Specialty Chemicals Market for Pulp and Paper Industry Forecast 2025 to 2035

Overview:

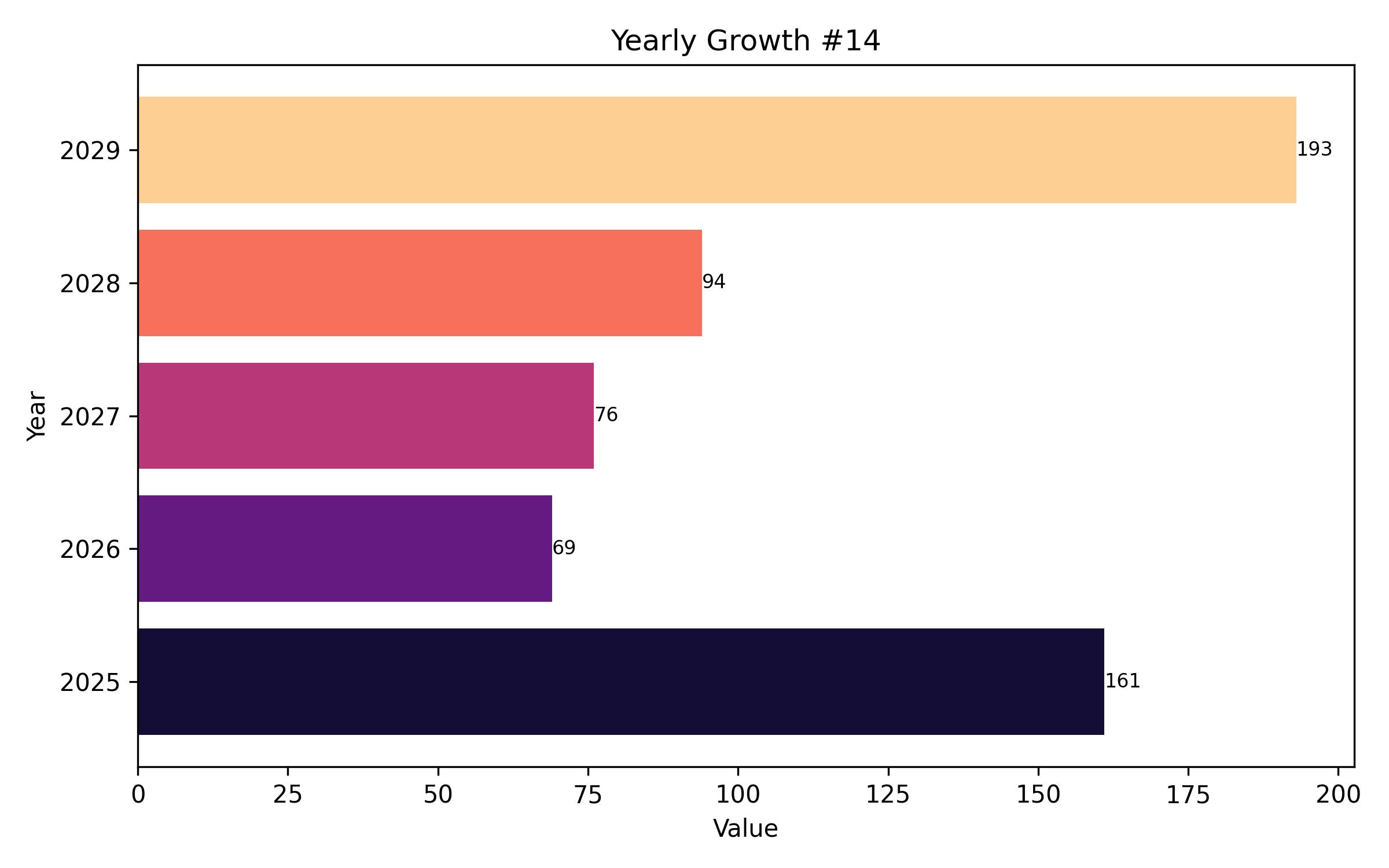

The specialty pulp and paper chemicals market is projected to experience robust expansion, climbing from USD 24.92 billion in 2025 to USD 35.15 billion by 2035. This represents a compound annual growth rate (CAGR) of 3.5% over the decade. Key factors expected to fuel this growth include the increasing focus on sustainable packaging solutions, the burgeoning demand from the e-commerce sector driving packaging needs, and innovations in the field of specialized paper chemicals.

Anticipated steady growth characterizes the market for specialty pulp and paper chemicals from 2025 through 2035. This upward trend is significantly influenced by the rising consumer demand for high-quality and environmentally sound paper products. Innovations in chemical formulations and the adoption of greener manufacturing processes are also critical contributors to this market’s expansion. These specialized chemicals are essential for enhancing paper characteristics such as brightness, print fidelity, and structural integrity, making them indispensable for applications in packaging, printing, and tissue paper production.

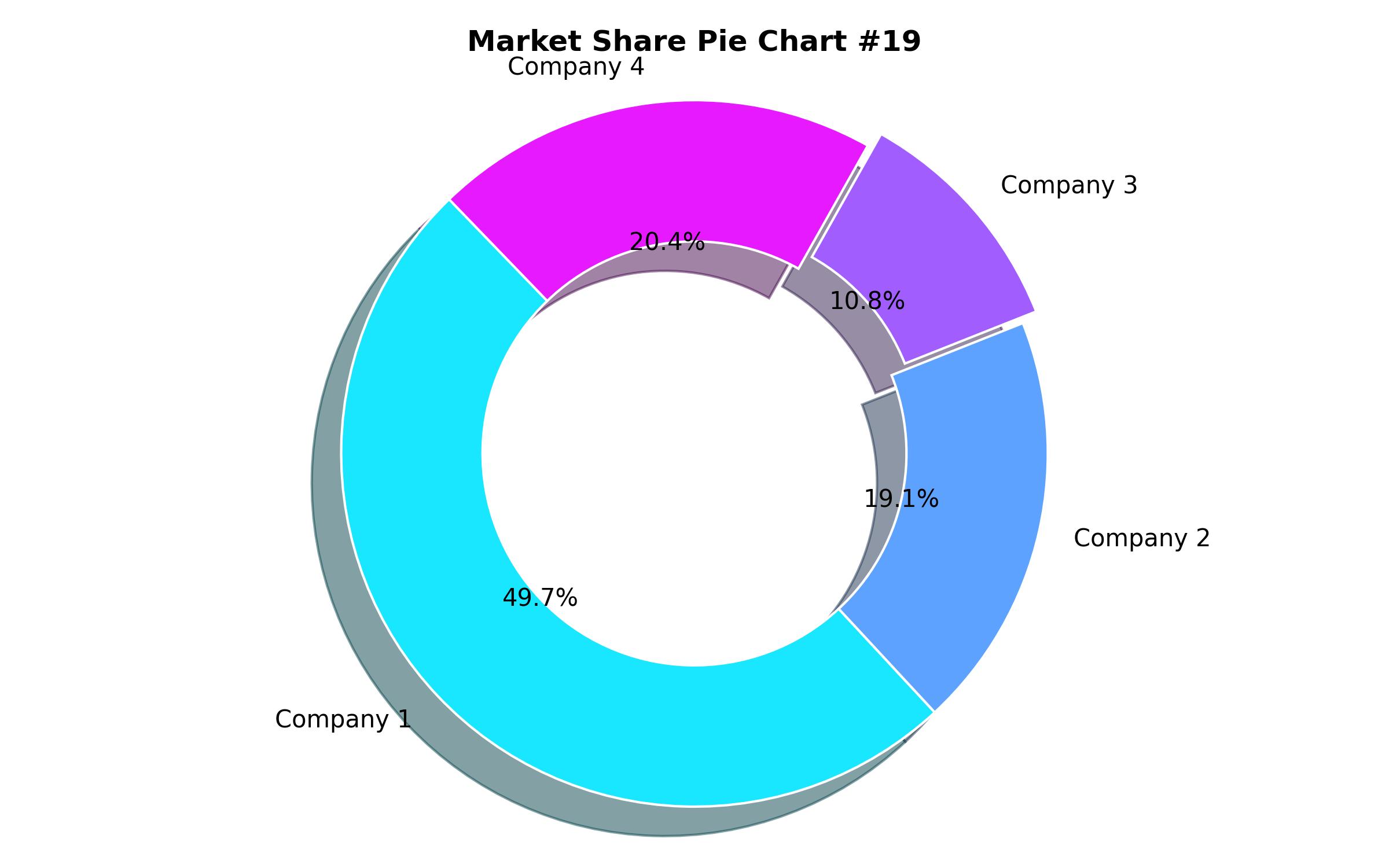

The North American market is a substantial contributor to the global specialty pulp and paper chemicals industry, primarily due to the significant demand for packaging and tissue paper products. The United States holds a leading position in this region, characterized by its emphasis on environmentally conscious paper manufacturing and the implementation of stringent regulations that promote the use of eco-friendly chemicals. Although the digital revolution has reduced the need for traditional printing papers, the surge in online retail has dramatically increased the demand for specialized paper used in packaging.

Europe also plays a vital role, hosting some of the world’s foremost producers of sustainable paper, including countries like Germany, Sweden, and Finland. The market for biodegradable and recycled paper goods within the region is bolstered by strict environmental regulations and a strong commitment to circular economy principles. Furthermore, the application and development of enzymatic and bio-based chemicals for use in paper processing are expected to see considerable growth, pushing the market forward.

The Asia-Pacific region is poised for the most rapid growth, driven by rapid industrialization, increasing urbanization, and a growing need for premium paper items. Advancements in paper manufacturing processes and specialized chemicals are set to boost production in key nations like China, India, and Japan. Increased demand for tissue products, packaging containers, and specialized papers for food and beverage industries, consumer staples, and healthcare applications will also contribute to the industry’s expansion in this area.

However, the market faces challenges. Stricter environmental regulations aiming to curb chemical waste and emissions are expected to constrain growth. The necessity for investment in research and development to transition towards sustainable alternatives and the resulting lack of scale economies can lead to higher production costs. Price volatility of raw materials also poses a risk to market stability.

A significant opportunity lies in the shift towards sustainable and bio-based chemicals. The trend towards green chemistries and environmentally responsible practices is a major force in the specialty pulp and paper chemicals market. Innovations with bio-based and enzymatic chemicals can meet performance requirements while lowering the ecological footprint. Companies that invest in these sustainable solutions and circular economy models are well-positioned for a competitive edge.

The period from 2020 to 2024 saw the market moving towards greener and more sustainable chemicals, influenced by regulations and environmental concerns. Nanotechnology and enzyme-based formulas improved paper properties and production efficiency. The rise of e-commerce and food packaging further propelled market growth.

Looking ahead to 2025-2035, the emphasis will intensify on sustainable, bio-based alternatives to synthetic chemicals. New carbon-neutral production mandates will drive companies to innovative, greener offerings. Smart, functional papers with properties like water resistance and antimicrobial surfaces will gain traction. AI is expected to optimize chemical processes, and improved recycling will yield better outcomes.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 24.92 Billion |

| Revenue Forecast for 2035 | USD 35.15 Billion |

| Growth Rate (CAGR) | 3.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD Million/Billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Type, application, process, end use industry, and region |

| Regional Scope | North America, Latin America, Europe, East Asia, South Asia, Oceania, MEA |

| Country Scope | U.S., Canada, Brazil, Mexico, Germany, UK, France, Italy, China, Japan, South Korea, India, Thailand, Australia, New Zealand, GCC Countries, South Africa |

| Key Companies Analyzed | BASF SE, Kemira Oyj, Solenis LLC, Dow Chemical Company, Ashland Global Holdings, Clariant AG, Buckman Laboratories International, SNF Floerger, Harima Chemicals Group, Evonik Industries AG |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Functional Chemicals

- Bleaching & Filler Chemicals

- Process Chemicals

- Coating Chemicals

- By Application

- Printing Paper

- Packaging

- Tissue Paper

- Specialty Paper

- By Process

- Groundwood Pulping

- Chemical Pulping

- Recycled Fiber Pulping

- Other Pulping Processes

- By End Use Industry

- Printing and Publishing

- Food and Beverages Packaging

- Consumer Goods Packaging

- Healthcare and Hygiene

- By Region

- North America (U.S., Canada)

- Latin America (Brazil, Mexico)

- Europe (Germany, UK, France, Italy)

- East Asia (China, Japan, South Korea)

- South Asia (India, Thailand)

- Oceania (Australia, New Zealand)

- Middle East and Africa (GCC Countries, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Dynamics

- Global Market Analysis 2020-2024 and Forecast

2025-2035 - Market Trends and Developments

- Policy and Regulatory Landscape

- Value Chain Analysis

- Price Trend Analysis

- Market Analysis 2020-2024 and Forecast

2025-2035, By Product Type - Functional Chemicals

- Bleaching & Filler Chemicals

- Process Chemicals

- Coating Chemicals

- Market Analysis 2020-2024 and Forecast

2025-2035, By Application - Printing Paper

- Packaging

- Tissue Paper

- Specialty Paper

- Market Analysis 2020-2024 and Forecast

2025-2035, By Process - Groundwood Pulping

- Chemical Pulping

- Recycled Fiber Pulping

- Other Pulping Processes

- Market Analysis 2020-2024 and Forecast

2025-2035, By End Use Industry - Printing and Publishing

- Food and Beverages Packaging

- Consumer Goods Packaging

- Healthcare and Hygiene

- North America Market Analysis 2020-2024 and Forecast

2025-2035 - Europe Market Analysis 2020-2024 and Forecast

2025-2035 - Asia Pacific Market Analysis 2020-2024 and Forecast

2025-2035 - Latin America Market Analysis 2020-2024 and Forecast

2025-2035 - Middle East and Africa Market Analysis 2020-2024 and Forecast

2025-2035 - Emerging Countries Market Analysis 2020-2024 and Forecast

2025-2035 - Competition Landscape

- Market Share Analysis

- Company Profiles

- BASF SE

- Kemira Oyj

- Solenis LLC

- Dow Chemical Company

- Ashland Global Holdings

- Other Key Players

- Assumptions and Acronyms

- Research Methodology