Comprehensive Analysis of the Industrial Motors Market: Trends, Growth, and Forecasts to 2035

Overview:

The industrial motors market is currently experiencing steady growth, and projections estimate a continued upward trajectory in the coming years. The market is expected to reach USD 724.8 million by 2025, driven by increasing demand across various industries. With a compound annual growth rate (CAGR) of approximately 3.5%, the market is anticipated to reach a valuation of USD 1 billion by 2035. This expansion is attributed to the rising adoption of industrial motors in critical sectors such as manufacturing, oil and gas, and power generation.

Technological advancements are playing a crucial role in shaping the industrial motors market. Innovations in motor design, materials, and control systems are enhancing energy efficiency and performance. The integration of smart technologies, such as IoT and predictive maintenance, is also gaining traction, enabling businesses to optimize operations and reduce downtime.

The push for sustainability and energy conservation is further fueling market growth. Governments and industries are implementing stringent regulations to reduce carbon emissions and improve energy efficiency. This is driving the demand for energy-efficient industrial motors and related technologies.

Regionally, Asia Pacific is expected to witness the highest growth rate due to increasing industrialization and infrastructure development. North America and Europe also represent significant markets, driven by technological advancements and stringent energy efficiency standards. Key players such as ABB Ltd., Siemens AG, and General Electric are actively engaged in product innovation and strategic partnerships to strengthen their market presence.

The industrial motors market is characterized by intense competition and continuous technological advancements. Companies are focused on developing innovative products and solutions to meet the evolving needs of various end-use industries. The market’s future growth is underpinned by the increasing demand for energy-efficient and smart industrial motors across the globe.

Moreover, the growing emphasis on automation and digitalization in industrial processes is expected to create new opportunities for industrial motor manufacturers. As industries continue to adopt advanced technologies to enhance efficiency and reduce costs, the demand for high-performance industrial motors is likely to increase significantly.

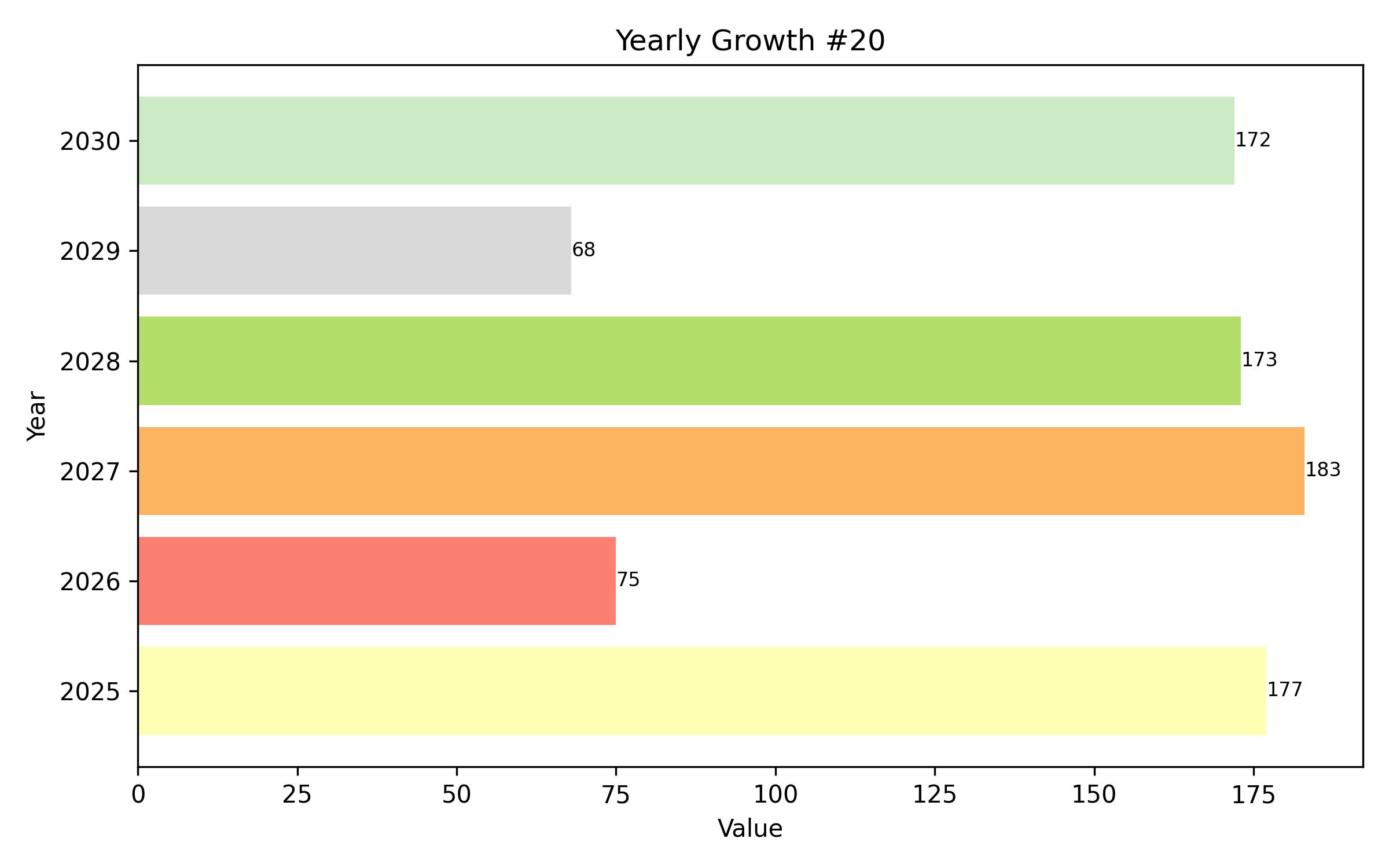

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 724.4 million |

| Revenue Forecast for 2035 | USD 1 billion |

| Growth Rate (CAGR) | 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, power output, end use and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | General Electric; Hitachi Ltd.; Nidec Corporation; WEG SA; Siemens AG; ABB Ltd.; Regal Rexnord Corporation; Toshiba Corporation |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

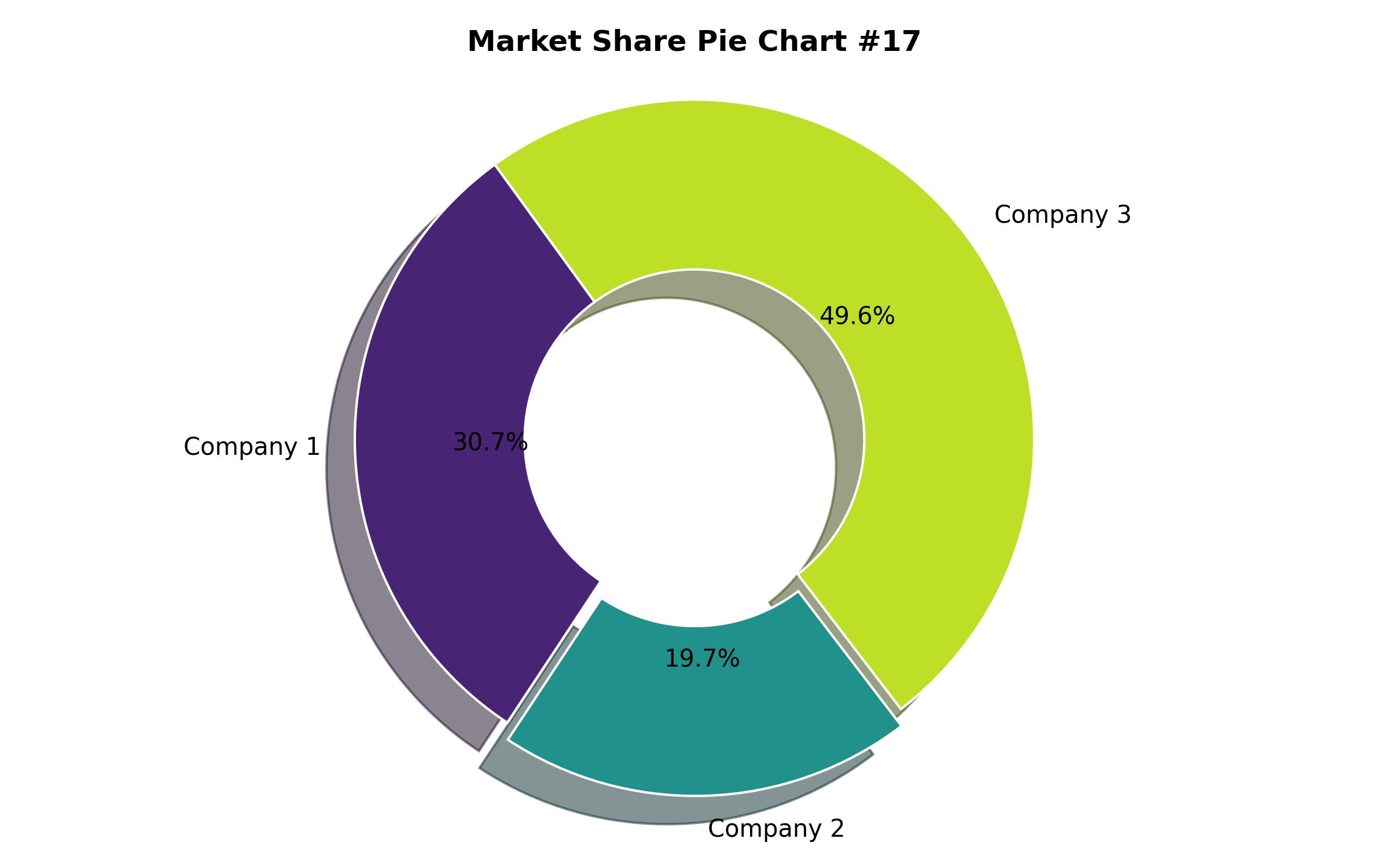

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- AC Motors

- DC Motors

- Servo Motors

- Hermetic Motors

- By Power Output

- fractional Horsepower

- Integral Horsepower

- High Horsepower

- By End Use Industry

- Oil and Gas

- Water and wastewater treatment

- Automotive

- Food and Beverage

- Pharmaceutical

- Chemical and Petrochemical

- Power Generation

- Mining

- Cement

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina, Colombia)

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Global Economic Outlook

- Key Market Trends

- Market Drivers and Restraints

- Industrial Motors Market Demand Analysis, 2020 – 2024 and Forecast, 2025 – 2035

- Industrial Motors Market – Pricing Analysis

- Industrial Motors Market Analysis, by Product Type

- AC Motors

- DC Motors

- Servo Motors

- Hermetic Motors

- Industrial Motors Market Analysis, by Power Output

- Fractional Horsepower

- Integral Horsepower

- High Horsepower

- Industrial Motors Market Analysis, by End Use Industry

- Oil and Gas

- Water and Wastewater Treatment

- Automotive

- Food and Beverage

- Pharmaceutical

- Chemical and Petrochemical

- Power Generation

- Mining

- Cement

- Industrial Motors Market Analysis, by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa

- North America Industrial Motors Market Analysis, 2025 – 2035

- Europe Industrial Motors Market Analysis, 2025 – 2035

- Asia Pacific Industrial Motors Market Analysis, 2025 – 2035

- Latin America Industrial Motors Market Analysis, 2025 – 2035

- Middle East & Africa Industrial Motors Market Analysis, 2025 – 2035

- Competitive Landscape

- Major Company Profiles

- Market Structure Analysis

- Assumptions and Acronyms Used

- Research Methodology