Global Litigation Finance Market: Industry Evaluation and Projections, 2025-2035

Overview:

The global litigation funding investment market is poised for substantial expansion in the coming decade. Projections indicate a market size of USD 20.61 billion in 2025, escalating to USD 49.25 billion by 2035. This represents a compound annual growth rate (CAGR) of 14.2% over the forecast period.

This growth is propelled by increasing awareness of litigation funding as a viable financial solution for businesses and individuals involved in legal disputes. Litigation funding offers the opportunity to pursue meritorious claims without incurring upfront legal costs, transferring the financial risk to the funder.

The commercial litigation segment is expected to maintain a dominant position, driven by the high value of disputes and the increasing complexity of legal proceedings. Bankruptcy claims and international arbitration also represent significant growth areas, fueled by the rise in cross-border transactions and insolvency cases.

North America and Europe currently hold the largest market share, owing to their well-established legal systems and favorable regulatory environments. However, the Asia-Pacific region is anticipated to exhibit the highest growth rate, driven by rapid economic expansion and increasing litigation activity.

Key players in the litigation funding market include specialized firms, hedge funds, and private equity investors. These entities provide capital to plaintiffs and law firms in exchange for a share of the settlement or judgment.

The market faces certain challenges, including regulatory uncertainty and potential ethical concerns related to conflicts of interest. Nevertheless, the growing demand for alternative financing solutions in the legal sector is expected to outweigh these challenges.

Technological advancements in data analytics and artificial intelligence are also playing a role in the market, enabling funders to more accurately assess the merits of potential investments. This is leading to increased efficiency and reduced risk for both funders and claimants.

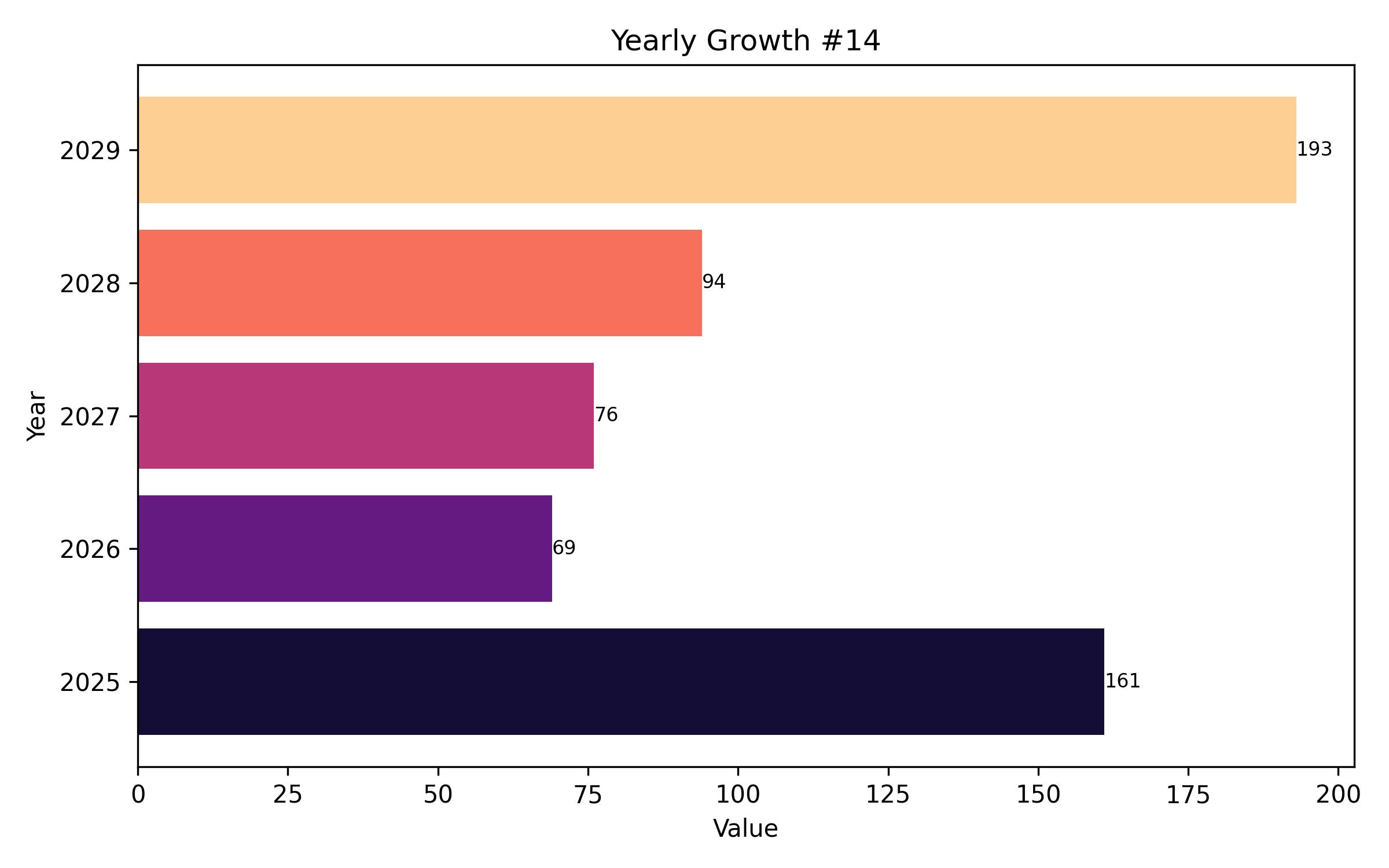

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 20,613.8 million |

| Revenue Forecast for 2035 | USD 49,249.9 million |

| Growth Rate (CAGR) | 14.2% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Commercial litigation, bankruptcy claims, and international arbitration |

| Regional Scope | North America, Europe, Asia Pacific |

| Country Scope | U.S., Canada, UK, Germany, France, China, Australia, India, Singapore, Japan, South Korea |

| Key Companies Analyzed | Burford Capital LLC; IMF Bentham (Omni Bridgeway); Litigation Capital Management (LCM); Therium Capital Management; Augusta Ventures |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

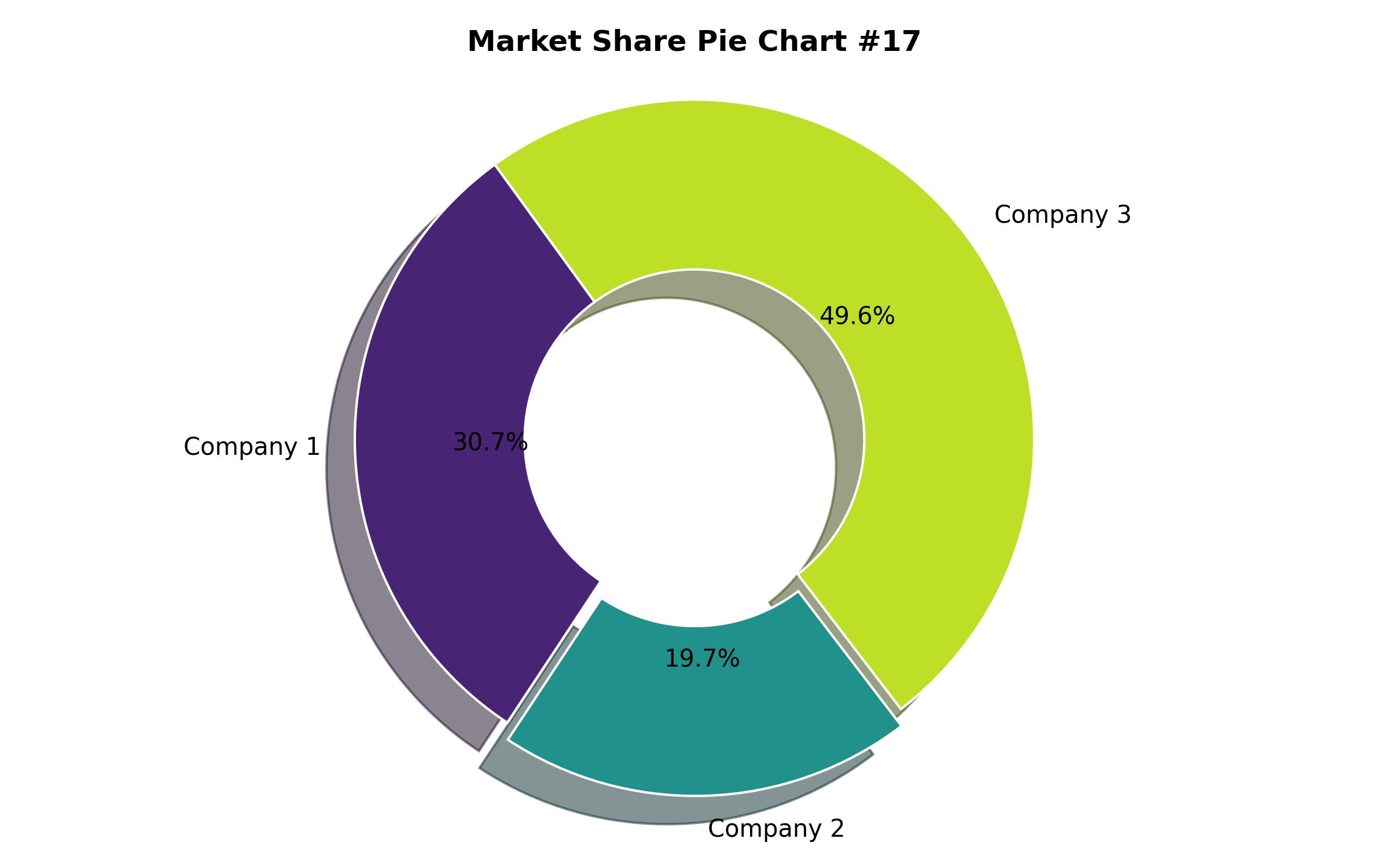

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Claim Type

- Commercial Litigation

- Bankruptcy Claims

- International Arbitration

- By Investment Size

- Small Claims (Under $5 million)

- Medium Claims ($5 – $25 million)

- Large Claims (Over $25 million)

- By Region

- North America (U.S., Canada)

- Europe (UK, Germany, France)

- Asia-Pacific (China, Australia, India, Singapore, Japan, South Korea)

Table of Content

- Executive Summary

- Market Overview

- Key Market Dynamics

- Drivers and Restraints

- Market Opportunities

- Risk Analysis

- Litigation Funding – Pricing Analysis

- Market Analysis 2025 to 2035, By Claim Type

- Commercial Litigation

- Bankruptcy Claims

- International Arbitration

- Market Analysis 2025 to 2035, By Investment Size

- Small Claims (Under $5 million)

- Medium Claims ($5 – $25 million)

- Large Claims (Over $25 million)

- Market Analysis 2025 to 2035, By Region

- North America

- Europe

- Asia-Pacific

- North America Market Analysis 2025 to 2035

- Europe Market Analysis 2025 to 2035

- Asia-Pacific Market Analysis 2025 to 2035

- Market Share Analysis

- Competitive Landscape

- Key Company Profiles

- Burford Capital LLC

- IMF Bentham (Omni Bridgeway)

- Litigation Capital Management (LCM)

- Therium Capital Management

- Augusta Ventures

- Market Trends & Future Outlook

- Industry Recommendations

- Assumptions and Acronyms Used

- Research Methodology