ePayment Solutions Market Study by Component, Deployment Type, Enterprise Scale, Vertical, and Geographic Region, Forecast to 2035

Overview:

The global ePayment system market is poised for substantial expansion in the coming years. Projections indicate that the market size will reach USD 138.7 billion by 2025, driven by a compound annual growth rate (CAGR) of approximately 20.2%. This growth trajectory is expected to propel the market to an estimated value of USD 816.9 billion by 2035. Several factors contribute to this impressive growth, including the increasing adoption of digital payment methods across various industries and the rising demand for secure and convenient transaction solutions.

Advancements in technology, such as mobile payment platforms and blockchain, are significantly shaping the ePayment system market. These innovations are enhancing transaction speeds, reducing costs, and improving security measures. The integration of artificial intelligence (AI) and machine learning (ML) is further optimizing fraud detection and risk management processes, thereby fostering greater trust and reliability in ePayment systems.

Regional dynamics play a crucial role in the ePayment system market, with North America, Europe, and Asia Pacific leading in terms of market share and growth. Countries such as the United States, China, and India are at the forefront of digital payment adoption, driven by large consumer bases and supportive regulatory environments. The increasing penetration of smartphones and internet access in emerging economies is also contributing to the expansion of the ePayment system market.

Key industry players, including PayPal Holdings Inc., Visa Inc., and Mastercard Inc., are continuously innovating and expanding their service offerings to cater to the evolving needs of businesses and consumers. Strategic collaborations and partnerships are also prevalent, as companies seek to leverage each other’s strengths and expand their market reach. The competitive landscape is characterized by intense competition and a focus on differentiation through technology and customer service.

The ePayment system market is also influenced by regulatory frameworks and data security standards. Compliance with regulations such as GDPR and PCI DSS is essential for ensuring the security and privacy of financial transactions. As the market continues to grow, addressing cybersecurity threats and maintaining consumer trust will remain critical priorities for industry stakeholders. These factors will continue to shape the trajectory of the global ePayment system market in the foreseeable future.

The increasing shift towards cashless economies and the growing prevalence of e-commerce are further accelerating the adoption of ePayment systems. Businesses are increasingly recognizing the benefits of digital payment solutions, including increased efficiency, reduced transaction costs, and improved customer experiences. As a result, the demand for ePayment systems is expected to continue to surge in the coming years. The constant evolution of technology and consumer preferences will continue to drive innovation and growth in this dynamic market.

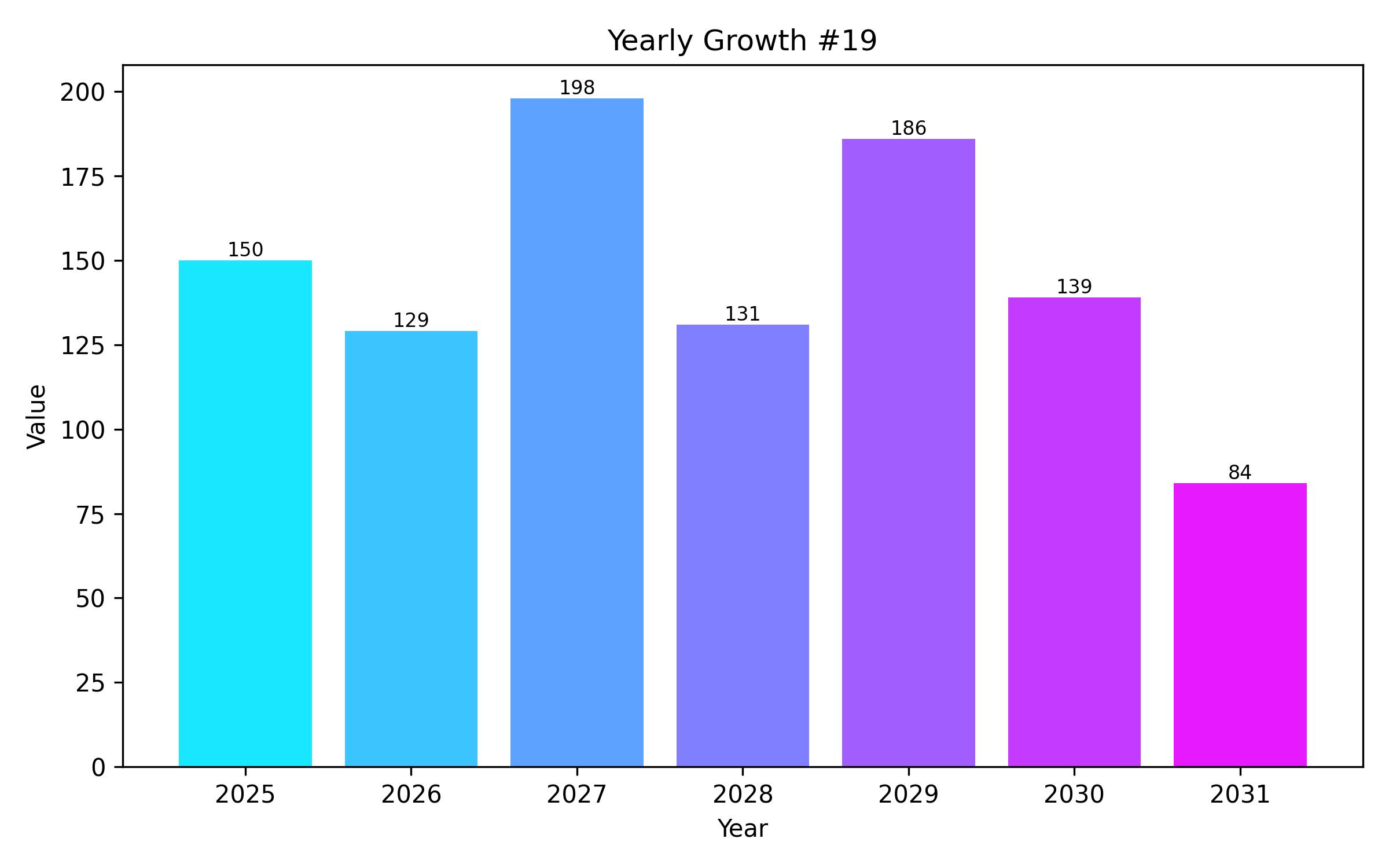

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 138.8 billion |

| Revenue Forecast for 2035 | USD 816.8 billion |

| Growth Rate (CAGR) | 20.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Component, deployment, enterprise size, industry, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | PayPal Holdings Inc.; Visa Inc.; Mastercard Inc.; Square (Block, Inc.); Stripe; Amazon Pay; Google Pay; Apple Pay; Alipay (Ant Group); WeChat Pay |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

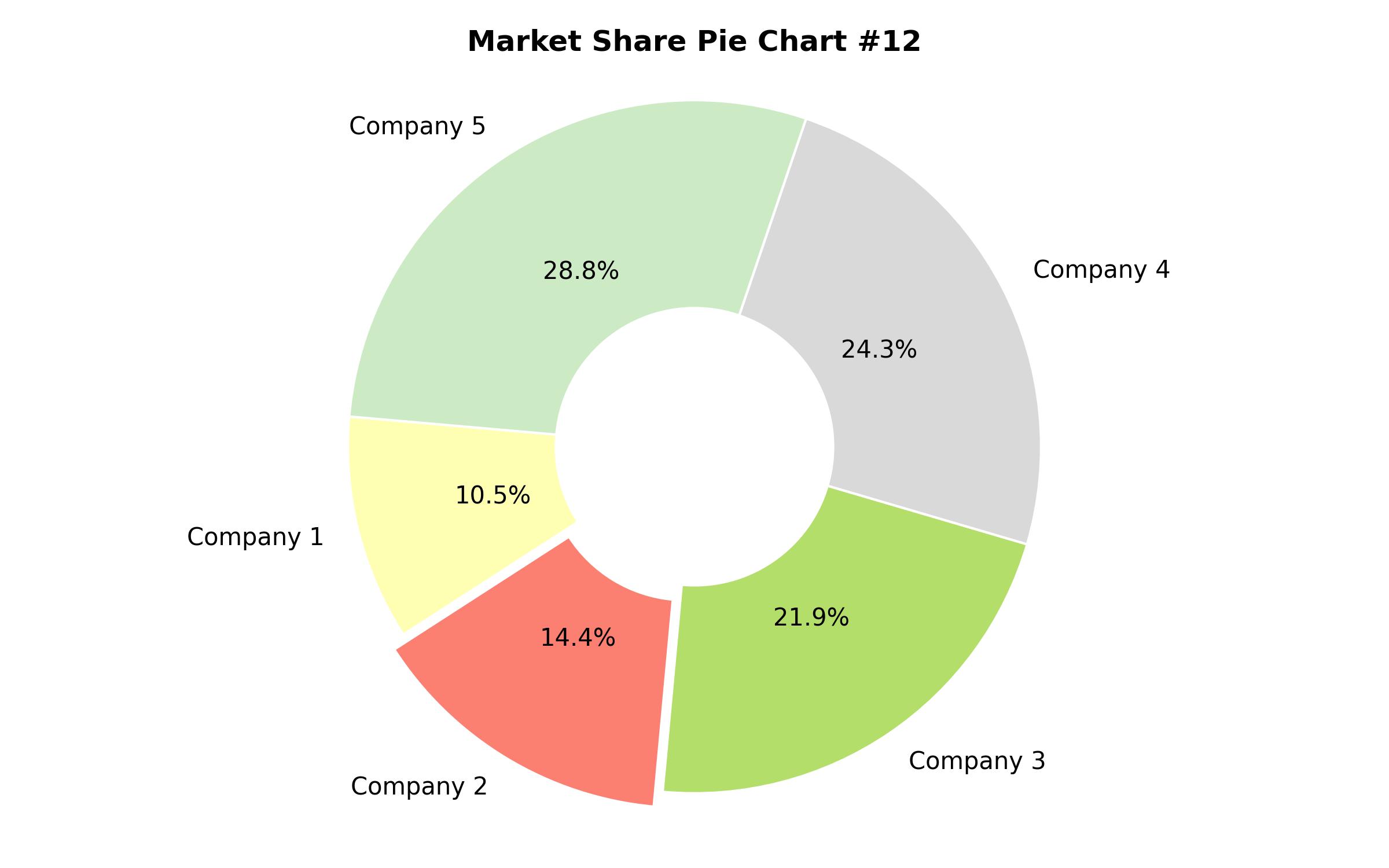

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Component

- Solutions

- Services

- By Deployment

- Cloud

- On-Premise

- By Enterprise Size

- Small and Medium Enterprises (SMEs)

- Large Enterprises

- By Industry

- Retail

- BFSI

- Healthcare

- IT & Telecom

- Government

- Others

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Poland)

- Asia-Pacific (China, India, Japan, Australia, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (MEA) (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Dynamics

- Solutions Analysis 2024 to 2034

- Service Analysis 2024 to 2034

- Cloud Deployment Analysis 2024 to 2034

- On-Premise Deployment Analysis 2024 to 2034

- Small and Medium Enterprises Analysis 2024 to 2034

- Large Enterprises Analysis 2024 to 2034

- Retail Industry Analysis 2024 to 2034

- BFSI Industry Analysis 2024 to 2034

- Healthcare Industry Analysis 2024 to 2034

- IT & Telecom Industry Analysis 2024 to 2034

- Government Industry Analysis 2024 to 2034

- Regional Market Analysis

- North America Market Analysis 2024-2034

- Europe Market Analysis 2024-2034

- Asia Pacific Market Analysis 2024-2034

- Latin America Market Analysis 2024-2034

- Middle East & Africa Market Analysis 2024-2034

- Competitive Landscape