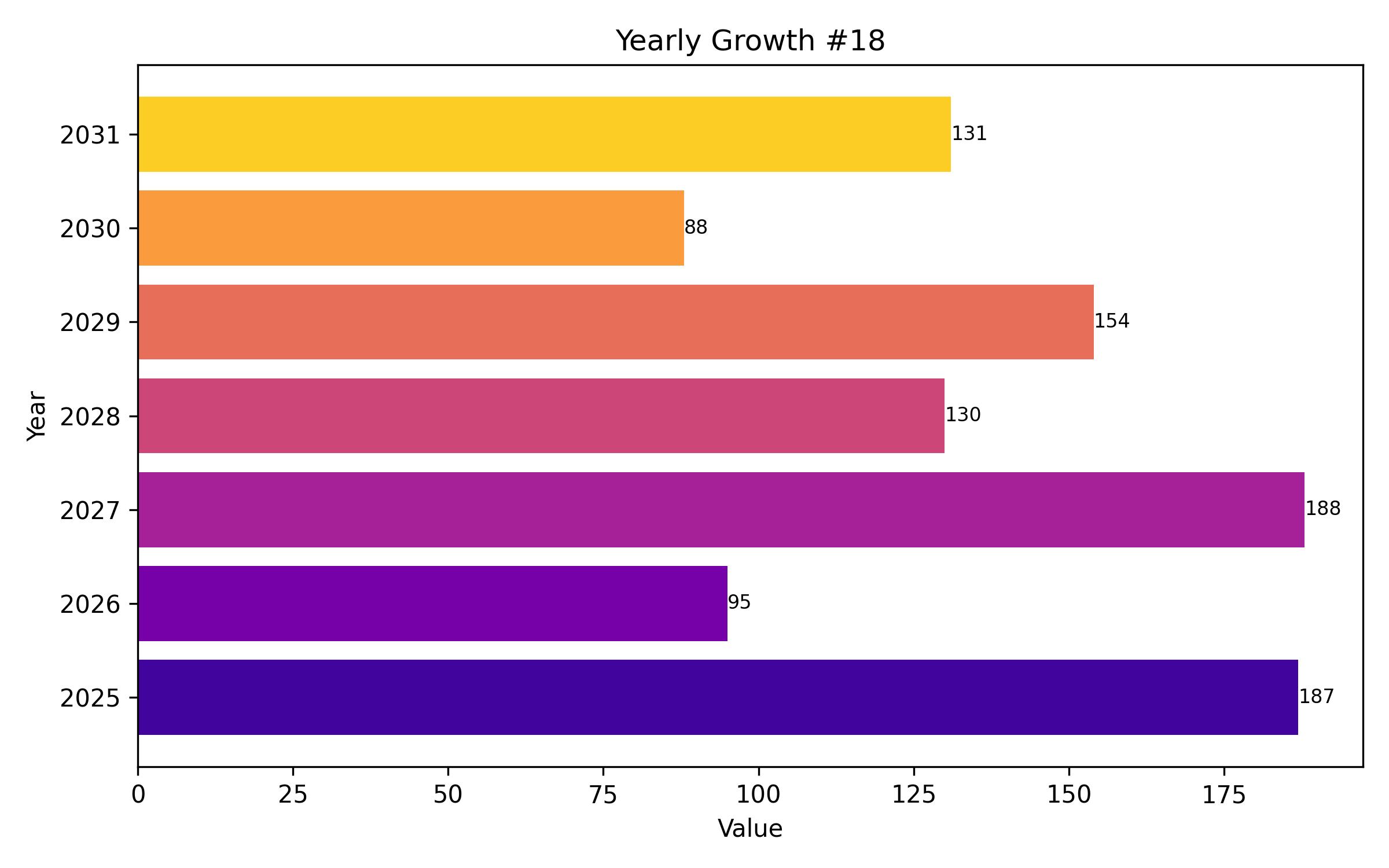

The bead winding machine market is projected to achieve a value of USD 998.5 million in 2025, progressing to USD 1,280.1 million by 2035, exhibiting a compound annual growth rate (CAGR) of 2.5%. This expansion is significantly influenced by increased demand for advanced and precise tire manufacturing processes. The transition towards highly efficient and automated production systems is a key driver, enabling manufacturers to meet the rising need for sustainable and high-performance tires.

Current market dynamics in 2024 highlight a strong emphasis on automation, enhancing the precision of the bead winding process. Industry participants are prioritizing operational efficiency through technological integration, aiming to streamline production workflows and reduce reliance on manual labor. A concurrent focus on sustainability is pushing the adoption of energy-efficient machinery, designed to optimize material usage without compromising the quality of the final product.

Anticipated growth in 2025 is set to be propelled by sustained demand for premium automotive tires and the increasing adoption of environmentally conscious manufacturing techniques. The integration of artificial intelligence (AI) into manufacturing processes is expected to further boost efficiency and consistency, leading to cost reductions and improved product reliability.

Strategic investments in research and development are anticipated to enhance machine capabilities, aligning with evolving industry requirements. With the automotive sector continuing its trajectory towards fuel-efficient vehicles, bead winding machines will maintain their critical role in producing high-quality tires, underpinning both market growth and technological evolution.

The market is intimately linked with the broader industrial machinery domain, specifically equipment used in tire and rubber production. Its trajectory is notably shaped by the performance of the automotive sector, which is currently experiencing robust demand for high-quality tires across various vehicle types.

Moreover, geopolitical shifts and changes in global supply chain structures significantly impact the bead winding machine industry. Major economies, including the United States, China, and European nations, are increasingly focusing on localized industrial policies, offering substantial support and subsidies for automation and sustainable manufacturing initiatives.

Financially, the market is attracting considerable private equity investment, driven by increasing confidence in the long-term profitability of technologies centered around electric vehicle (EV) tires. This influx of investment is fueling the sector’s movement towards high-precision, technologically advanced manufacturing solutions.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 998.5 million |

| Revenue Forecast for 2035 | USD 1,280.1 million |

| Growth Rate (CAGR) | 2.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

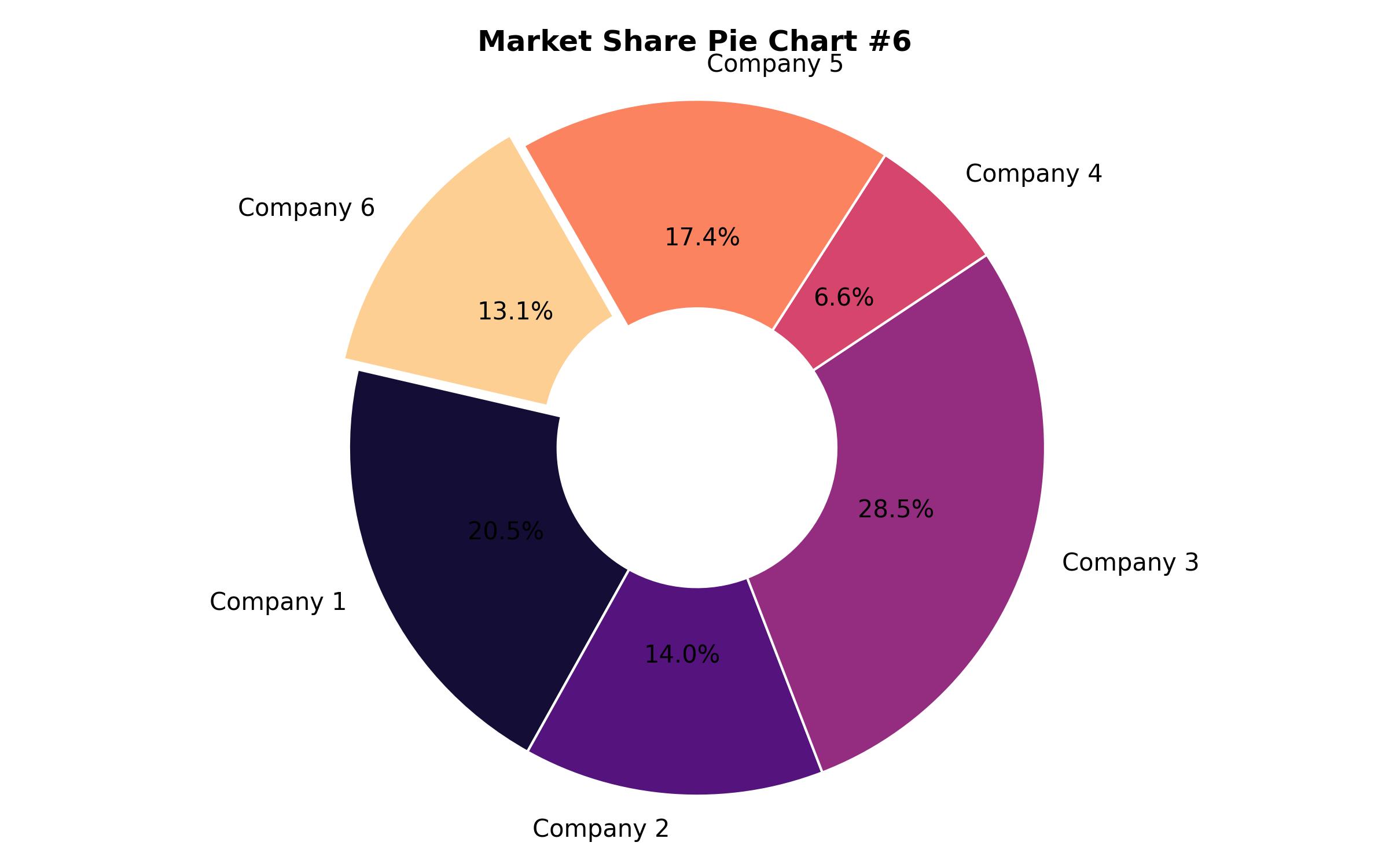

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, tire type, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Bharaj Machineries Pvt Ltd, VMI Group, Kobe Steel, Ltd, Tianjin Saixiang Technology Co, Ltd, Herbert Maschinenbau GmbH & Co. KG, Cimcorp, Lorenz Pan AG, MEC A/S, Strongman Group, L&T Technologies, Roland Electronics, Bartell Machinery Systems, Zeppelin Systems, Marangoni, Siemens AG |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Type

- Single Wire Machines

- Multi Wire Machines

- By Tire Type

- Passenger Car Tires

- Commercial Truck Tires

- Two-Wheeler Tires

- Off-the-Road (OTR) Tires

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy)

- Asia-Pacific (China, India, Japan, South Korea, Australia & New Zealand)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2018 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Million) Analysis 2018 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Type

- Single Wire Machines

- Multi Wire Machines

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Tire Type

- Passenger Car Tires

- Commercial Truck Tires

- Two-Wheeler Tires

- Off-the-Road (OTR) Tires

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2024 & 2035

- Market Structure Analysis

- Competition Analysis

- Bharaj Machineries Pvt Ltd

- VMI Group

- Kobe Steel, Ltd

- Tianjin Saixiang Technology Co, Ltd

- Herbert Maschinenbau GmbH & Co. KG

- Cimcorp

- Lorenz Pan AG

- MEC A/S

- Strongman Group

- L&T Technologies

- Roland Electronics

- Bartell Machinery Systems

- Zeppelin Systems

- Marangoni

- Siemens AG

- Assumptions and Acronyms Used

- Research Methodology