Analysis of Key Trends and Future Landscape of the Loan Origination Software Market: 2025 to 2035

Overview:

The loan origination software market is poised for significant expansion between 2025 and 2035. This growth trajectory is intrinsically linked to the ongoing digital transformation within the financial industry, the increasing preference for automated lending processes among both institutions and consumers, and the rapid advancements in technologies like artificial intelligence and cloud computing.

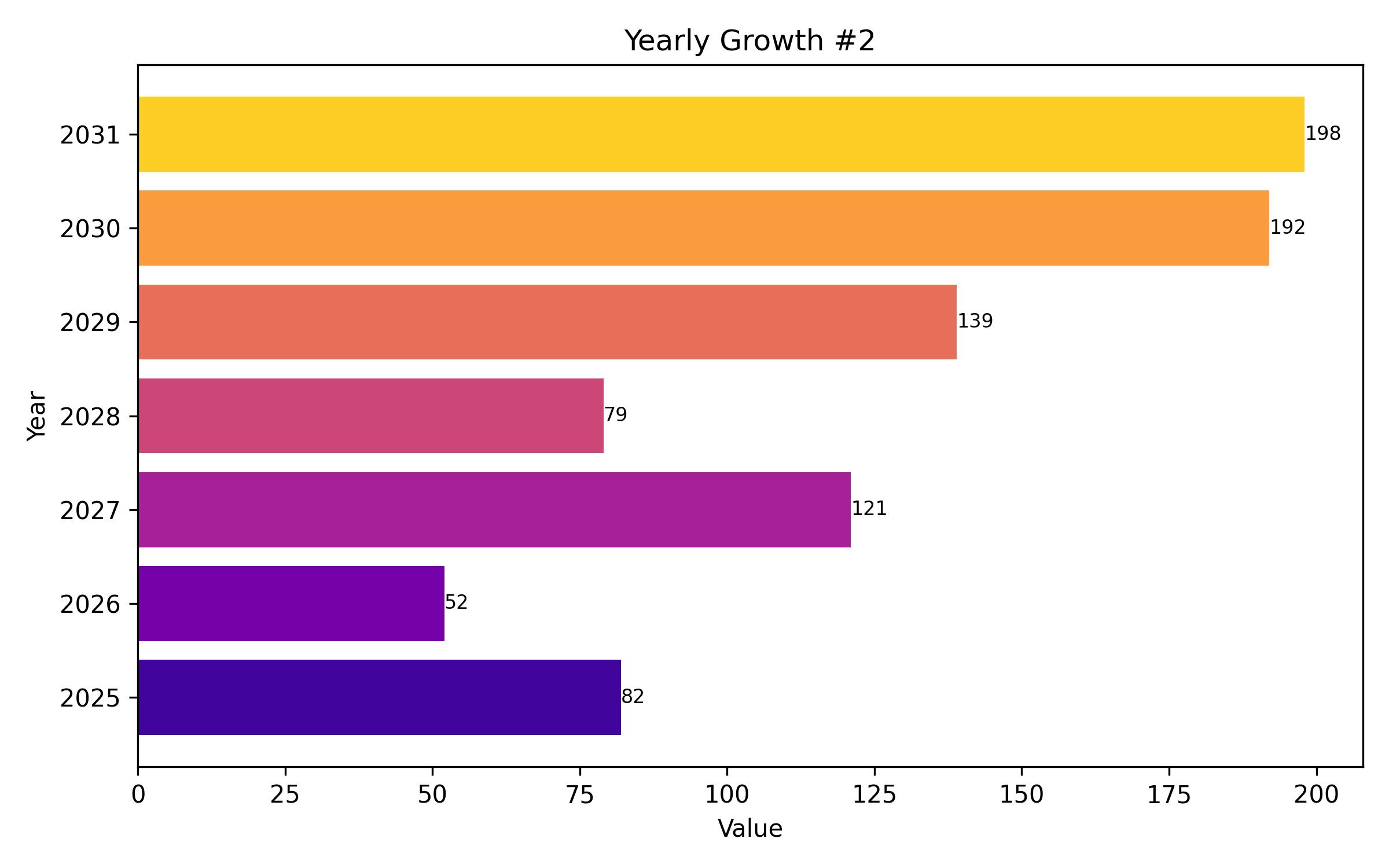

Adoption of loan origination software streamlines operations, significantly reducing the time required to process loan applications and disburse funds to applicants. Projections indicate a robust compound annual growth rate of 13%, propelling the market from a valuation of approximately USD 6.4 billion in 2025 to over USD 21.7 billion by 2035.

Market proliferation is driven by the increasing popularity of cloud-based lending platforms, evolving regulatory landscapes, and the widespread integration of digital banking technologies. AI-powered tools within loan origination software empower financial institutions to enhance credit risk assessment, automate key underwriting tasks, and deliver a more efficient and user-friendly experience throughout the loan application journey. The demand for sophisticated origination platforms is further amplified by consumer expectations for convenient digital applications and mobile-first banking services.

However, challenges persist, including concerns surrounding data security with AI implementation, complexities in integrating new systems with existing infrastructure, and the substantial initial investment required for deployment. Nevertheless, software providers are actively developing secure, scalable, and cost-effective solutions designed to address diverse lending requirements and overcome these hurdles.

Key indicators for the market illustrate a substantial increase in value over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 6,416 Million |

| Industry Value (2035F) | USD 21,780 Million |

| CAGR (2025 to 2035) | 13% |

The loan origination software market is primarily categorized by deployment model and the end-user sector, observing increasing utilization across a spectrum of financial entities, including traditional banks, credit unions, and alternative financing providers.

The market features two principal deployment options: on-premise and cloud-based loan origination software. Cloud solutions hold a dominant position, offering inherent flexibility, cost efficiencies, and remote accessibility, enabling financial institutions to optimize their loan management workflows. Conversely, larger banking institutions and organizations prioritizing stringent security often opt for on-premise solutions to maintain greater control over their customized and secure lending platforms.

The banking sector represents the largest segment for loan origination software adoption, utilizing it extensively for processing personal loans, business financing, and mortgage applications. The burgeoning fintech industry is also expanding its adoption, employing digital lending systems to facilitate faster loan approvals and leveraging artificial intelligence for sophisticated credit risk evaluation.

Credit unions and non-banking financial companies are increasingly implementing loan origination solutions to improve both their lending operations and the overall borrower experience. Modern software vendors are incorporating advanced technologies such as artificial intelligence and blockchain into their platforms to enhance fraud detection, integrate with open banking functionalities, and ultimately boost the quality and security of the loan processing landscape.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 6,416 million |

| Revenue Forecast for 2035 | USD 21,780 million |

| Growth Rate (CAGR) | 13% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Deployment Type, End-User, Application Type, Enterprise Size |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, South Korea, Brazil, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Ellie Mae (ICE Mortgage Technology), Fiserv, Inc., Black Knight, Inc., Finastra, Temenos AG, nCino, Inc., Wipro Ltd., Tavant Technologies, Sigma Infosolutions, BankPoint, Calyx Software, Roostify, Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Deployment Type

- Cloud-based

- On-premises

- By End-User

- Banks

- Credit Unions

- Mortgage Lenders

- Fintech Companies

- Other Financial Institutions

- By Application

- Mortgage

- Personal Loan

- Business Loan

- Other Loan Types

- By Company Size

- Small and Medium-sized Enterprises

- Large Enterprises

Table of Content

- Executive Snapshot

- Market Dynamics

- Key Trends and Innovations

- Market Size and Forecast (2025-2035)

- CAGR Analysis by Segment and Region

- Market Segmentation by Deployment Type

- Market Segmentation by End-User

- Market Segmentation by Application Type

- Market Segmentation by Enterprise Size

- Regional Analysis: North America

- Regional Analysis: Europe

- Regional Analysis: Asia Pacific

- Regional Analysis: Latin America

- Regional Analysis: Middle East & Africa

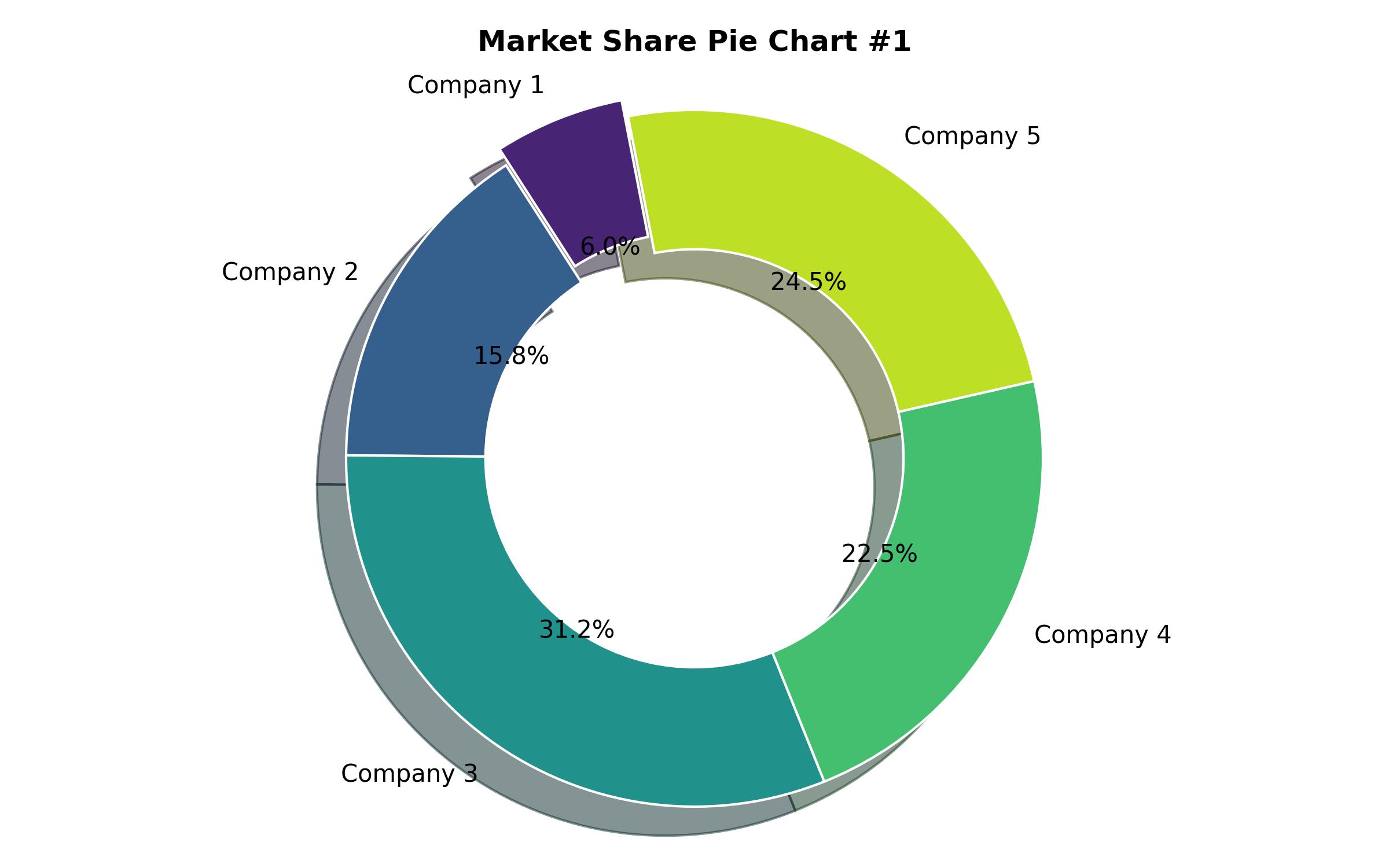

- Competitive Landscape and Market Share Analysis

- Key Company Profiles and Offerings

- Growth Strategies of Leading Players

- Impact of AI and Machine Learning on Loan Origination

- Integration of Blockchain Technology in Lending

- Future Outlook and Opportunities

- Regulatory Landscape and Compliance Challenges

- Market Entry Barriers and Risks

- Research Methodology and Assumptions