Feed Premix Market Dynamics: Addressing Nutritional Demands and Growth Opportunities (2025-2035)

Overview:

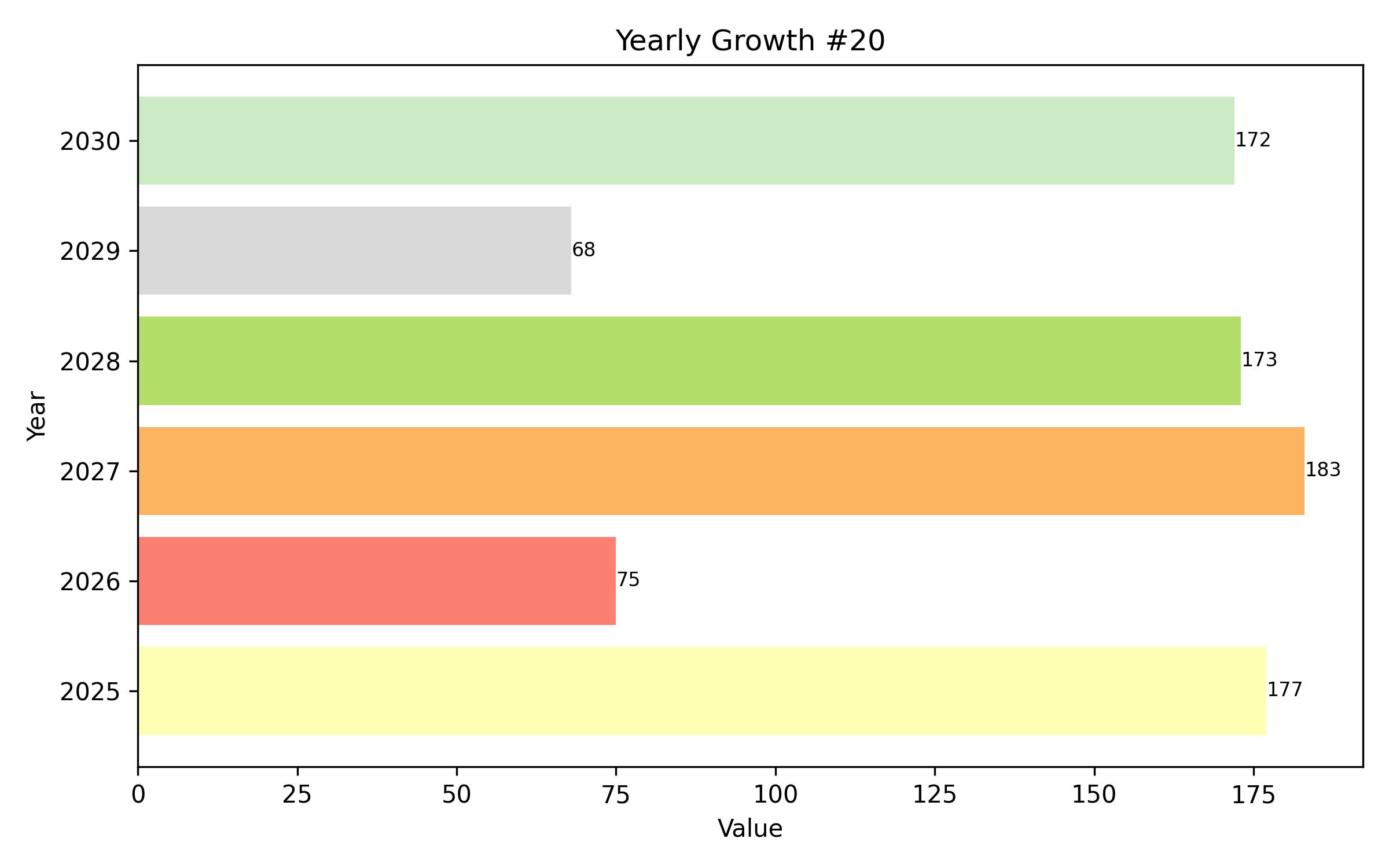

The global market for feed premixes is anticipated to expand to USD 12.75 billion by the conclusion of 2035, demonstrating a compound annual growth rate (CAGR) of 3.5% from its valuation of USD 9.25 billion in 2025. Over the preceding period from 2020 to 2025, the market witnessed a consistent growth rate of 3.2% per annum.

Recent years have seen significant shifts in agricultural practices and consumer preferences, which have notably impacted the feed premix sector. Several key factors contribute to these changes. Firstly, the increasing sophistication of modern livestock farming methods has created a greater reliance on tailored feed premixes for specific nutritional requirements across different animal types and life stages.

Driven by the pursuit of enhanced profitability and animal welfare, producers are placing increased emphasis on optimizing animal nutrition, leading to a higher demand for specialized feed formulations. Furthermore, advancements in nutritional science and feed technology have facilitated the development of customized premix solutions designed to improve feed conversion efficiency, minimize environmental footprints, and boost overall animal productivity while adhering to sustainability goals.

Industry participants are leveraging these technological capabilities to cater to a broad spectrum of livestock producers, ranging from extensive industrial farms to specialized organic operations. The integration of farming systems and vertical consolidation within the agricultural value chain are also modifying the demand patterns for essential feed ingredients.

The trend towards larger, more integrated operations favors the adoption of comprehensive feed strategies that ensure uniform nutrient distribution and intake across entire animal populations, thereby enhancing overall animal health and management efficiency.

A significant element influencing the market is the growing inclination towards natural and organic components in animal feed. Producers and consumers alike are showing increased concern regarding the source and quality of feed inputs used for their animals. This concern is motivated by issues related to animal welfare, environmental consequences, and the presence of chemical residues in animal products.

Consequently, there is a heightened search for products containing certified organic or natural ingredients, such as plant extracts and botanicals, recognized for their beneficial health properties. In response, companies are increasingly adopting clean label initiatives and implementing sustainable sourcing and production processes throughout their supply chains, prompted by both regulatory requirements and consumer calls for greater transparency.

Companies embracing these natural and organic strategies are strategically positioned to capitalize on the expanding demand for animal nutrition solutions that are perceived as both healthy and environmentally responsible. The market for feed premixes incorporating natural and organic ingredients is poised for further expansion as regulatory bodies enforce stricter standards and consumer demand for supply chain transparency continues to rise.

Between 2020 and 2024, the market experienced an average annual growth rate of 3.1%. Projections for the period spanning 2025 to 2035 indicate a slightly accelerated growth trajectory, with an anticipated compound annual growth rate of 3.3%.

Feed premixes are meticulously formulated composites containing essential nutrients, including various vitamins, amino acids, and other necessary additives, designed to elevate the nutritional value of animal feed. These premixes are vital for ensuring animals receive a well-rounded and complete diet. Their flexibility in formulation allows them to be produced in various physical forms such as powders, liquids, or granules, enabling diverse applications across different feeding programs.

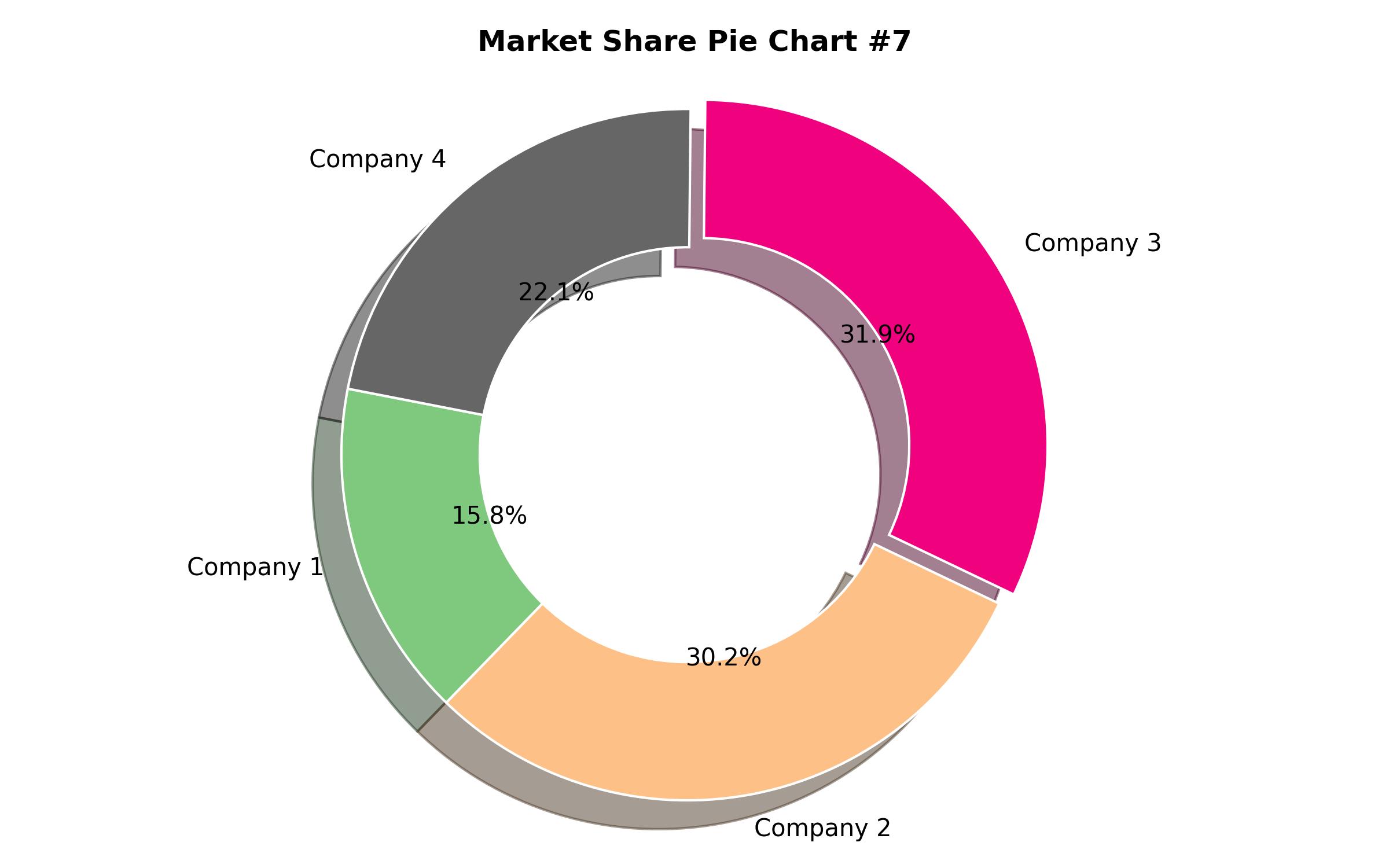

The competitive landscape is influenced by the market concentration across different company tiers. Tier 1 companies, comprising major global leaders, collectively hold a substantial market share, approximately 40%. These entities are typically characterized by extensive product ranges, high production capacities, broad geographic reach, deep expertise in various feed formats, and a robust customer base. They often utilize advanced technology and adhere to stringent regulatory standards to deliver high-quality products and services.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 9.09 Billion |

| Revenue Forecast for 2035 | USD 12.58 Billion |

| Growth Rate (CAGR) | 3.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Form, Product, Animal Type, Application, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, Middle East and Africa |

| Country Scope | U.S., Canada, Mexico, Germany, France, Italy, U.K., Spain, China, India, Japan, South Korea, Australia, Brazil, Argentina, Colombia, South Africa, Saudi Arabia, UAE |

| Key Companies Analyzed | Cargill Incorporated, Archer Daniels Midland Company (ADM), Dansk LandbrugsGrovvareselskab A.M.B.A. (DLG), BASF SE, Land O’Lakes, Inc., Godrej Agrovet, Koninklijke DSM N.V., Corbion N.V., Farbest-Tallman Foods Corporation, Glanbia plc, Nutreco N.V., SternVitamin GmbH & Co. KG, Vitablend Nederland BV, Watson Foods Co., Inc., Wright Enrichment Inc., Zagro Asia Ltd. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- Powder

- Liquid

- Vitamins

- Minerals

- Amino Acids

- Antibiotics

- Enzymes

- Antioxidants

- Other Products

- Poultry

- Swine

- Ruminants

- Aquaculture

- Equine

- Pets

- Growth Performance

- Health and Immunity

- Reproduction

- Egg Production

- Milk Production

- Meat Quality

- North America (U.S., Canada, Mexico)

- Europe (Germany, U.K., France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina, Colombia)

- Middle East and Africa (South Africa, Saudi Arabia, UAE)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Supply-side Analysis

- Demand-side Analysis

- Market Value Chain Analysis

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Concentration Analysis

- Market Analysis 2025 to 2035, By Form

- Powder

- Liquid

- Market Analysis 2025 to 2035, By Product

- Vitamins

- Minerals

- Amino Acids

- Antibiotics

- Enzymes

- Antioxidants

- Other Products

- Market Analysis 2025 to 2035, By Animal Type

- Poultry

- Swine

- Ruminants

- Aquaculture

- Equine

- Pets

- Market Analysis 2025 to 2035, By Application

- Growth Performance

- Health and Immunity

- Reproduction

- Egg Production

- Milk Production

- Meat Quality

- Market Analysis 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Market Analysis 2025 to 2035

- Europe Market Analysis 2025 to 2035

- Asia Pacific Market Analysis 2025 to 2035

- Latin America Market Analysis 2025 to 2035

- Middle East and Africa Market Analysis 2025 to 2035

- Country-wise Analysis

- Competition Analysis

- Key Players in the Market

- Research Methodology

- Assumptions and Acronyms