Comprehensive Market Analysis and Future Projections for Food Grade Carrageenan

Overview:

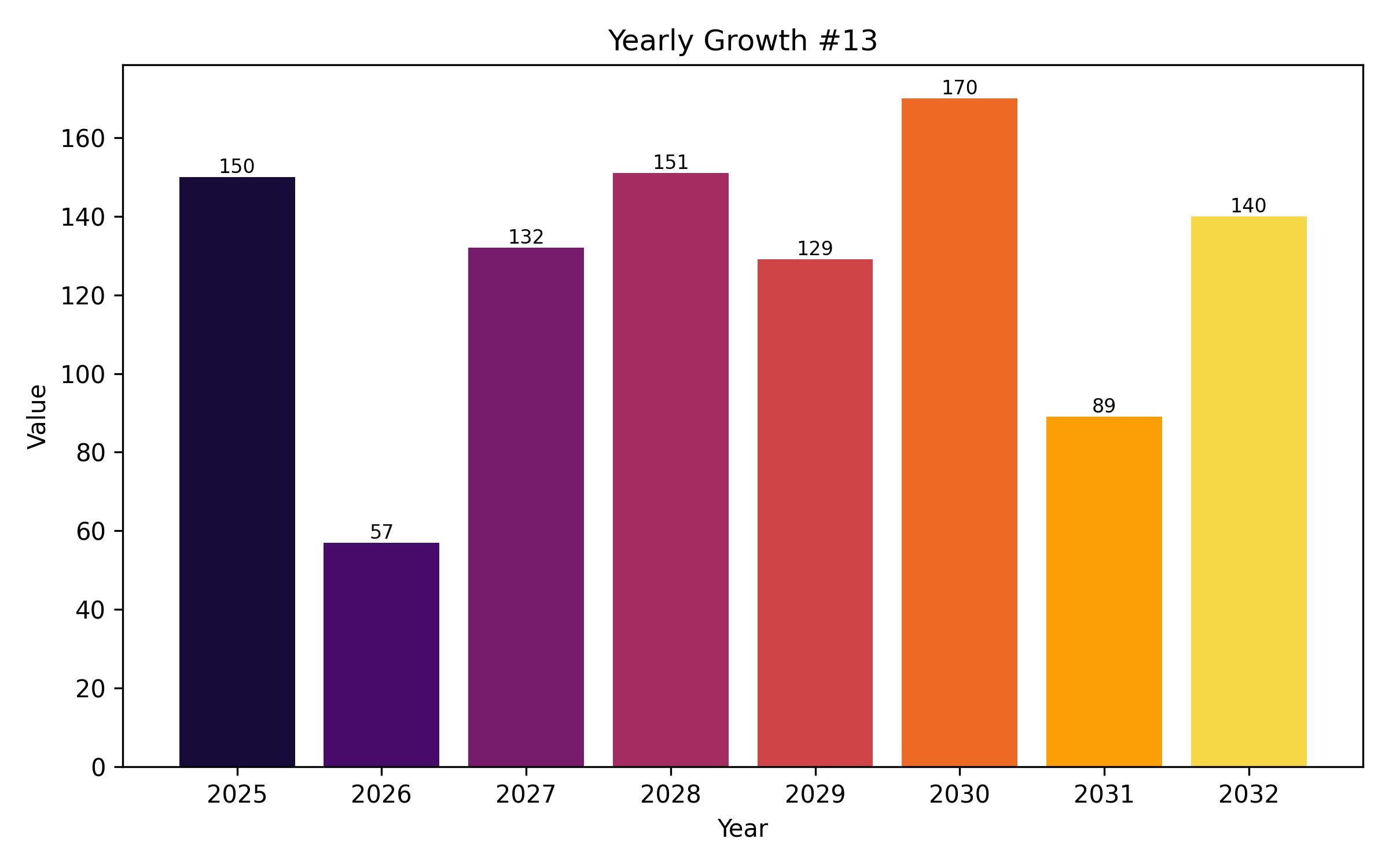

The global food grade carrageenan market is poised for substantial growth, projected to achieve a value of USD 1395.63 million in 2025 and reach USD 2523.05 million by 2035. This expansion corresponds to a compound annual growth rate (CAGR) of 6.1% over the forecast period.

Carrageenan, a natural extract from red seaweed, holds significant importance in various food formulations due to its functional attributes. Its capabilities in gelling, thickening, and stabilizing make it an invaluable ingredient across a diverse range of food items, including dairy products, meats, and baked goods.

The market’s growth is intrinsically linked to the increasing consumer preference for natural and plant-based ingredients. This trend reflects a broader shift towards healthier and more sustainable food choices. As health awareness rises, the demand for clean-label products fuels the expansion of the food grade carrageenan sector.

Several key factors contribute to the market’s upward trajectory. The widespread adoption of carrageenan within the food and beverage industry, where it enhances texture and provides stability, is a primary driver. Furthermore, growing recognition of carrageenan’s potential health benefits, such as its contribution to gut health and lower caloric value, is boosting demand.

The convenience food sector plays a crucial role in driving the market, as carrageenan is frequently used in ready-to-eat products to maintain quality during storage and transport. Additionally, ongoing advancements in extraction and processing technologies are improving production efficiency and the quality of carrageenan, thereby supporting market growth.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025E) | USD 1395.63 Million |

| Projected Industry Value (2035F) | USD 2523.05 Million |

| Value-based CAGR (2025 to 2035) | 6.1% |

The Asia-Pacific region is expected to lead the food grade carrageenan market, largely due to increasing consumption in countries such as Indonesia, China, and Japan. Carrageenan is widely used in both traditional and processed food products in these nations. Concurrently, Europe and North America are emerging as significant markets, driven by a shift towards natural ingredients and a rising demand for minimally processed foods.

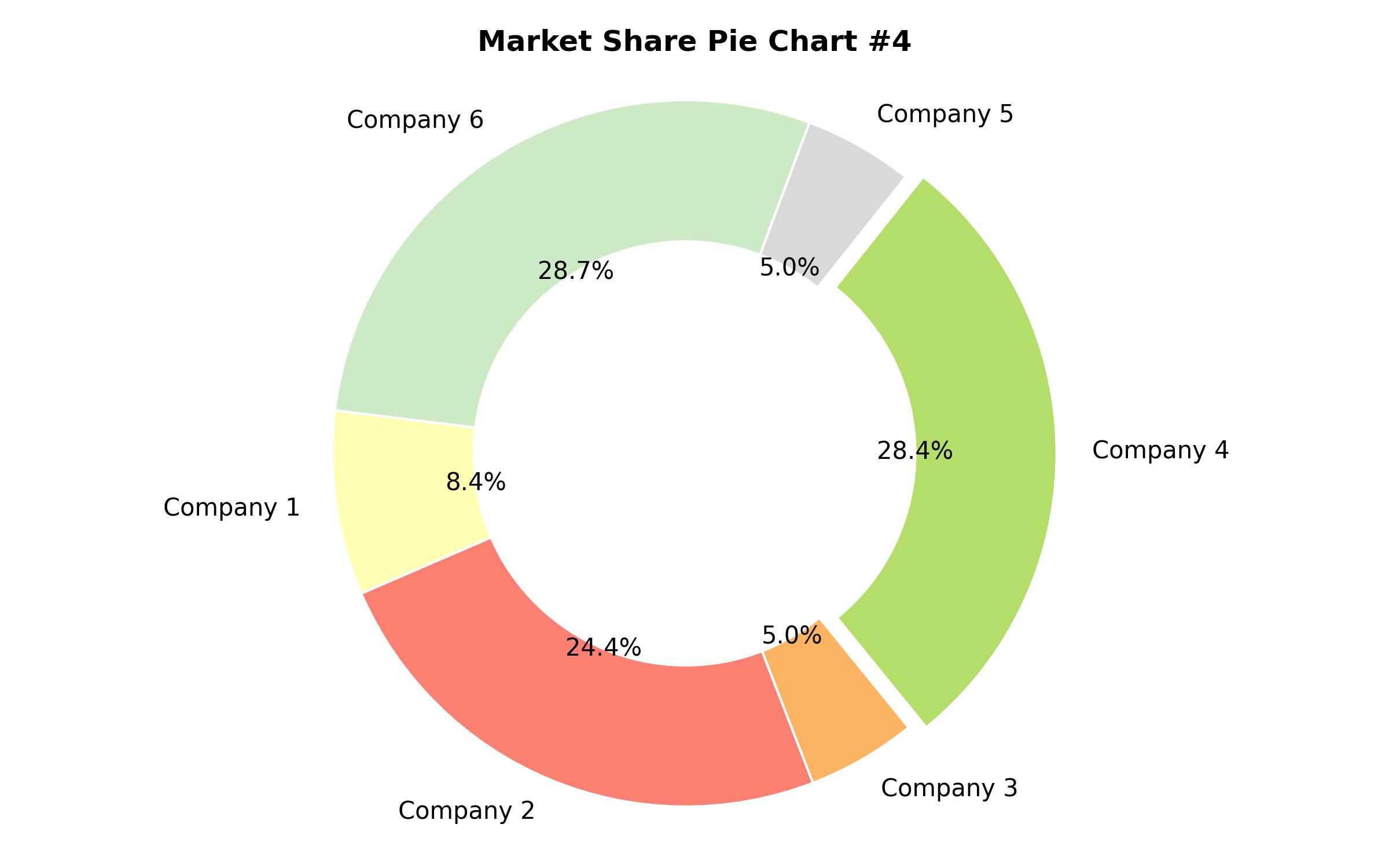

The presence of numerous carrageenan suppliers alongside well-established food processing industries in these regions further accelerates market development. Moreover, the expanding food and beverage sectors in developing countries, coupled with improving living standards and evolving dietary habits, are creating favorable opportunities for businesses globally.

Regulatory bodies across the world have affirmed the safety of carrageenan as a food additive, solidifying its position in the market. Approvals from organizations such as the FDA, EFSA, and JECFA have instilled confidence in its use, further contributing to the market’s positive outlook.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1395.63 million |

| Revenue Forecast for 2035 | USD 2523.05 million |

| Growth Rate (CAGR) | 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Function, Application, Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | USA, Germany, India, China, Japan, UK, France, Italy, Brazil, UAE, South Africa |

| Key Companies Analyzed | DuPont, Cargill, CP Kelco, Ashland Inc., Ingredion, Ceamsa, W Hydrocolloids, Inc., Gelymar, Ina Food Industry Co. Ltd., ACCEL Carrageenan Corporation |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Lota

- Iota

- Kappa

- Lambda

- By Function

- Gelling Agent

- Thickener

- Stabilizer

- Emulsifier

- By Application

- Dairy & Desserts

- Meat & Poultry

- Bakery & Confectionery

- Beverages

- Pet Food

- Other Food Applications

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Summary

- Market Introduction

- Key Market Dynamics

- Macro-economic Factors

- Market Value Chain Analysis

- Market Analysis 2020 – 2024 and Forecast 2025 – 2035

- Market Analysis 2025 – 2035, By Product Type

- Lota Carrageenan

- Iota Carrageenan

- Kappa Carrageenan

- Lambda Carrageenan

- Market Analysis 2025 – 2035, By Function

- Carrageenan as Gelling Agent

- Carrageenan as Thickener

- Carrageenan as Stabilizer

- Carrageenan as Emulsifier

- Market Analysis 2025 – 2035, By Application

- Use in Dairy & Desserts

- Use in Meat & Poultry

- Use in Bakery & Confectionery

- Use in Beverages

- Use in Pet Food

- Use in Other Food Applications

- Market Analysis 2025 – 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America Food Grade Carrageenan Market

- Europe Food Grade Carrageenan Market

- Asia Pacific Food Grade Carrageenan Market

- Latin America Food Grade Carrageenan Market

- Middle East & Africa Food Grade Carrageenan Market

- Competitive Landscape

- Company Profiles

- Assumptions and Research Methodology