Comprehensive Analysis of the ATM Outsourcing Services Market by Type, Deployment, and Geography: Trends and Projections Through 2035

Overview:

The global ATM outsourcing services market is anticipated to experience steady growth over the next decade. In 2025, the market size is expected to reach USD 21.53 billion, driven by increasing demand from financial institutions looking to streamline operations and reduce capital expenditure. The revenue forecast for 2035 projects a market size of USD 40.38 billion, indicating a compound annual growth rate (CAGR) of 6.5% from 2025 to 2035.

Market growth is primarily fueled by the rising complexity of ATM management, including software upgrades, security enhancements, and compliance requirements. Outsourcing these functions allows banks and credit unions to focus on their core competencies while leveraging the expertise of specialized service providers.

The shift towards advanced ATM functionalities, such as cash recycling, contactless payments, and integrated teller services, is also contributing to market expansion. These technologies require specialized knowledge and infrastructure, making outsourcing an attractive option for many institutions.

Regional analysis reveals significant opportunities in developing economies, where expanding banking networks and increasing ATM penetration are driving demand for outsourcing services. North America, Europe, and Asia Pacific are expected to be key markets, with varied growth rates influenced by local economic conditions and regulatory landscapes.

Key players in the market include companies offering a range of services from ATM maintenance and cash management to transaction processing and security solutions. These providers are continually innovating to meet evolving customer needs and maintain a competitive edge.

The future of the ATM outsourcing services market will be shaped by ongoing technological advancements, regulatory changes, and the evolving needs of the financial services industry. As banks seek to optimize their ATM networks and enhance customer experience, outsourcing will remain a strategic imperative.

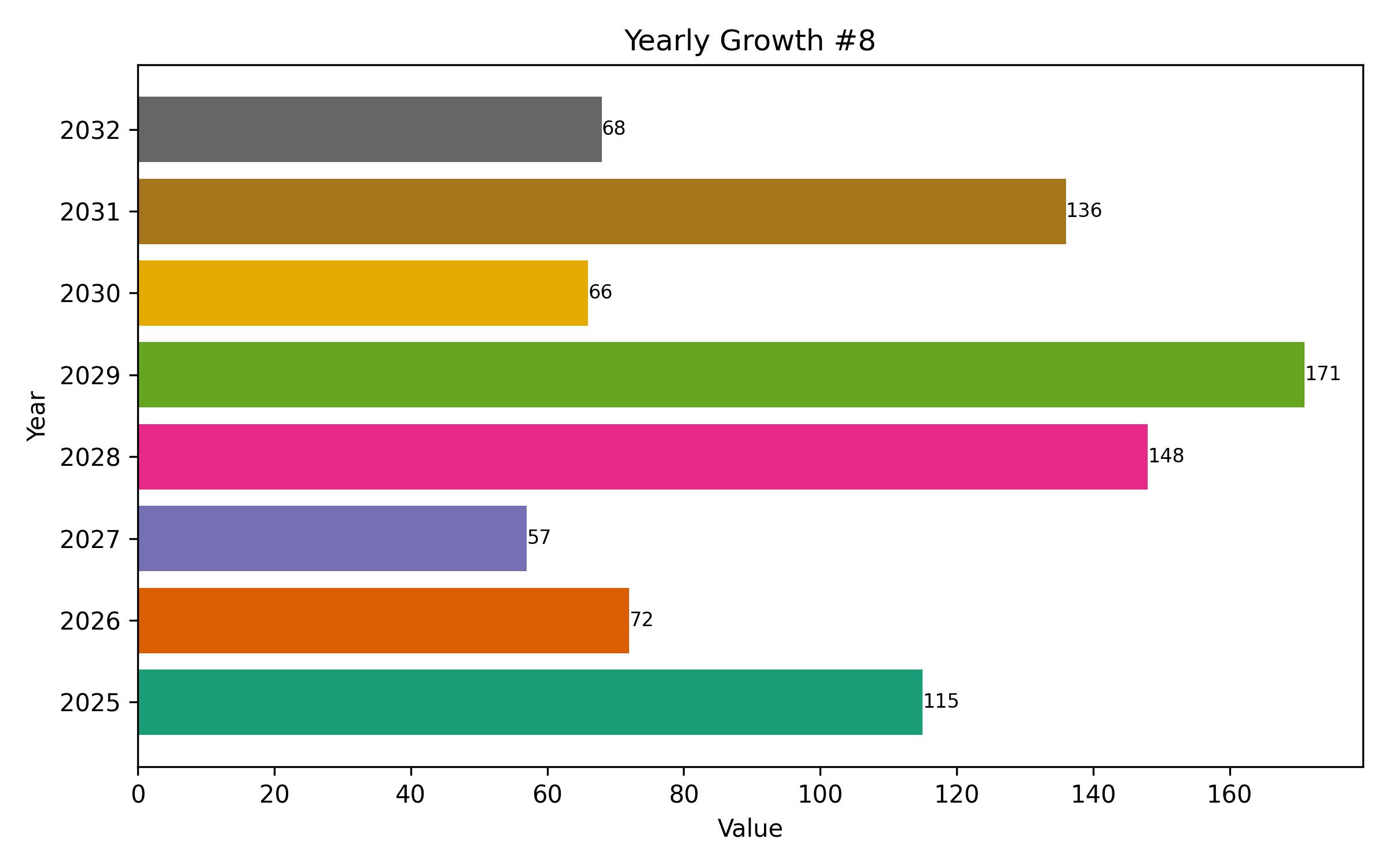

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 21.53 billion |

| Revenue Forecast for 2035 | USD 40.38 billion |

| Growth Rate (CAGR) | 6.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Service Type, ATM Deployment, and Region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | Diebold Nixdorf, Inc.; NCR Corporation; FIS (Fidelity National Information Services, Inc.); Euronet Worldwide, Inc.; Cardtronics; Hitachi-Omron Terminal Solutions; Hyosung TNS; Brinks Inc.; AGS Transact Technologies |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

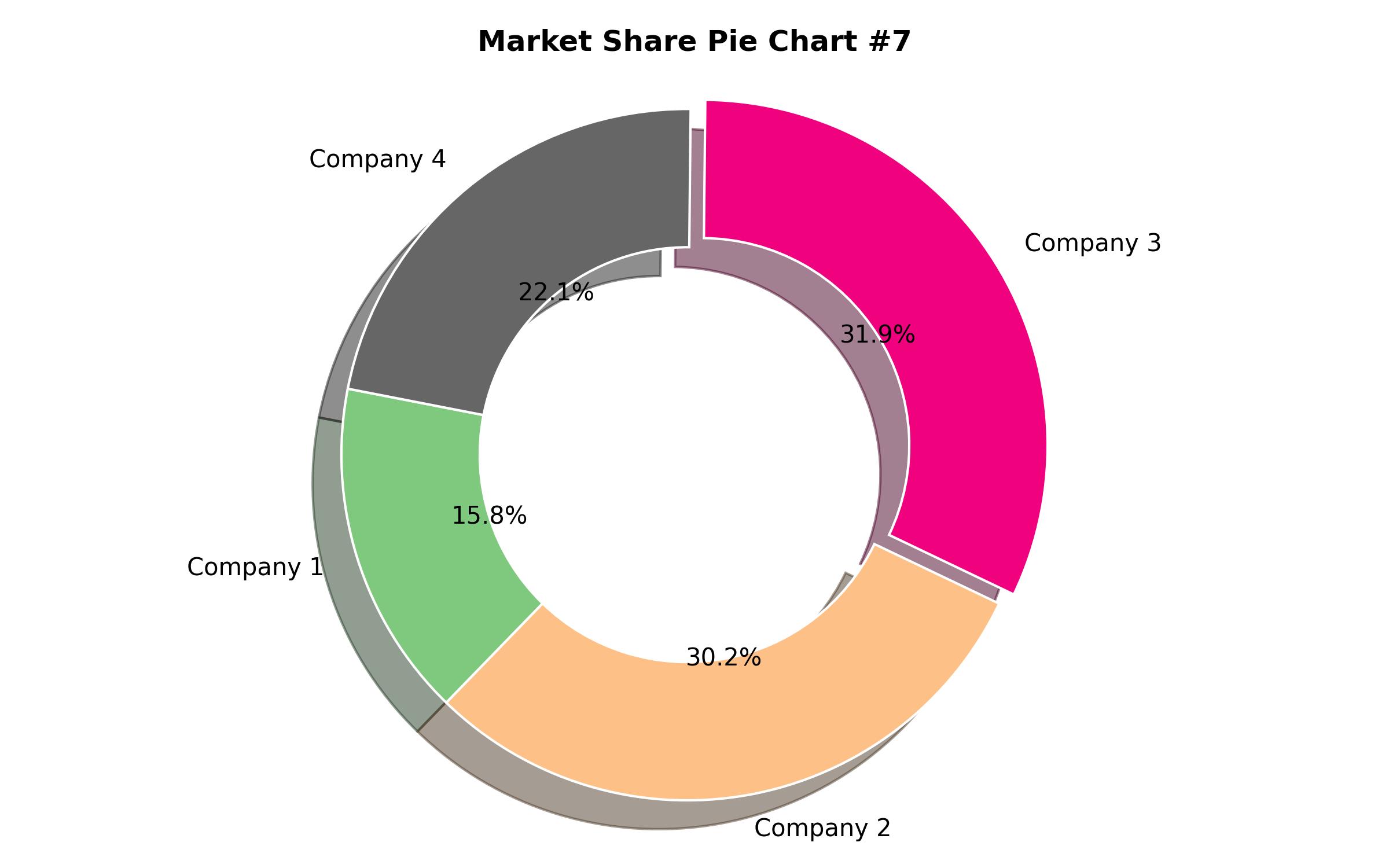

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Service Type

- Full ATM Outsourcing

- Partial ATM Outsourcing

- By ATM Deployment

- On-site

- Off-site

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Dynamics

- ATM Outsourcing Services Market: Key Trends

- Market Demand Analysis 2024 to 2028 and Forecast, 2029 to 2035

- Market – Pricing Analysis

- Market Size (Value in USD Billion) Analysis 2024 to 2028 and Forecast, 2029 to 2035

- Market Background

- Market Analysis 2024 to 2028 and Forecast 2029 to 2035, By Service Type

- Full ATM Outsourcing

- Partial ATM Outsourcing

- Market Analysis 2024 to 2028 and Forecast 2029 to 2035, By ATM Deployment

- On-site

- Off-site

- Market Analysis 2024 to 2028 and Forecast 2029 to 2035, By Region

- North America

- Latin America

- East Asia

- South Asia & Pacific

- Western Europe

- Eastern Europe

- Central Asia

- Russia & Belarus

- Middle East and Africa

- North America Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- Latin America Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- East Asia Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- South Asia & Pacific Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- Western Europe Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- Eastern Europe Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- Middle East & Africa Market Analysis 2024 to 2028 and Forecast 2029 to 2035

- Market Structure Analysis

- Competitive Landscape

- Assumptions and Acronyms Used

- Research Methodology