Comprehensive Analysis of Automotive Exhaust Systems Market: Trends, Growth, and Forecasts to 2035

Overview:

The global automotive exhaust systems market is poised for considerable expansion in the coming years. Projections indicate that the market will reach a size of USD 126.38 billion in 2025, driven by increasing vehicle production and stringent emission regulations worldwide. The market is expected to exhibit a compound annual growth rate (CAGR) of 6.3% from 2025 to 2035, culminating in a projected value of USD 228.71 billion by 2035. This growth is supported by continuous advancements in exhaust system technologies and materials.

Stringent environmental regulations imposed by governments across the globe are compelling automotive manufacturers to integrate advanced exhaust systems to curtail emissions. Catalytic converters, diesel particulate filters, and selective catalytic reduction systems are becoming standard components in modern vehicles. The rising demand for fuel-efficient vehicles and the escalating sales of hybrid and electric vehicles are also influencing the evolution of automotive exhaust systems.

The Asia-Pacific region is anticipated to emerge as a prominent market for automotive exhaust systems, fueled by the burgeoning automotive industry in countries such as China and India. North America and Europe are also expected to maintain significant market shares, driven by stringent emission standards and technological innovation.

Key industry participants are focusing on research and development activities to introduce innovative exhaust systems that meet evolving regulatory requirements and enhance vehicle performance. Collaborations, mergers, and acquisitions are prevalent strategies adopted by market players to strengthen their market presence and technological capabilities.

The increasing focus on reducing greenhouse gas emissions and promoting sustainable transportation solutions will further drive the automotive exhaust systems market. The development of lightweight materials and advanced exhaust treatment technologies is expected to gain traction in the coming years.

Overall, the automotive exhaust systems market is anticipated to witness substantial growth, propelled by regulatory mandates, technological advancements, and the escalating demand for cleaner and more efficient vehicles. The market’s trajectory is shaped by the global automotive industry’s commitment to environmental sustainability and the continuous pursuit of innovative solutions.

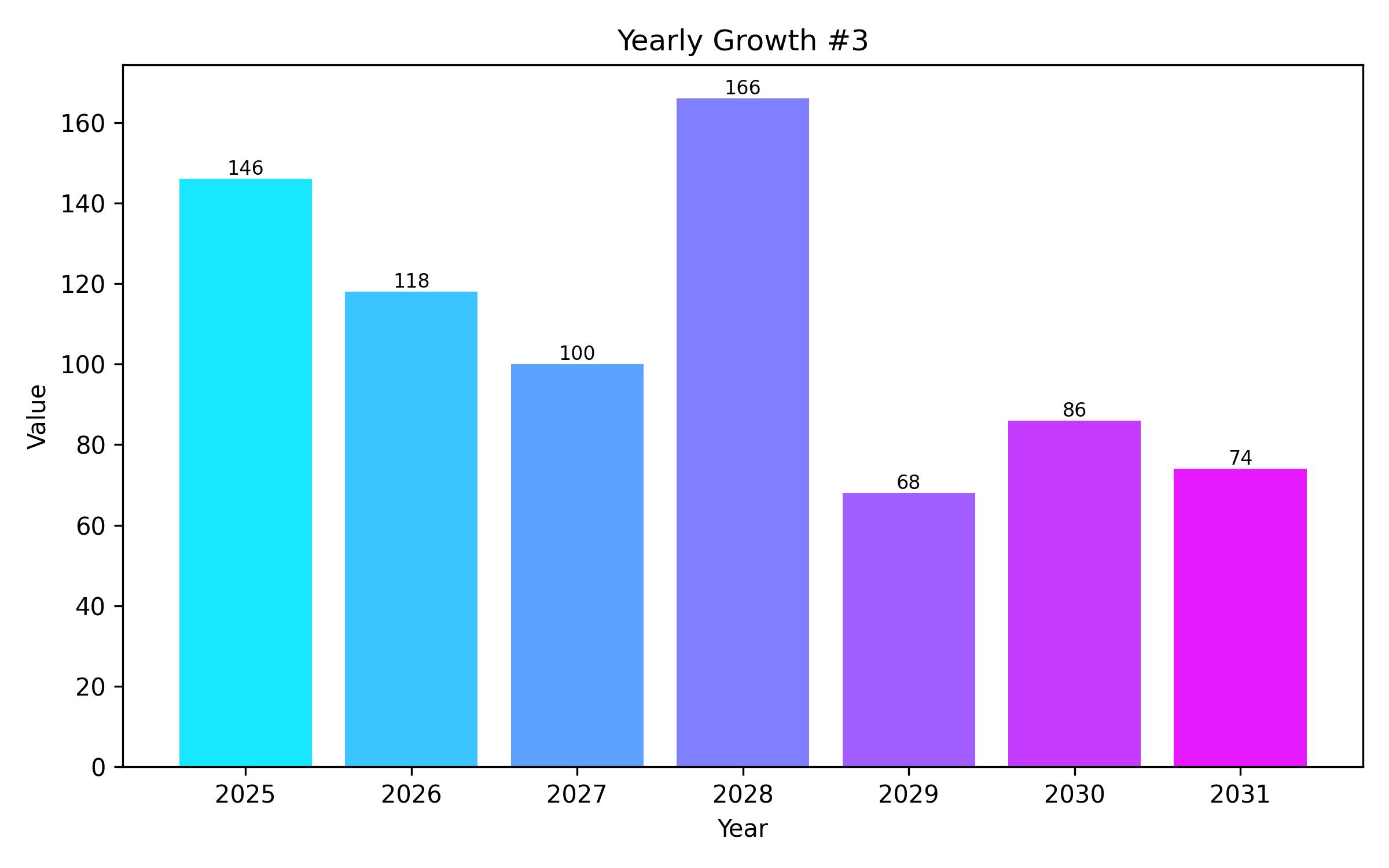

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 126.82 billion |

| Revenue Forecast for 2035 | USD 229.26 billion |

| Growth Rate (CAGR) | 6.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, propulsion type, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Faurecia SA; Tenneco Inc.; Eberspächer Group; Benteler Automotive; Bosal Group |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

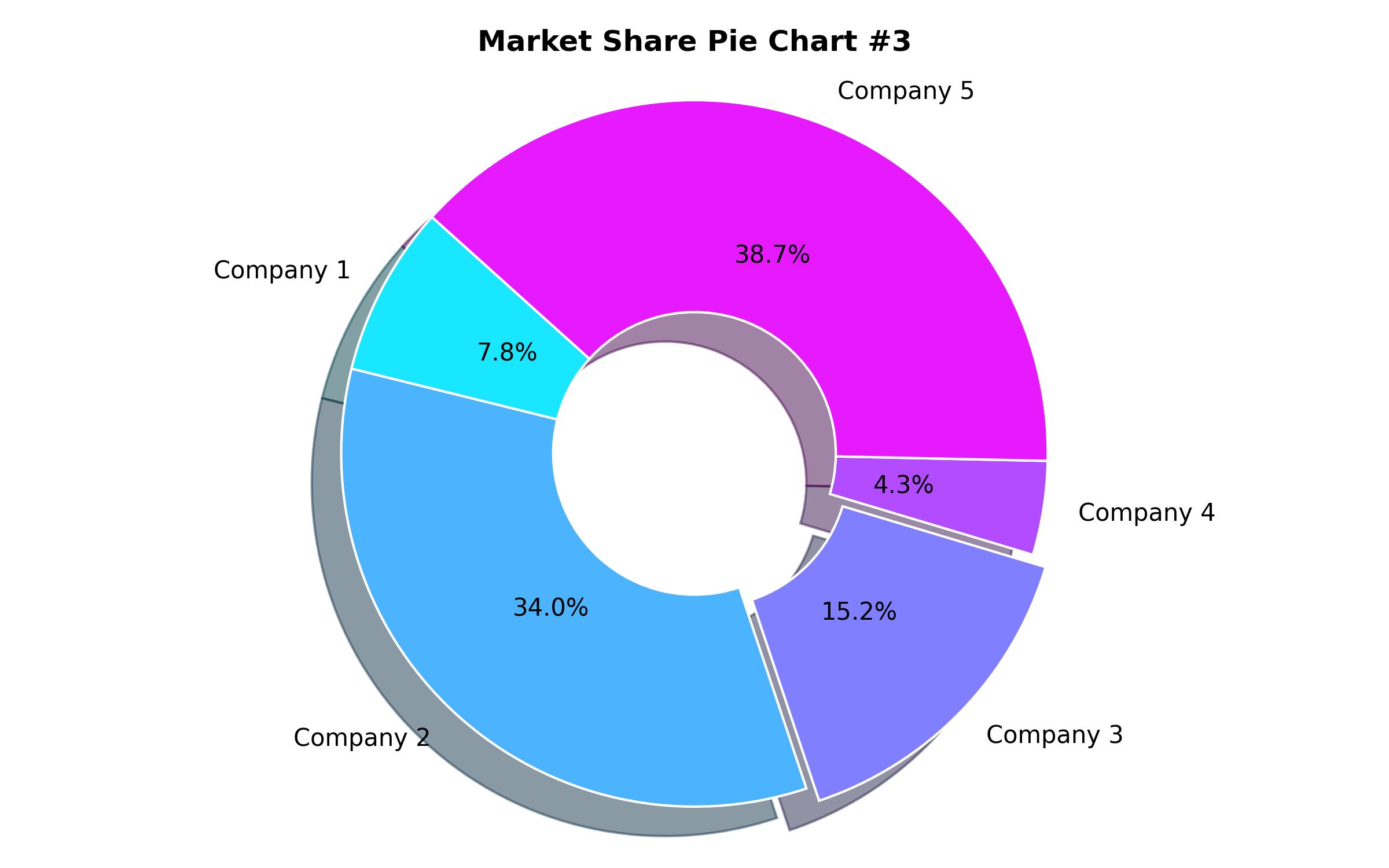

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Component Type

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Resonators

- Manifolds

- By Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- By Fuel Type

- Gasoline

- Diesel

- Hybrid

- Electric

- By Aftertreatment Device

- Diesel Oxidation Catalysts (DOC)

- Diesel Particulate Filters (DPF)

- Selective Catalytic Reduction (SCR)

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Global Economic Outlook

- Key Market Trends

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Challenges

- Global Automotive Production Trends

- Regulatory Landscape for Automotive Emissions

- Market Analysis 2025-2035, by Component Type

- Mufflers

- Catalytic Converters

- Exhaust Pipes

- Market Analysis 2025-2035, by Vehicle Type

- Passenger Vehicles

- Commercial Vehicles

- Market Analysis 2025-2035, by Fuel Type

- Gasoline

- Diesel

- Hybrid

- Market Analysis 2025-2035, by Aftertreatment Device

- Diesel Oxidation Catalysts (DOC)

- Diesel Particulate Filters (DPF)

- Selective Catalytic Reduction (SCR)

- Market Analysis 2025-2035, by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- North America Automotive Exhaust Systems Market Analysis 2025-2035

- Europe Automotive Exhaust Systems Market Analysis 2025-2035

- Asia-Pacific Automotive Exhaust Systems Market Analysis 2025-2035

- Latin America Automotive Exhaust Systems Market Analysis 2025-2035

- Middle East & Africa Automotive Exhaust Systems Market Analysis 2025-2035

- Competitive Landscape

- Market Share Analysis

- Key Player Profiles

- Strategic Recommendations

- Research Methodology