Operational Technology Market Dynamics: Analyzing Growth Opportunities and Future Trajectories from 2025 to 2035

Overview:

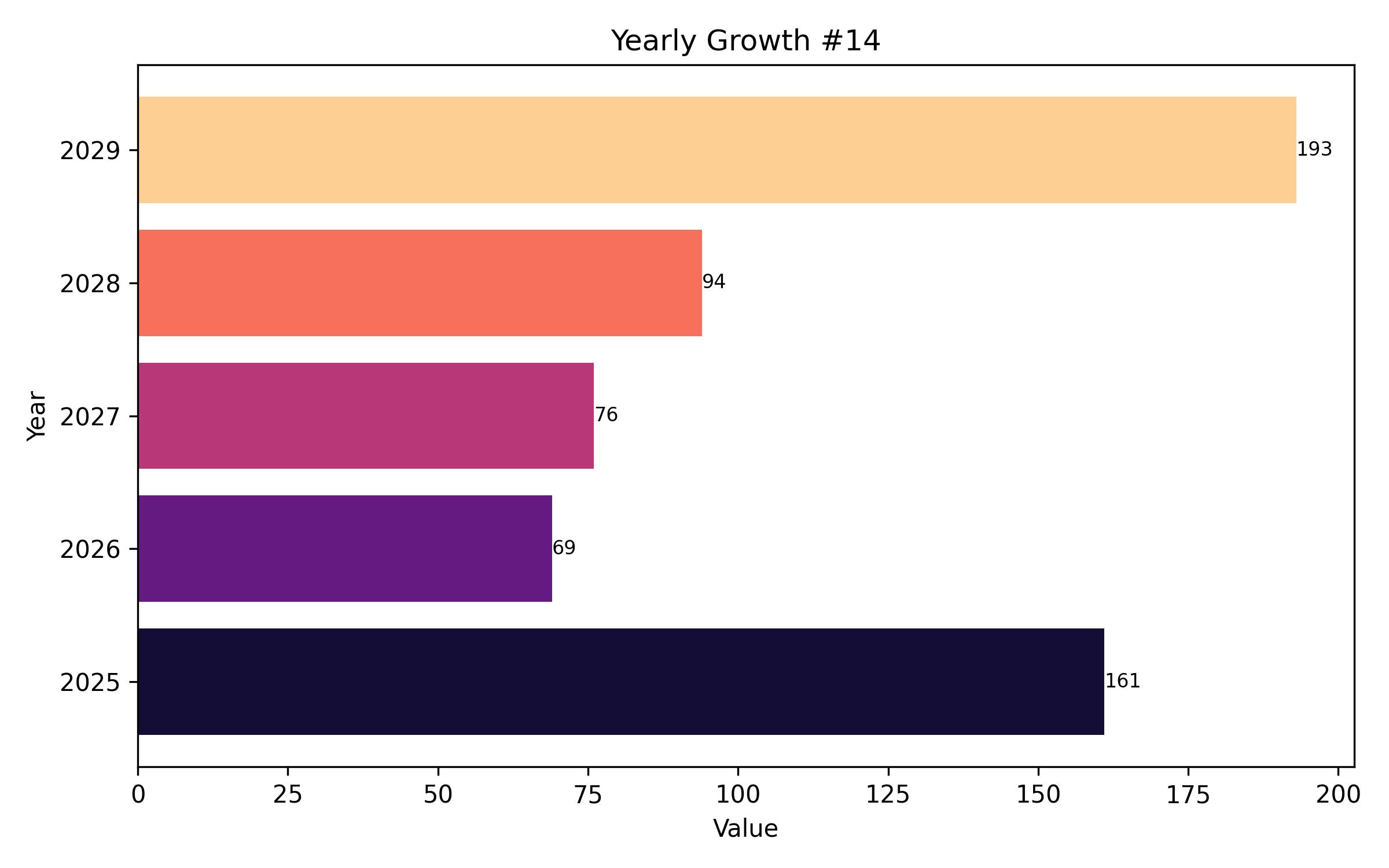

The operational technology (OT) market is poised for substantial expansion between 2025 and 2035, driven by accelerated industrial automation adoption, rising emphasis on cybersecurity, and the proliferation of Internet of Things (IoT) solutions. The market is estimated to be valued at approximately USD 27.1 billion in 2025, projecting robust growth to USD 132.8 billion by 2035, demonstrating a compelling compound annual growth rate (CAGR) of 18.1% across the forecast period.

Several key factors underpin this significant market shift. A primary driver is the increasing connectivity between physical devices and digital systems, leading to enhanced productivity and efficiency across diverse sectors. OT solutions are rapidly becoming foundational elements within key industries including manufacturing, energy production, transportation networks, and critical infrastructure.

For example, advanced smart grid technologies employ operational technology to streamline the distribution of electricity, conserve energy resources, and ensure grid stability. However, the interconnected nature of modern OT networks introduces heightened cybersecurity concerns, exposing these systems to potential vulnerabilities and malicious attacks.

Consequently, organizations are allocating substantial capital towards bolstering their security infrastructure. This focused investment aims to protect essential operational equipment and systems without compromising performance or continuity.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 27,050 million |

| Industry Value (2035F) | USD 132,800 million |

| CAGR (2025 to 2035) | 18.1% |

The market also exhibits segmentation across solution and application tiers within operational technology frameworks. Industrial control systems (ICS), supervisory control and data acquisition (SCADA), and distributed control systems (DCS) represent significant forces propelling OT integration. ICS solutions are widely implemented in manufacturing environments to automate processes, minimize downtime, and enhance safety protocols.

SCADA systems offer real-time monitoring and control functionalities, essential for environments such as oil and gas production facilities and water treatment plants. Distributed Control Systems, conversely, facilitate comprehensive industrial process automation, emphasizing improved efficiency and precision. Furthermore, OT services are increasingly vital in enabling smart city initiatives, leveraging real-time data for applications like traffic flow analysis, monitoring, and optimizing utility service provision.

North America holds a leading position in the operational technology landscape, marked by the widespread integration of automation into industrial and infrastructure sectors. The region, particularly the United States and Canada, is at the forefront of adopting Industry 4.0 principles, integrating OT systems with technologies such as artificial intelligence and the Internet of Things.

For instance, the energy sector extensively utilizes SCADA and ICS for remotely monitoring infrastructure like pipelines, enhancing safety measures, and improving extraction process yields. Alongside this sector-specific application, the escalating frequency of cyber threats is prompting businesses to make considerable investments in comprehensive OT cybersecurity solutions to safeguard their systems against future attacks.

A notable trend in North America involves the application of OT combined with data analytics for predictive maintenance. Organizations are employing real-time condition monitoring techniques to anticipate potential equipment failures before they occur, thereby reducing costly downtime and cutting operational expenses. This approach is particularly prevalent in industries like aerospace and automotive manufacturing, where sustained equipment uptime is directly correlated with productivity.

Europe represents another significant contributor to the operational technology market, with particularly high demand observed in the markets of Germany, the United Kingdom, and France. The automotive industry, exemplified by major manufacturers, is a substantial consumer of OT solutions, utilizing advanced robotics, AI-driven automation, and sophisticated predictive analytics to optimize manufacturing workflows.

Another major catalyst in Europe is the ongoing transition towards clean energy sources and the development of smart infrastructure. Countries such as Denmark and the Netherlands are increasingly integrating OT solutions into wind farm operations and smart grid networks to facilitate effective load balancing and optimize power distribution. Additionally, stringent European Union cybersecurity regulations, such as the NIS2 Directive, are compelling organizations to enhance their OT security postures to ensure regulatory compliance and strengthen protections against potential threats.

The Asia-Pacific region is expected to demonstrate the most vigorous expansion in operational technology adoption, a trajectory fueled by rapid industrialization, increasing urbanization, and widespread industry digitalization. Countries including China, India, Japan, and South Korea are prominent leaders in integrating OT, with China spearheading this trend through substantial investments in smart manufacturing initiatives, industrial automation leveraging 5G technology, and extensive infrastructure development projects.

China’s Belt and Road Initiative, for example, is a major driver of OT deployment across the transportation and logistics sectors, leading to the implementation of more sophisticated monitoring infrastructure for roadways, railways, and port facilities. India’s government-supported ‘Make in India’ program, aimed at boosting domestic manufacturing, is seeing increased application of SCADA and DCS technologies to streamline factory productivity and optimize resource utilization. Furthermore, Japan’s advanced robotics sector is leveraging advancements in OT to enhance precision manufacturing processes in power electronics and semiconductor production.

Despite this strong market momentum, challenges persist, including the integration of legacy systems, managing cybersecurity risks, and the high costs associated with implementing these technologies. Governments in the region are actively addressing these hurdles by promoting digital transformation initiatives and offering financial incentives to businesses for developing their OT infrastructure.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 27.1 billion |

| Revenue Forecast for 2035 | USD 132.8 billion |

| Growth Rate (CAGR) | 18.1% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

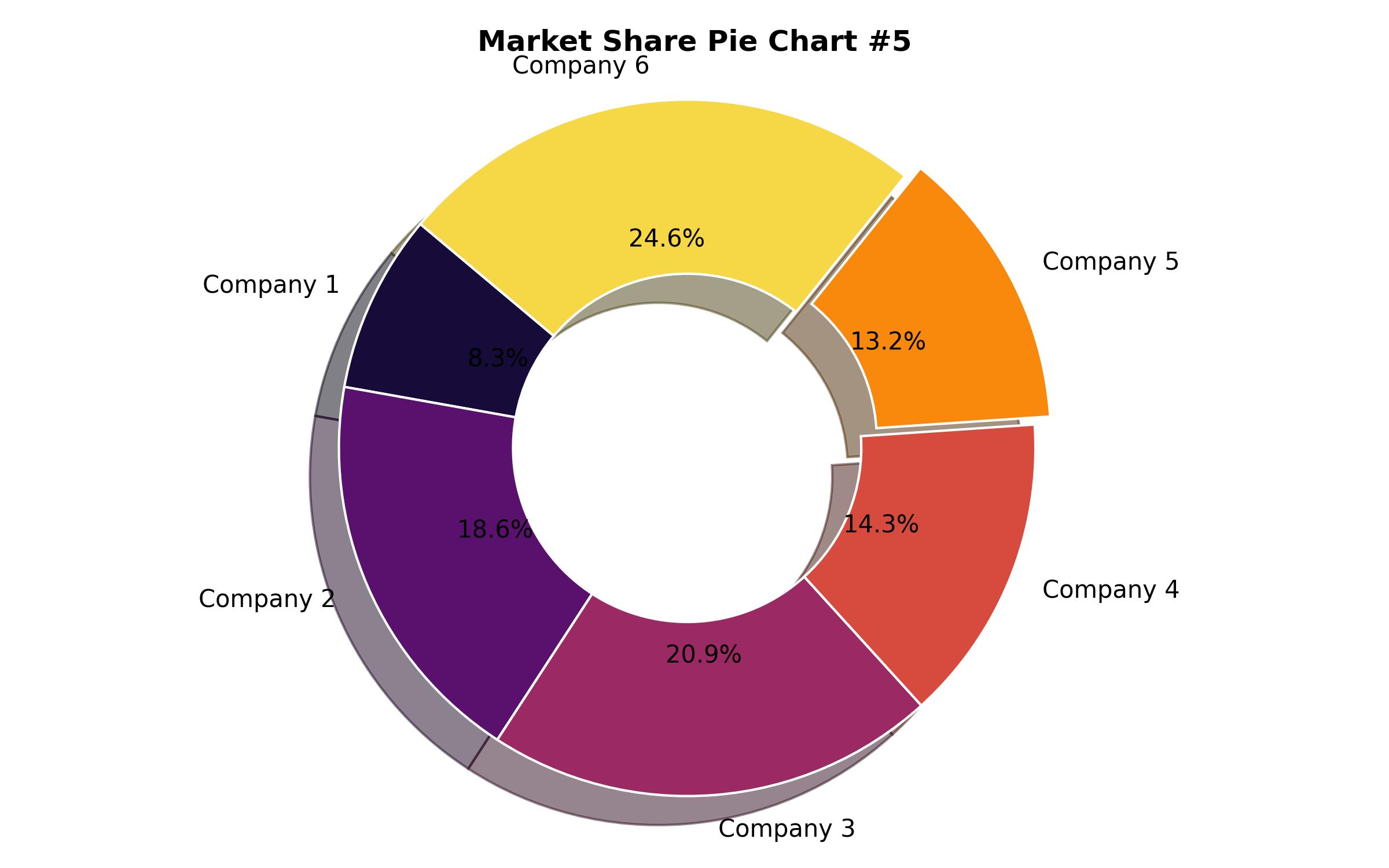

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Component, Technology, Industry, Deployment Type, Enterprise Size |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, UK, Germany, France, Italy, China, Japan, South Korea, India, Brazil, Mexico, GCC Countries, South Africa |

| Key Companies Analyzed | Siemens AG, Rockwell Automation, Schneider Electric, Honeywell International, ABB Ltd., Emerson Electric Co., Mitsubishi Electric Corporation, Yokogawa Electric Corporation, General Electric (GE), Palo Alto Networks, Fortinet Inc., Check Point Software Technologies, Belden Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Component

- Hardware

- Software

- Services

- By Technology

- SCADA Systems

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Manufacturing Execution Systems (MES)

- Human-Machine Interface (HMI)

- Industrial Cybersecurity

- Plant Asset Management (PAM)

- Functional Safety

- Building Management Systems (BMS)

- Variable Frequency Drives (VFD)

- Computer Numerical Control (CNC) Systems

- By Industry

- Oil & Gas

- Manufacturing

- Energy & Power

- Transportation

- Water & Wastewater Treatment

- Mining & Metals

- Aerospace & Defense

- Healthcare

- By Deployment Type

- On-premises

- Cloud-based

- By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- By Region

- North America (U.S., Canada)

- Europe (UK, Germany, France, Italy)

- Asia Pacific (China, Japan, South Korea, India)

- Latin America (Brazil, Mexico)

- Middle East & Africa (GCC Countries, South Africa)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Industry Background

- Market Analysis 2025 to 2035, By Component

- Hardware

- Software

- Services

- Market Analysis 2025 to 2035, By Technology

- SCADA Systems

- Distributed Control Systems (DCS)

- Programmable Logic Controllers (PLC)

- Manufacturing Execution Systems (MES)

- Human-Machine Interface (HMI)

- Industrial Cybersecurity

- Plant Asset Management (PAM)

- Functional Safety

- Building Management Systems (BMS)

- Variable Frequency Drives (VFD)

- Computer Numerical Control (CNC) Systems

- Market Analysis 2025 to 2035, By Industry

- Oil & Gas

- Manufacturing

- Energy & Power

- Transportation

- Water & Wastewater Treatment

- Mining & Metals

- Aerospace & Defense

- Healthcare

- Market Analysis 2025 to 2035, By Deployment Type

- On-premises

- Cloud-based

- Market Analysis 2025 to 2035, By Enterprise Size

- Large Enterprises

- Small and Medium-sized Enterprises (SMEs)

- Market Analysis 2025 to 2035, By Region

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2025 to 2035

- Europe Market Analysis 2025 to 2035

- Asia Pacific Market Analysis 2025 to 2035

- Latin America Market Analysis 2025 to 2035

- Middle East & Africa Market Analysis 2025 to 2035

- Market Structure Analysis

- Competition Analysis

- Siemens AG

- Rockwell Automation

- Schneider Electric

- Honeywell International

- ABB Ltd.

- Other Key Players

- Assumptions and Acronyms

- Research Methodology