Comprehensive Analysis of the Feed Amino Acids Market by Product, Application, and Region Through 2035

Overview:

The global feed amino acids market is poised for substantial expansion in the coming years. In 2025, the market is projected to reach a valuation of USD 8,250 million, driven by increasing demand from the animal feed industry. A compound annual growth rate (CAGR) of 5.7% is expected to propel the market to an estimated USD 14,500 million by 2035. This growth is significantly influenced by the rising global population and the subsequent need for increased meat production.

Amino acids play a vital role in animal nutrition, serving as essential building blocks for proteins that promote growth, health, and overall productivity in livestock and aquaculture. The growing awareness of the importance of feed quality and the nutritional benefits of amino acids is further contributing to market expansion. Regulatory standards and quality control measures are also playing a key role in ensuring the consistent use of amino acids in feed formulations.

Geographically, the Asia Pacific region is anticipated to lead the market, fueled by the region’s large livestock population and increasing demand for meat products. North America and Europe are also significant markets, driven by advanced farming practices and a focus on high-quality animal nutrition. Key industry players, including Evonik Industries AG, Ajinomoto Co., Inc., and Archer Daniels Midland (ADM), are continuously innovating to meet the evolving demands of the market.

The expansion of the aquaculture sector and the rising demand for pet food are creating new avenues for market growth. Technological advancements in amino acid production, such as fermentation and enzymatic processes, are improving efficiency and reducing production costs. These factors are collectively shaping the trajectory of the global feed amino acids market.

The market is also influenced by the availability and cost of raw materials used in amino acid production, such as corn and soybeans. Fluctuations in these commodity prices can impact the overall profitability of feed manufacturers. The development of sustainable and environmentally friendly production methods is becoming increasingly important, driven by consumer and regulatory pressures.

Furthermore, ongoing research and development efforts are focused on enhancing the bioavailability and efficacy of amino acids in animal feed. These advancements are expected to further improve animal health and performance, solidifying the role of amino acids in modern animal nutrition. The feed amino acids market is dynamic and complex, driven by multiple factors that collectively contribute to its growth and evolution.

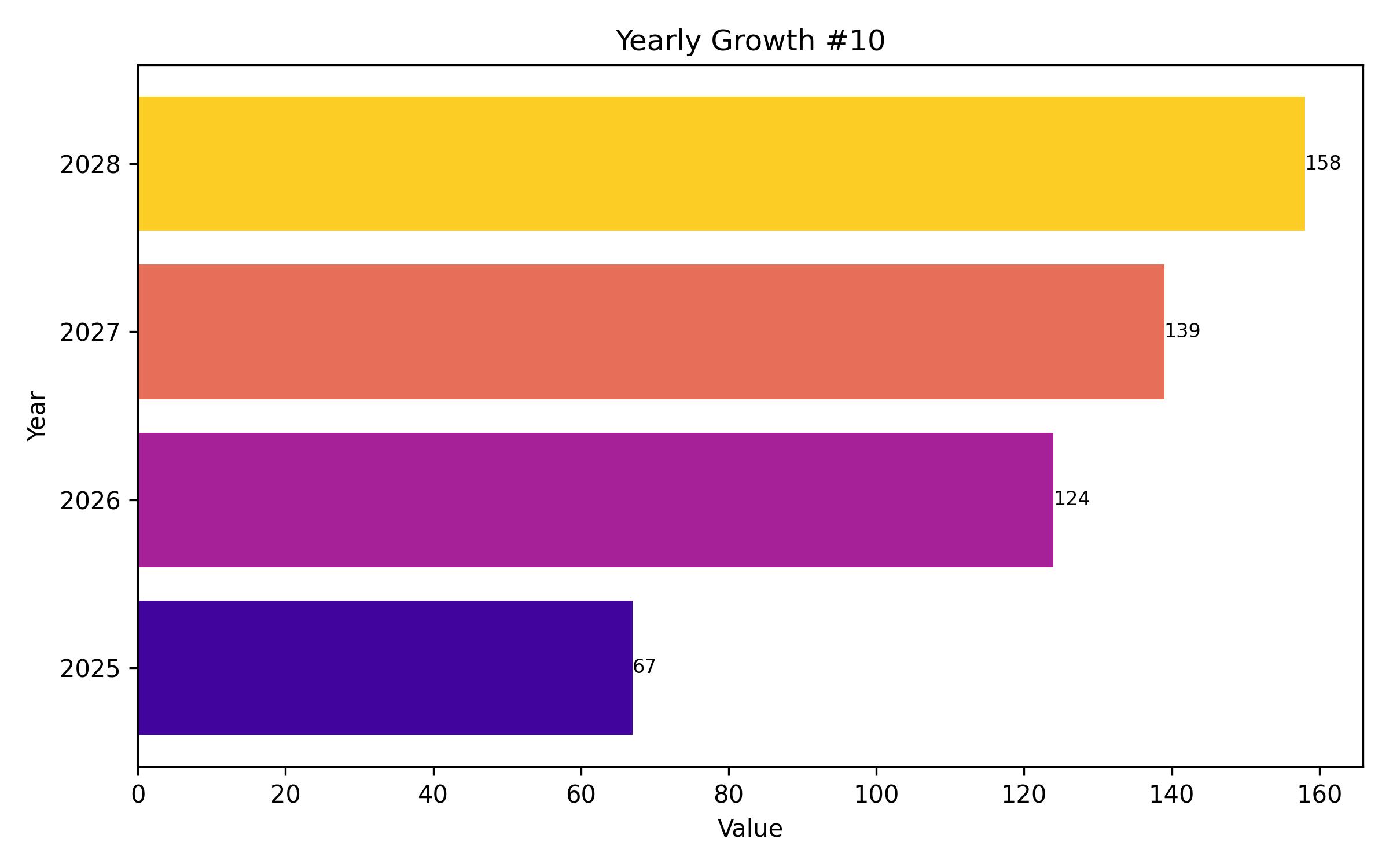

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 8,250 million |

| Revenue Forecast for 2035 | USD 14,500 million |

| Growth Rate (CAGR) | 5.7% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product, application, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa, France, New Zealand |

| Key Companies Analyzed | Evonik Industries AG; Ajinomoto Co., Inc.; Archer Daniels Midland (ADM); CJ CheilJedang Corporation; Novus International, Adisseo, Kemin Industries, Meihua Group, Bluestar Adisseo Company, and Global Bio-Chem Technology Group |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

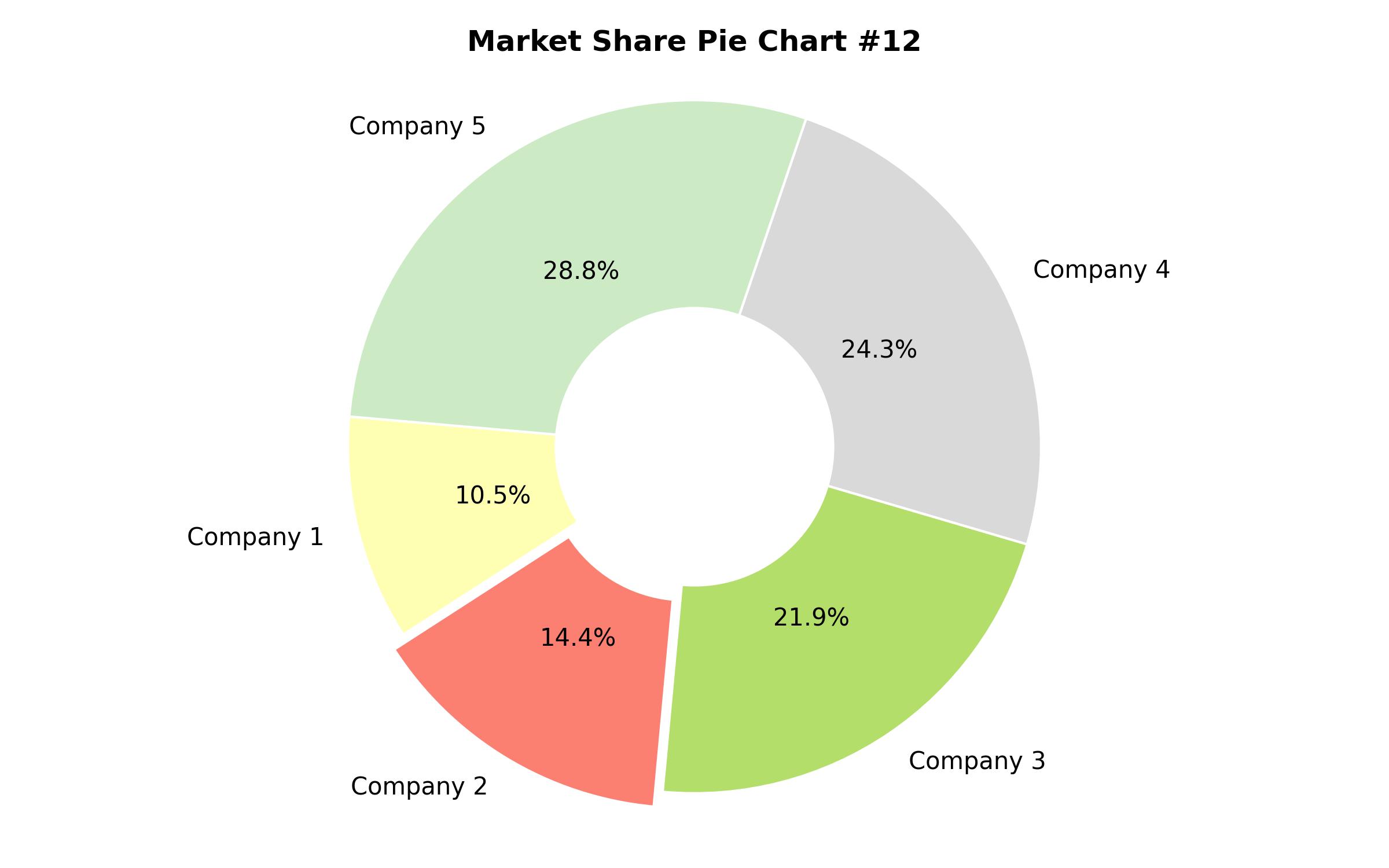

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Lysine

- Threonine

- Tryptophan

- Methionine

- Valine

- By Application

- Poultry Feed

- Swine Feed

- Ruminant Feed

- Aquaculture Feed

- Pet Food

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Dynamics

- Value Chain Analysis

- Market Demand Analysis 2024 to 2034

- Pricing Trends

- Global Trade Analysis

- Market Analysis 2024 to 2034, By Product Type

- Lysine

- Threonine

- Tryptophan

- Methionine

- Market Analysis 2024 to 2034, By Application

- Poultry Feed

- Swine Feed

- Ruminant Feed

- Regional Market Analysis 2024 to 2034

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- Competitive Landscape

- Company Profiles

- Evonik Industries AG

- Ajinomoto Co., Inc.

- Market Opportunities and Future Trends

- Regulatory Framework

- Strategic Recommendations

- Research Methodology

- Assumptions and Acronyms