Deep Dive into South Korea’s Portable Dishwasher Sector: Market Size, Shares, and Evolving Trends (2025-2035)

Overview:

The South Korean market for portable dishwashers is projected to reach a valuation of USD 8.1 million in 2025. The sector is anticipated to expand at a compound annual growth rate (CAGR) of 4.7% from 2025 to 2035, hitting USD 13.1 million by the conclusion of the forecast period. Market expansion within South Korea is being propelled by several significant factors, largely influenced by changing consumer preferences and evolving industry dynamics.

A key driving force is the increasing urbanization and the prevalence of smaller households across the country. As a greater number of individuals relocate to more compact living spaces in urban centers, particularly within major cities like Seoul, the demand for space-saving appliances has risen. Portable dishwashers, owing to their compact size, convenient storage, and mobility, align well with the requirements of these consumers.

Given that many urban residences lack the necessary space to accommodate traditional built-in dishwashers, portable options offer a practical and economical alternative for city dwellers. Furthermore, South Korean consumers are placing a growing emphasis on convenience and domestic appliances that save time.

These dishwashers enable users to efficiently clean dishes without extensive manual effort, freeing up time for other activities. This shift in consumer behavior, especially among young professionals and busy families, has contributed to the increasing popularity of these products.

Additionally, heightened environmental consciousness represents another significant consideration. South Koreans are becoming more mindful of resource consumption, and these products are typically designed to be more energy and water efficient compared to manual dishwashing. Many newer models incorporate features that enhance energy efficiency, appealing to environmentally aware consumers seeking to reduce their environmental footprint.

The increasing reach of online retail channels and enhanced marketing efforts by appliance manufacturers are further stimulating market expansion. As e-commerce platforms facilitate price comparisons and offer a wider variety of models, consumers are becoming more informed and inclined to invest in such appliances. This accessibility has broadened the market, supporting overall growth.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 8.1 million |

| Industry Value (2035F) | USD 13.1 million |

| CAGR (2025 to 2035) | 4.7% |

Market Dynamics: Trends and Consumer Preferences Across End-Use Categories

The market is characterized by distinct purchasing behaviors and priorities that vary among different end-use sectors, including residential consumers, commercial entities, and institutional buyers. Understanding these dynamics is crucial for grasping market trends and consumer decision-making.

Within the residential segment, the primary purchase drivers for products are dimensions, available features, energy efficiency, and ease of use. Consumers in South Korean urban areas with limited space often prefer lightweight, compact models that can be easily stored when not actively used.

Energy efficiency holds significant importance as buyers become more environmentally aware and seek to reduce electricity and water usage. Consumers are also drawn to appliances offering multiple washing cycles, rapid cleaning options, and quiet operation.

With the rise in smaller households and single-person living arrangements, features supporting simpler lifestyles, such as slim profiles and portability, are gaining prominence. For commercial establishments like restaurants, cafes, and smaller hotels, procurement choices are typically influenced by capacity, durability, and operational speed.

Businesses in this sector require dishwashers capable of efficiently handling high volumes of dishes while maintaining sanitation standards. Commercial clients seek units that provide quick cycle times to support frequent dishwashing needs and ensure smooth operations during peak service periods.

The market is shaped by the specific requirements and preferences of its various end-use segments. Residential buyers prioritize compactness and efficiency, while commercial users focus on capacity and robustness. Institutional purchasers emphasize reliability and ease of maintenance.

Manufacturers are adapting to these diverse consumer needs by innovating and introducing specialized features designed to fulfill the demands of each segment.

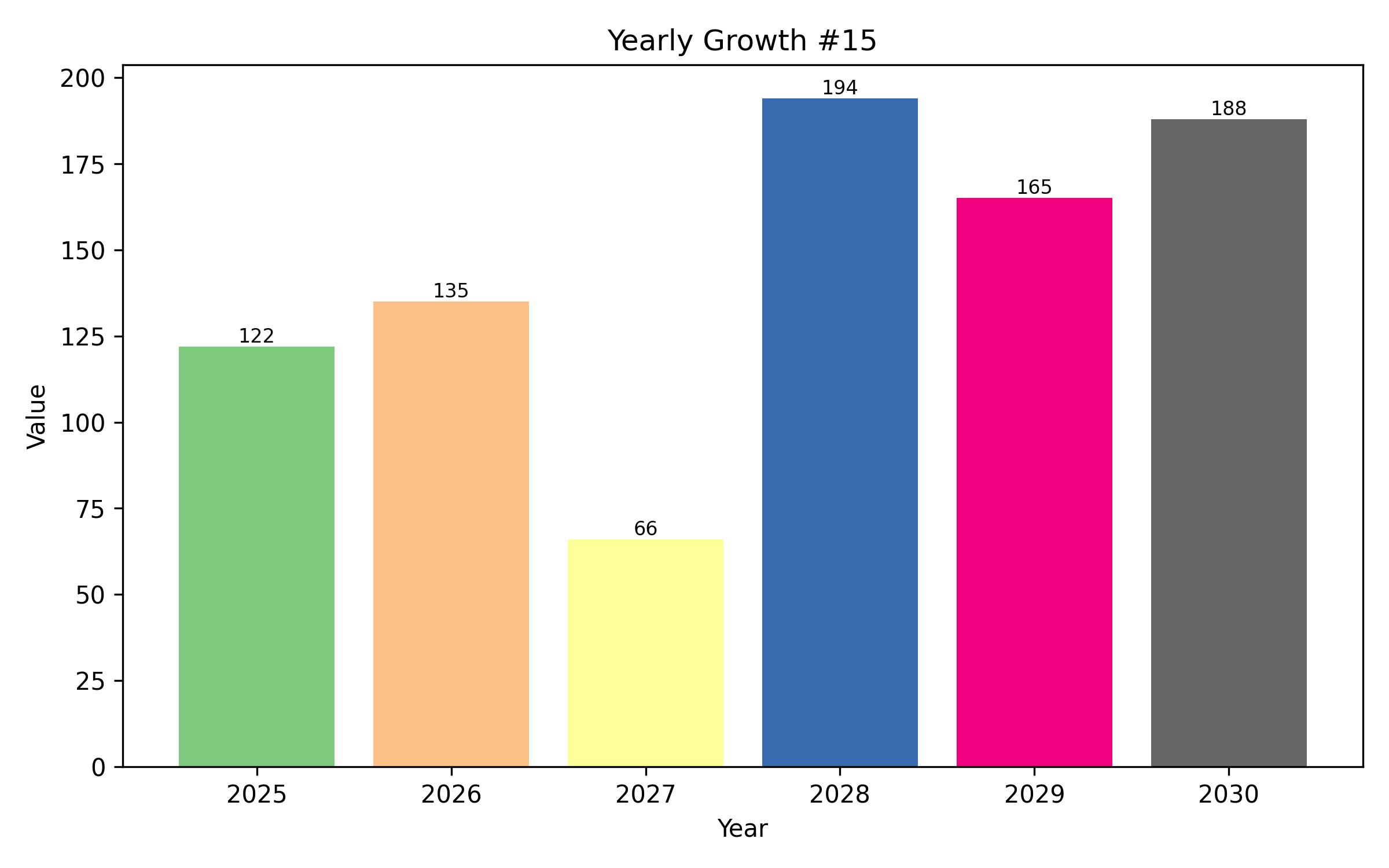

Market Evolution from 2020 to 2024 and Future Projections 2025 to 2035

Between 2020 and 2024, the market experienced considerable transformation, spurred by changing consumer lifestyles, technological advancements, and growing environmental concerns. A particularly noticeable trend during this period was the increased focus on compact design and energy efficiency in appliances.

Ongoing urbanization means more South Koreans now live in apartments and smaller homes, where space for bulkier appliances is limited. This has generated higher demand for space-saving, mobile dishwashers that can be conveniently put away when not required. Consumers are also increasingly prioritizing energy efficiency, choosing models that not only conserve water but also reduce electricity consumption, reflecting heightened environmental awareness.

Over the forecast period, 2025 to 2035, the market is anticipated to shift further due to continued trends and innovations. As consumers remain focused on sustainability, manufacturers will place even greater emphasis on developing energy-saving models with reduced environmental impact.

There will be elevated demand for eco-friendly dishwashers minimizing water and energy use, and companies are likely to adopt cleaner manufacturing processes in response to South Korea’s initiatives aimed at lowering carbon emissions.

Industry Shift Analysis: Comparing 2020 to 2024 with 2025 to 2035

| 2020 to 2024 (Trends) | 2025 to 2035 (Future Projections) |

|---|---|

| Rising demand for compact, space-efficient dishwashers driven by urbanization and reduced living areas. Convenience became a significant factor during the pandemic, linked to more home cooking and cleaning. | Sustained demand for energy-efficient and ecologically conscious models. Growing interest in premium, feature-rich dishwashers incorporating advanced capabilities. |

| Introduction of smart, connected dishwashers featuring Wi-Fi and application controls. Quick wash and energy-saving functions were integrated into models to appeal to busy, tech-oriented consumers. | Greater integration of artificial intelligence and machine learning for optimizing wash cycles. Anticipation of more sophisticated connectivity and features such as automated detergent dispensing and self-cleaning technology. |

| Shift towards convenience-driven purchasing, influenced by fast-paced lifestyles and increased time spent at home during the pandemic. Consumers sought appliances that minimized manual effort. | Increased focus on sustainability, with environmentally aware consumers requesting greener, water-efficient and energy-saving products. Higher adoption rates for high-quality, durable models with extended lifespans. |

| Growing adoption of products in apartments and smaller residences. Strong emphasis on affordability, practical features, and immediate convenience. | Expansion within the premium market segment, with a stronger focus on performance, design, and innovation. Consumers will increasingly seek appliances that complement modern lifestyles and interior aesthetics. |

Risk Assessment of the South Korean Portable Dishwasher Market

One primary vulnerability for the market is its exposure to economic downturns. The South Korean economy is closely linked to international trade and can be influenced by economic slowdowns among its major trading partners. During periods of economic uncertainty, consumer spending often contracts, leading to a decline in demand for discretionary items like household appliances.

Market expansion may decelerate as consumers pivot towards essential purchases rather than convenience-oriented appliances. Additionally, if the economic environment results in higher interest rates or inflation, disposable incomes could decrease, further restricting consumer spending on premium appliances.

Another challenge is the rapid pace of technological innovation within the appliance industry. Companies must continually invest in research and development (R&D) to maintain competitiveness by integrating new features, such as smart technology, enhanced energy efficiency, and superior cleaning performance. However, the continuous introduction of new features and models can shorten product life cycles, raising risks of obsolescence.

Consumers may become more selective, favoring newer models with advanced features, leaving older stock unsold or underutilized. This not only compels manufacturers to innovate constantly but also requires retailers to manage inventory effectively, particularly when newer versions diminish the appeal of older models.

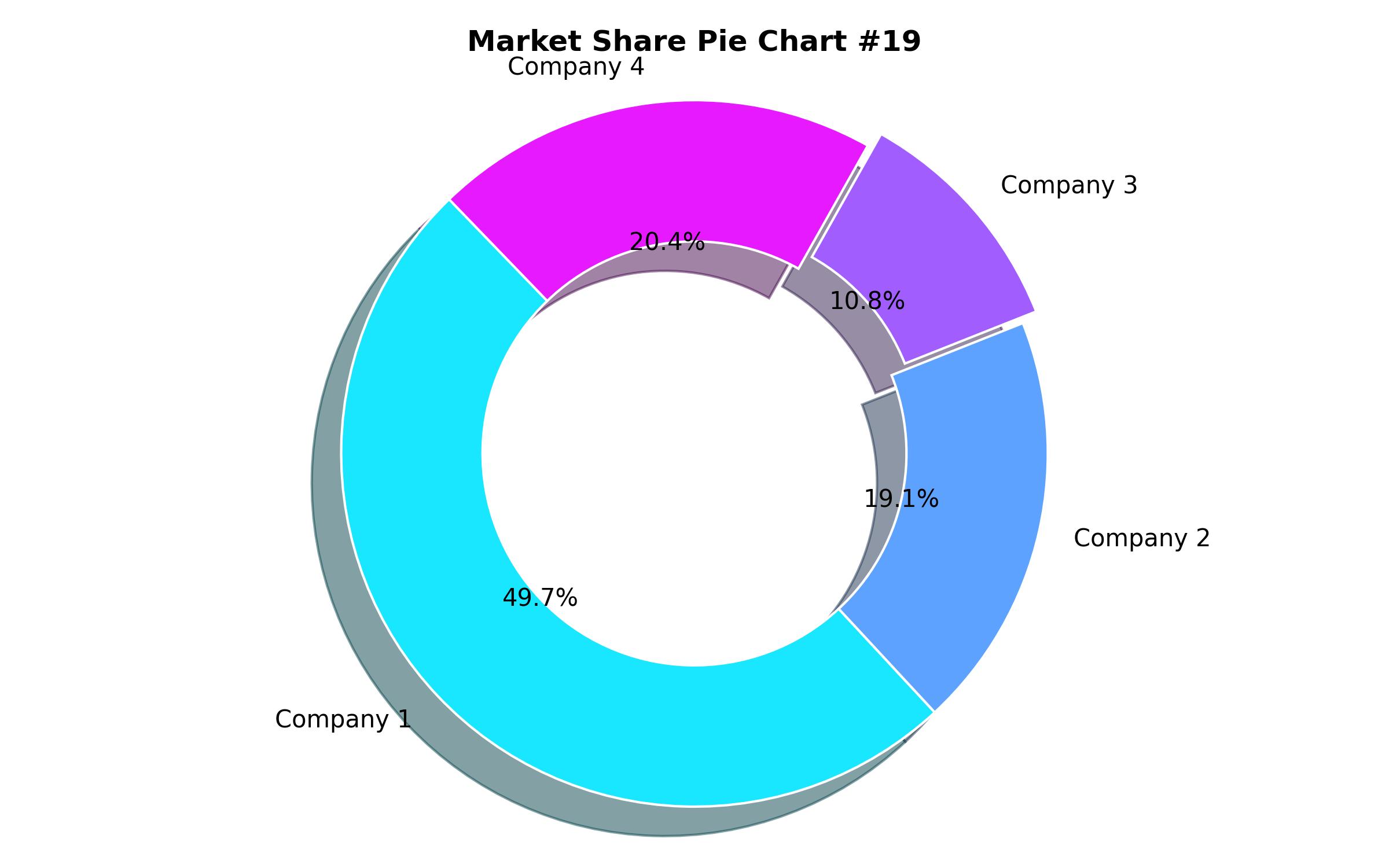

Segmentation Insights

By Application

Commercial use of portable dishwashers is currently more prevalent than residential adoption in South Korea. This is largely attributable to the rising number of restaurants, cafes, hotels, and other food service businesses, particularly in major urban centers like Seoul.

The significant requirement for effective, space-efficient, and economic cleaning equipment in commercial kitchens drives the usage of these products. These establishments need powerful dishwashing machines capable of cleaning a high volume of dishes efficiently without sacrificing performance or occupying excessive space.

Portable dishwashers are well-suited for such environments due to their mobility, minimal installation requirements, and affordability compared to larger, built-in commercial units. Furthermore, the increasing focus on hygiene, cleanliness, and sanitation within the food service industry further boosts the demand for these appliances.

In residential contexts, the adoption rate of portable dishwashers in South Korea remains relatively lower. Although urban homes with compact kitchens or limited storage space could benefit from portable versions, the overall penetration is less widespread.

A key factor is the cultural preference for manual dishwashing and the perception that dishwashers are not essential household items. However, with the growing trend of modernizing homes and increased awareness of time-saving appliances, the residential segment is gradually seeing increased interest, especially among younger, tech-savvy consumers. Nevertheless, the commercial market presently dominates the consumption of portable dishwashers in South Korea due to their practical benefits and efficiency in high-demand settings.

By Sales Channel

In South Korea, online platforms currently serve as the primary distribution channel for portable dishwashers. The increasing reliance on internet-based platforms for purchasing goods, particularly home appliances, has significantly propelled this trend. South Korean consumers value the convenience of online shopping, where they can easily compare prices, read customer reviews, and access a vast selection of products from various brands.

E-commerce sites also provide detailed product specifications, allowing consumers to make informed decisions based on features, capacity, and energy efficiency, which are crucial considerations when buying dishwashers.

The expansion of online retail is also supported by the growth of major e-commerce players such as Coupang and Gmarket, which offer rapid delivery services, flexible payment options, and frequent promotional discounts.

These platforms particularly appeal to the younger, technologically inclined generation who favor the ease of online transactions. The availability of convenient return policies and warranties further encourages customers to purchase portable dishwashers online.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 8.1 million |

| Revenue Forecast for 2035 | USD 13.1 million |

| Growth Rate (CAGR) | 4.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth drivers, and key trends |

| Covered Segments | Application, Capacity, Sales Channel, Price Range, and Region |

| Regional Scope | Seoul Capital Area, Gyeongsang, Jeolla, Chungcheong, Gangwon, Other Regions |

| Country Scope | South Korea |

| Key Companies Analyzed | Moneual, HAVA, Dolphin Co., Ltd, TradeKorea, Carousell Singapore, DA Technology, Electrolux AB, Samsung Electronics Co., Ltd, Robert Bosch GmbH, LG Appliance |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

-

By Capacity

- 4 Place Settings

- 6 Place Settings

- 8 Place Settings

- Greater than 8 Place Settings

-

By Application

- Residential

- Commercial

-

By Sales Channel

- Offline

- Specialty Stores

- Electronic Stores

- Hypermarkets/Supermarkets

- Other Retail Formats

- Online

- Direct to Consumer

- Third-party Online Retailers

- Offline

-

By Price Range

- Low

- Mid

- High

-

By Region

- Seoul Capital Area

- Gyeongsang Region

- Jeolla Region

- Chungcheong Region

- Gangwon Region

- Other Regions

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Million) Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Background

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Capacity

- 4 Place Settings

- 6 Place Settings

- 8 Place Settings

- Greater than 8 Place Settings

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Residential

- Commercial

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Offline

- Specialty Stores

- Electronic Stores

- Hypermarkets/Supermarkets

- Other Retail Formats

- Online

- Direct to Consumer

- Third-party Online Retailers

- Offline

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Price Range

- Low

- Mid

- High

-

Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- Seoul Capital Area

- Gyeongsang Region

- Jeolla Region

- Chungcheong Region

- Gangwon Region

- Other Regions

- Seoul Capital Area Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Gyeongsang Region Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Jeolla Region Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Chungcheong Region Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Gangwon Region Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Other Regions Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Competition Analysis

- Strategic Outlook

- Key Industry Players

- Assumptions and Acronyms Used

- Research Methodology