Comprehensive Analysis of the Animal Feed Market by Species, Form, Source, and Distribution Channel Through 2035

Overview:

The global animal feed market is poised for substantial expansion in the coming years. Projections estimate the market size will reach USD 605.3 billion in 2025, driven by a compound annual growth rate (CAGR) of 7.3%. By 2035, the market is expected to attain a value of USD 1,224.6 billion. This expansion is largely attributed to increasing demands within the livestock and aquaculture industries.

A growing global population, with a corresponding rise in meat and seafood consumption, necessitates higher production efficiency in animal farming. This trend is compelling producers to adopt advanced and nutritional feed solutions to enhance animal health and productivity, thereby boosting market growth. Moreover, the escalating demand for pet food is also significantly contributing to market expansion.

Emerging trends in the market include a heightened focus on sustainable feed sources and innovative feed formulations. These trends are driven by rising environmental concerns and a push for more eco-friendly farming practices. The industry is also witnessing increased adoption of feed additives and supplements to improve animal health and nutritional intake.

Regionally, Asia Pacific currently dominates the animal feed market, owing to its large livestock population and increasing demand for animal products. North America and Europe also hold significant market shares, driven by advanced farming practices and high consumption levels. Latin America and the Middle East and Africa are expected to exhibit strong growth potential during the forecast period.

Key players in the animal feed market include companies such as Cargill Inc., Archer Daniels Midland, Nutreco, and Alltech. These industry leaders are focused on product innovation, strategic collaborations, and geographical expansion to strengthen their market positions.

The market’s trajectory is shaped by technological advancements in feed production, a heightened focus on animal health, and evolving dietary preferences. These factors collectively drive the ongoing transformation of the global animal feed industry.

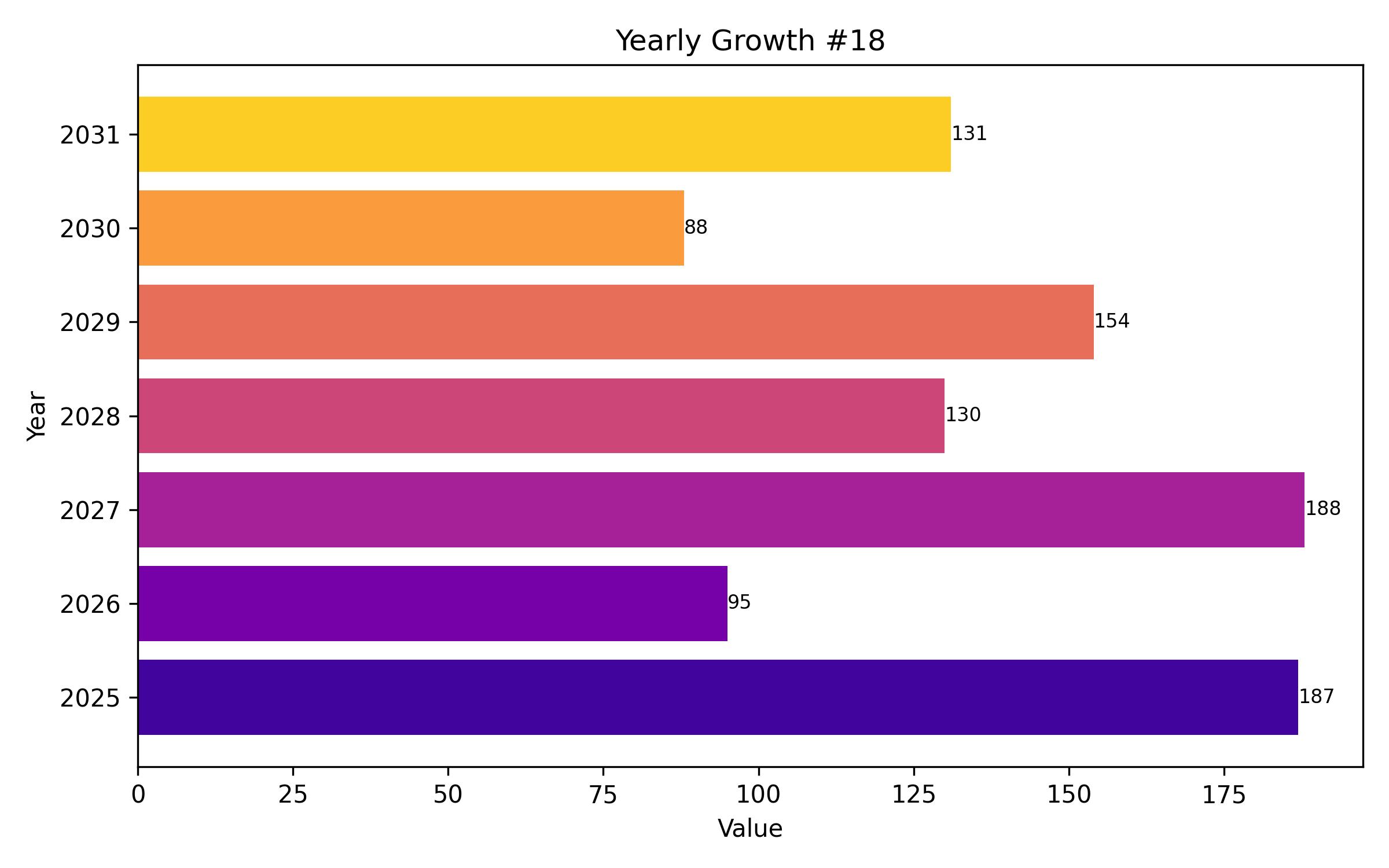

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 605.3 billion |

| Revenue Forecast for 2035 | USD 1,224.6 billion |

| Growth Rate (CAGR) | 7.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, form, source, and sales channel |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Cargill Inc., Archer Daniels Midland, Nutreco, Alltech, Land O’Lakes, DSM N.V, BASF SE, Fuji Chemical Industries Co |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

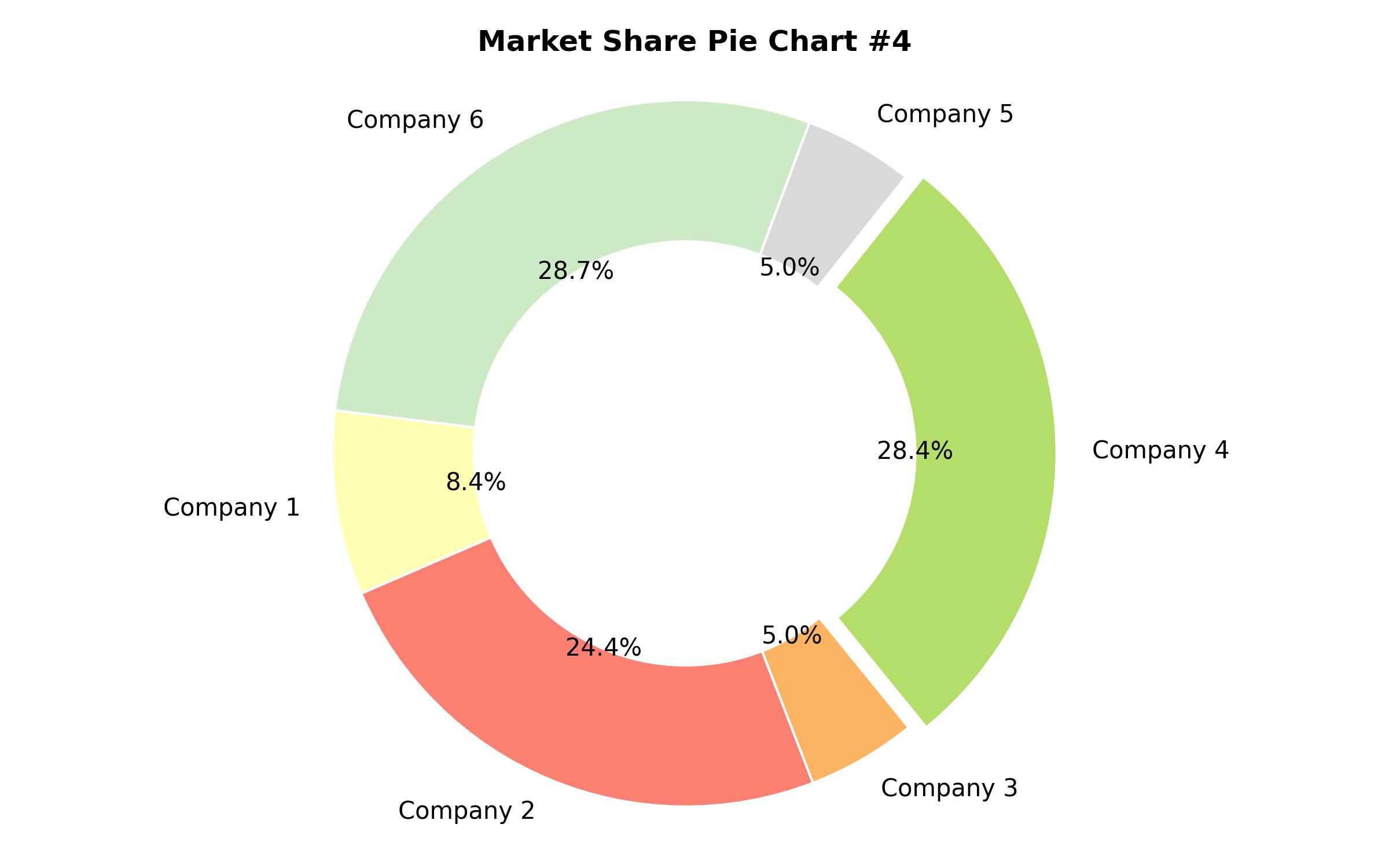

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Species

- Poultry Feed

- Swine Feed

- Ruminant Feed

- Aquaculture Feed

- Pet Food

- By Form

- Mash

- Pellets

- Crumbs

- Extruded

- Liquid

- By Source

- Conventional

- Organic

- By Sales Channel

- Direct Sales

- Indirect Sales

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Dynamics

- Critical Success Factors

- Global Market Demand Analysis 2018-2023 and Forecast, 2024-2035

- Market – Pricing Trends

- Market Size (USD Billion) Analysis 2018-2023 and Forecast, 2024-2035

- Market Segmentation

- Market Analysis 2018-2023 and Forecast 2024-2035, by Species

- Poultry

- Swine

- Ruminant

- Market Analysis 2018-2023 and Forecast 2024-2035, by Form

- Mash

- Pellets

- Crumbs

- Market Analysis 2018-2023 and Forecast 2024-2035, by Source

- Conventional

- Organic

- Market Analysis 2018-2023 and Forecast 2024-2035, by Sales Channel

- Direct Sales

- Indirect Sales

- Market Analysis 2018-2023 and Forecast 2024-2035, by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2018-2023 and Forecast 2024-2035

- Europe Market Analysis 2018-2023 and Forecast 2024-2035

- Asia Pacific Market Analysis 2018-2023 and Forecast 2024-2035

- Latin America Market Analysis 2018-2023 and Forecast 2024-2035

- Middle East & Africa Market Analysis 2018-2023 and Forecast 2024-2035

- Competitive Landscape

- Major Company Profiles

- Assumptions and Acronyms

- Research Methodology