Comprehensive Analysis of the Anti-hyperglycemic Agents Market: Assessment of Growth, Emerging Trends, and Projections Through 2035

Overview:

The global anti-hyperglycemic agents market is poised for substantial expansion over the next decade. In 2025, the market is projected to reach a valuation of USD 50.13 billion. Driven by a steady compound annual growth rate (CAGR) of 4.7%, the market is anticipated to reach USD 80.15 billion by 2035. This growth is primarily attributed to the increasing prevalence of diabetes and related metabolic disorders worldwide.

The escalating rates of obesity, sedentary lifestyles, and aging populations are significant factors contributing to the rise in diabetes cases. This, in turn, fuels the demand for effective anti-hyperglycemic agents.

Advancements in pharmaceutical research and development have introduced novel drug classes, such as SGLT2 inhibitors and GLP-1 receptor agonists, which offer improved glycemic control and additional benefits like weight management and cardiovascular protection. These innovative therapies are gaining traction among healthcare providers and patients.

The market is characterized by intense competition among key players, including established pharmaceutical giants and emerging biotech companies. These companies are focused on developing and commercializing innovative anti-hyperglycemic agents to address the unmet needs of diabetic patients.

Regional market dynamics vary, with North America and Europe leading in terms of market size and adoption of advanced therapies. However, Asia Pacific is expected to exhibit the highest growth rate due to the large diabetic population and increasing healthcare expenditure in countries like China and India.

The increasing awareness about diabetes management, coupled with government initiatives to improve access to healthcare, is further driving the growth of the anti-hyperglycemic agents market. The market’s future trajectory will depend on continued innovation in drug development and effective strategies to address the global diabetes epidemic.

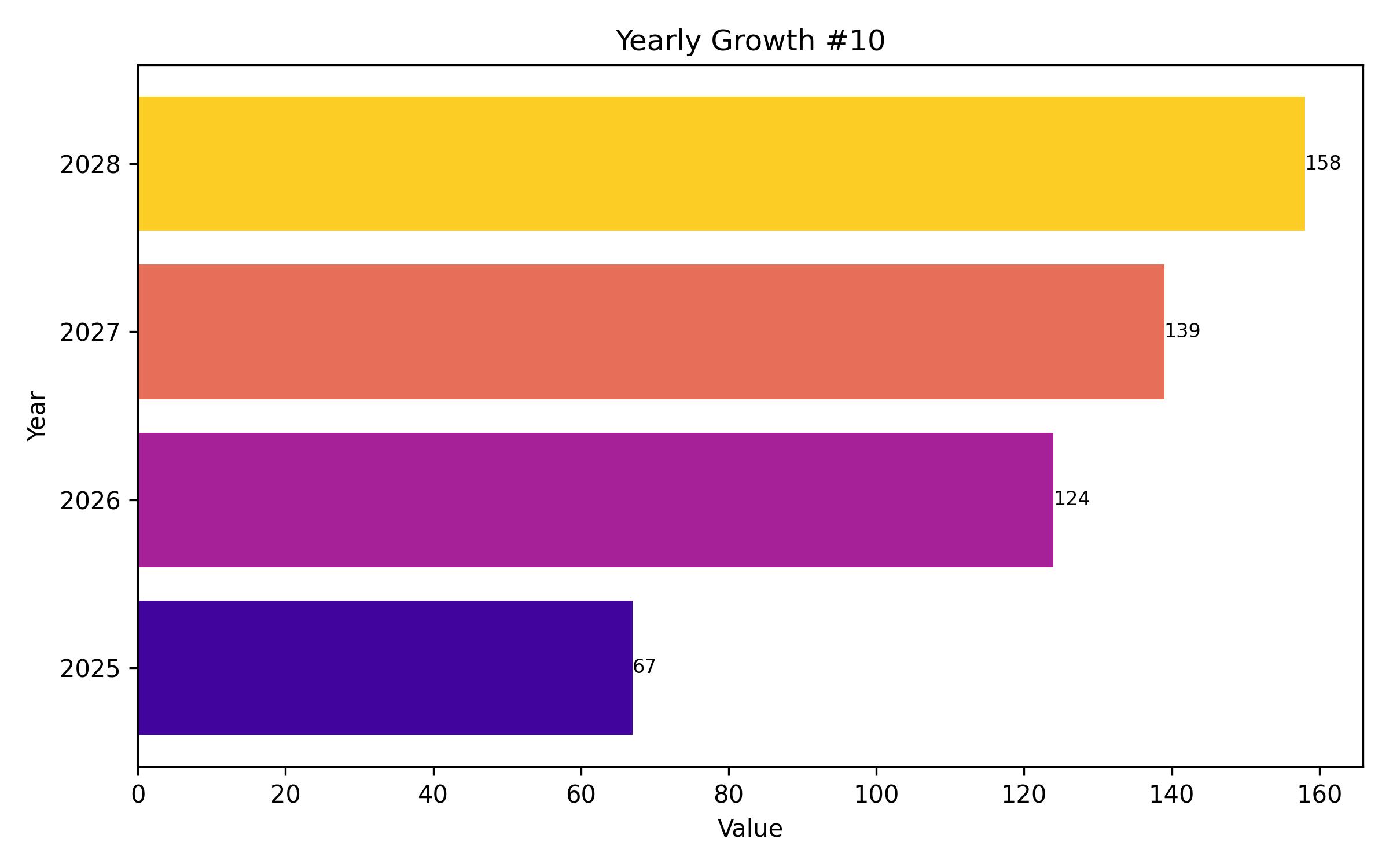

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 50.23 billion |

| Revenue Forecast for 2035 | USD 80.05 billion |

| Growth Rate (CAGR) | 4.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | N/A |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product Type, Material, Distribution Channel, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA (Implied from content) |

| Country Scope | U.S., U.K., France, Germany, Italy, South Korea, Japan, China, Australia & New Zealand, Brazil, India (Implied from content) |

| Key Companies Analyzed | Novo Nordisk, Sanofi, Merck & Co., BoehringerIngelheim, Eli Lilly, Bristol-Myers Squibb, Johnson & Johnson, AstraZeneca, GlaxoSmithKline, Lupin Pharmaceuticals, Amgen, Bayer. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

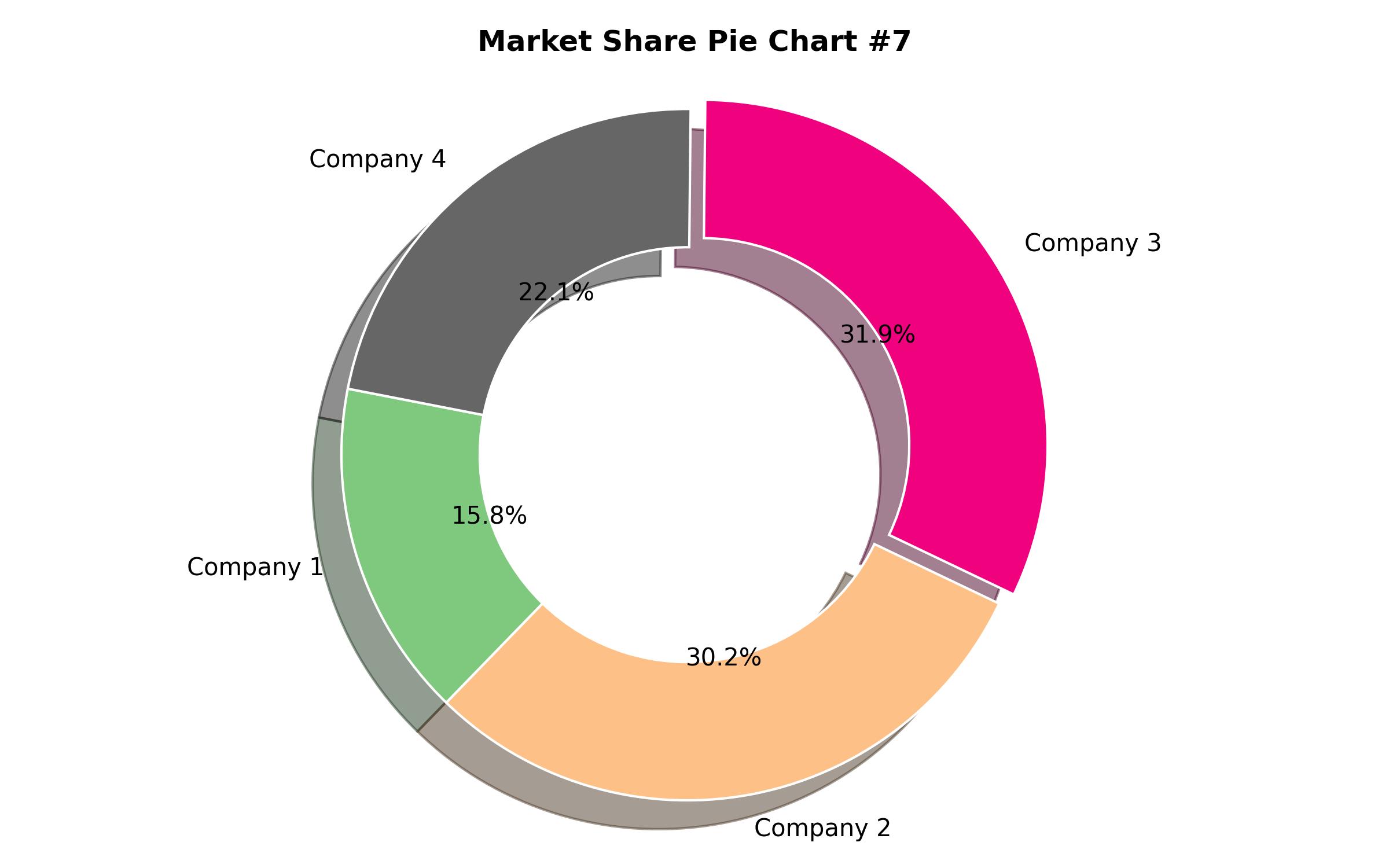

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Drug Class

- Biguanides

- Sulfonylureas

- Thiazolidinediones

- DPP-4 Inhibitors

- SGLT2 Inhibitors

- GLP-1 Receptor Agonists

- Insulin

- By Route of Administration

- Oral

- Injectable

- By Therapeutic Class

- Monotherapy

- Combination Therapy

- By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- By Region

- North America (U.S., Canada)

- Europe (Germany, France, U.K., Italy, Spain)

- Asia Pacific (China, Japan, India, South Korea, Australia)

- Latin America (Brazil, Mexico, Argentina)

- Middle East & Africa (Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Anti-Hyperglycemic Agents Market Analysis, by Product Type

- Global Anti-Hyperglycemic Agents Market Analysis, by Material

- Global Anti-Hyperglycemic Agents Market Analysis, by Distribution Channel

- Global Anti-Hyperglycemic Agents Market Analysis, by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America Anti-Hyperglycemic Agents Market Analysis

- Europe Anti-Hyperglycemic Agents Market Analysis

- Asia Pacific Anti-Hyperglycemic Agents Market Analysis

- Latin America Anti-Hyperglycemic Agents Market Analysis

- Middle East & Africa Anti-Hyperglycemic Agents Market Analysis

- Market Share Analysis

- Competitive Landscape

- Key Players

- Market Positioning

- Recent Developments

- Company Profiles

- Novo Nordisk

- Sanofi

- Merck & Co.

- Boehringer Ingelheim

- Eli Lilly

- Research Methodology

- Assumptions and Acronyms