Ferro Vanadium Market Overview, Size Estimation, Share Analysis, and Future Growth Projections (2025-2035)

Overview:

The ferro vanadium sector is valued at an estimated USD 5.3 billion in 2025 and is anticipated to achieve a compound annual growth rate of 5.2% over the coming decade. Consequently, the global market for ferrovanadium is projected to approach USD 8.8 billion by the conclusion of 2035. A primary factor propelling this expansion is the increasing worldwide requirement for advanced high-strength, low-alloy steels within the construction, automotive, and energy infrastructure domains. Ferrovanadium serves as an indispensable alloying element, providing essential strength, durability, and resistance properties to these materials.

In the realm of steel manufacturing, ferrovanadium plays a pivotal role by significantly enhancing tensile strength and resistance to corrosion. As developing economies accelerate investments in infrastructure projects and smart urban centers, the demand for reinforced steel escalates. The unique alloying capabilities of ferrovanadium contribute to the longevity and cost-efficiency of construction materials used in critical structures like bridges, pipelines, and buildings designed for seismic resistance.

The automotive sector is increasingly focused on reducing vehicle weight, a trend driven by global initiatives to decrease carbon emissions. Ferrovanadium enables manufacturers to produce stronger yet thinner steel components, thereby reducing overall vehicle mass without compromising safety standards. This trend is expected to intensify with the projected growth in electric vehicle production globally, fueling new demand for innovative metal composites.

Industries such as oil and gas heavily rely on ferrovanadium-enhanced steel for equipment like drill pipes that must withstand extremely harsh operational conditions. As drilling operations extend to greater depths and more challenging environments, the superior toughness provided by materials enriched with ferrovanadium becomes invaluable. Geopolitical developments and resource protectionism are also elevating vanadium deposits to a position of strategic significance on an international scale.

While traditional players dominate supply chains, efforts are being made to increase domestic vanadium production and recycling activities as a means to lessen dependence on external sources. These forces are actively redefining the competitive dynamics and encouraging innovative approaches across the entire ferrovanadium supply chain.

Key purchasing considerations vary across end-use sectors. In construction, performance in extreme temperatures and structural integrity are paramount. The energy sector prioritizes corrosion resistance and fatigue strength for longevity in harsh environments. The aerospace and defense industries demand high strength-to-weight ratios and material traceability, while the chemical industry emphasizes inertness and resistance to corrosive substances.

Technological advancements are influencing material properties. Ultra-high-strength steels require specific ferrovanadium grades, and advancements in additive manufacturing are opening up new possibilities for customized alloy compositions. As industries evolve, the performance attributes derived from ferrovanadium will continue to be critical, shaping demand patterns and product development.

Sustainability is also becoming a significant factor in sourcing decisions. End users are increasingly seeking ferrovanadium produced through environmentally conscious processes, such as those incorporating recycling or utilizing renewable energy. Compliance with environmental regulations is not only a risk factor for producers but also a purchasing criterion for customers, influencing supply chain transparency and material selection.

The shift towards a circular economy is encouraging the recovery of vanadium from spent catalysts, industrial slags, and end-of-life products. This trend supports resource efficiency and reduces reliance on primary production, aligning with global sustainability goals and influencing long-term supply strategies within the market.

Forward-looking companies are investing in R&D to develop novel vanadium alloys with enhanced properties for emerging applications, such as lightweight materials for electric vehicles and high-performance components for renewable energy systems. This focus on innovation aims to secure future market share and address evolving industry demands across various sectors.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 5.3 billion |

| Revenue Forecast for 2035 | USD 8.8 billion |

| Growth Rate (CAGR) | 5.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Commercial grade, production process, end-use, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | USA, UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand |

| Key Companies Analyzed | Atlantic Ltd., AMG Advanced Metallurgical Group, Tremond Metals Corp., Core Metals Group, Gulf Chemical and Metallurgical Corporation, Bear Metallurgical Company, JFE Material, Hickman, Williams and Companies, Pangang, HBIS Chengsteel |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Commercial Grade

- FeV 60

- FeV 80

- Other Grades

- By Production Process

- Aluminothermic Reduction

- Silicon Reduction

- By End-Use Industry

- Steel Manufacturing

- Aerospace

- Chemicals

- Battery Production

- Other Industries

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Summary

- Market Scope and Overview

- Key Market Dynamics and Trends

- Macroeconomic Factors and Market Influence

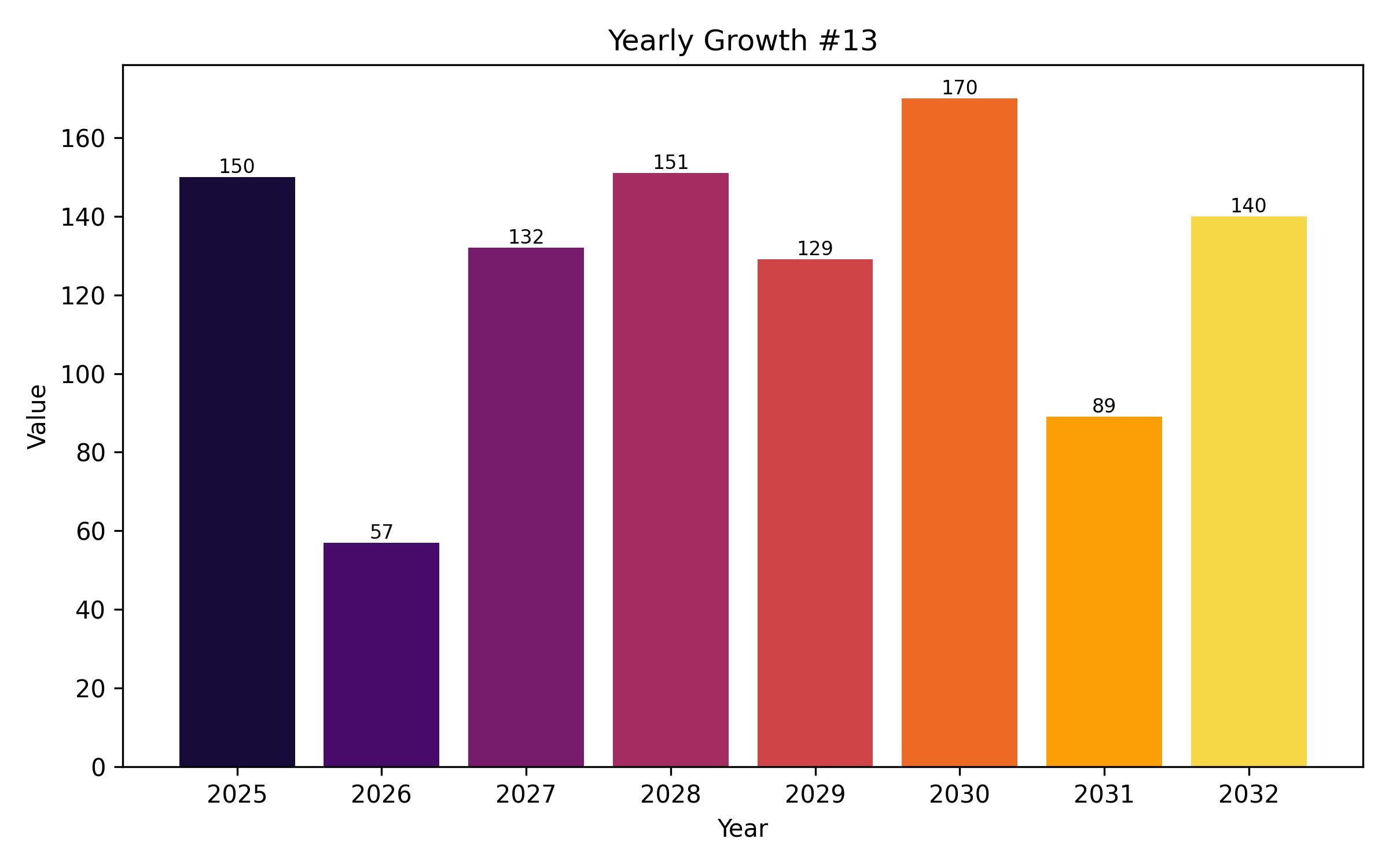

- Market Value and Growth Forecast (2018-2024 and 2025-2035)

- Pricing Analysis and Trends

- Market Size (USD Billion) Historic and Forecast (2018-2024 and 2025-2035)

- Market Structure and Background

- Market Segmentation Analysis by Commercial Grade

- FeV 60 Analysis

- FeV 80 Analysis

- Other Grades Analysis

- Market Segmentation Analysis by Production Process

- Aluminothermic Reduction Process Analysis

- Silicon Reduction Process Analysis

- Market Segmentation Analysis by End-Use Industry

- Steel Manufacturing Applications

- Aerospace Industry Demand

- Chemical Sector Usage

- Battery Production Impact

- Other Industrial Uses

- Regional Market Analysis (2018-2024 and 2025-2035)

- North America Market Analysis

- Europe Market Analysis

- Asia Pacific Market Analysis

- Latin America Market Analysis

- Middle East & Africa Market Analysis

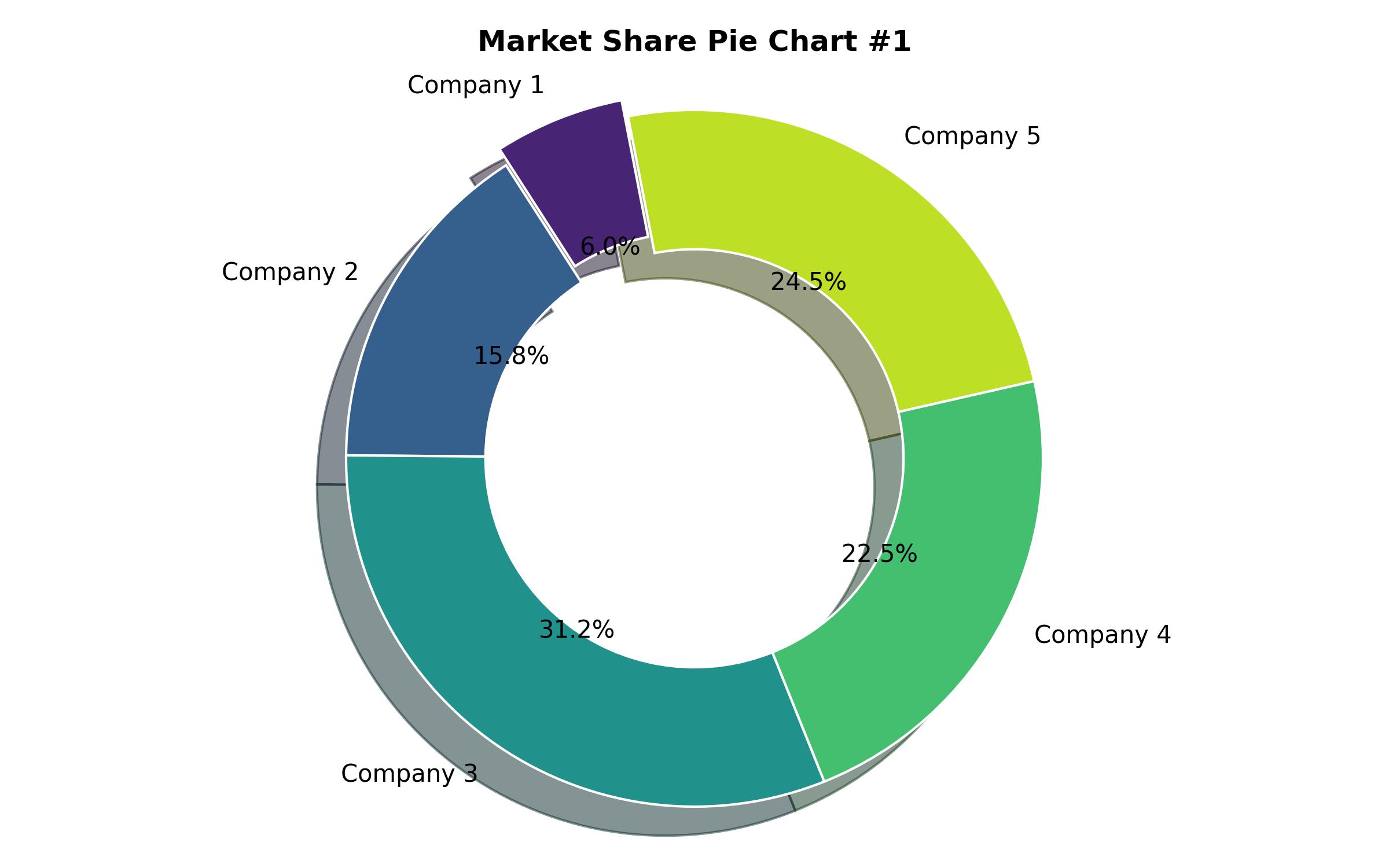

- Competitive Landscape Analysis

- Market Share Analysis of Key Players

- Company Profiles and Offerings

- Assumptions and Definitions

- Research Methodology