Electrical Steel Market Expansion Forecast and Trends 2025-2035

Overview:

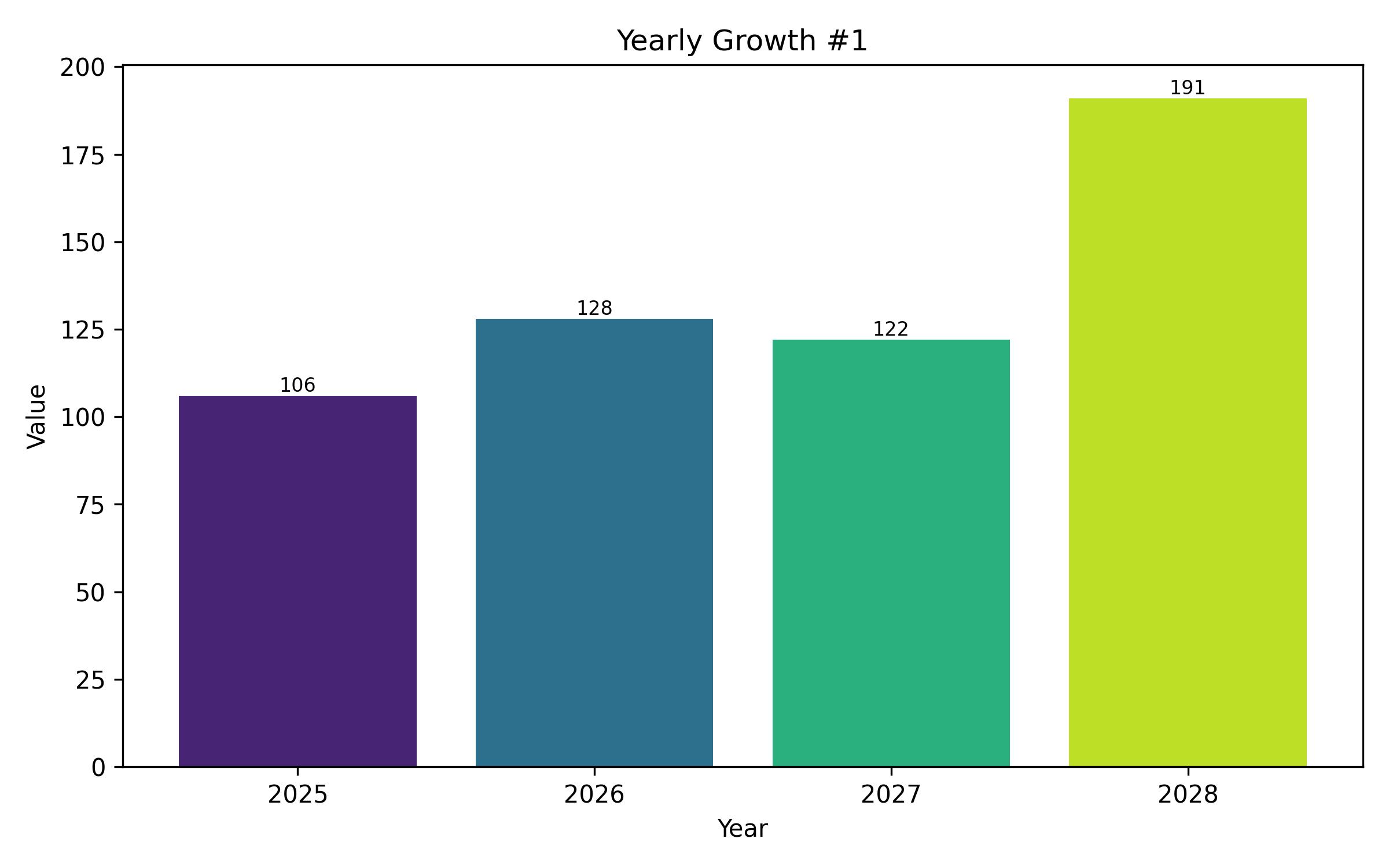

The market for electrical steel is projected to be valued at approximately USD 48.2 billion in 2025, with expectations to reach around USD 89.8 billion by the year 2035. This represents a compound annual growth rate (CAGR) of roughly 6.5% over the ten-year forecast period, indicating a steady expansion trajectory. This growth trajectory underscores the critical role of advanced electrical steel types in modern power systems, including their use in electric vehicles, vital industrial machinery, and the integration of renewable energy sources into existing grids.

A significant catalyst for market expansion is the global push towards energy efficiency and the development of cleaner power technologies. Both governmental bodies and private enterprises are increasingly focused on reducing energy consumption and minimizing carbon footprints. This global emphasis is accelerating investments in upgrading electrical infrastructure, which in turn escalates the demand for electrical steel variants that offer superior magnetic properties and reduced energy losses during operation.

The increasing deployment of smart grid technologies and the expansion of power generation and distribution networks are further bolstering demand within the sector. The surging adoption of electric vehicles (EVs) stands out as a particularly strong driver; electrical steel is an essential component in EV motors and charging units, prized for its efficiency, longevity, and lightweight characteristics crucial for vehicle performance and range.

Stringent global emission standards continue to favor the production and sale of EVs over traditional internal combustion engine vehicles. This trend is positioning the automotive industry as a key segment for high-performance electrical steel, demanding materials optimized for electric powertrains. Furthermore, the rising demand for renewable energy, particularly from large-scale solar and wind power installations, heightens the need for reliable transformers and related equipment, all of which rely heavily on electrical steel for efficient operation and long-term reliability.

Technological advancements in steel processing, such as precise laser scribing and innovative insulation coating techniques, are enabling manufacturers to produce higher grades of electrical steel that yield enhanced performance and efficiency. Concurrently, metallurgical innovations are leading to the development of steels with ultra-low core losses, directly supporting global efforts towards energy conservation across diverse applications.

The shift from 2020 to 2024 reflected solid market growth, fueled by increasing applications in power generation, automotive, and industrial sectors, particularly for energy-efficient motors and transformers utilizing grain-oriented (GOES) and non-grain-oriented (NGOES) electrical steels. Regulatory pushes for energy efficiency and the adoption of EVs accelerated demand, though premium costs and supply chain issues presented some challenges.

Looking ahead from 2025 to 2035, market dynamics will increasingly be shaped by the pervasive global trend towards electrification. The rapid proliferation of electric vehicles, alongside advancements in smart grids, wind power technology, and innovative solid-state transformers, will be pivotal. Future materials are expected to integrate nanostructures and amorphous metal alloys, potentially enhanced by artificial intelligence in design processes, to produce lighter, more efficient, and environmentally conscious steel. The focus will also shift towards sustainable steel production methods, including hydrogen-based techniques, to align with carbon neutrality goals.

Operational and trade risks are significant, including tariffs and anti-dumping duties that affect material costs and trade flows, alongside increasingly strict environmental regulations on emissions and waste. Companies face pressure to adopt cleaner processes and improve sustainability across their operations, from sourcing to recycling, to meet investor and consumer expectations regarding Environmental, Social, and Governance (ESG) factors. Failure to adapt to these sustainability trends could result in reputational damage and financial consequences.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 48.2 billion |

| Revenue Forecast for 2035 | USD 89.8 billion |

| Growth Rate (CAGR) | 6.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Application, End Use, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | US, UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand |

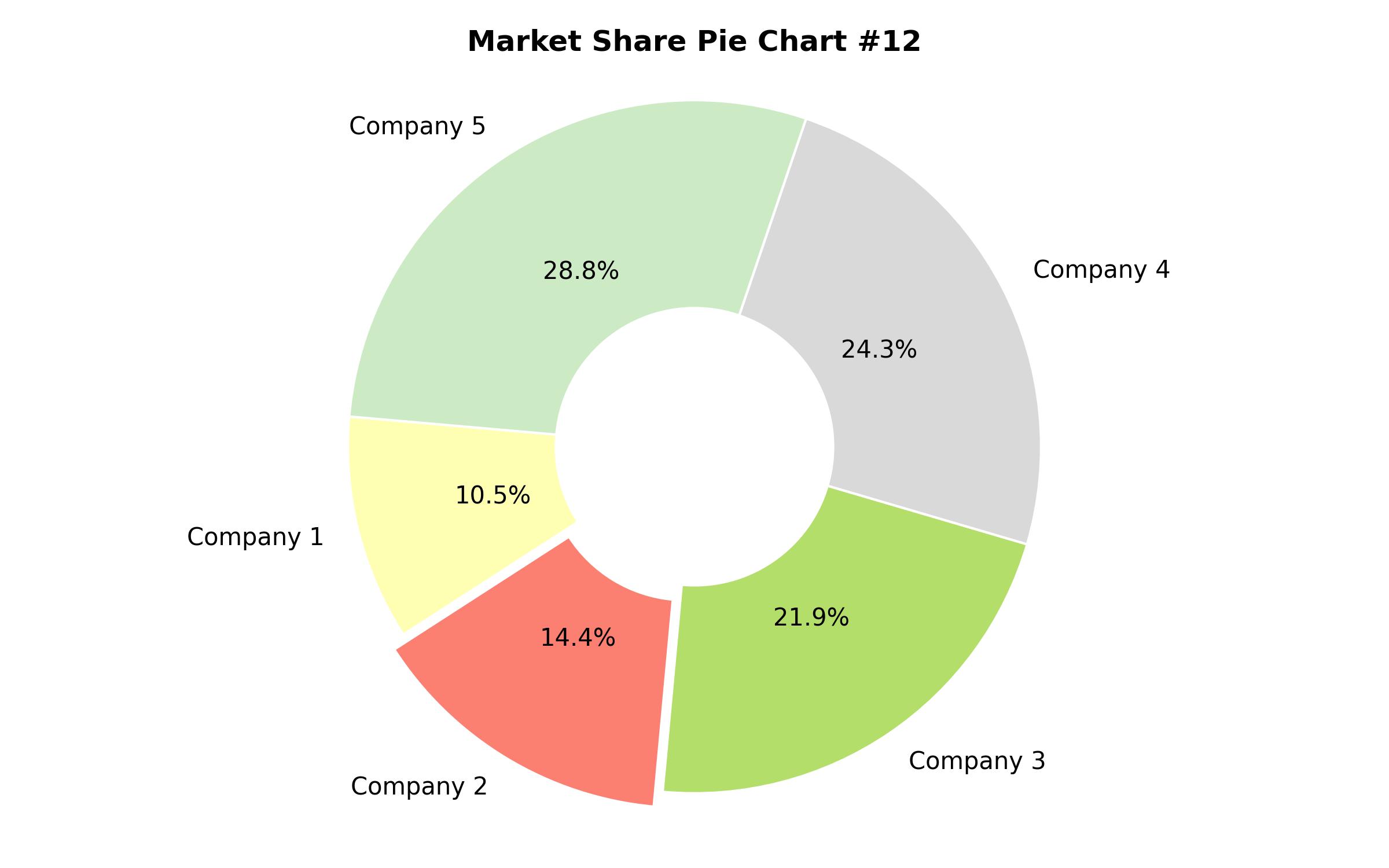

| Key Companies Analyzed | Novolipetsk Steel, Voestalpine Stahl GmbH, POSCO, Nippon Steel & Sumitomo Metal Corporation, ThyssenKrupp AG, JFE Steel Corporation, Cogent Power, ArcelorMittal SA, Aperam SA, Baosteel Group, AK Steel Holding Corp, Allegheny Technologies, Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Grain-Oriented Electrical Steel (GOES)

- Non-Grain-Oriented Electrical Steel (NGOES)

- By Application

- Transformers

- Motors

- Generators

- Inductors

- Other Applications

- By End Use

- Energy

- Automotive

- Industrial Equipment

- Household Appliances

- Other End Uses

- By Region

- North America (US, Canada, Mexico)

- Europe (UK, Germany, France, Italy, Spain, Russia)

- Asia Pacific (China, India, Japan, South Korea, Southeast Asia, Oceania)

- Latin America (Brazil, Argentina, Colombia)

- Middle East and Africa (GCC Countries, South Africa, Turkey)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Growth Drivers and Restraints

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Risk Assessment in the Industry

- Market Value (in USD Billion) Analysis 2020 to 2024 and Forecast 2025 to 2035

- Value Chain Analysis

- Market Background

- Pricing Analysis

- Regulatory Landscape

- Analysis by Product Type 2020 to 2024 and Forecast 2025 to 2035

- Grain-Oriented Electrical Steel (GOES)

- Non-Grain-Oriented Electrical Steel (NGOES)

- Analysis by Application 2020 to 2024 and Forecast 2025 to 2035

- Transformers

- Motors

- Generators

- Inductors

- Other Applications

- Analysis by End Use 2020 to 2024 and Forecast 2025 to 2035

- Energy

- Automotive

- Industrial Equipment

- Household Appliances

- Other End Uses

- Analysis by Region 2020 to 2024 and Forecast 2025 to 2035

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

- North America Market Analysis 2025-2035

- Europe Market Analysis 2025-2035

- Asia Pacific Market Analysis 2025-2035

- Latin America Market Analysis 2025-2035

- Middle East and Africa Market Analysis 2025-2035

- Competitive Landscape

- Key Market Players Overview

- Research Methodology