Analysis of the Global Liquid Sugar Market by Source, Nature, and Application (2025-2035)

Overview:

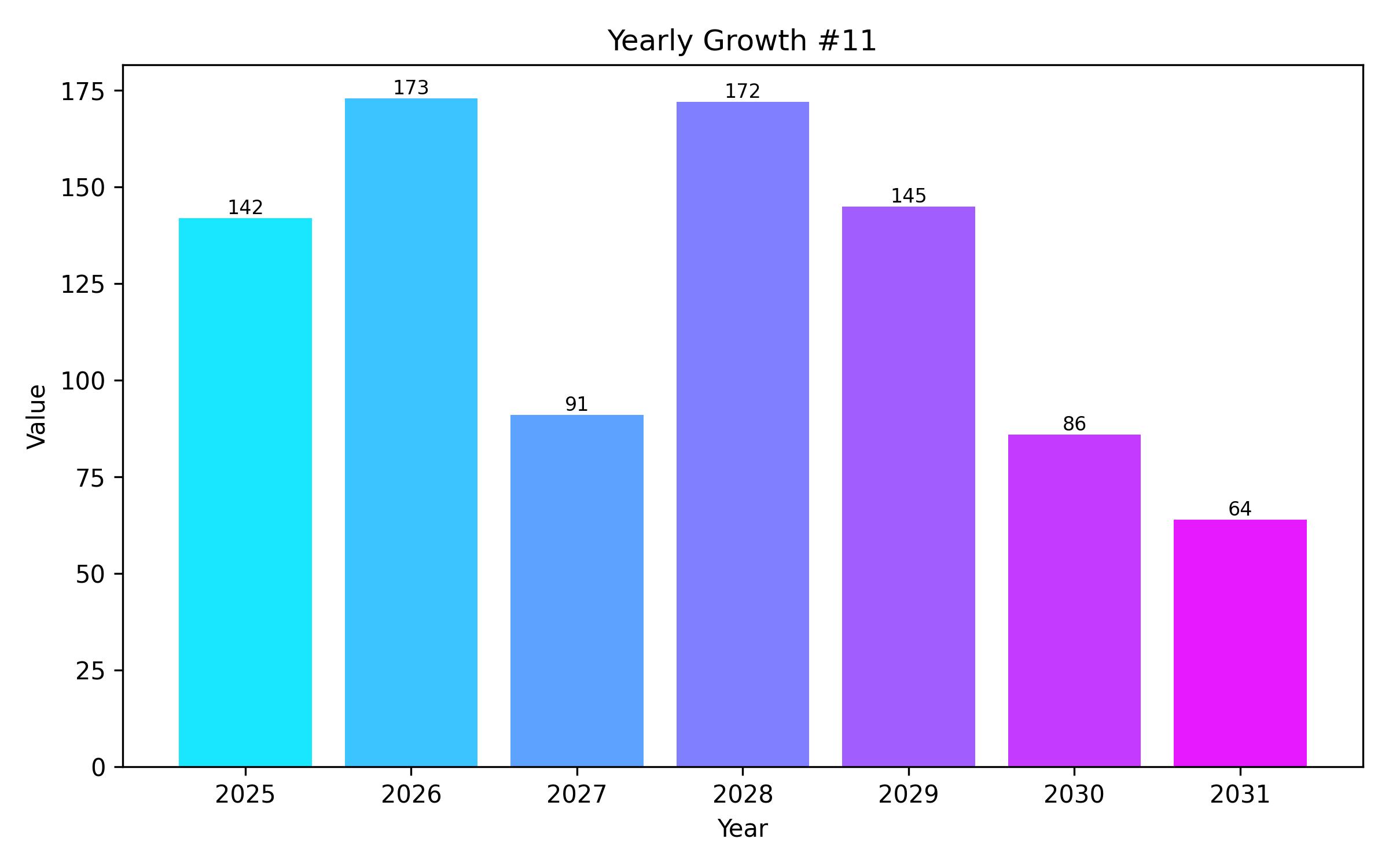

The global liquid sugar market reached a valuation of USD 73.2 million in 2023. Projections indicate that demand will increase, pushing the market size to USD 81.1 million in 2025. Global sales are estimated to reach USD 142.3 million by 2035, exhibiting a growth rate of 5.8% annually from 2025 to 2035.

Significant growth in the liquid sugar market is largely attributed to its extensive utilization in the food and beverage industry. Its ease of blending and ability to provide consistent texture make it a preferred ingredient in a wide array of products, including soft drinks, baked goods, dairy products, and sweets, compared to granular sugar.

Manufacturers favor liquid sugar for its benefits in processing efficiency and product quality, particularly given the rising consumer demand for convenience and processed foods. Additionally, the market has seen growth due to increasing consumer interest in natural and clean-label sweeteners, prompting manufacturers to offer organic and minimally processed liquid sugar options.

Technological advancements in manufacturing and the adoption of responsible sourcing practices have also positively influenced the liquid sugar market. Leading companies in the industry are adopting improved extraction and purification methods, which are expected to enhance product quality and contribute to market expansion during the forecast period.

The growing awareness of health concerns associated with sugar intake is driving innovations towards low-calorie and natural alternatives in liquid sugar. This trend encourages manufacturers to develop and market products that feature natural sweeteners like agave or are infused with ingredients such as honey.

| Attributes | Description |

|---|---|

| Estimated Global Liquid Sugar Industry Size (2025E) | USD 81.1 million |

| Projected Global Liquid Sugar Industry Value (2035F) | USD 142.3 million |

| Value-based CAGR (2025 to 2035) | 5.8 % |

Demand for liquid sugar remains strong in the food service sector, encompassing cafes, restaurants, and beverage companies. Its stability and ease of use make it a favored choice for preparing dishes and drinks. Furthermore, the beverage industry, specifically producers of soft drinks, flavored water, and energy drinks, continues to be a major consumer of liquid sugar due to its superior solubility and uniform sweetness distribution.

Analyzing the semi-annual market updates reveals subtle but important shifts in the sector’s performance. The compound annual growth rate is anticipated to show a gradual increase, reflecting factors such as innovation adoption and expanding market penetration. These trends suggest a steady upward trajectory for the liquid sugar market over the next decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.4 % (2024 to 2034) |

| H2 | 5.5 % (2024 to 2034) |

| H1 | 5.7 % (2025 to 2035) |

| H2 | 5.8 % (2025 to 2035) |

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 81.1 million |

| Revenue Forecast for 2035 | USD 142.3 million |

| Growth Rate (CAGR) | 5.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Source, nature, and application |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Country Scope | USA, Germany, China, Japan, India |

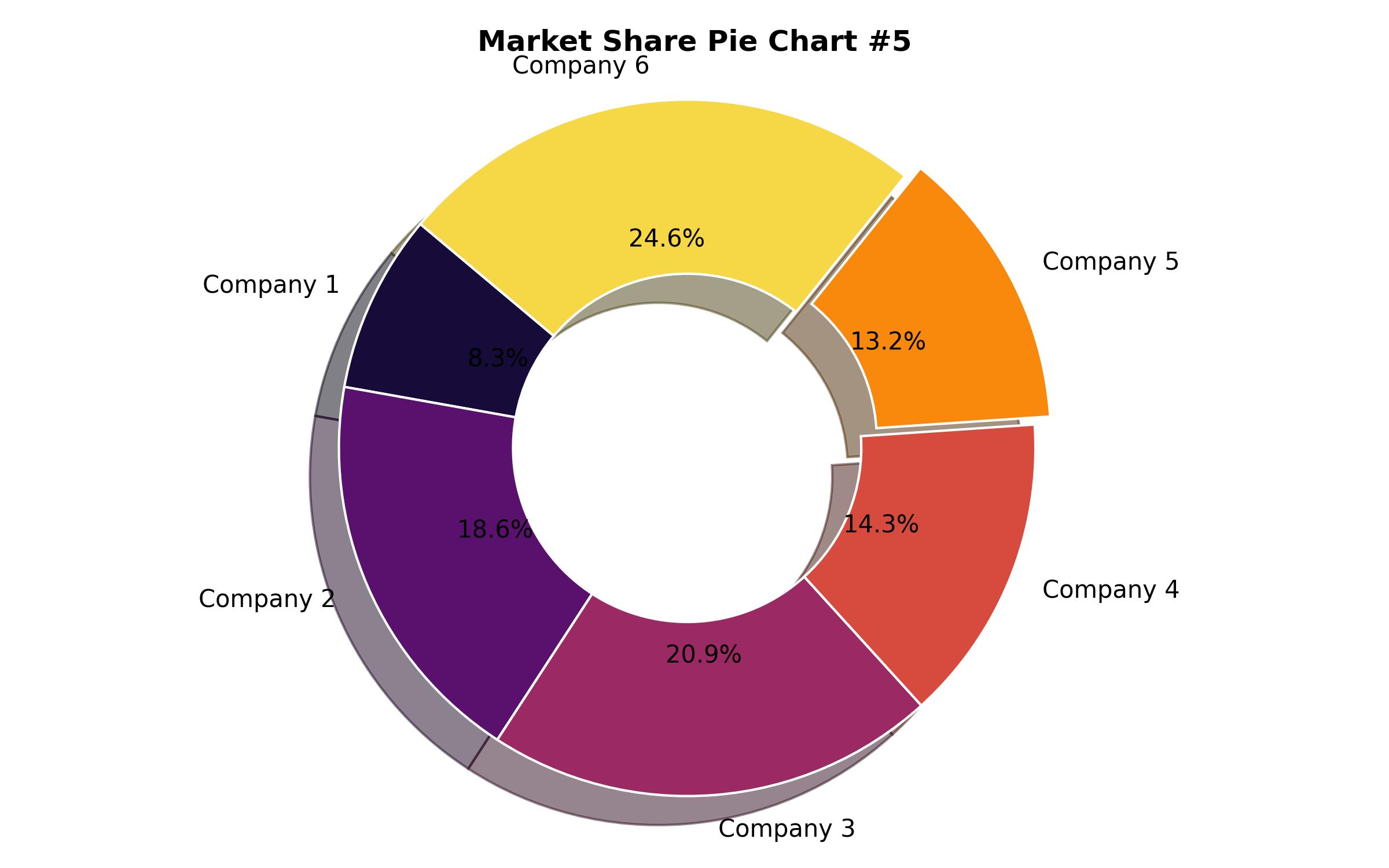

| Key Companies Analyzed | Boettger Gruppe, Tate & Lyle PLC, Nordzucker AG, Sugar Australia Company Ltd, Zukán S.L.U., Banah, Südzucker, Maui Brand Sugars, Natural Raw Liquid Sugar, Eye candy, Da vinci gourmet and Monin, Cargill Incorporated, Archer Daniel Midland, Raizen SA |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Source

- Sugarcane

- Beet

- Maize

- Other Sources

- By Nature

- Organic

- Conventional

- By Application

- Beverages

- Bakery & Confectionery

- Dairy & Desserts

- Processed Foods

- Pharmaceuticals

- Other Applications

- By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

Table of Content

- Executive Summary

- Market Overview

- Key Market Drivers

- Key Market Restraints

- Market Opportunities

- Market Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Million) Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Source

- Sugarcane

- Beet

- Maize

- Other Sources

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Nature

- Organic

- Conventional

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Application

- Beverages

- Bakery & Confectionery

- Dairy & Desserts

- Processed Foods

- Pharmaceuticals

- Other Applications

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- East Asia

- South Asia & Pacific

- Middle East & Africa

- North America Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- South Asia & Pacific Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Assumptions and Acronyms Used

- Research Methodology