Global A2 Infant Formula Market Dynamics: Form Type, Age Group, Distribution Channels, and Regional Overview – Growth Forecast 2025 to 2035

Overview:

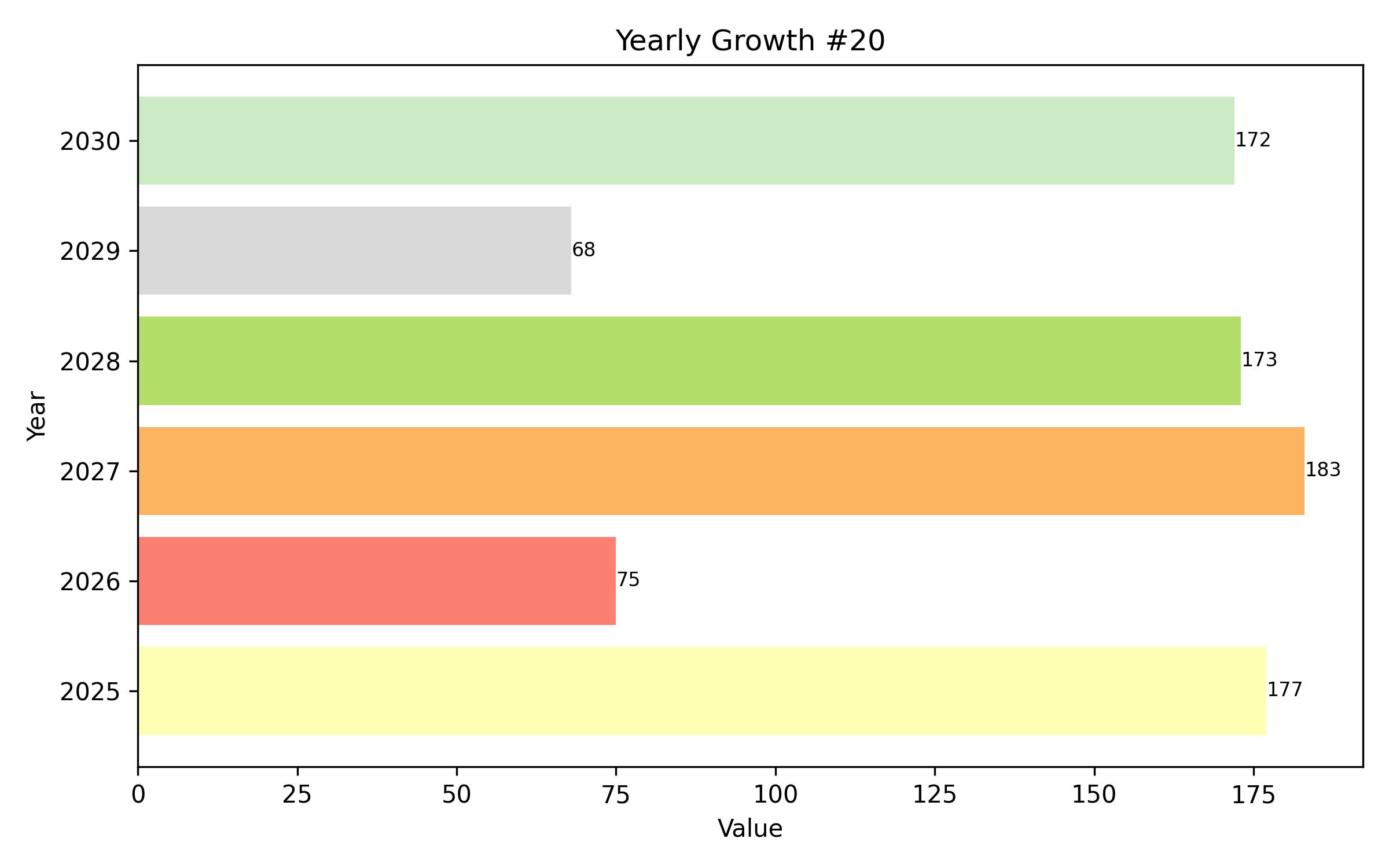

The market for A2 infant formula is experiencing substantial growth, valued at approximately USD 1,180 million in 2025. Projections indicate a strong upward trajectory, expected to reach over USD 4,400 million by 2035, demonstrating long-term potential with an impressive compound annual growth rate of 18.2%.

This expansion is primarily fueled by increasing recognition among parents concerning the possible digestive benefits associated with A2 protein. Many parents are opting for formulas containing this protein due to its perceived ability to reduce digestive discomfort, gas, and symptoms resembling colic in infants. Furthermore, the rising trend towards premium and specialized infant nutrition contributes significantly to market demand, particularly as consumers increasingly seek organic, non-GMO, and transparently labeled products.

Consumer choices are heavily influenced by scientific studies, recommendations from healthcare providers, and discussions across social media platforms. The shift in perception towards A2 infant formula, seeing it as a more easily digestible alternative to traditional cow’s milk formulas, which typically include A1 protein, is a key driver.

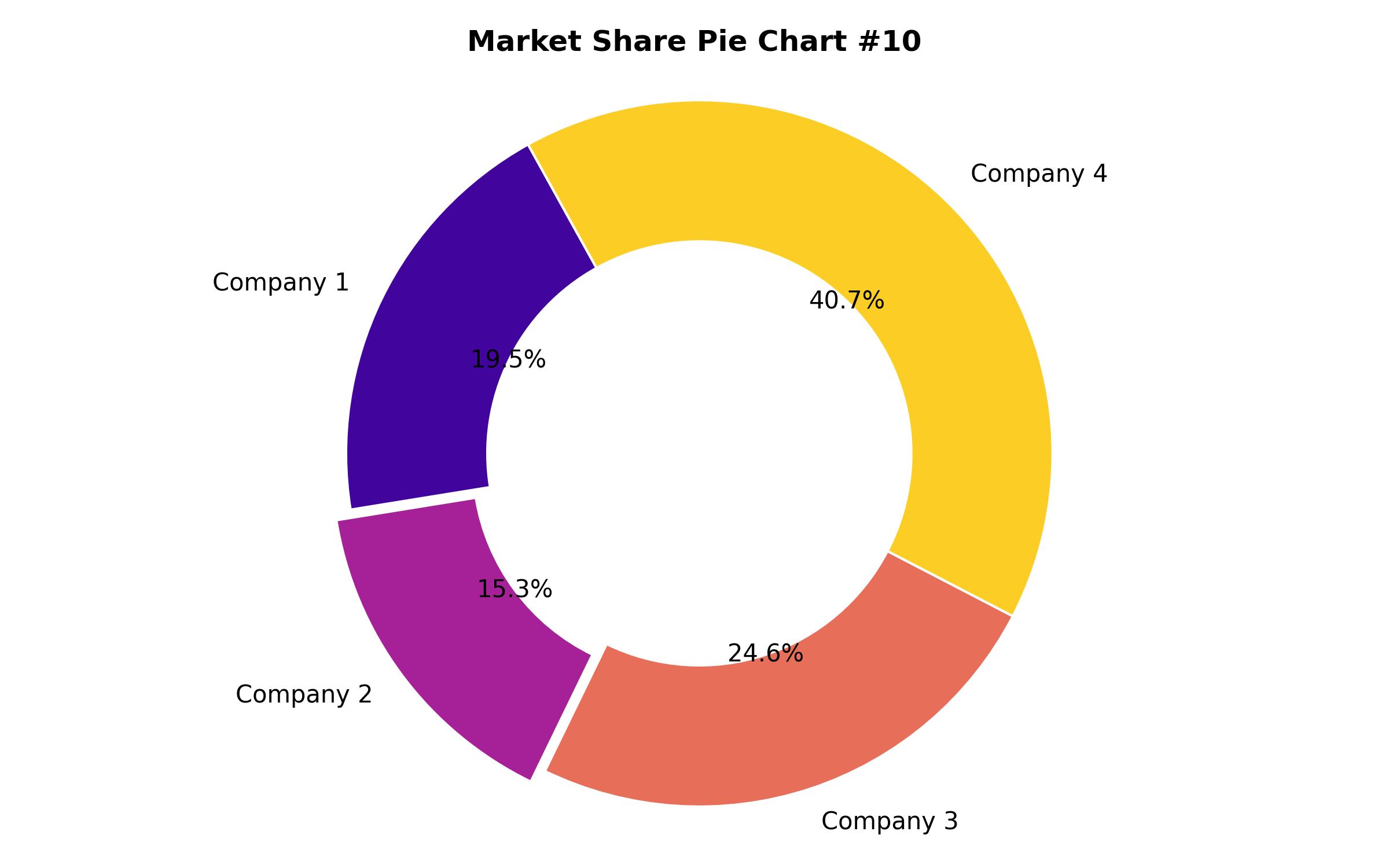

Markets in countries such as China and the United States are witnessing particularly strong demand, reflecting evolving dietary preferences and a greater receptiveness to specialized nutritional products. Manufacturers are actively adapting and innovating their product lines to cater to this expanding demand, driven by ongoing research into the health benefits of A2 protein.

Investment in research and development is crucial for leading market participants. Companies are focused on improving product quality and aligning offerings with shifting consumer requirements. A prominent entity in this sector has been actively expanding its range of scientifically validated infant formulas designed to support optimal infant health and development.

Similarly, other companies have introduced premium A2 milk products in the Asian market, targeting discerning consumers seeking high-quality, specially sourced options. These strategic product introductions and geographical expansions are reshaping the competitive landscape and reinforcing the market’s growth potential.

As innovation continues and researchers further explore the advantages of A2 protein, the market for A2 infant formula is poised for considerable expansion. This environment offers significant opportunities for both manufacturers and investors looking to capitalize on the rising demand for these specialized nutritional products.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1,180 million |

| Revenue Forecast for 2035 | USD 4,400 million |

| Growth Rate (CAGR) | 18.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Form Type, Age Group, Distribution Channel, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Country Scope | USA, UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand, Canada, Spain, Argentina, Brazil, UAE, South Africa |

| Key Companies Analyzed | The A2 Milk Company, Nestlé S.A., Danone S.A., Abbott Laboratories, Reckitt Benckiser Group, Bellamy’s Organic, Bubs Australia, Yili Group, Feihe International Inc, Mengniu Dairy |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Form Type

- Powdered Formula

- Liquid Concentrate

- Ready-to-Feed

- By Age Group

- Infant (0-6 Months)

- Follow-on (6-12 Months)

- Toddler (1-3 Years)

- By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies and Drugstores

- Online Retail

- Specialty Stores

- Pediatric Clinics

- By Region

- North America

- USA

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Asia Pacific

- China

- Japan

- South Korea

- Australia

- New Zealand

- Latin America

- Brazil

- Argentina

- Middle East and Africa

- UAE

- South Africa

- North America

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Growth Drivers

- Market Challenges

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Form Type

- Powdered Formula

- Liquid Concentrate

- Ready-to-Feed

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Age Group

- Infant (0-6 Months)

- Follow-on (6-12 Months)

- Toddler (1-3 Years)

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Distribution Channel

- Supermarkets and Hypermarkets

- Pharmacies and Drugstores

- Online Retail

- Specialty Stores

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- Risk Assessment

- Competitive Outlook

- Market Structure Analysis

- Company Market Share Analysis

- Key Company Offerings and Activities

- Key Player Profiles

- Assumptions and Acronyms Used

- Research Methodology