Telematics Integrated Auto Insurance Market: Analysis and Long-Term Projections from 2025-2035

Overview:

The global telematics-based auto insurance market is poised for substantial expansion in the coming years. The market is expected to reach a size of USD 3,542.1 million in 2025, and, with a compound annual growth rate (CAGR) of 18.5%, it should achieve a value of USD 19,339.7 million by 2035. The increasing adoption of telematics solutions in the automotive industry is a key driver behind this growth, offering insurers new ways to assess risk and personalize premiums.

Telematics-based auto insurance leverages real-time data collected from vehicles to monitor driving behavior. This data includes speed, acceleration, braking patterns, and distance traveled. By analyzing this information, insurers can gain insights into driving habits and offer customized insurance policies that reward safe driving.

The market is further propelled by increasing consumer awareness of the benefits of telematics, including potential cost savings through lower premiums and improved driving safety. Additionally, regulatory support and government initiatives promoting safer driving practices contribute to market growth.

Regionally, North America and Europe are leading the market, driven by high adoption rates of advanced technologies and stringent safety regulations. Asia Pacific is expected to witness the highest growth rate during the forecast period, owing to increasing vehicle sales and rising awareness of telematics-based insurance solutions.

Key players in the telematics-based auto insurance market include established insurance companies and technology providers. These companies are focused on developing innovative telematics solutions and expanding their market presence through strategic partnerships and acquisitions.

The future of the telematics-based auto insurance market looks promising, with continued technological advancements and increasing market penetration expected to drive further growth. As more drivers embrace telematics, insurers will have greater opportunities to refine their risk assessment models and offer personalized insurance products.

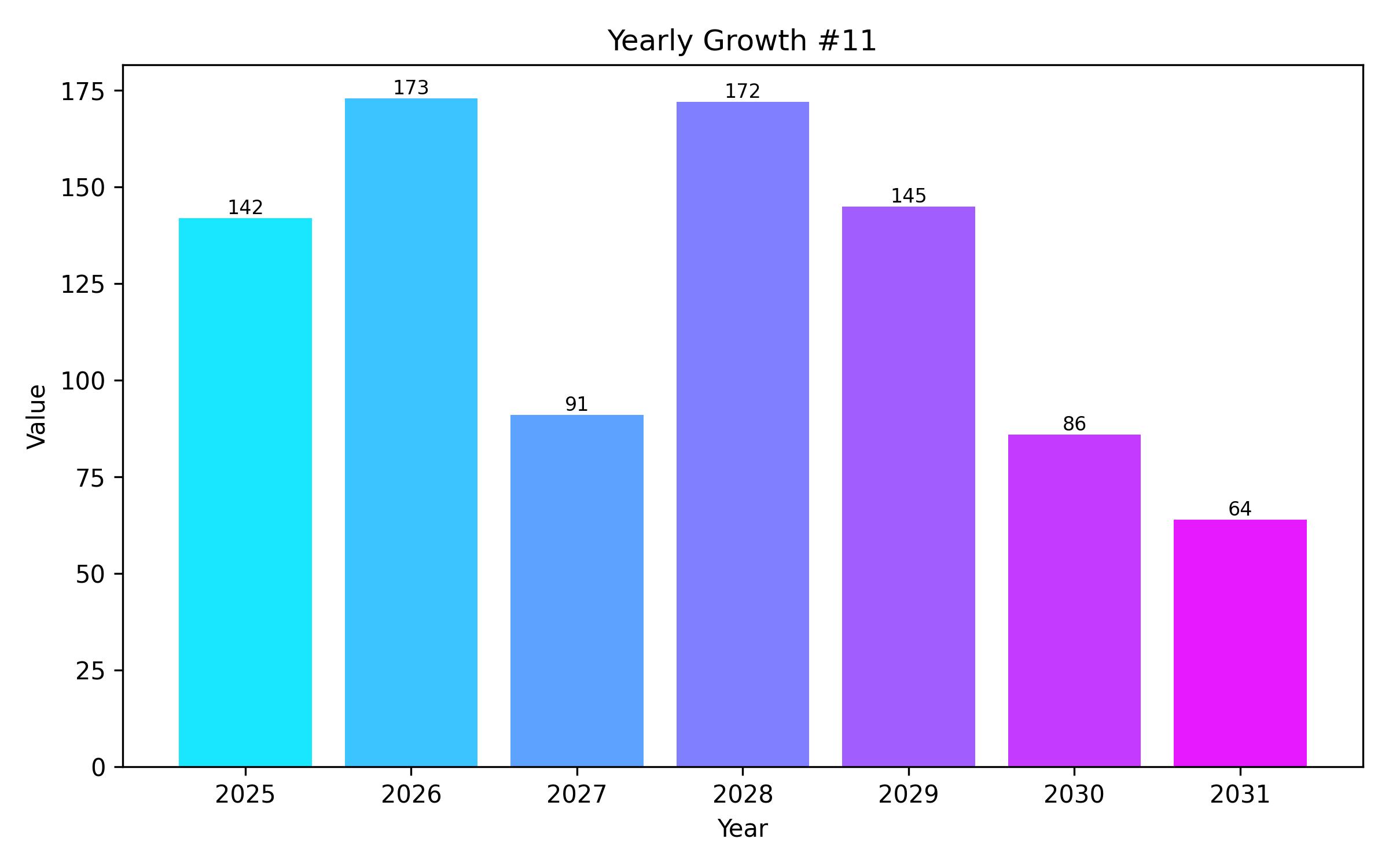

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 3,542.1 Million |

| Revenue Forecast for 2035 | USD 19,339.7 Million |

| Growth Rate (CAGR) | 18.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, propulsion type, and region |

| Regional Scope | North America, Europe, Asia Pacific |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, China, India, Japan, Australia, South Korea |

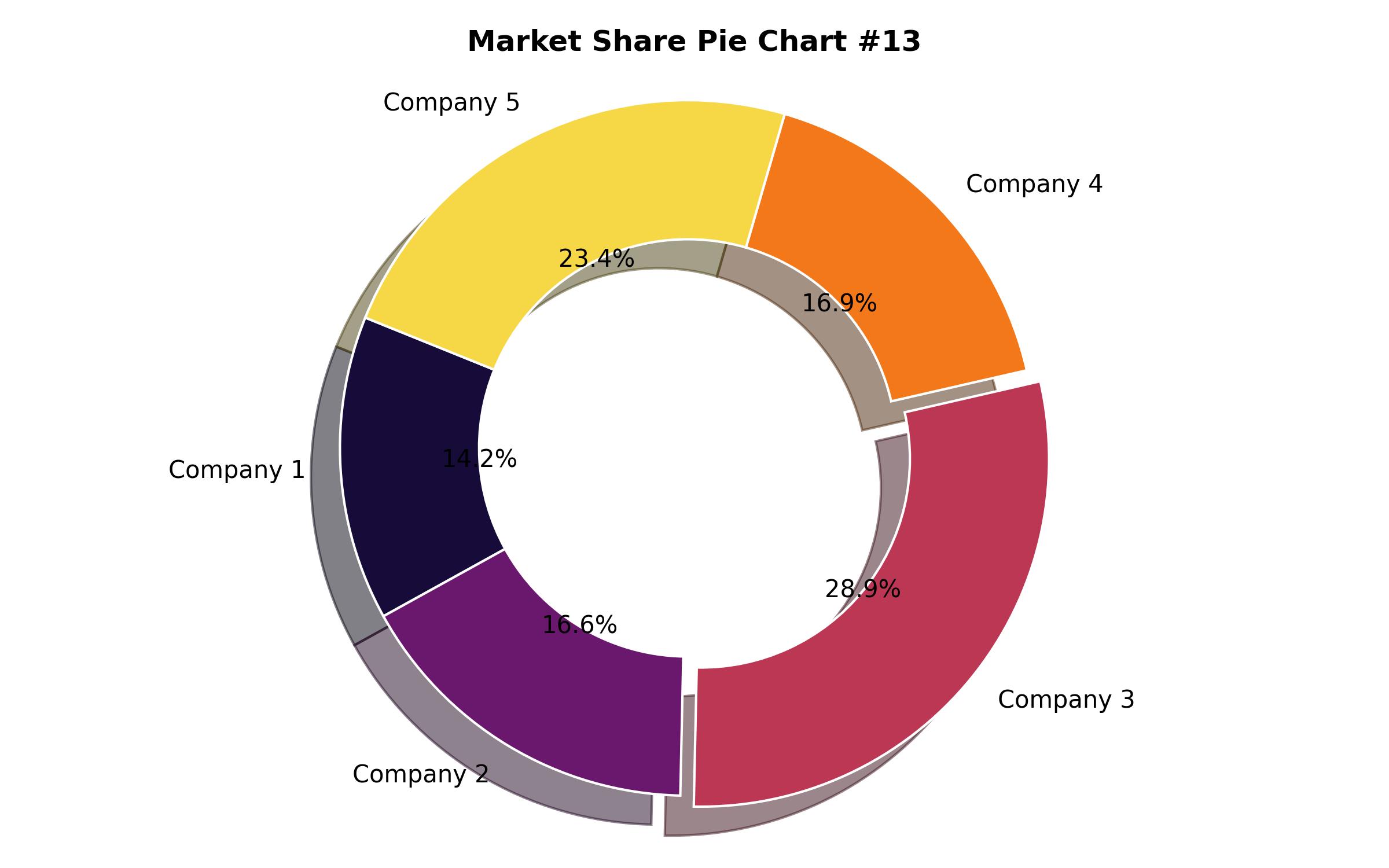

| Key Companies Analyzed | Progressive Corporation; Allstate Corporation; State Farm Mutual Automobile Insurance; Liberty Mutual Insurance; Root Insurance Company |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- By Technology Adoption

- Smartphone-based

- Embedded Systems

- OBD-II Dongle

- By Service Type

- Usage-Based Insurance (UBI)

- Pay-As-You-Drive (PAYD)

- Manage-How-You-Drive (MHYD)

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Impact of COVID-19

- Telematics-based Auto Insurance Market Analysis 2025 to 2035, By Vehicle Type

- Passenger Cars

- Commercial Vehicles

- Telematics-based Auto Insurance Market Analysis 2025 to 2035, By Technology Adoption

- Smartphone-based

- Embedded Systems

- OBD-II Dongle

- Telematics-based Auto Insurance Market Analysis 2025 to 2035, By Service Type

- Usage-Based Insurance (UBI)

- Pay-As-You-Drive (PAYD)

- Manage-How-You-Drive (MHYD)

- Telematics-based Auto Insurance Market Analysis 2025 to 2035, By Region

- North America

- Europe

- Asia-Pacific

- North America Telematics-based Auto Insurance Market Analysis 2025 to 2035

- Europe Telematics-based Auto Insurance Market Analysis 2025 to 2035

- Asia-Pacific Telematics-based Auto Insurance Market Analysis 2025 to 2035

- Competitive Landscape

- Market Share Analysis

- Company Profiles

- Key Company Profiles

- Progressive Corporation

- Allstate Corporation

- State Farm Mutual Automobile Insurance

- Liberty Mutual Insurance

- Root Insurance Company

- Strategic Recommendations

- Assumptions and Acronyms Used

- Research Methodology