Aerospace Head-Up Display: Market Dynamics, Growth Trends, and Forecasts Through 2035

Overview:

The global aerospace head-up display (HUD) market is poised for substantial expansion in the coming years, driven by increasing demand for enhanced situational awareness and safety in both commercial and military aviation. The market is expected to reach USD 3.1 billion by 2025, with projections indicating a rise to USD 12.7 billion by 2035, reflecting a compound annual growth rate (CAGR) of 15.9% from 2025 to 2035.

This growth is propelled by several factors, including the rising adoption of HUDs in next-generation aircraft, stringent aviation safety regulations, and technological advancements in display technology. HUDs provide pilots with critical flight information directly in their line of sight, reducing the need to look down at cockpit instruments and improving reaction times during critical maneuvers.

The market is segmented based on system type, platform, end user, and region. Windshield-based HUDs and combiner-based HUDs are the primary system types, with both commercial and military aircraft increasingly integrating these systems. The OEM (Original Equipment Manufacturers) segment currently dominates the market, although the aftermarket segment is expected to witness significant growth due to increasing retrofitting activities.

North America is the largest regional market for aerospace HUDs, driven by the presence of major aircraft manufacturers and defense contractors. However, the Asia-Pacific region is anticipated to exhibit the highest growth rate, fueled by increasing air traffic and defense spending in countries such as China and India.

Key players in the aerospace HUD market include BAE Systems plc, Collins Aerospace (RTX), Thales Group, Honeywell International Inc., and Lockheed Martin Corporation. These companies are focused on developing advanced HUD solutions with enhanced capabilities, such as augmented reality and synthetic vision, to meet the evolving needs of the aviation industry.

The aerospace HUD market is likely to see sustained growth driven by ongoing technological innovations, increasing demand for safer and more efficient air travel, and the modernization of aircraft fleets worldwide. This convergence of factors will provide significant opportunities for market participants to expand their presence and enhance their product offerings

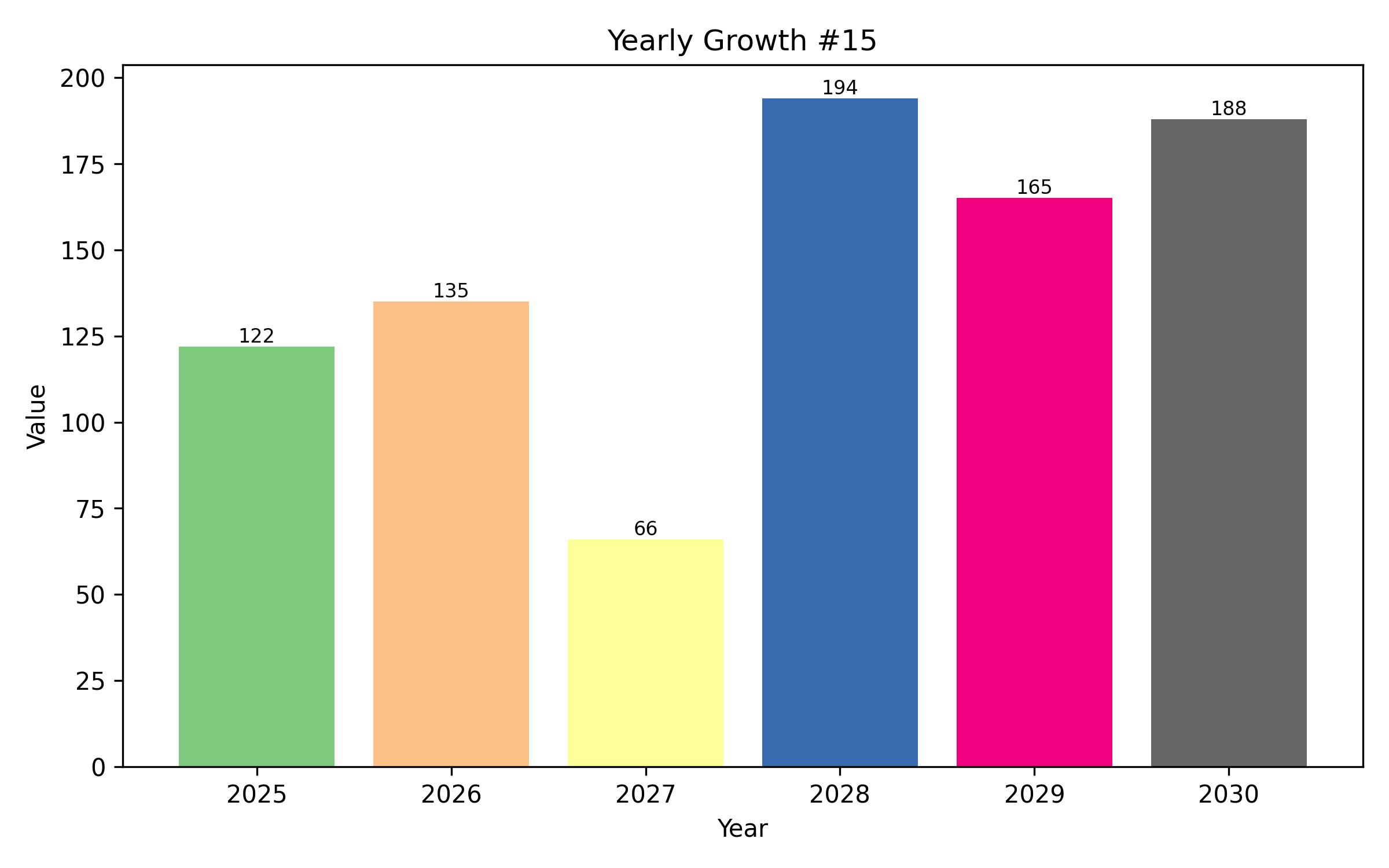

Year On Year Growth Chart

“`html

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 2.9 billion |

| Revenue Forecast for 2035 | USD 12.9 billion |

| Growth Rate (CAGR) | 16.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type and end user |

| Regional Scope | USA, UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand |

| Country Scope | USA, UK, France, Germany, Italy, South Korea, Japan, China, Australia, New Zealand |

| Key Companies Analyzed | BAE Systems plc; Collins Aerospace (RTX); Thales Group; Honeywell International Inc.; Lockheed Martin Corporation; Elbit Systems Ltd.; Saab AB; Raytheon Technologies (RTX); Leonardo S.p.A.; Garmin Ltd. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

“`

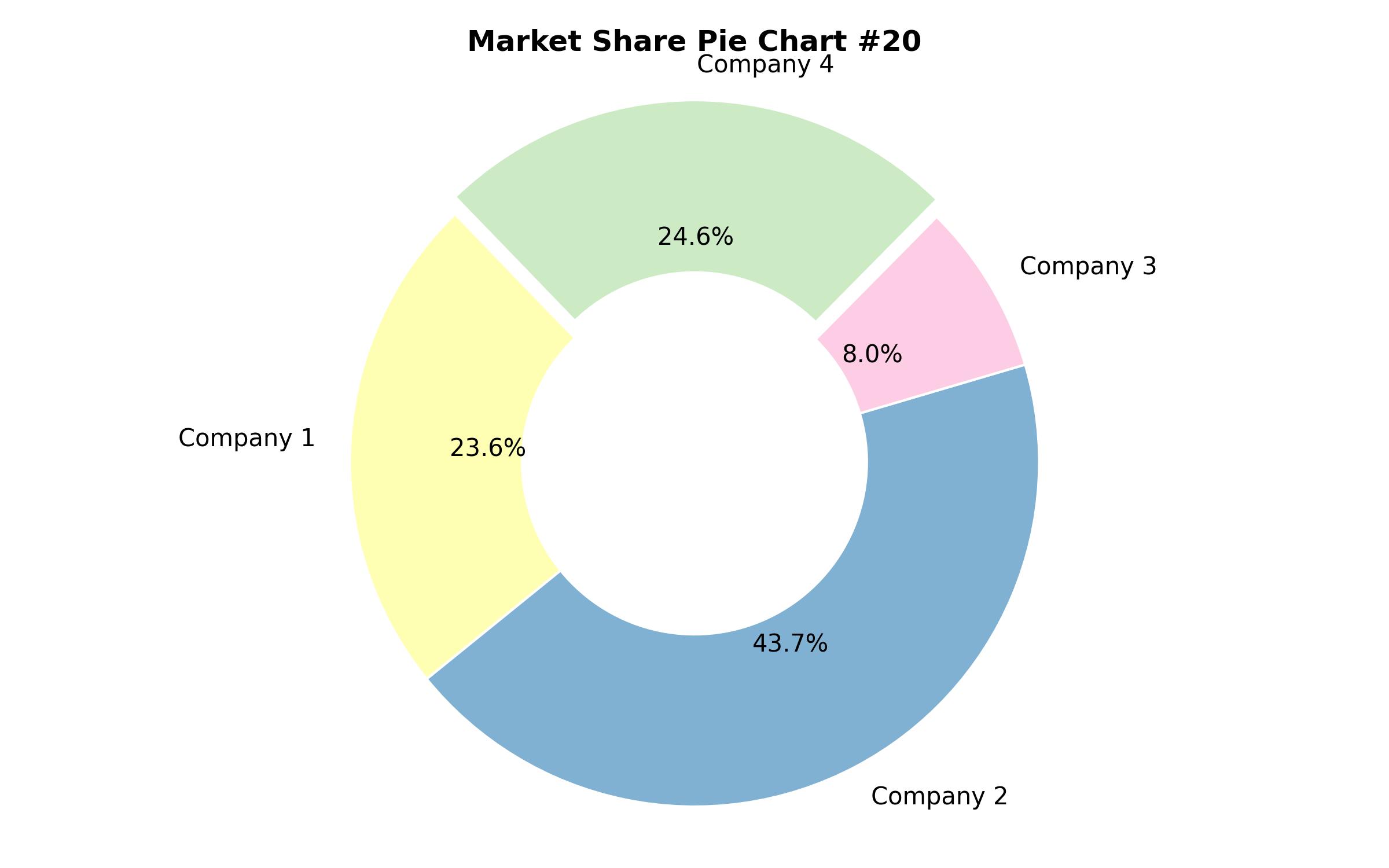

Key Companies Market Share

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By System Type

- Windshield-Based HUD

- Combiner-Based HUD

- By Platform

- Commercial Aircraft

- Military Aircraft

- Business Jets

- Helicopters

- By End User

- OEM (Original Equipment Manufacturers)

- Aftermarket

- By Component

- Display Unit

- Projector Unit

- Processing Unit

- Other components

- By Region

- North America (U.S., Canada)

- Europe (Germany, France, UK, Italy, Spain)

- Asia-Pacific (China, Japan, South Korea, India, Australia)

- Latin America (Brazil, Mexico)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Global Aerospace HUD Market Analysis, 2020-2024 and Forecast, 2025-2035

- Market Dynamics

- Drivers

- Restraints

- Opportunities

- Trends

- Impact of COVID-19

- Aerospace HUD Market Analysis, by System Type, 2020-2024 and Forecast, 2025-2035

- Windshield-Based HUD

- Combiner-Based HUD

- Aerospace HUD Market Analysis, by Platform, 2020-2024 and Forecast, 2025-2035

- Commercial Aircraft

- Military Aircraft

- Business Jets

- Helicopters

- Aerospace HUD Market Analysis, by End User, 2020-2024 and Forecast, 2025-2035

- OEM (Original Equipment Manufacturers)

- Aftermarket

- Aerospace HUD Market Analysis, by Component, 2020-2024 and Forecast, 2025-2035

- Display Unit

- Projector Unit

- Processing Unit

- Other components

- Regional Market Analysis, 2020-2024 and Forecast, 2025-2035

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- Country-Level Analysis

- United States

- Canada

- Germany

- France

- United Kingdom

- Italy

- Spain

- China

- Japan

- South Korea

- India

- Australia

- Brazil

- Mexico

- UAE

- Saudi Arabia

- South Africa

- Competitive Landscape

- Market Share Analysis

- Company Profiles

- Product Benchmarking

- Key Company Profiles

- BAE Systems plc

- Collins Aerospace (RTX)

- Thales Group

- Honeywell International Inc.

- Lockheed Martin Corporation

- Elbit Systems Ltd.

- Saab AB

- Raytheon Technologies (RTX)

- Leonardo S.p.A.

- Garmin Ltd.

- Appendix

- Assumptions and Acronyms

- Research Methodology