Global Animal Feed Antioxidants Market Dynamics and Growth Forecast Through 2035

Overview:

The global animal feed antioxidants market demonstrated a value of USD 343.6 million in 2022. Experiencing a notable annual growth rate, the market expanded by 13.2% in 2023, reaching a projected size of USD 389 million in 2025. Looking ahead, the market is anticipated to exhibit a compound annual growth rate (CAGR) of 13.7% between 2025 and 2035, reaching an estimated value of USD 1,403.1 million by 2035.

The increasing adoption of feed antioxidants is primarily driven by the imperative to enhance animal welfare and improve the nutritional quality of animal diets. These additives play a crucial role in preserving the integrity of feed materials and protecting animal health from oxidative stress. By mitigating oxidative damage, antioxidants contribute to reduced disease susceptibility and promote enhanced productivity and overall well-being in livestock and other animals.

In the contemporary global market, where there is a heightened demand for high-quality animal products such as meat, milk, and eggs, the inclusion of antioxidants in animal feed has become increasingly essential. These compounds are instrumental in maintaining feed quality and stability throughout storage, which in turn supports improved animal growth and development.

| Attribute | Description |

|---|---|

| Estimated Global Animal Feed Antioxidants Industry Size (2025E) | USD 389 million |

| Projected Global Animal Feed Antioxidants Industry Value (2035F) | USD 1,403.1 million |

| Value-based CAGR (2025 to 2035) | 13.7% |

Furthermore, the increasing consumer preference for high-quality meat, milk, and eggs is prompting producers to explore advanced feeding strategies. The integration of antioxidants into animal feed is viewed as a key method to optimize animal health, production, and overall performance, thereby maximizing profitability in the agricultural sector.

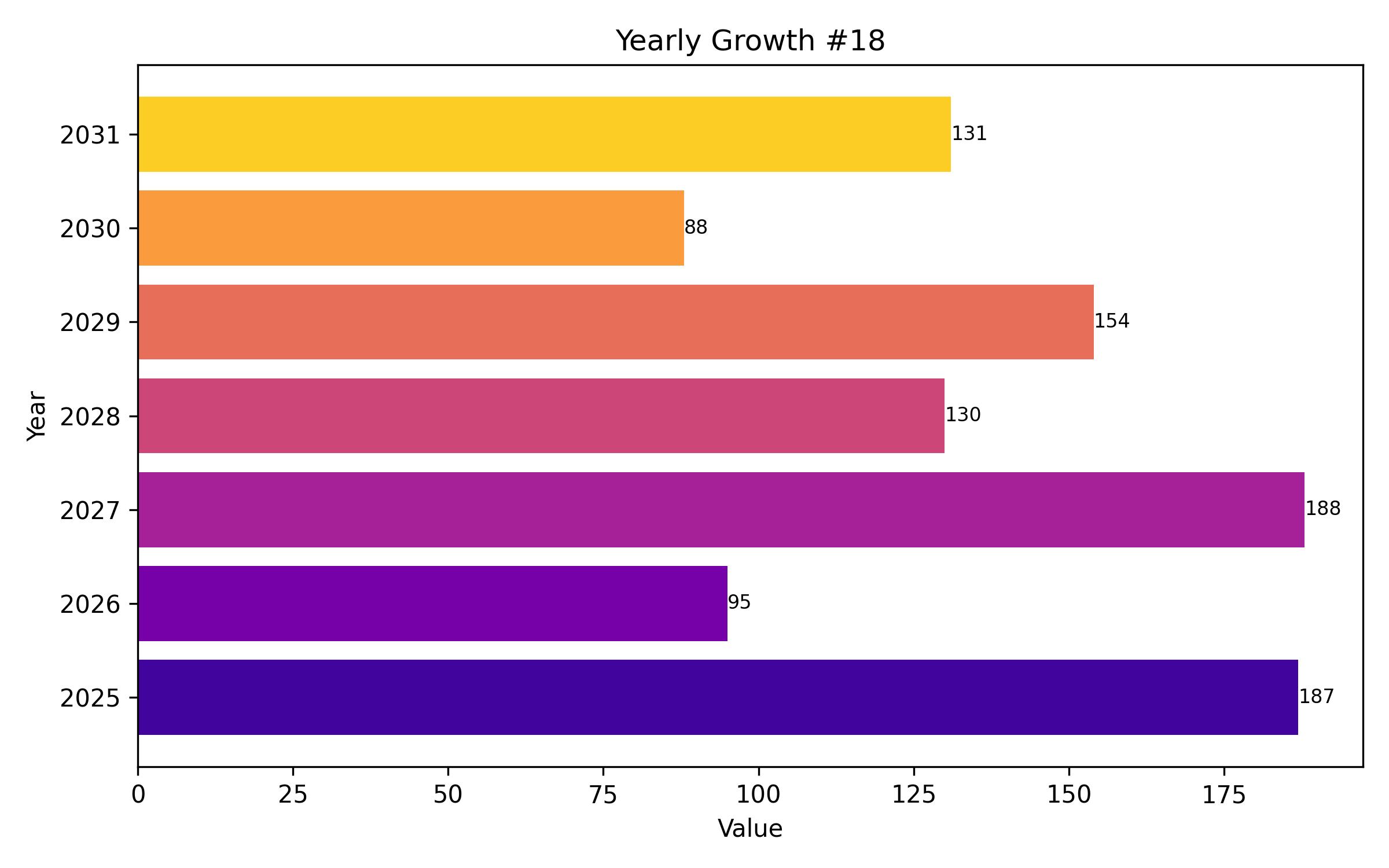

An analysis of the semi-annual growth trajectory reveals that the market is set for sustained expansion. From 2025 to 2035, the first half of the year (H1) is expected to show a CAGR of 13.6%, while the second half (H2) is projected to grow slightly faster at 13.7%. This performance indicates a steady upward trend in revenue realization throughout the forecast period.

Significant market drivers for animal feed antioxidants are rooted in the nutritional and health requirements presented by modern animal agriculture. Antioxidants, including Vitamin C, Vitamin E, and selenium, enhance animal immunity and growth rates by bolstering resistance to diseases linked to oxidative stress, contributing to improved animal health outcomes.

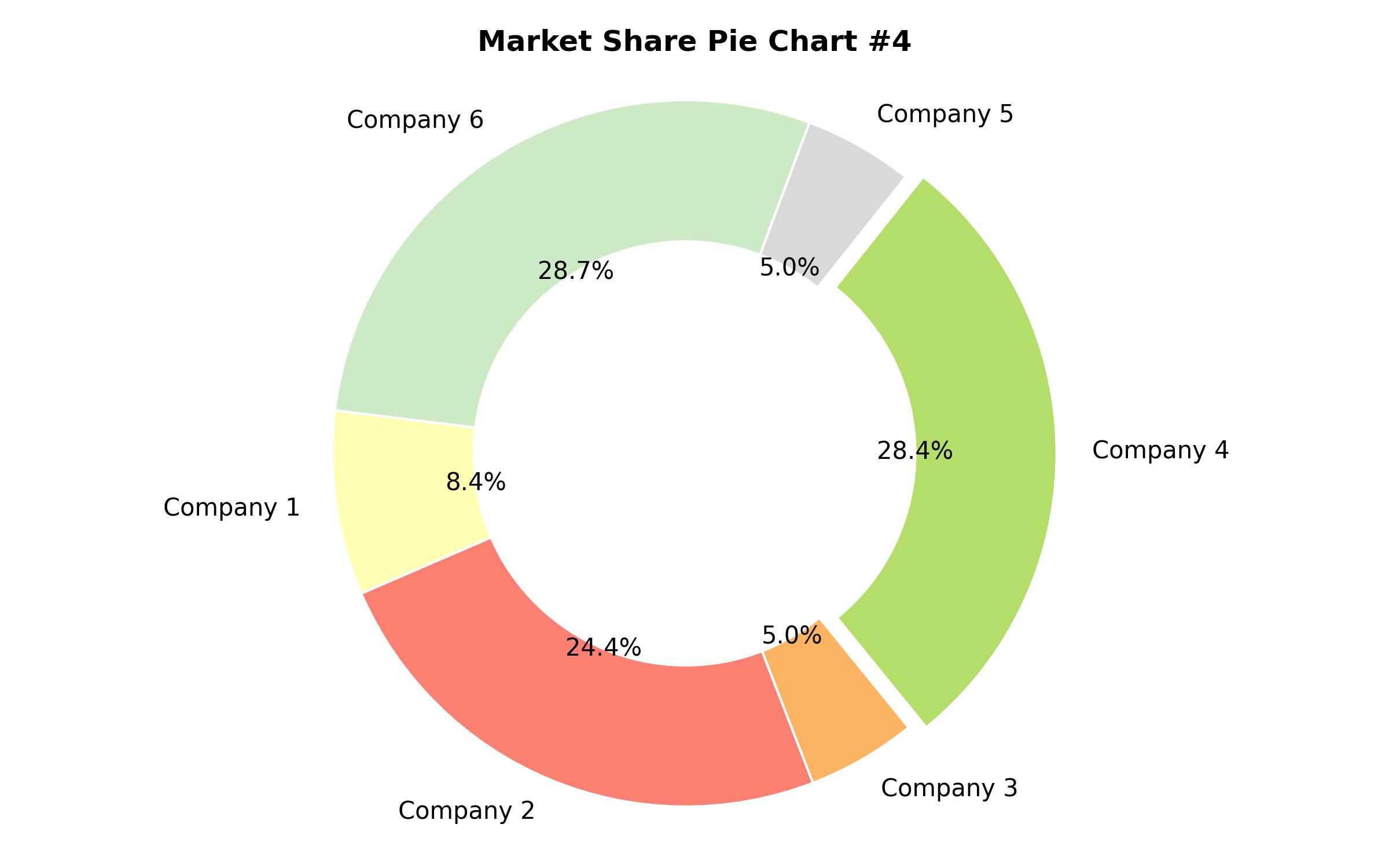

The competitive landscape features a tiered structure, with global leaders like Cargill, ADM, and DSM leveraging extensive production capabilities, cutting-edge research, and vast distribution networks. Regional players such as Kemin Industries and Novus International focus on specialized products and regional markets, while emerging innovators, including Vitablend and Eastman Chemical Company, are concentrating on natural and sustainable solutions.

Key trends influencing demand include a growing preference for natural antioxidants over synthetic ones, driven by regulatory changes and consumer demand for clean-label products. The aquaculture and pet food sectors are also seeing increased demand for antioxidants to improve animal health and longevity, reflecting broader shifts in consumer priorities and industry practices.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 389 million |

| Revenue Forecast for 2035 | USD 1,403.1 million |

| Growth Rate (CAGR) | 13.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Form, Animal Type, Region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Scope | USA, Germany, China, Japan, India, Canada, Mexico, UK, France, Italy, Poland, Australia, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Kemin Industries, Inc., Novus International, Inc., Cargill, Incorporated, Nutreco N.V., Alltech, Inc., BASF SE, DSM Nutritional Products, Adisseo, Evonik Industries AG, DuPont de Nemours, Inc., Chr. Hansen Holding A/S, Perstorp Holding AB, Vitablend Nederland B.V., Archer Daniels Midland (ADM), AB Vista, Zinpro Corporation, Bluestar Adisseo, Pancosma, Phytobiotics Futterzusatzstoffe GmbH, Impextraco NV, Miavit GmbH, Orffa International, EW Nutrition GmbH, Provimi, Trouw Nutrition, Caldic B.V. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Synthetic Antioxidants

- BHT (Butylated Hydroxytoluene)

- BHA (Butylated Hydroxyanisole)

- Ethoxyquin

- TBHQ (Tertiary Butylhydroquinone)

- Natural Antioxidants

- Tocopherols (Vitamin E)

- Ascorbic Acid (Vitamin C)

- Carotenoids

- Polyphenols (Grape Seed Extract, Rosemary Extract)

- Selenium

- Synthetic Antioxidants

- By Form

- Dry

- Liquid

- By Animal Type

- Poultry

- Swine

- Cattle

- Aquaculture

- Pets

- Other Animals (Sheep, Goats, etc.)

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2018 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Million/Billion) Analysis 2018 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Product Type

- Synthetic Antioxidants Analysis and Forecast

- Natural Antioxidants Analysis and Forecast

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Form

- Dry Form Analysis and Forecast

- Liquid Form Analysis and Forecast

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Animal Type

- Poultry Feed Analysis and Forecast

- Swine Feed Analysis and Forecast

- Cattle Feed Analysis and Forecast

- Aquaculture Feed Analysis and Forecast

- Pet Food Analysis and Forecast

- Other Animal Feed Analysis and Forecast

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Region

- North America Market Analysis and Forecast

- Latin America Market Analysis and Forecast

- Europe Market Analysis and Forecast

- East Asia Market Analysis and Forecast

- South Asia & Pacific Market Analysis and Forecast

- Middle East & Africa Market Analysis and Forecast

- North America Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Latin America Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Europe Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- East Asia Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Animal Feed Antioxidants Market Analysis 2018 to 2024 and Forecast 2025 to 2035

- Regional Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Leading Companies Profiles

- Competitive Landscape

- Assumptions and Acronyms Used

- Research Methodology