Analysis of the Food Fortification Market by Nutrient Type, Food Vehicle, Process, and Application Through 2035

Overview:

The global market for food fortification is experiencing robust growth, driven by increased awareness regarding micronutrient deficiencies and the impact of adequate nutritional intake on health. This understanding is significantly boosting the demand for fortified food items worldwide.

The market reached a valuation of approximately USD 982.5 billion in 2023. By 2025, it is anticipated to grow to USD 119.1 billion, representing a year-on-year increase of about 9.5% in 2024. Projections indicate that the total market value could surge to USD 312.4 billion by 2035, expanding at a compound annual growth rate of 10.2% over the forecast timeframe.

Integrating micronutrients into widely consumed food staples has become a fundamental strategy in public health. Collaborative efforts among governments, health organizations, and food manufacturers are crucial for preventing deficiencies in essential nutrients like iron, vitamin A, iodine and folic acid. Fortifying staple foods such as rice, wheat flour, milk, oil, and salt is a key method to reach a large segment of the population and improve health outcomes.

A growing consumer preference for functional and health-enhancing foods is also a major impetus for the market’s rapid expansion. As consumers actively seek out food products that support immune function and offer general wellness benefits, manufacturers are increasingly offering fortified cereals, dairy items, infant formula, and various beverages that address these needs.

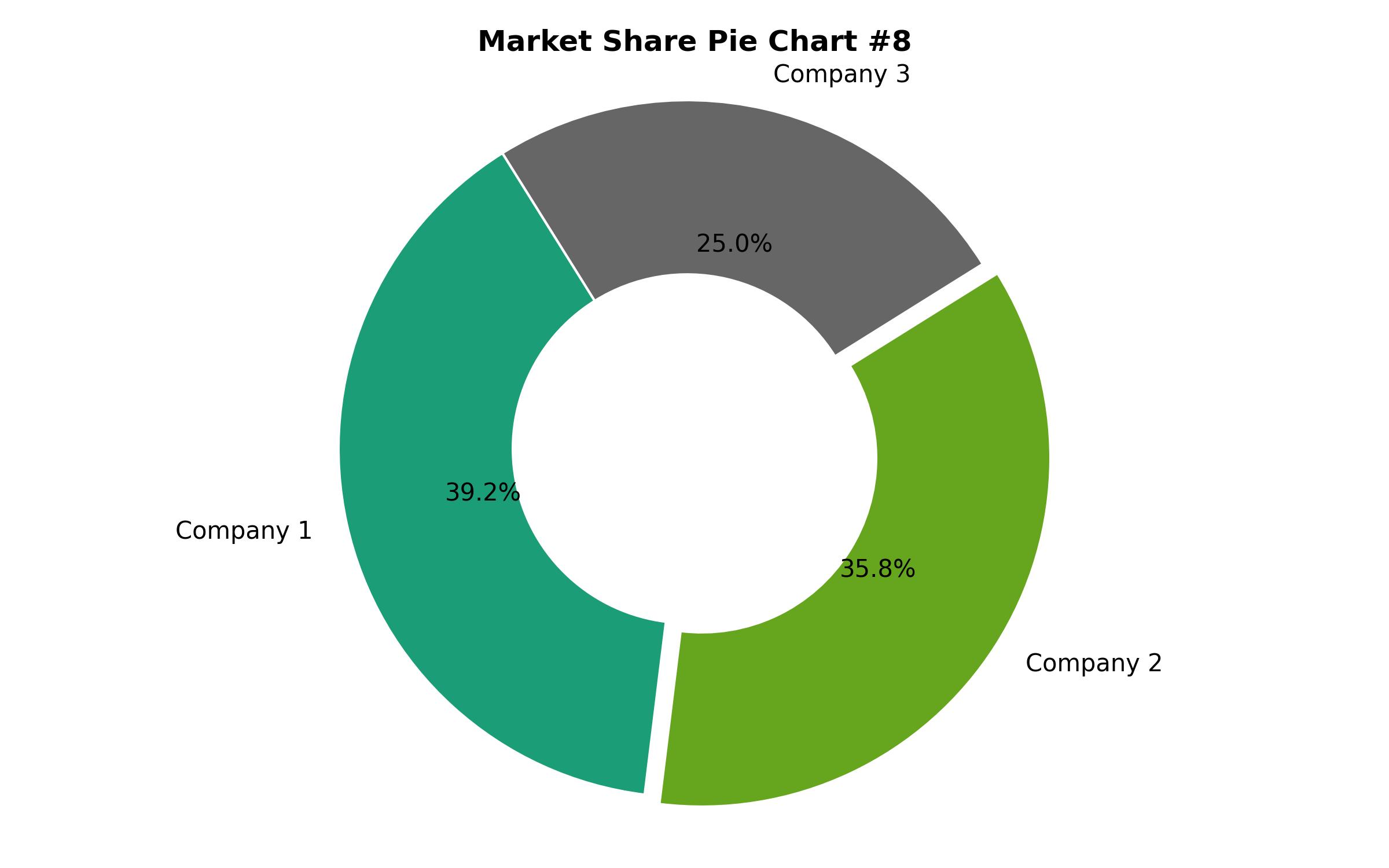

North America holds the dominant position in the global market share for food fortification. This is largely attributable to strong governmental support, high consumer awareness of health, and the early and widespread adoption of fortified food products across the region. Europe follows, supported by significant investment in research and development and the presence of key nutraceutical industry players.

Conversely, the Asia Pacific region is poised for significant growth and is expected to become the most dynamic market. This acceleration is due to high rates of malnutrition, coupled with increasing government initiatives focused on nutrition and rapid urbanization across major economies like China, India, and Indonesia.

Leading companies in the market, including Nestlé, BASF SE, General Mills, DSM Nutritional Products, and Unilever, are driving innovation in fortification technologies and actively collaborating with public health bodies. These corporations are investing heavily in research to improve the bioavailability, extend shelf life, and enhance the sensory qualities of fortified ingredients. Strategic branding that emphasizes health benefits and clear labeling are also playing a vital role in encouraging consumer adoption.

Advanced technologies like microencapsulation and nano-delivery systems are also likely to further stimulate market growth by ensuring the stability and effectiveness of nutrients within fortified foods. Additionally, large-scale fortification initiatives supported by international collaborations involving organizations such as WHO, UNICEF, and GAIN are reinforcing the global commitment to improving nutrition security.

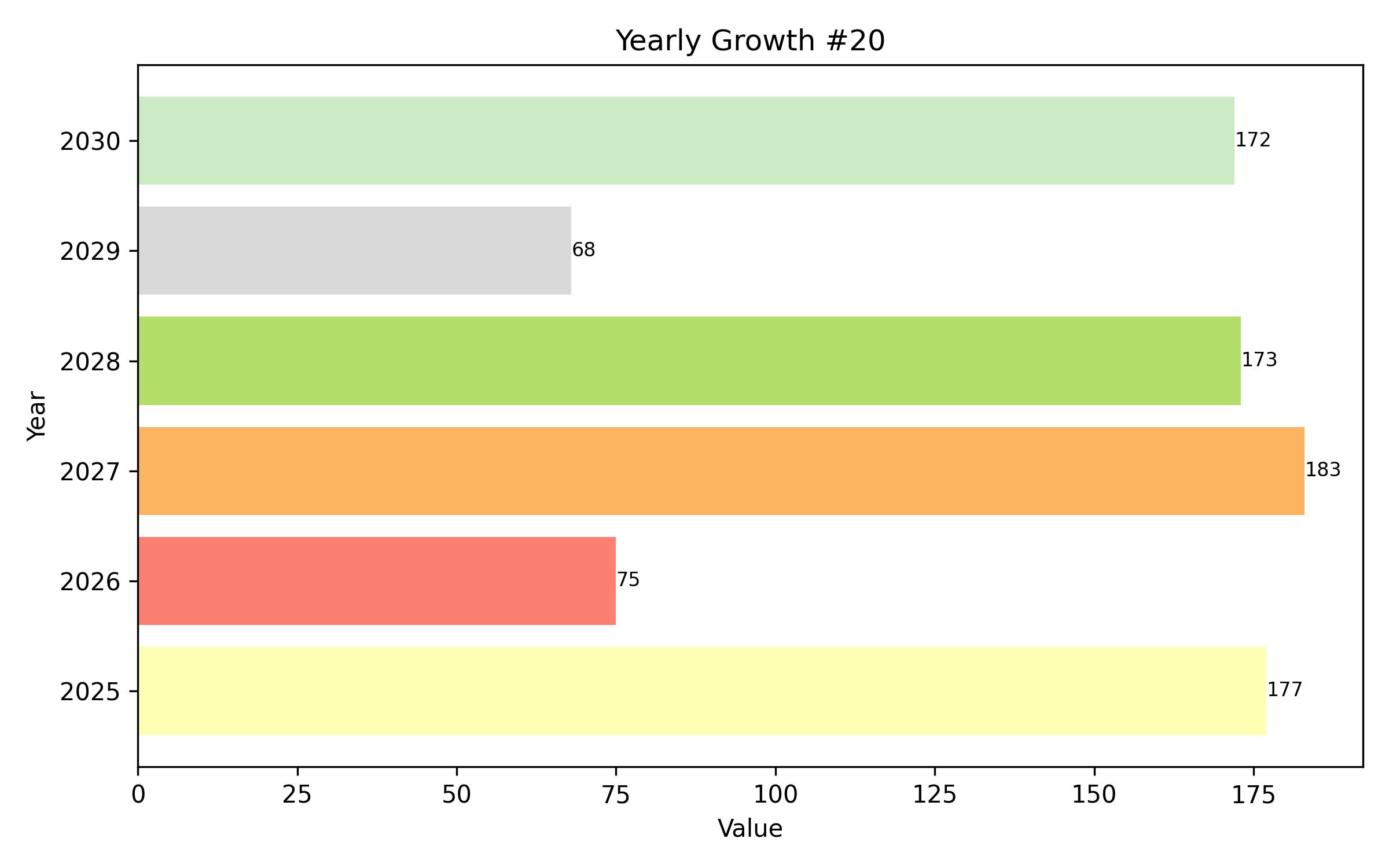

The semi-annual market analysis indicates an upward trend in growth rates. During the 2024 to 2034 period, the second half (H2) saw a growth rate of 10.1%, an increase from the 9.8% CAGR observed in the first half (H1). This uplift was linked to global nutrition awareness campaigns and the implementation of mandatory fortification policies in several developing nations.

The subsequent period from 2025 to 2035 showed further acceleration, with H1 registering 10.3% growth and H2 reaching 10.4%. Key factors contributing to this enhanced growth included increased demand for fortified plant-based and vegan options, the influence of digital health trends, and expanded market access through online retail and community-based health programs.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 119.1 billion |

| Revenue Forecast for 2035 | USD 312.4 billion |

| Growth Rate (CAGR) | 10.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Nutrient type, food vehicle, process type, application, distribution channel, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Germany, France, UK, China, India, Japan, Brazil, Mexico, GCC, South Africa |

| Key Companies Analyzed | Nestlé S.A., Kellogg Company, General Mills, Inc., The Archer Daniels Midland Company, Cargill, Incorporated, BASF SE, DSM Nutritional Products, Glanbia PLC, Bühler Group, FMC Corporation, Corbion N.V., Tate & Lyle PLC, Lonza Group AG, Watson, Inc., SternVitamin GmbH & Co. KG |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Nutrient Type

- Vitamins

- Minerals

- Amino Acids

- Omega-3 Fatty Acids

- By Food Vehicle

- Cereals

- Dairy Products

- Edible Oils

- Salts

- Infant Formula

- Beverages

- Confectionery

- Snacks

- By Process Type

- Powder Fortification

- Liquid Fortification

- Spray Drying

- Drum Drying

- Microencapsulation

- By Application

- Public Health

- Commercial Food Products

- Animal Nutrition

- By Distribution Channel

- Retail

- Institutional

- By Region

- North America (U.S., Canada)

- Europe (Germany, France, UK)

- Asia Pacific (China, India, Japan)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Trends in Food Fortification

- Semi-Annual Market Outlook

- Market Concentration Analysis

- Demand Trends and Strategic Responses

- Market Analysis by Nutrient Type

- Market Analysis by Food Vehicle

- Market Analysis by Process Type

- Market Analysis by Application

- Market Analysis by Distribution Channel

- Market Analysis by Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Country-wise Insights

- United States

- China

- India

- Germany

- Japan

- Competitive Landscape

- Leading Companies

- Analyst Recommendations

- Assumptions

- Research Methodology

- About the Author

- Data Sources

- Disclaimer