Comprehensive Analysis of the Elemental Sulfur Market: Assessment, Size, and Predictive Forecasts from 2025 to 2035

Overview:

The global elemental sulfur market is poised for steady expansion in the coming years. Projections indicate a market size of approximately USD 9.1 billion in 2025, with expectations of reaching USD 13.5 billion by 2035. This reflects a compound annual growth rate (CAGR) of 3.9% throughout the forecast period. The demand for elemental sulfur is significantly influenced by its extensive use in the production of fertilizers, chemical processing, and various industrial applications.

The fertilizer segment remains a primary driver due to the essential role of sulfur in enhancing crop yields and overall agricultural productivity. The chemical processing sector also exhibits substantial demand, with elemental sulfur serving as a crucial feedstock in synthesizing a wide array of chemical products. Stringent environmental regulations that aim to reduce sulfur emissions from industrial activities are expected to further contribute to market growth.

Geographically, the Asia Pacific region is anticipated to emerge as a dominant market, propelled by rapid industrialization and agricultural expansion in countries such as China and India. North America and Europe are also expected to show stable growth, supported by mature agricultural sectors and stringent environmental standards.

Key industry participants are focusing on optimizing production processes and expanding their market presence to capitalize on the increasing demand. Innovations in sulfur recovery and refining technologies are also gaining prominence, aimed at enhancing efficiency and minimizing environmental impact. These advancements are pivotal in sustaining the long-term growth of the elemental sulfur market.

The market’s future trajectory is also contingent on factors such as feedstock availability, technological advancements, and evolving regulatory landscapes. These elements will collectively shape the dynamics of the global elemental sulfur market in the coming decade.

Furthermore, the crude oil refining segment also significantly contributes to elemental sulfur production as a byproduct of desulfurization processes. This is driven by increasingly stringent environmental regulations aimed at reducing sulfur emissions. This interplay between environmental policies and industrial processes continues to support sustained market expansion.

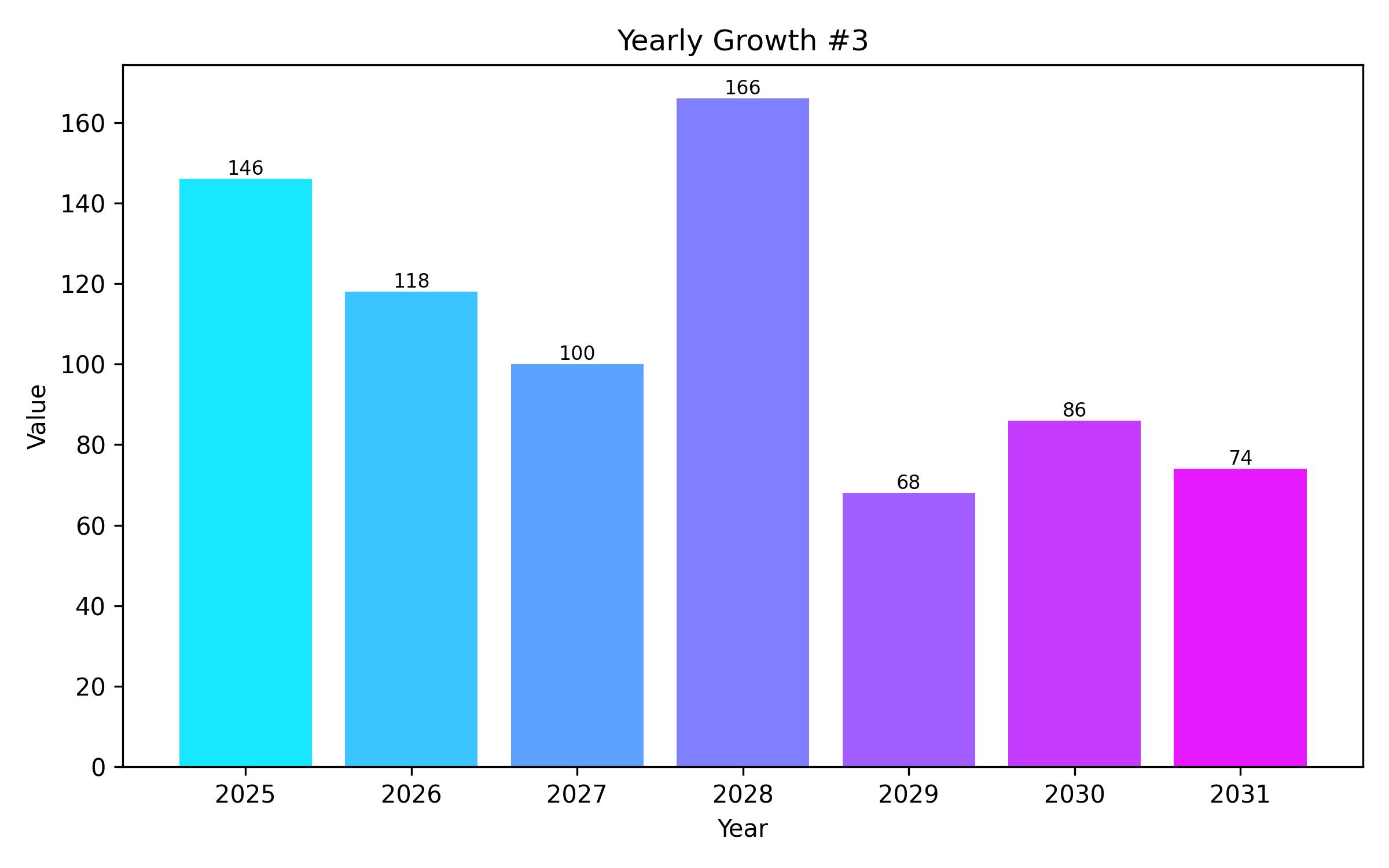

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 9.1 billion |

| Revenue Forecast for 2035 | USD 13.5 billion |

| Growth Rate (CAGR) | 3.9% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Application, Source, and Region |

| Regional Scope | North America, Europe, Asia Pacific |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, China, Australia, South Korea, Japan, New Zealand |

| Key Companies Analyzed | Saudi Arabian Oil Company, ExxonMobil, Sinopec, Gazprom, Abu Dhabi National Oil Company |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

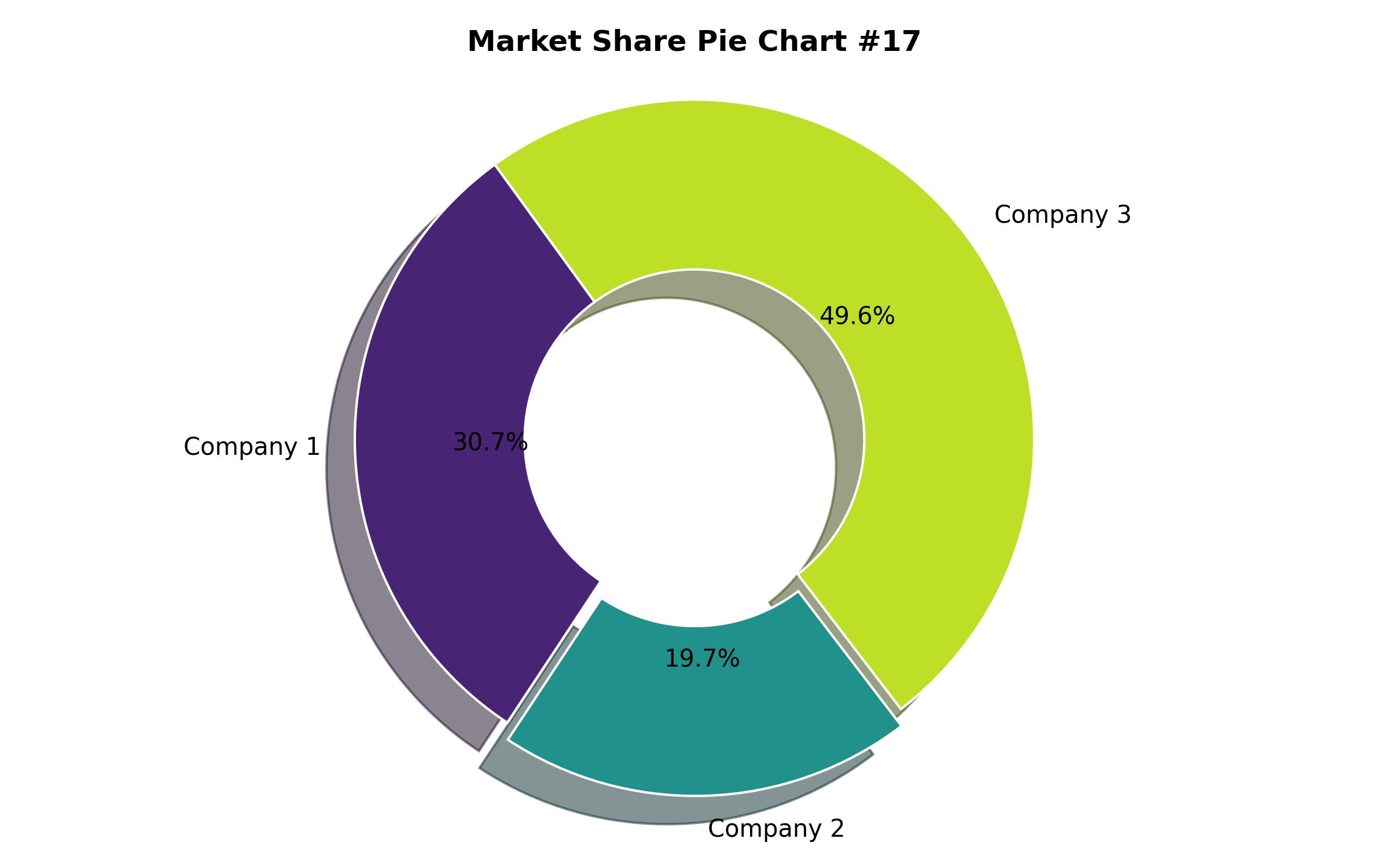

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Application

- Fertilizers

- Chemical Processing

- Petroleum Refining

- Metal Manufacturing

- Water Treatment

- By Source

- Natural Gas Sweetening

- Crude Oil Refining

- Sour Gas Processing

- Volcanic Deposits

- Other Sources

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Global Economic Outlook

- Industry Trends

- Market Dynamics: Drivers, Restraints, and Opportunities

- Impact of Regulations

- Technological Advancements in Sulfur Recovery

- Supply Chain Analysis

- Market Analysis by Application

- Fertilizers

- Chemical Processing

- Petroleum Refining

- Metal Manufacturing

- Water Treatment

- Market Analysis by Source

- Natural Gas Sweetening

- Crude Oil Refining

- Sour Gas Processing

- Volcanic Deposits

- Other Sources

- Regional Market Analysis

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- Competitive Landscape

- Key Company Profiles

- Market Forecast 2025-2035

- Analyst Recommendations

- Appendix: Data Sources and Methodology