Comprehensive Analysis of the Air Transportation Sector in Saudi Arabia: Market Trends and Future Outlook (2025-2035)

Overview:

The air traffic market within the Kingdom of Saudi Arabia is on a trajectory of significant expansion, projected to reach a market size of USD 17.5 billion in 2025. This substantial growth is expected to continue with a robust compound annual growth rate (CAGR) of 11.5% throughout the forecast period, culminating in a market valuation of USD 55.8 billion by 2035. These developments are closely aligned with national efforts to transform the kingdom into a pivotal global air travel nexus, marked by extensive upgrades and strategic initiatives within the regional air transport framework.

Spearheading this transformation are major infrastructure projects designed to bolster capacity and connectivity. Key among these is the ambitious King Salman International Airport in Riyadh, alongside substantial expansion efforts at King Abdulaziz International Airport in Jeddah. These projects are set to serve as critical gateways, enhancing air links between Africa, Europe, and Asia, thereby reinforcing the kingdom’s position on the international aviation stage.

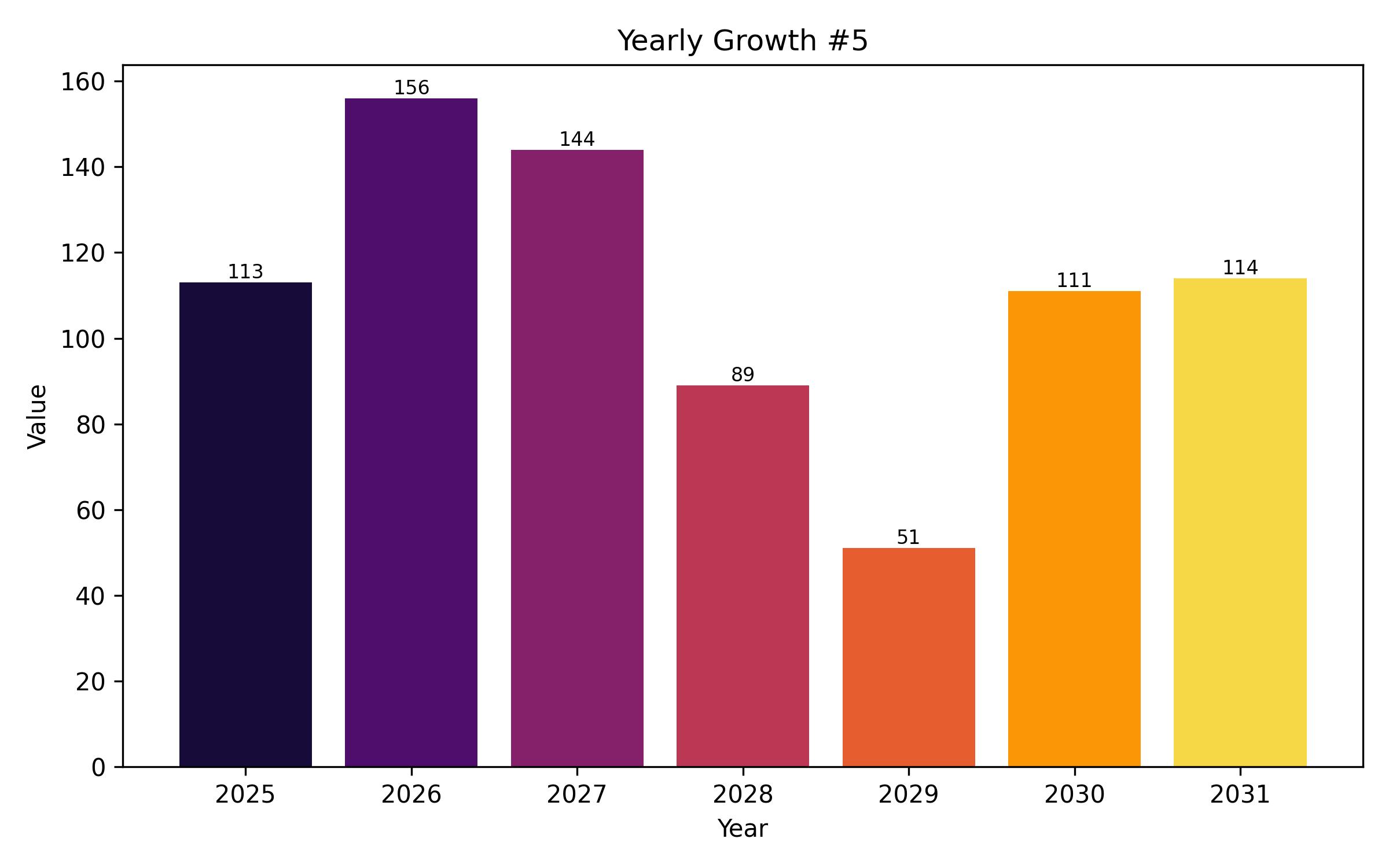

The first half of 2024 registered a promising growth rate of 10.8% for the Saudi air traffic industry. This momentum is being sustained through the latter half of the year, anticipating a year-end growth close to 11.1%. Contributing factors include the steady influx of religious tourists undertaking Umrah and Hajj, as well as the phased rollout and operational scaling of the new national flag carrier, Riyadh Air.

Further amplifying the industry’s upward trend are initiatives falling under the broad umbrella of Saudi Vision 2030. These national programs are actively catalyzing the modernization of the aviation sector, ensuring a more diversified and accessible range of air travel services are available to both domestic and international passengers.

In 2025, international passengers are expected to constitute over 62% of the total air travelers utilizing Saudi Arabian airports. This segment is forecast to grow from 75 million passengers in 2025 to a remarkable 168 million by 2035, significantly boosted by ongoing improvements to pilgrimage-related infrastructure and the establishment of strategic air access agreements, particularly with countries across the Asia-Pacific region and Europe.

While international traffic dominates, domestic air travel continues its expansion, projected for a 5.9% CAGR. This growth is underpinned by investments in secondary airports and increased business travel spurred by emerging economic centers like NEOM, Riyadh, and Jeddah. The introduction of new domestic routes connecting city pairs such as Abha to Tabuk and Medina to Yanbu by domestic carriers is also providing residents with more affordable and convenient regional travel options.

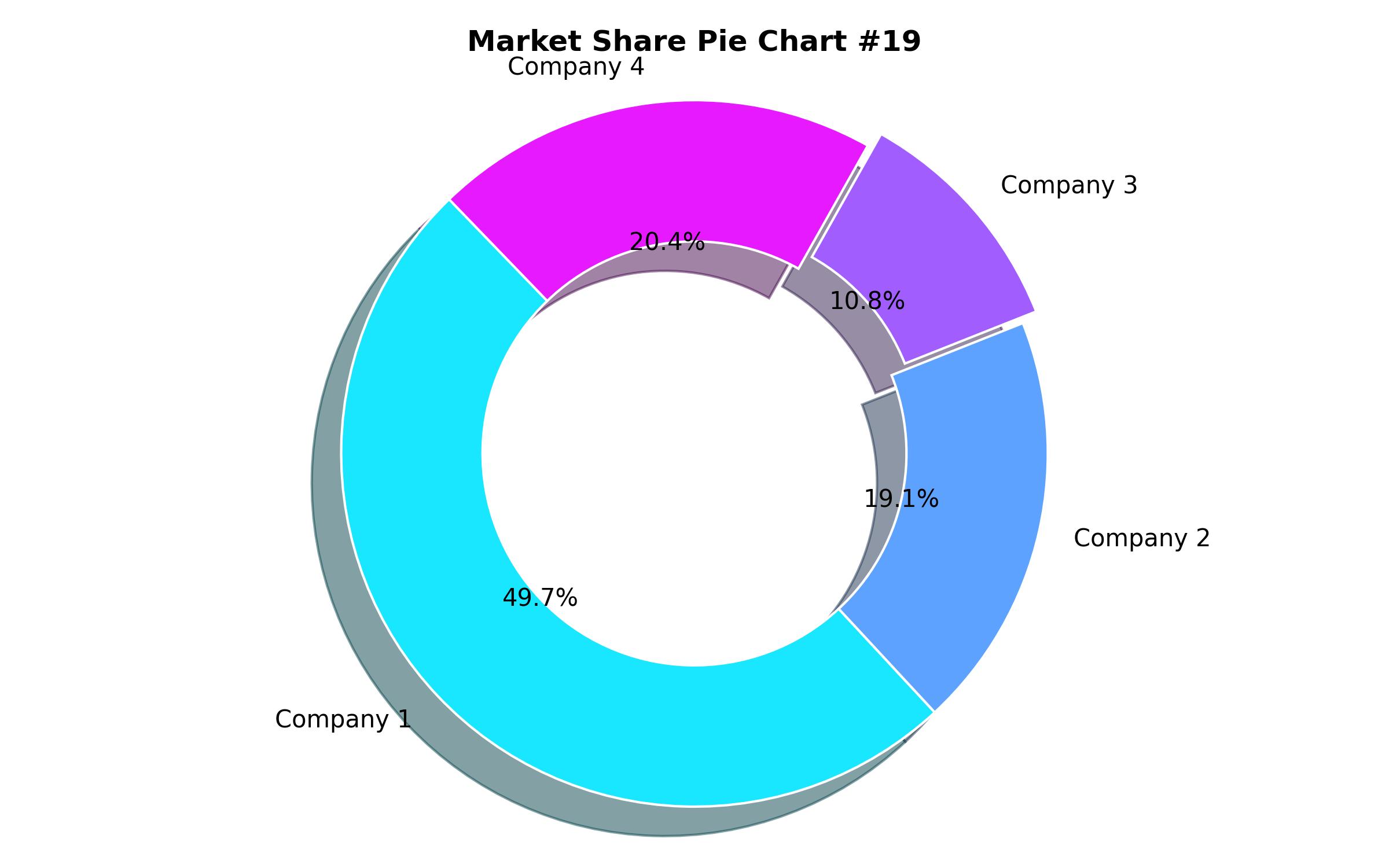

The market is characterized by a dynamic competitive landscape featuring established national airlines, emerging new carriers, regional operators, and specialized aviation service providers. Innovation is a constant, with a focus on technology adoption, sustainability initiatives, and the development of niche route strategies to cater to evolving passenger demands and market segments.

Overall, the Saudi Arabian air traffic industry is in a period of dynamic transformation, driven by government investment, ambitious infrastructure projects, a growing tourism sector, and the strategic expansion of both international and domestic air connectivity. This sets a strong foundation for sustained growth through the forecast period.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 17.5 billion |

| Revenue Forecast for 2035 | USD 55.8 billion |

| Growth Rate (CAGR) | 11.5% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share analysis, competitive landscape, growth factors, and market trends |

| Covered Segments | Passenger Type, Route Category, Flight Type, Airport Hub Tier |

| Regional Scope | Kingdom of Saudi Arabia |

| Country Scope | Saudi Arabia |

| Key Companies Analyzed | Saudia, Riyadh Air, Flynas, Flyadeal, Matarat Holding Co. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Passenger Type

- Domestic Passengers

- International Passengers

- By Route Category

- Domestic Routes

- International Routes

- By Flight Type

- Scheduled Flights

- Charter Flights

- General Aviation

- By Airport Hub Tier

- Tier 1 (Primary International Hubs)

- Tier 2 (Major Domestic and Regional Hubs)

- Tier 3 (Secondary and Local Airports)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Growth Driving Factors

- Market Restraints

- Market Opportunities

- Market Demand Analysis 2020 to 2024 and Forecast, 2025 to 2035

- Market Value (in USD Billion) Analysis 2020 to 2024 and Forecast 2025 to 2035

- Market Background

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Passenger Type

- Domestic Passengers

- International Passengers

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Route Category

- Domestic Routes

- International Routes

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Flight Type

- Scheduled Flights

- Charter Flights

- General Aviation

- Market Analysis 2020 to 2024 and Forecast 2025 to 2035, By Airport Hub Tier

- Tier 1 (Primary International Hubs)

- Tier 2 (Major Domestic and Regional Hubs)

- Tier 3 (Secondary and Local Airports)

- Saudi Arabia Market Analysis 2020 to 2024 and Forecast 2025 to 2035

- Pricing Analysis

- Value Chain Analysis

- Market Structure Analysis

- Competitive Landscape

- Competition Analysis

- Saudia

- Riyadh Air

- Flynas

- Flyadeal

- Matarat Holding Co.

- Assumptions and Acronyms

- Research Methodology