Future Market Insights: United States Countertop Market Projections and Demand Forecast (2025-2035)

Overview:

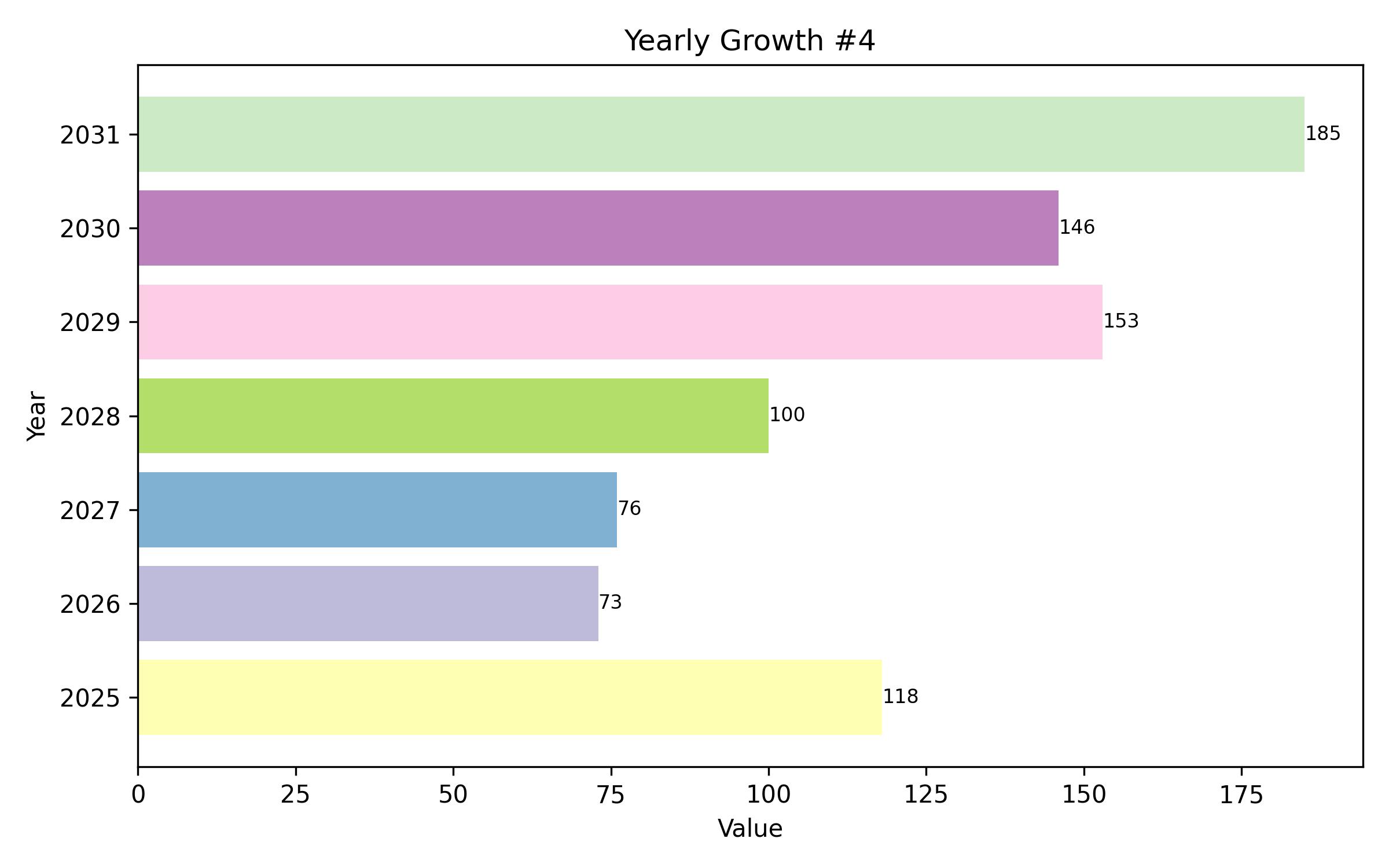

The countertop market in the United States is projected to reach a valuation of USD 87.1 billion in 2025. Anticipated to exhibit a steady compound annual growth rate (CAGR) of 6.3% over the decade, the market is forecast to achieve a value of USD 158.9 billion by the year 2035.

During the past year, the US countertop sector maintained upward momentum, significantly influenced by increased activity in both residential and commercial renovation projects. Despite elevated borrowing costs, the housing sector spurred substantial remodeling as property owners prioritized enhancing existing residences over purchasing new ones.

Engineered quartz surfaces witnessed a major uptake, driven by consumer preference for minimal maintenance and enhanced durability. This trend prompted manufacturers to scale up production, responding to the growing focus on resilient and sustainably engineered products. Early supply chain issues eased throughout the year, leading to improved stock management and more predictable order fulfillment times. Demand for high-end options, like natural stone and custom surfaces, also climbed, reflecting greater investment in premium kitchen and bath upgrades by affluent consumers.

Future projections indicate continued robust expansion through the forecast period of 2025 through 2035. Urbanization and ongoing commercial development initiatives will especially boost demand in retail and hospitality sectors. Advancements such as antimicrobial and self-healing surface technologies are expected to gain wider acceptance. Materials derived from recycled content and bio-based compounds are also anticipated shaping future market trends. Notwithstanding potential economic fluctuations, the countertop sector is positioned for substantial development, fueled by material innovation and changing purchasing patterns.

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 87.1 billion |

| Industry Value (2035F) | USD 158.9 billion |

| CAGR (2025 to 2035) | 6.3% |

Industry analysis confirms the positive growth trajectory in the US countertop industry, propelled by robust home refurbishments, new commercial builds, and increasing consumer preference for lasting, eco-conscious materials. Companies specializing in quartz, composite stone, and sustainable solutions are well-positioned, while traditional laminate manufacturers may need to adapt as preferences shift. With an estimated 6.3% CAGR, businesses prioritizing development and premium materials are set for consistent achievement.

Top 3 Strategic Imperatives for Stakeholders

Investments should focus on high-performance and sustainable materials. Executives must prioritize research, development, and manufacturing capacity for engineered quartz, recycled substance, and organic-based countertops to address rising expectations for durability and eco-friendly solutions. Extending portfolios with antimicrobial and self-healing features will also confer a competitive edge.

Enhancing supply chain resilience and cost efficiency is crucial. Companies should increase local sourcing, diversify vendor networks, and invest in process automation to reduce vulnerability to material shortfalls and escalating production expenses. Aligning operations with just-in-time inventory methods will improve both profitability and client satisfaction levels.

Strengthening strategic alliances and distribution channels is vital. To broaden market reach, companies can form relationships with major home renovation retailers, online platforms, and direct-to-consumer models. Exploring acquisition opportunities in niche bespoke fabricators or tech-centered startups has the potential to accelerate expansion and material innovation.

Top 3 Risks Stakeholders Should Monitor

| Risk | Probability & Impact |

|---|---|

| Raw Material Price Volatility | High Probability, High Impact |

| Shifts in Consumer Preferences | Medium Probability, High Impact |

| Regulatory & Sustainability Compliance | Medium Probability, Medium Impact |

1-year Executive Watchlist

| Priority | Immediate Action |

|---|---|

| Sustainable Material Expansion | Conduct a feasibility study on scaling recycled and bio-based countertops |

| Consumer-Centric Product Innovation | Initiate OEM and retailer feedback loop on demand for antimicrobial and self-healing surfaces. |

| Market Penetration & Distribution Growth | Launch an incentive pilot for aftermarket channel partners to boost premium product adoption |

For the Boardroom

To maintain competitiveness in the shifting countertop sector, sustained investment is critical in eco-conscious materials, cutting-edge surface technology, and strategic alliances. As consumer demand leans towards sustainable and resilient surfaces, the approach should center on research and development for antimicrobial and restorative surfaces, reinforcing local vendor networks, and implementing diverse distribution models.

Immediate priorities include securing essential vendor relationships, refining direct-to-customer offerings, and leveraging mergers and acquisitions to fuel material advancement. This market insight indicates a shift from price-driven competition to value-based differentiation, requiring quick adaptation to capitalize on emerging sector opportunities ahead of rivals.

Future Market Insights Survey with the United States Countertop Market

Surveyed Q4 2024, n=500 stakeholders, evenly distributed across manufacturers, distributors, retailers, homebuilders, and consumers in the USA.

Key Priorities of Stakeholders

- Durability & Material Innovation: 81% of participants identified durability (including scratch, heat, and stain resistance) as a “critical” consideration in their countertop purchase.

- Sustainability Demand: 74% of stakeholders highlighted the importance of recycled content and low-carbon manufacturing, with builders and commercial purchasers driving this trend.

- Consumer Aesthetic Preferences: 67% of retailers reported an increase in demand for natural stone looks, including marble and quartzite finishes, even within engineered products.

Regional Variance:

- West Coast: 76% of homebuilders mentioned eco-friendly certifications (such as LEED compliance) as a selling feature.

- Midwest: 60% of distributors reported heightened demand for laminate and budget-friendly surfaces due to the high cost of home renovations.

- Southeast: 65% of manufacturers reported significant growth in antimicrobial countertop coatings, particularly in commercial kitchens.

Technology & Smart Countertops

- High Adoption in Luxury & Commercial Segments: 57% of upscale homebuilders incorporated embedded charging, touch-activated lighting, and antimicrobial coatings.

- Slow Consumer Adoption: Only 29% of direct-to-consumer sales included smart countertop features, with cost cited as a primary deterrent.

- Retail & Hospitality Surge: 66% of commercial customers (hotels, restaurants) aimed to implement self-cleaning, high-duration surfaces by 2026.

Material Choices & Price Sensitivity

Consensus:

- Quartz: 70% of buyers’ first choice due to the blend of durability, looks, and ease of maintenance.

- Granite & Marble: 49% of customers continue to prefer natural stone in spite of the increased need for maintenance.

- Laminate: 43% opted for affordable options, with sharp growth in the Midwest and Southern markets.

Variance:

- Eco-Friendly Materials: 54% of West Coast contractors prefer recycled and carbon-friendly surfaces, compared to 30% nationwide.

- Concerns over Affordability: 69% of consumers stated that price hikes exceeding 10% on premium products could prompt them to opt for budget options.

Supply Chain & Distribution Challenges

- Manufacturers: 60% indicated that increased raw material costs (quartz up 21%, granite up 16%) affected profit margins.

- Distributors: 51% experienced increased lead times (5-7 weeks) for imported stone due to disruptions in global supply chains.

- Retailers: 46% reported having trouble keeping inventory ranges, which made consumers settle for fewer choices.

Priorities for Future Investment

- Automation & Efficiency: 73% of manufacturers intended to invest in automated cutting and finishing machinery to minimize waste and reliance on labor.

- Sustainability & Circular Economy: 61% of stakeholders anticipated increases in the use of recycled countertops and carbon-free production.

- Customization and Modular Design: 56% of retailers mentioned a rising demand for custom-cut, mix-and-match countertop products.

Regulatory & Compliance Factors

- EPA & Sustainability Regulations: 65% of the manufacturers specified new VOC emission regulations as a compliance issue.

- California & New York Legislation: 70% of the suppliers observed state-building codes impacting material selections.

- National Code Variability: 43% of industry players observed varying state regulations, which caused distribution inefficiencies.

Conclusion: Market Shifts & Strategic Insights

- Robust Consensus: Consumers are driving the USA countertop market with demands for durability, sustainability, and affordability.

- Critical Regional Differences: West Coast is ahead of the curve on green materials, the Midwest is focused on cost-effective solutions, and the Southeast is embracing antimicrobial coatings at a faster pace.

- Strategic Insight: Product offerings must be tailored by region for manufacturers and distributors, considering cost, sustainability, and technology to achieve optimal market penetration.

Government Regulations

| Sub-regions | Policies, Regulations, and Certifications |

|---|---|

| West United States |

|

| Midwest United States |

|

| Northeast United States |

|

| South United States |

|

Sub-region-wise Analysis

West United States

The West region, encompassing states such as California, is projected to experience a compound annual growth rate (CAGR) of approximately 6.9% between 2025 and 2035. California’s market size is expected to grow substantially, driven by strong real estate development and new residential construction. The region’s emphasis on green building practices and sustainable materials further boosts the demand for advanced countertop solutions.

FMI anticipates sales of countertops in the Western United States will expand at almost 7.0% CAGR over the period spanning 2025 through 2035.

Midwest United States

The Midwest market is expected to experience a consistent compound annual growth rate (CAGR) of approximately 6.0% throughout the forecast period. This is fueled by a stable property market and increasing renovation rates in states like Illinois and Ohio. Consumers in the Midwest favor durable yet cost-effective materials, leading to heightened demand for engineered stone and laminate surfaces.

FMI predicts countertop sales in the Midwest United States will see growth approaching 6.4% CAGR over the timeframe from 2025 to 2035.

Northeast United States

The Northeast, including states like New York, has a countertop market projected to expand at a compound annual growth rate (CAGR) of around 7.2% from 2025 through 2035. Dynamic urban centers and high-end residential construction in the region drive the need for premium materials such as granite and quartz. This robust expansion is rooted in the affluent consumer base and the prominent focus on luxury design in the area.

FMI expects countertop sales in the Northeast United States market to increase at a rate near 6.2% CAGR from 2025 until 2035.

South United States

The Southern market is anticipated to grow at a compound annual growth rate (CAGR) of approximately 6.5% during the forecast period. States like Texas and Florida are experiencing rapid population growth and increased urbanization, resulting in higher levels of residential construction and renovation activities. Demand in this area is characterized by a mix of traditional and modern aesthetics, with an increasing preference for engineered quartz and solid surface countertops due to their versatility and resilience.

FMI believes countertop sales across the Southern United States will record growth close to 7.1% CAGR through the period of 2025 to 2035.

Segmentation-wise Analysis

By Material Type

Granite, a visually appealing material known for its strength, remains a preferred choice for premium homes and commercial properties. Through the forecast period from 2025 to 2035, granite surfaces are expected to sustain popularity, though environmental concerns and extraction costs may limit their use in regions prioritizing sustainability. In response, manufacturers are developing pre-finished and engineered granite products to reduce maintenance needs and increase longevity.

Solid surface materials, primarily composed of acrylic, polyester, and natural minerals, are forecast to maintain steady growth. They offer a smooth aesthetic and can be shaped into custom forms. Being non-porous, they are highly suitable for environments demanding rigorous cleanliness, such as healthcare facilities, hotels, and food establishments. The introduction of new antibacterial features will further boost their appeal, especially in sectors with stringent hygiene standards.

Laminates represent an economical option for budget-conscious homeowners and businesses. Advancements in high-pressure laminates, offering improved impact resistance, water durability, and aesthetic possibilities, are anticipated to drive substantial progress over the next decade. They can convincingly replicate the appearance of more expensive materials, including marble and wood, at a much lower expense, making them attractive for use in rental properties, office settings, and multi-unit residential buildings.

Engineered quartz has emerged as a preferred material due to its blend of aesthetic appeal, lasting durability, and simple upkeep. With concerns surrounding silica dust during manufacturing, industry participants are focusing on safer, lower-silica formulations. Its non-absorbent nature and extensive selection of colors will continue to fuel demand across both residential and business installations. Increased domestic production in Europe and North America is expected to reduce reliance on imported goods, bolstering the growth of local markets.

Marble will continue to serve as a premium selection for high-end residential projects and exclusive office spaces. Despite its undeniable beauty, marble’s vulnerability to stains and scratches limits its suitability for high-traffic zones. Progress in surface treatments and composite marble products is gaining traction as a mitigation strategy. Simultaneously, demand for domestically sourced marble in Europe is growing, promoting more sustainable practices within the stone industry.

Natural materials, including slate, soapstone, and limestone, are expected to see moderate expansion as consumers who prioritize ecological considerations increasingly value their inherent and unique characteristics. The opportunity to acquire stone quarried locally will become a notable factor, especially in areas focused on minimizing their environmental footprint. Enhancements in surface treatment techniques will increase the resilience and durability of these stones, positioning them as credible alternatives to manufactured items.

Polymers and composites will gain market share due to their reduced weight, simplified installation, and lower cost compared to natural stone. Materials incorporating recycled glass, salvaged stone, and resin-based composites will appeal to buyers with environmental concerns. The integration of functionalities like self-healing surfaces and smart technology will open up new design opportunities for contemporary offices and kitchens.

Metal countertops, including stainless steel, copper, and aluminum, will become more prevalent in industrial kitchens, contemporary residences, and upscale commercial establishments. Stainless steel remains a primary selection in food service and medical facilities owing to its outstanding sanitation properties and resistance to heat. Copper and brass, known for their inherent antibacterial qualities, are being considered for use in high-end eateries and bar areas. Sustainable construction projects will aim to utilize recycled metal surfaces as a component of their eco-friendly building practices.

By End Use

Growth in new residential construction is increasing the need for robust and attractive countertop materials. Engineered quartz is highly sought after due to its resilience and broad range of designs, appearing frequently in contemporary homes. Luxury residences will continue to favor natural granite and marble.

Home modernization continues its upward trend, with kitchen and bathroom remodels attracting significant investment. Engineered quartz and solid surfaces are growing in popularity for their straightforward installation and low maintenance needs. For cost-effective and rapid renovations, laminates remain a leading choice, while metal and natural stone are in demand for high-end transformations. With property values rising, homeowners are also electing premium countertops to improve their home’s marketability.

Demand is increasing within commercial structures for highly durable and resilient surfaces suitable for hospitals, hotels, and office environments. Seamless and hygienic solid surfaces are perfectly suited for healthcare and food preparation areas. Office and retail spaces favor engineered quartz and sintered stone for their visually appealing appearance and long-lasting durability. Metal will continue to be utilized in restaurant and industrial kitchens, while natural stone and composite materials find use in specialized commercial settings.

Corporate refurbishments, hospitality sector updates, and institutional upgrades are driving non-residential remodeling projects. High-traffic locations like eateries, transportation hubs, and retail centers are choosing engineered quartz and solid surfaces due to their resistance to discoloration and impacts. Laminates are still the budget-friendly choice for retail and office modernizations, while high-end spaces maintain preference for marble and natural stone. Recent advances in antimicrobial and self-repairing technologies are influencing selections in healthcare and lodging facilities.

Competitive Landscape

The United States countertop market is intensely competitive, featuring both major global corporations and local providers vying for significant market share.

Key players in the sector employ competitive pricing strategies, focus on continuous product enhancement, form strategic alliances, and pursue geographical expansion. Their initiatives involve expanding manufacturing capabilities to satisfy increasing demand, investing in research for improved and sustainable countertop materials, and reinforcing distribution channels to deepen market penetration in various regions.

Notable incidents occurred throughout 2024 within the sector. In November 2024, Quikrete Holdings, Inc., a major producer of concrete goods, announced plans to acquire Summit Materials, Inc. for USD 11.8 billion. This transaction is expected to boost Quikrete’s operational efficiency and enhance its market presence within the construction materials segment.

Furthermore, in December 2024, Future Market Insights documented substantial growth in the USA countertop market, attributing it to the swift expansion of the residential construction sector and a growing preference for engineered quartz surfaces. Technological advancements have facilitated the introduction of bespoke, heat-tolerant, and antibacterial surfaces, catering to the rising popularity of smart kitchens and adaptable designs.

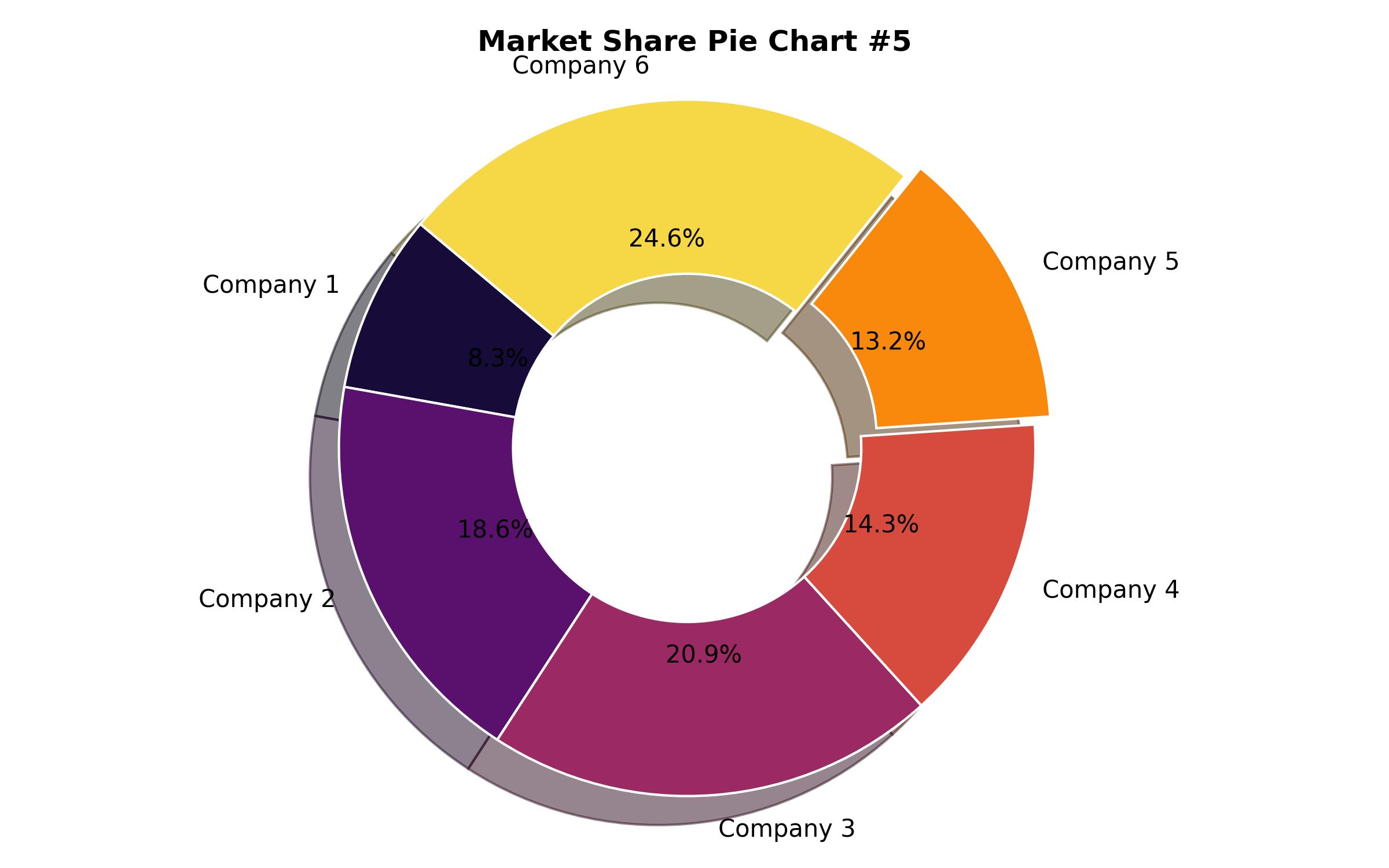

Major Share Analysis

- Cosentino Group leads the USA countertop market, projected to command about 17-19% share in 2025, maintaining its leading position with popular lines like Silestone and Dekton.

- Caesarstone is expected to hold around 14-16% market share in 2025, showing a slight increase from its 2023 figures, aided by expanded distribution and innovative product launches in engineered stone.

- Cambria Company is estimated to account for 13-15% of the USA countertop market in 2025, bolstered by its premium engineered quartz surfaces and domestic production strategy.

- Wilsonart International is anticipated to grasp approximately 11-13% market share in 2025, leveraging its core strengths in laminate and solid surface offerings for both residential and commercial applications.

- LG Hausys, now operating as LX Hausys, is set to maintain roughly 9-11% market share in 2025, actively growing its presence in the engineered stone and solid surface categories.

- MSI (M S International) is forecast to secure about 8-10% market share in 2025, driven by its extensive portfolio covering natural stone, quartz, and porcelain.

- Formica Corporation is estimated to hold a market share of around 6-8% in 2025, primarily focusing on laminate countertop products catering to budget-conscious consumers.

- The remaining market share (approximately 21-28%) is distributed among many smaller producers, regional fabricators, and specialized companies serving specific industry niches.

Key Companies

- Cosentino Group (Silestone, Dekton)

- Caesarstone

- Cambria Company

- Wilsonart International

- LX Hausys (formerly LG Hausys)

- MSI (M S International)

- Formica Corporation

- DuPont (Corian)

- Daltile

- Mohawk Industries

- Lotte Chemical (Staron)

- Hanwha Surfaces (HanStone)

- Anatolia Tile & Stone

- Arborite

- Aristech Surfaces

- Compac

- Evonik Industries

- Ecostone

- Hyundai L&C

- NatureKast

- Neolith

- The Marble Factory

- Arizona Tile

- Viatera

- Stone Source

- PentalQuartz

- Vicostone

- Corian Design

- Sapienstone

Frequently Asked Questions

What are the key factors driving the growth of the countertop industry?

Rising demand and increased renovations.

Which countertop materials are expected to see the highest demand in the coming years?

Engineered quartz, solid surfaces, and composites.

How are companies in this industry staying competitive?

Innovation, acquisitions, and partnerships.

What challenges does the countertop industry face?

Material costs, regulations, and labor shortages.

How is sustainability influencing the countertop industry?

Demand for recycled and eco-friendly materials.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 87.1 billion |

| Revenue Forecast for 2035 | USD 158.9 billion |

| Growth Rate (CAGR) | 6.3% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Material Type, End-use, and Region |

| Regional Scope | United States (West, Midwest, Northeast, South) |

| Country Scope | U.S. (California, Illinois, Ohio, New York, Texas, Florida and others) |

| Key Companies Analyzed | Cosentino Group; Caesarstone; Cambria Company; Wilsonart International; LX Hausys; MSI (M S International); Formica Corporation; DuPont; Daltile; Mohawk Industries |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Material Type

- Granite

- Solid Surface

- Laminate

- Engineered Quartz

- Marble

- Natural Materials

- Polymers and Composites

- Metal

- By End Use

- New Residential

- Renovation Residential

- New Commercial

- Renovation Non-Residential

- By Region

- West United States

- Midwest United States

- Northeast United States

- South United States

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Emerging Opportunities

- Market Demand Analysis 2019 to 2024 and Forecast, 2025 to 2035

- Pricing Analysis

- Market Size Projections (USD Billion) 2019 to 2024 and Forecast, 2025 to 2035

- Market Background Factors

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Material Type

- Granite

- Solid Surface

- Laminate

- Engineered Quartz

- Marble

- Natural Materials

- Polymers and Composites

- Metal

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By End-use

- New Residential

- Renovation Residential

- New Commercial

- Renovation Non-Residential

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Region

- West United States

- Midwest United States

- Northeast United States

- South United States

- West United States Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Midwest United States Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Northeast United States Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- South United States Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Regional Market Share Analysis 2025 & 2035

- Market Structure

- Competitive Landscape Assessment

- Cosentino Group

- Caesarstone

- Cambria Company

- Wilsonart International

- LX Hausys (formerly LG Hausys)

- MSI (M S International)

- Formica Corporation

- DuPont (Corian)

- Daltile

- Mohawk Industries

- Cambria

- Lotte Chemical (Staron)

- Hanwha Surfaces (HanStone)

- Anatolia Tile & Stone

- Arborite

- Aristech Surfaces

- Compac

- Evonik Industries

- Ecostone

- Hyundai L&C

- NatureKast

- Neolith

- The Marble Factory

- Arizona Tile

- Viatera

- Stone Source

- PentalQuartz

- Vicostone

- Corian Design

- Sapienstone

- Research Methodology

- Assumptions and Defined Terms