Global Mobile Payment Transaction Market Projections: Technology Applications and Outlook 2025-2035 Analysis

Overview:

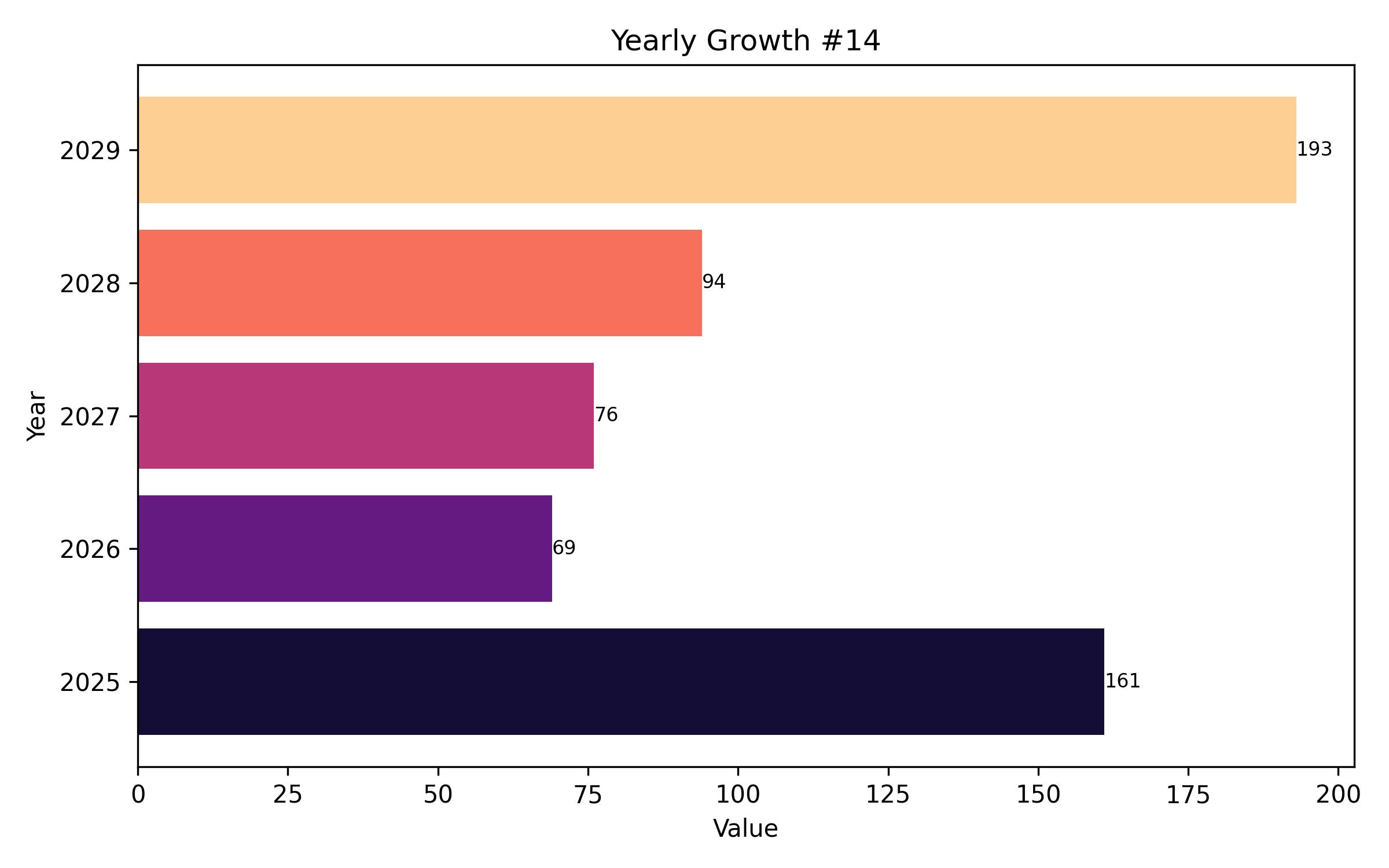

The mobile payment transaction market is set for substantial expansion, projected to grow from USD 21.5 trillion in 2025 to USD 62.4 trillion by 2035, demonstrating a strong compound annual growth rate (CAGR) of 13.5%. This significant growth is influenced by the integration of advanced technologies such as blockchain for enhanced security and the evolution of digital payment regulations. Furthermore, a pivotal factor is the rapid shift towards cashless societies in growing economies, contributing significantly to the market’s size and global transaction landscape.

Innovative mobile payment systems, encompassing digital wallets, near-field communication (NFC), and QR code solutions, are fundamentally altering how consumers and businesses conduct financial exchanges. These technologies facilitate immediate, effortless transactions, gradually diminishing the reliance on cash and traditional banking methods.

Key elements fueling this market’s expansion include breakthroughs in e-commerce, alongside increased global smartphone adoption and better internet accessibility. These factors are foundational to the widespread and swift embrace of mobile payment options.

Globally, governmental bodies and central banks are actively promoting digital financial inclusion. This push is supported by initiatives like open banking frameworks and real-time payment infrastructures. Additionally, the increasing popularity of ‘super apps’ that consolidate multiple financial services into one platform is significantly boosting market momentum.

Despite its upward trend, the mobile payment transaction sector confronts notable obstacles. Cybersecurity remains a primary concern, with digital payment networks frequently targeted by fraud and data breaches, posing persistent security and privacy challenges.

Another significant hurdle is the absence of uniform international regulations, which can impede smooth cross-border transactions. Moreover, high transaction fees charged by various services can be limiting, especially in cost-sensitive markets, underscoring the need for more economical options and greater financial inclusivity.

The future of mobile payment transactions is marked by ongoing technological advancements and strategic collaborations across industries. The potential introduction of central bank digital currencies (CBDCs) could further spur digital payment adoption by offering a secure, state-backed alternative to existing financial systems.

Technological progress is continuous, leading to more secure digital wallets, AI-driven financial management tools, and blockchain-powered transaction systems. Concurrently, partnerships between financial service providers, major e-commerce entities, and mobile network operators are crucial for extending global reach.

While digital transformation is accelerating changes, the mobile payments industry is poised to profoundly redefine global financial transactions, aiming to make payments quicker, more secure, and accessible to a broader audience.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 21.5 trillion |

| Revenue Forecast for 2035 | USD 62.4 trillion |

| Growth Rate (CAGR) | 13.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD trillion and CAGR from 2025 to 2035 |

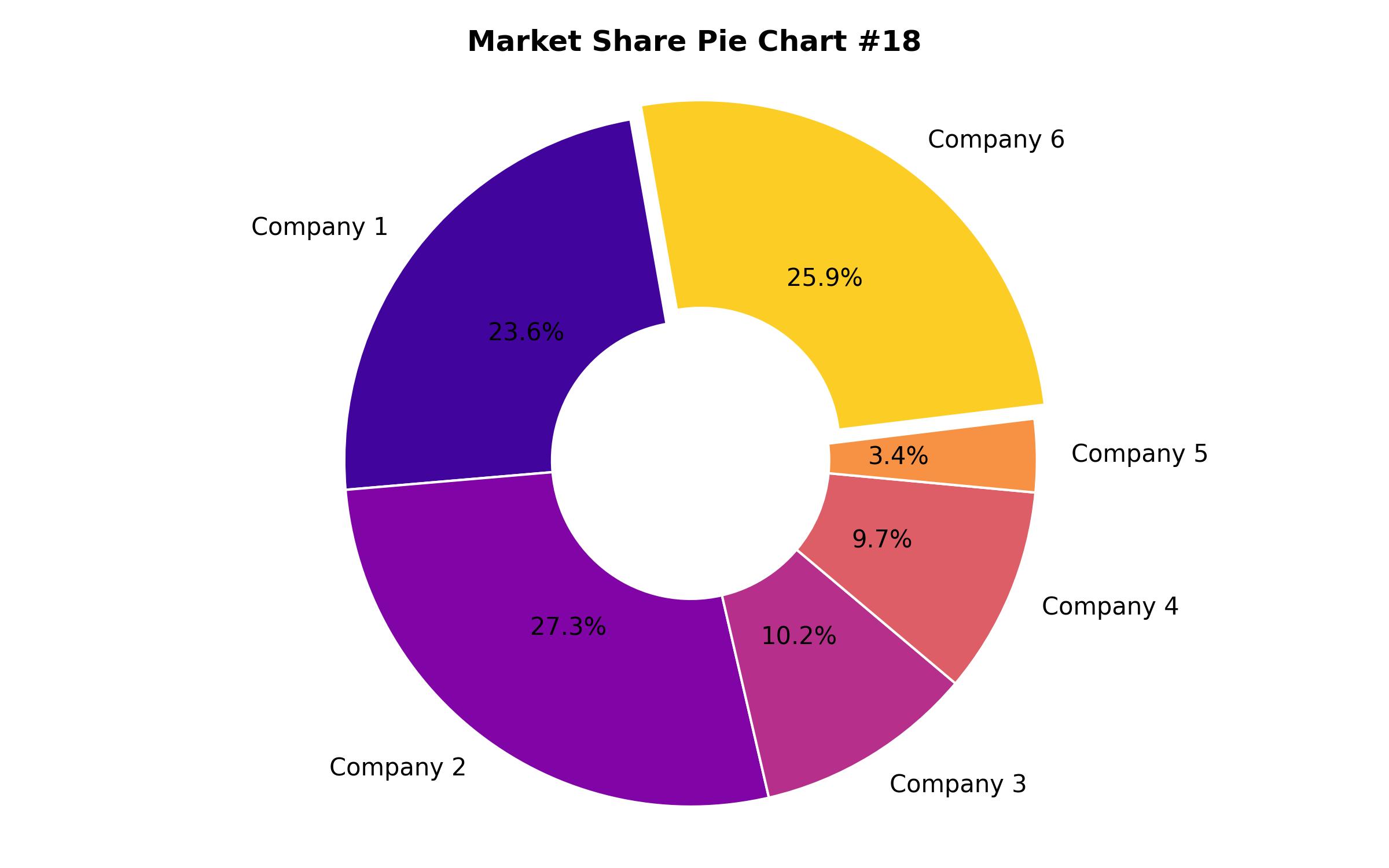

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Technology, purpose, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, South Korea, Japan, China, Australia, New Zealand |

| Key Companies Analyzed | PayPal Holdings Inc., Apple Pay, Google Pay, Samsung Pay, Square (Block Inc.), Alipay, WeChat Pay, Visa Inc., Mastercard Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Technology

- WAP/WEB

- USSD (Unstructured Supplementary Service Data)

- NFC (Near Field Communication)

- QR Code Payment Systems

- SMS

- Bluetooth

- By Purpose

- Money Transfer

- Bill Payment

- Ticketing

- Retail Payments

- Ecommerce

- Other Purposes

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy, Spain)

- Asia-Pacific (China, India, Japan, South Korea, Australia)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Growth Drivers

- Challenges and Restraints

- Risk Assessment

- Industry Shifts (2020-2024) and Future Trends (2025-2035)

- Comparative Market Shift Analysis

- Market Segmentation by Technology

- Market Analysis: WAP/WEB

- Market Analysis: USSD

- Market Analysis: NFC

- Market Analysis: QR Code Payment Systems

- Market Analysis: SMS

- Market Analysis: Bluetooth

- Market Segmentation by Purpose

- Market Analysis: Money Transfer

- Market Analysis: Bill Payment

- Market Analysis: Ticketing

- Market Analysis: Retail Payments

- Market Analysis: Ecommerce

- Market Analysis: Other Purposes

- Regional Analysis

- North America Market Analysis

- Europe Market Analysis

- Asia-Pacific Market Analysis

- Latin America Market Analysis

- Middle East & Africa Market Analysis

- Country-wise Market Projections

- Competitive Landscape

- Company Market Share Analysis

- Key Company Offerings and Activities

- Conclusion and Recommendations

- Research Methodology

- Assumptions and Acronyms