Bread Emulsifier Market Comprehensive Analysis by Source, Product Type, and Application through 2035

Overview:

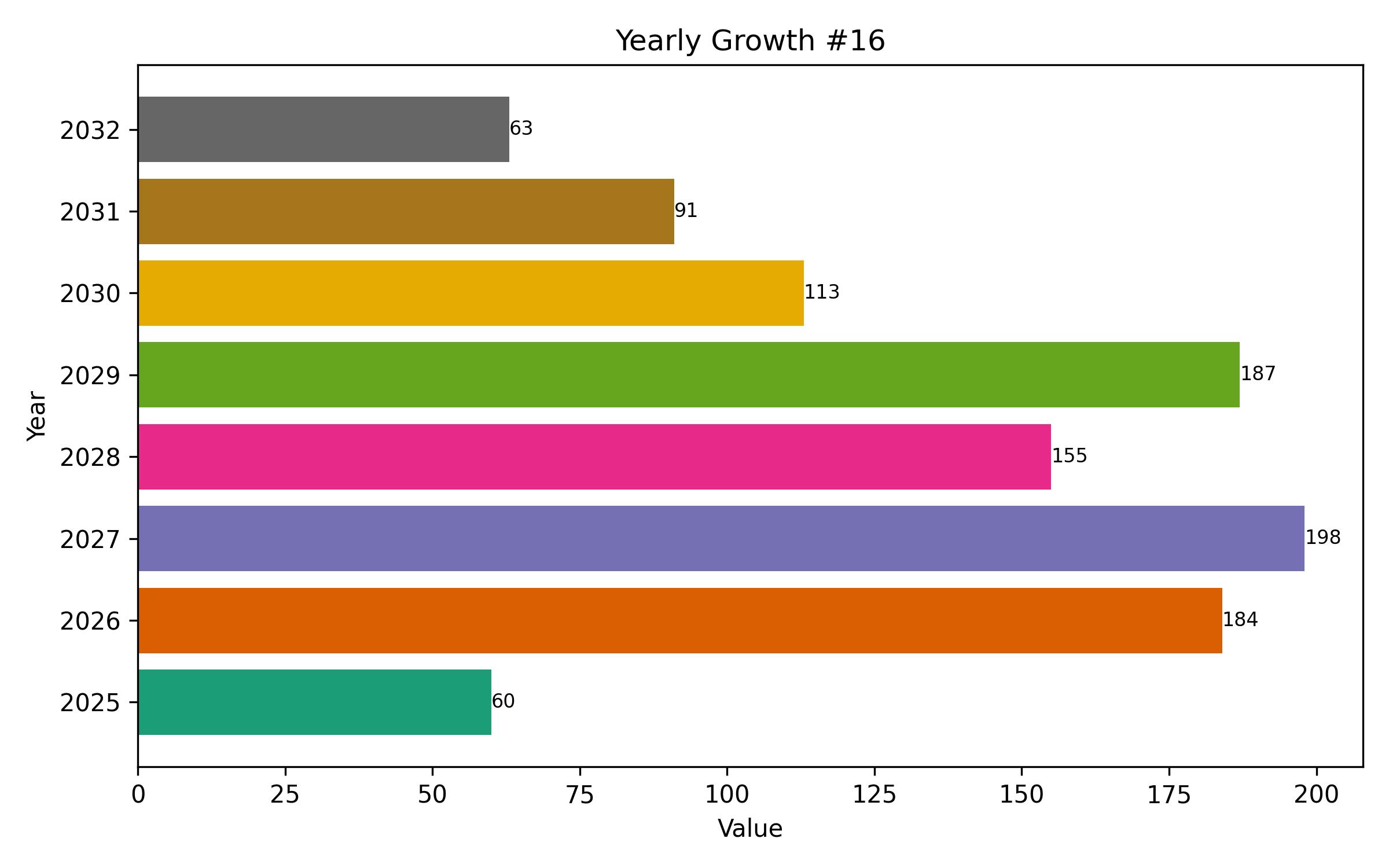

The global bread emulsifier market reached a valuation of USD 1777.6 million in 2024. Demand saw an increase of 3.1% year-on-year in 2025, pushing market value to USD 1832.7 million. Over the forecast period spanning from 2025 to 2035, worldwide sales are anticipated to exhibit a compound annual growth rate (CAGR) of 3.5%, leading to a total sales figure of USD 2607.5 million by the conclusion of 2035.

In the commercial baking sector, bread emulsifiers are crucial components used to enhance dough stability, increase yield, and produce a desirable soft crumb texture. Growing interest in clean-label formulations is further boosting their demand. Modern consumers increasingly prefer bakery items without artificial additives, yet still expect products that offer both softness and extended freshness, along with a long shelf life. Emulsifiers like mono- and di-glycerides or lecithin are instrumental in fulfilling these desires while adhering to clean label standards.

A surge in the popularity of ready-to-eat bakery goods and frozen dough applications, particularly in urban centers, also contributes significantly to market expansion. Consequently, leading food manufacturers are increasing their investments in emulsifier technology for both gluten-free and high-fiber bread product lines.

The trend towards using plants-based and multi-functional emulsifier blends continues, spearheaded by prominent companies such as TEXTURE MAKER ENTERPRISE CO., LTD., Garuda International, Inc., and Bob’s Red Mill Natural Foods Inc.

Furthermore, rising bread consumption in the Asia-Pacific and Middle East regions, influenced by the adoption of Western diets and the expansion of quick-service restaurant chains, is stimulating greater adoption of emulsifiers. Conversely, North American and European markets are focusing on the innovation of emulsifier variants that are organic and non-GMO to align with relevant regulatory requirements.

Consumer preference for natural and longer-lasting bakery products has transformed the perception of emulsifiers from mere chemical additives to essential functional food ingredients. Industry leaders are also demonstrating a commitment to environmentally conscious manufacturing and ethical sourcing, particularly concerning lecithin and enzymatic emulsifiers, in response to the rising awareness among younger generations.

A look at semi-annual market performance indicates that the market is projected to grow at a CAGR of 3.4% during the first half of the 2025-2035 period, slightly lower than the 3.5% expected in the second half. Comparing half-yearly data, growth momentum in the first half showed a 30 BPS improvement compared to 2024, while growth for the second half was 20 BPS higher, suggesting a stable and albeit gradual upward trend for the bread emulsifier market.

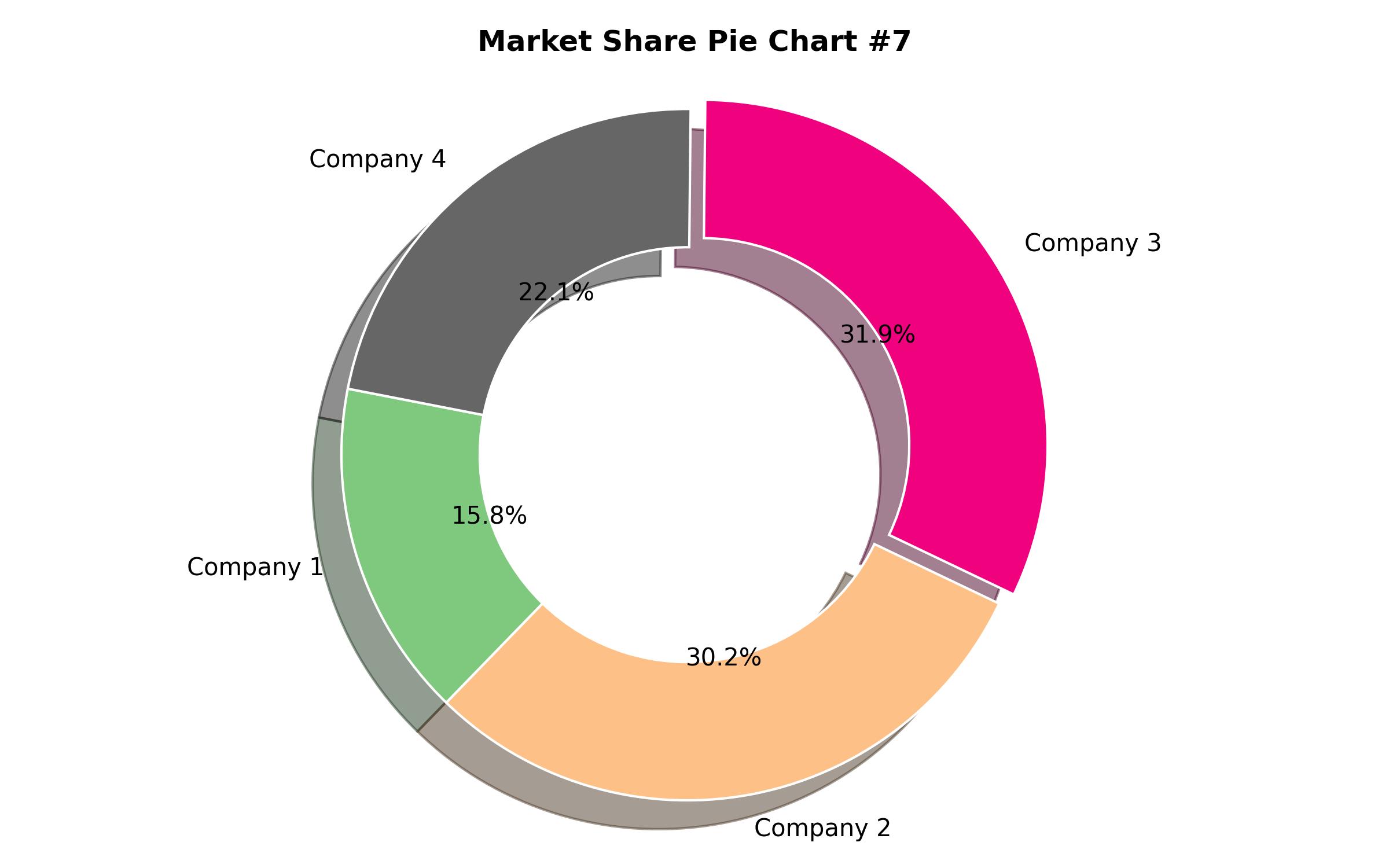

The market displays a layered competitive structure. Tier 1 comprises high-revenue, dominant companies with extensive global reach. These organizations possess significant brand equity, invest heavily in research and development, and maintain strategic alliances with various baking and bakery production companies. Key players in this category include TEXTURE MAKER ENTERPRISE CO., LTD., Connoils LLC, and Garuda International, Inc.

These companies benefit from a worldwide presence, substantial production capabilities, and continuous product innovation aimed at meeting diverse baking requirements, such as clean-label options, gluten-free formulations, and products with extended shelf life. Their distribution partnerships with major baking chains and food service entities enable them to achieve broad market penetration.

Tier 2 includes companies with moderate revenue and a significant regional presence. An example is Bob’s Red Mill Natural Foods Inc., which has established a unique position in North America by focusing on natural and whole-food products, including its plant-based emulsifier offerings.

FFM Berhad Group, which primarily operates in Southeast Asia, benefits from an integrated supply chain and stable demand from regional bread manufacturers. Companies in this tier often specialize in niche products like organic or enzymatic emulsifiers, catering primarily to smaller bakeries and health-oriented product lines.

Tier 3 consists of newer, smaller participants who provide specialized or innovative emulsifier blends and sometimes employ direct-to-bakery business models. Companies such as KUNHUA BIOLOGICAL TECHNOLOGY CO., LTD., Kanta Enterprises Private Limited, and Weihai Baihe Biology Technological Co., Ltd. fall into this category. They operate with lean structures and adaptable production processes, allowing them to respond quickly to market shifts and specific customer requirements.

Although their distribution networks may not be as extensive as those of Tier 1 and 2 companies, their agility, cost-effectiveness, and focus on collaborating with local partners help them gain traction, particularly in developing economies and the artisanal baking sector. Many of these smaller firms are leveraging digital channels and targeted business-to-business strategies to expand their market reach.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1832.7 million |

| Revenue Forecast for 2035 | USD 2607.5 million |

| Growth Rate (CAGR) | 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Source, product type, application, sales channel, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | USA, Germany, China, Japan, India |

| Key Companies Analyzed | TEXTURE MAKER ENTERPRISE CO., LTD., Bob’s Red Mill Natural Foods Inc., FFM Berhad Group, Connoils LLC, Garuda International, Inc., TEXTURE MAKER ENTERPRISE CO., LTD., Kanta Enterprises Private Limited, KUNHUA BIOLOGICAL TECHNOLOGY CO., LTD., Weihai Baihe Biology Technological Co., Ltd |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Source

- Plant-based

- Animal-based

- Synthetic

- By Product Type

- Mono- and Di-glycerides

- Lecithin

- DATEM (Diacetyl Tartaric Acid Ester of Monoglycerides)

- SSL (Sodium Stearoyl Lactylate)

- Enzymes

- Polyglycerol Esters

- Sorbian Esters

- By Application

- White Bread

- Whole Wheat Bread

- Specialty Bread

- Frozen Bread Products

- Gluten-Free Bread

- By Sales Channel

- Direct Sales

- Distributors

- E-commerce

- By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

Table of Content

- Executive Snapshot

- Market Definition and Overview

- Market Dynamics

- Key Trends Shaping the Market

- Value Chain Analysis

- Market Forecast Factors

- Global Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Pricing Assessment

- Market Size Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Plant-based

- Animal-based

- Synthetic

- Market Size Analysis 2020 to 2024 and Forecast 2025 to 2035, By Product Type

- Mono- and Di-glycerides

- Lecithin

- DATEM

- SSL

- Enzymes

- Polyglycerol Esters

- Sorbian Esters

- Market Size Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- White Bread

- Whole Wheat Bread

- Specialty Bread

- Frozen Bread Products

- Gluten-Free Bread

- Market Size Analysis 2020 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Direct Sales

- Distributors

- E-commerce

- Market Size Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Asia Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Country-level Analysis

- Competition Landscape

- Key Player Profiles

- Research Methodology

- Assumptions and Limitations

- Appendix