Battery Leasing Services: Market Analysis and Forecast by Model, Battery, Vehicle Type, and Region, 2025-2035

Overview:

The global battery leasing service market is poised for substantial expansion in the coming years, driven by the increasing adoption of electric vehicles and the growing need for affordable energy solutions. In 2025, the market is projected to attain a size of USD 189.63 million, fueled by innovative business models and technological advancements in battery technology. The projected compound annual growth rate (CAGR) of 17.4% from 2025 to 2035 indicates a robust upward trajectory, estimating a market value of USD 943.17 million by 2035.

This growth is largely attributed to the increasing consumer demand for electric vehicles, coupled with the economic benefits of battery leasing services. Battery leasing reduces the initial cost of EV ownership, making electric mobility more accessible to a broader range of consumers. Additionally, the industry is witnessing advancements in battery technology, providing higher energy density and longer lifecycles, which further enhance the attractiveness of leasing models.

Regionally, the battery leasing service market shows strong potential across North America, Europe, and Asia Pacific. Countries such as the United States, China, and Germany are anticipated to lead the market, supported by favorable government policies and growing investments in electric vehicle infrastructure. Key industry participants, including NIO, BYD, and Renault, are significantly shaping the competitive landscape by offering comprehensive battery leasing programs.

The convergence of sustainability goals and economic incentives is propelling the battery leasing service market forward. As electric vehicles become increasingly integrated into the transportation sector, the market is set to play a crucial role in accelerating the transition to sustainable mobility solutions. This transition is further reinforced by the focus on reducing greenhouse gas emissions and promoting cleaner energy alternatives.

Moreover, the market is also influenced by the emergence of innovative battery technologies, with solid-state batteries and other advanced chemistries offering enhanced performance and safety features. These advancements are expected to attract a wider user base and create new opportunities for leasing service providers. The integration of smart technologies and connectivity solutions in battery management systems is also enabling more efficient and reliable leasing operations.

Government initiatives and regulations that support electric vehicle adoption and promote battery recycling are contributing to market growth as well. Overall, the battery leasing service market is expected to maintain its growth trajectory, driven by a combination of technological innovation, economic feasibility, and environmental consciousness.

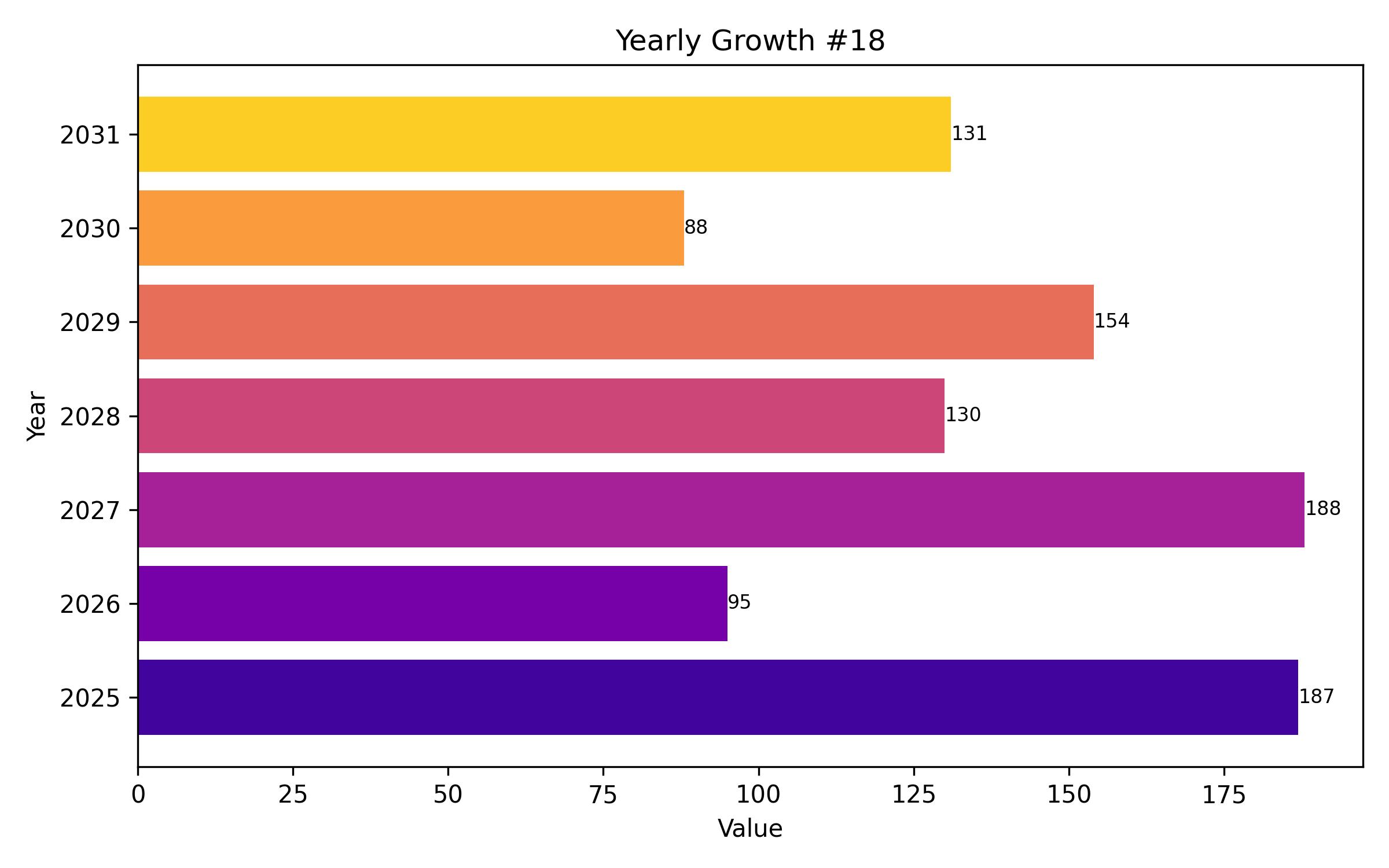

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 189.63 million |

| Revenue Forecast for 2035 | USD 943.17 million |

| Growth Rate (CAGR) | 17.4% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Business Model, Battery Type, Vehicle Type, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | NIO, BYD, Hyundai, Kia, Renault, Peugeot, Volkswagen, BMW, Tesla, Nissan, Jaguar Land Rover |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

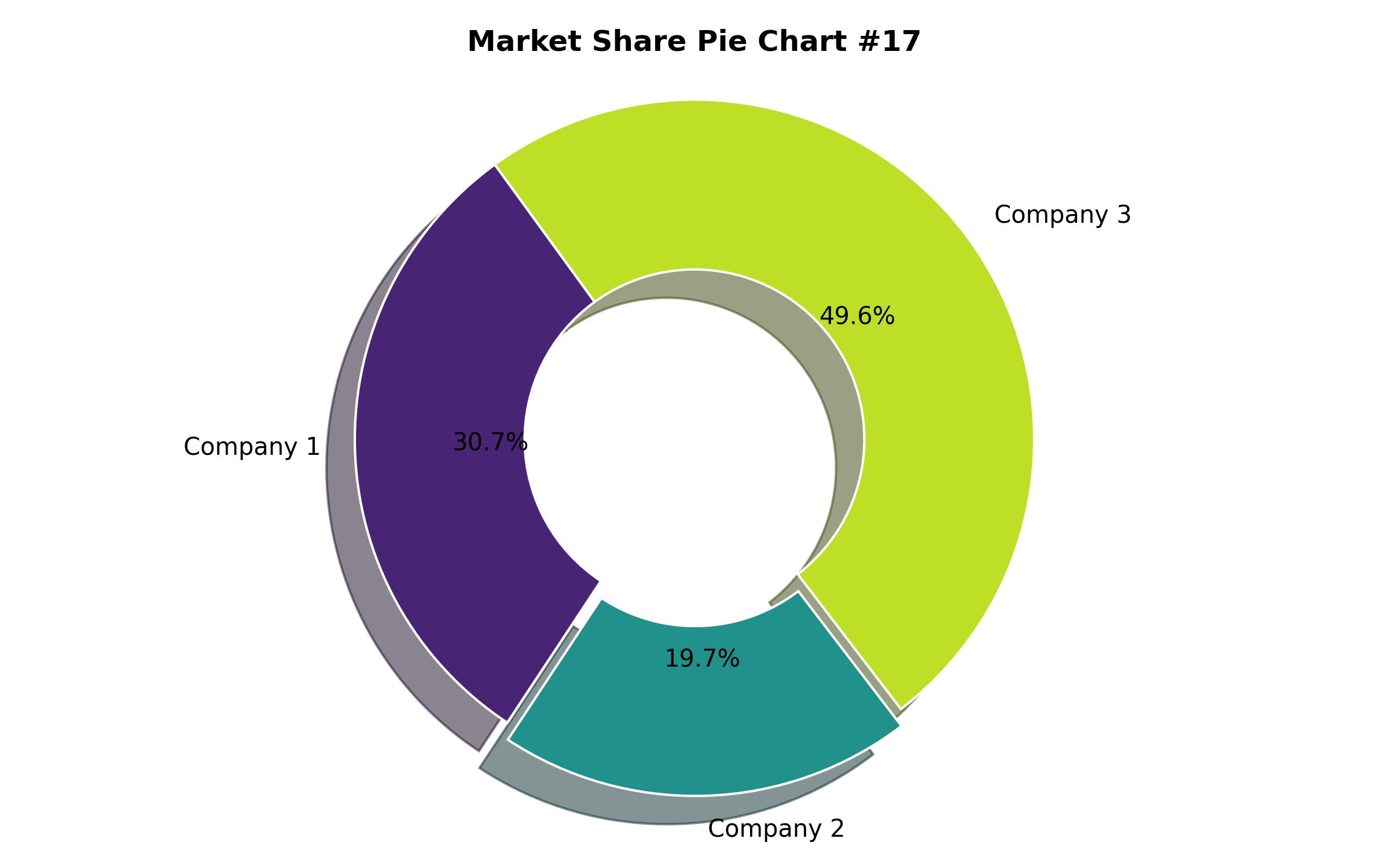

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Business Model

- Subscription

- Pay-per-Use

- Lease-to-Own

- By Battery Type

- Lithium-Ion

- Solid-State

- Other Advanced Chemistries

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Scooters

- Buses

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Global Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- Market Value (USD Million)

- Market Volume (Units)

- Market Analysis by Business Model, 2018 – 2023 and Forecast, 2025 – 2035

- Subscription

- Pay-per-Use

- Lease-to-Own

- Market Analysis by Battery Type, 2018 – 2023 and Forecast, 2025 – 2035

- Lithium-Ion

- Solid-State

- Other Advanced Chemistries

- Market Analysis by Vehicle Type, 2018 – 2023 and Forecast, 2025 – 2035

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers & Scooters

- Buses

- Regional Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Competitive Landscape

- Market Share Analysis

- Key Player Profiles

- North America Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- U.S.

- Canada

- Mexico

- Europe Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- U.K.

- Germany

- France

- Italy

- Poland

- Asia Pacific Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- China

- India

- Japan

- Australia

- South Korea

- Latin America Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- Brazil

- Argentina

- Middle East & Africa Market Analysis, 2018 – 2023 and Forecast, 2025 – 2035

- UAE

- Saudi Arabia

- South Africa

- Company Profiles

- NIO

- BYD

- Hyundai

- Kia

- Renault

- Conclusion and Recommendations

- Methodology