Market Analysis of Compressor Rentals by Type, Application, and Geography: 2025 – 2035

Overview:

The global compressor rental market is poised for substantial expansion, driven by increasing demand across various sectors. In 2025, the market is anticipated to reach a valuation of USD 4.85 billion, and projections indicate a robust compound annual growth rate (CAGR) of 7.5% through 2035, culminating in a market size of approximately USD 10 billion. This growth is primarily fueled by the cost-effectiveness and flexibility that rental compressors offer to industries such as construction, manufacturing, and oil and gas.

The construction industry, in particular, is a significant end-user, benefiting from the availability of compressors for short-term projects without the capital investment of purchasing equipment. Similarly, the manufacturing sector relies on rental compressors for temporary boosts in production capacity or during maintenance periods.

Regionally, North America and Europe currently hold substantial market shares, owing to their developed industrial infrastructure and stringent environmental regulations that encourage the use of energy-efficient compressors. However, the Asia-Pacific region is expected to exhibit the highest growth rate, driven by rapid industrialization and infrastructure development in countries such as China and India.

Technological advancements are also playing a crucial role in shaping the compressor rental market. The introduction of more efficient and eco-friendly compressors, coupled with remote monitoring and diagnostics, is enhancing the value proposition for end-users. Moreover, the increasing adoption of electric compressors is contributing to reduced emissions and operational costs.

Key players in the compressor rental market include companies that offer a wide range of compressor types and services, catering to diverse customer needs. These companies are focused on expanding their rental fleets and service networks to capitalize on the growing market opportunities. Overall, the compressor rental market is characterized by its resilience, adaptability, and potential for sustained growth in the coming years.

Furthermore, the market benefits from the increasing trend of outsourcing equipment maintenance and management, allowing businesses to focus on their core operations. This trend is particularly evident in industries where compressor downtime can lead to significant financial losses. Additionally, the growing demand for specialized compressors, such as those used in the healthcare and electronics sectors, is creating niche opportunities for rental providers.

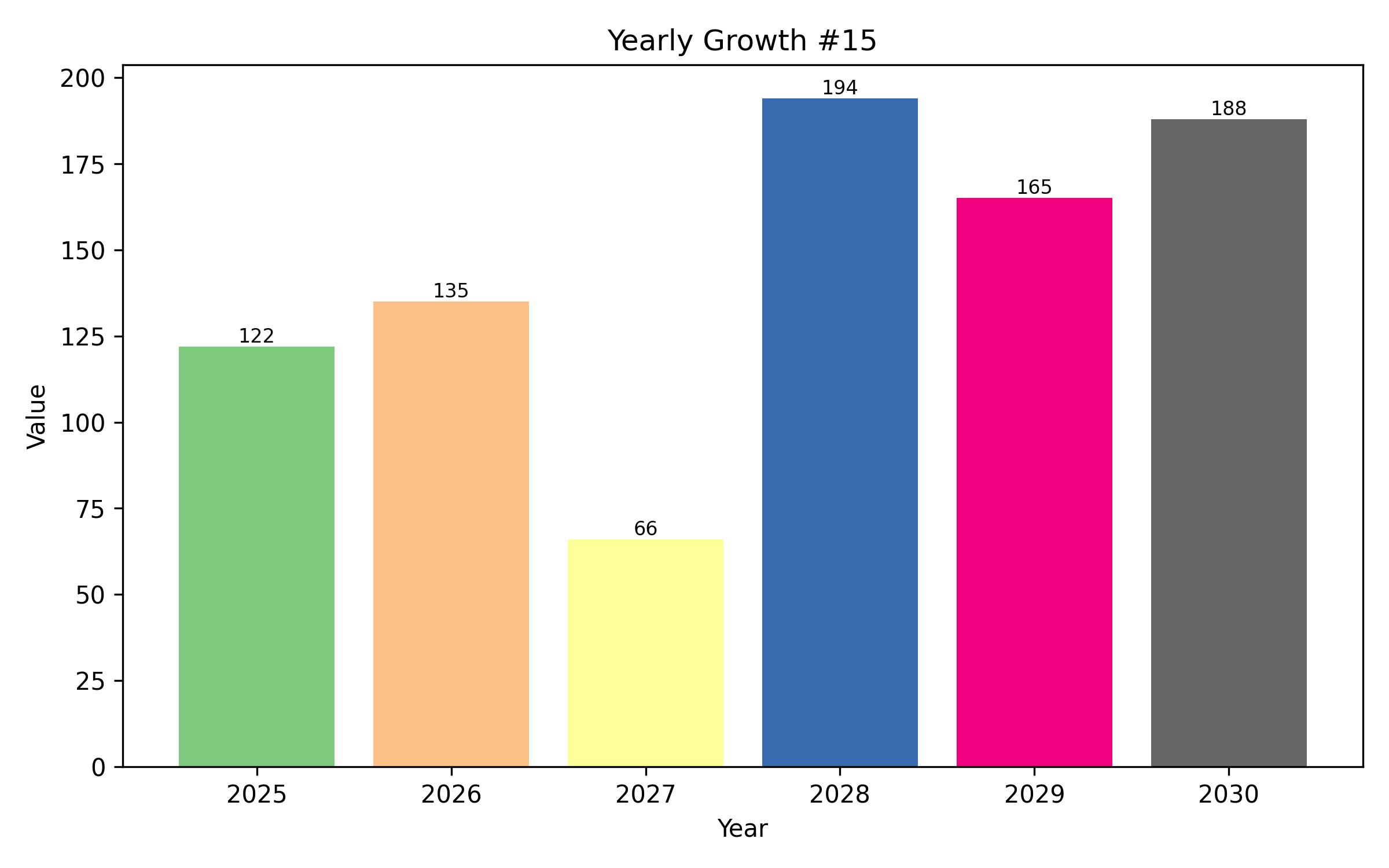

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 4.85 billion |

| Revenue Forecast for 2035 | USD 10 billion |

| Growth Rate (CAGR) | 7.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, end-use, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, Italy, Poland, China, India, Japan, Australia, South Korea, Brazil, UAE, KSA, South Africa |

| Key Companies Analyzed | United Rentals, Atlas Copco, Aggreko, Sunbelt Rentals, Herc Rentals, Caterpillar Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

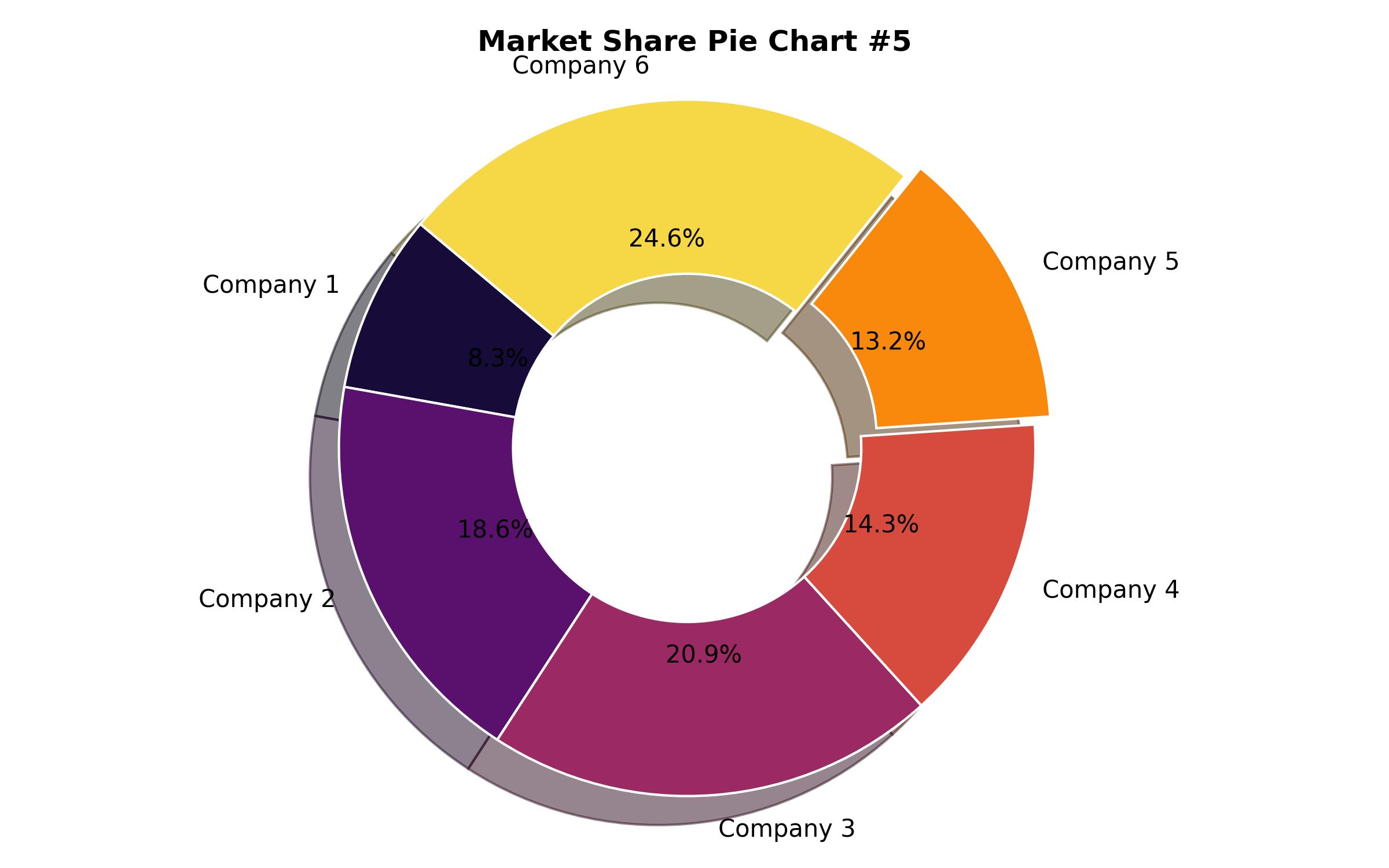

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Compressor Type

- Portable Compressors

- Stationary Compressors

- Oil-free Compressors

- Oil-lubricated Compressors

- By End-Use Industry

- Construction

- Manufacturing

- Oil and Gas

- Mining

- Healthcare

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina, Colombia)

- Middle East & Africa (Saudi Arabia, UAE, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Drivers

- Restraints and Challenges

- Market Trends

- Macroeconomic Factors

- Market Demand Analysis 2025 to 2035

- Pricing Analysis

- Market Size Forecast by Compressor Type

- Portable Compressors

- Stationary Compressors

- Oil-free Compressors

- Oil-lubricated Compressors

- Market Size Forecast by End-Use Industry

- Construction

- Manufacturing

- Oil and Gas

- Mining

- Healthcare

- Market Size Forecast by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis

- Europe Market Analysis

- Asia-Pacific Market Analysis

- Latin America Market Analysis

- Middle East & Africa Market Analysis

- Competitive Landscape

- Key Company Profiles

- Market Share Analysis

- Strategic Recommendations

- Assumptions and Acronyms

- Research Methodology