Endpoint Detection and Response Market Projected for Robust Growth from 2025 to 2035

Overview:

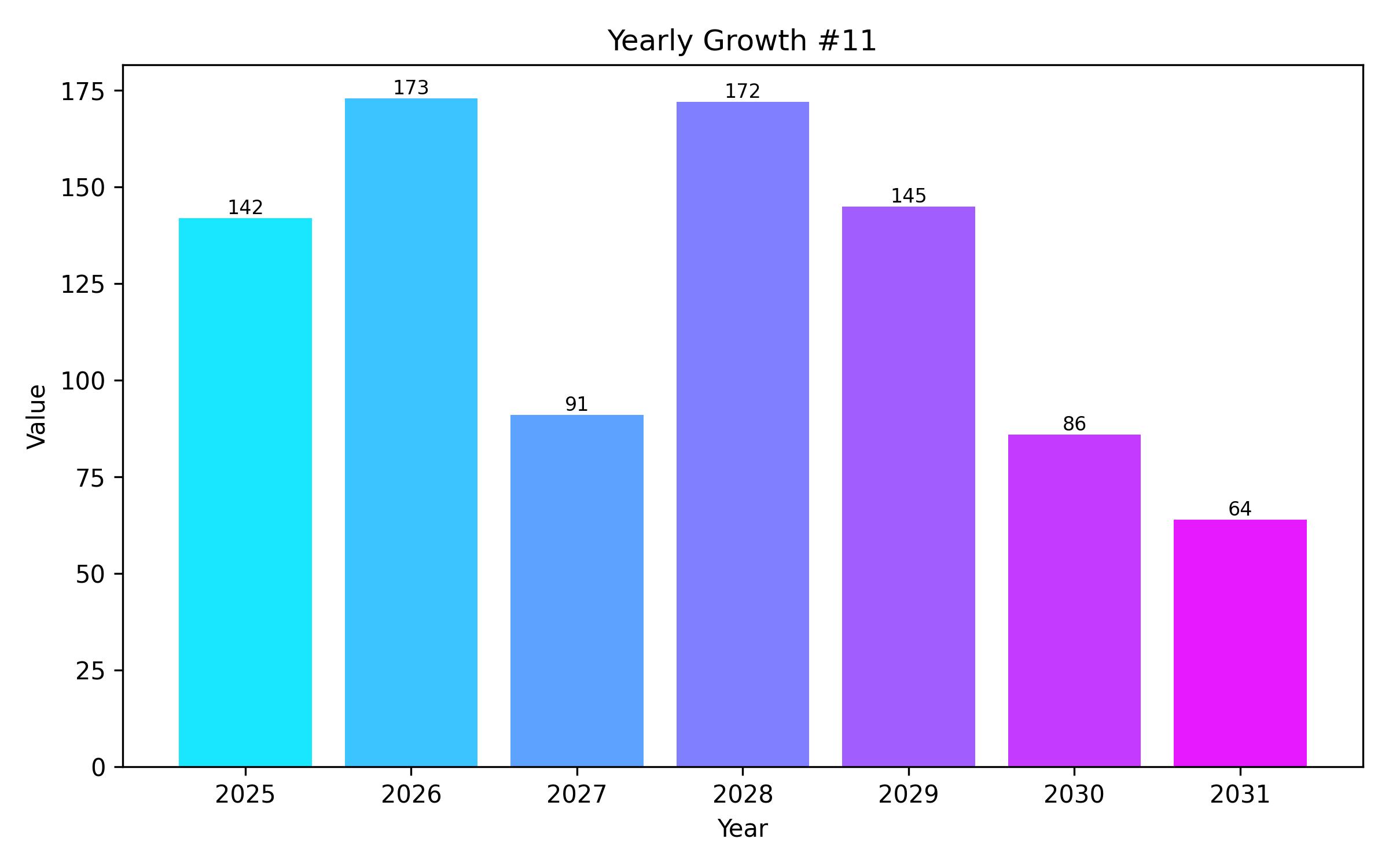

The global endpoint detection and response (EDR) market is poised for significant expansion, driven by the escalating volume and sophistication of cyber threats, the widespread adoption of remote work models, and increasingly stringent data protection regulations. EDR solutions offer critical real-time visibility into endpoint activities, empowering organizations to effectively detect, analyze, and respond to security incidents. The market is projected to reach USD 5.1 billion by 2025 and is anticipated to grow to USD 42.5 billion by 2035, exhibiting a compound annual growth rate (CAGR) of 22.8% over the forecast period.

There is a growing demand for advanced threat protection capabilities that cover a diverse range of endpoints, including laptops, mobile phones, servers, and cloud workloads. Traditional security measures like legacy antivirus and perimeter defenses are no longer sufficient in the current digital landscape, characterized by a rise in zero-day exploits, ransomware attacks, and insider threats. EDR platforms incorporate essential features such as behavioral analysis, threat hunting, and automated response actions, aligning with the requirements of modern zero-trust security frameworks.

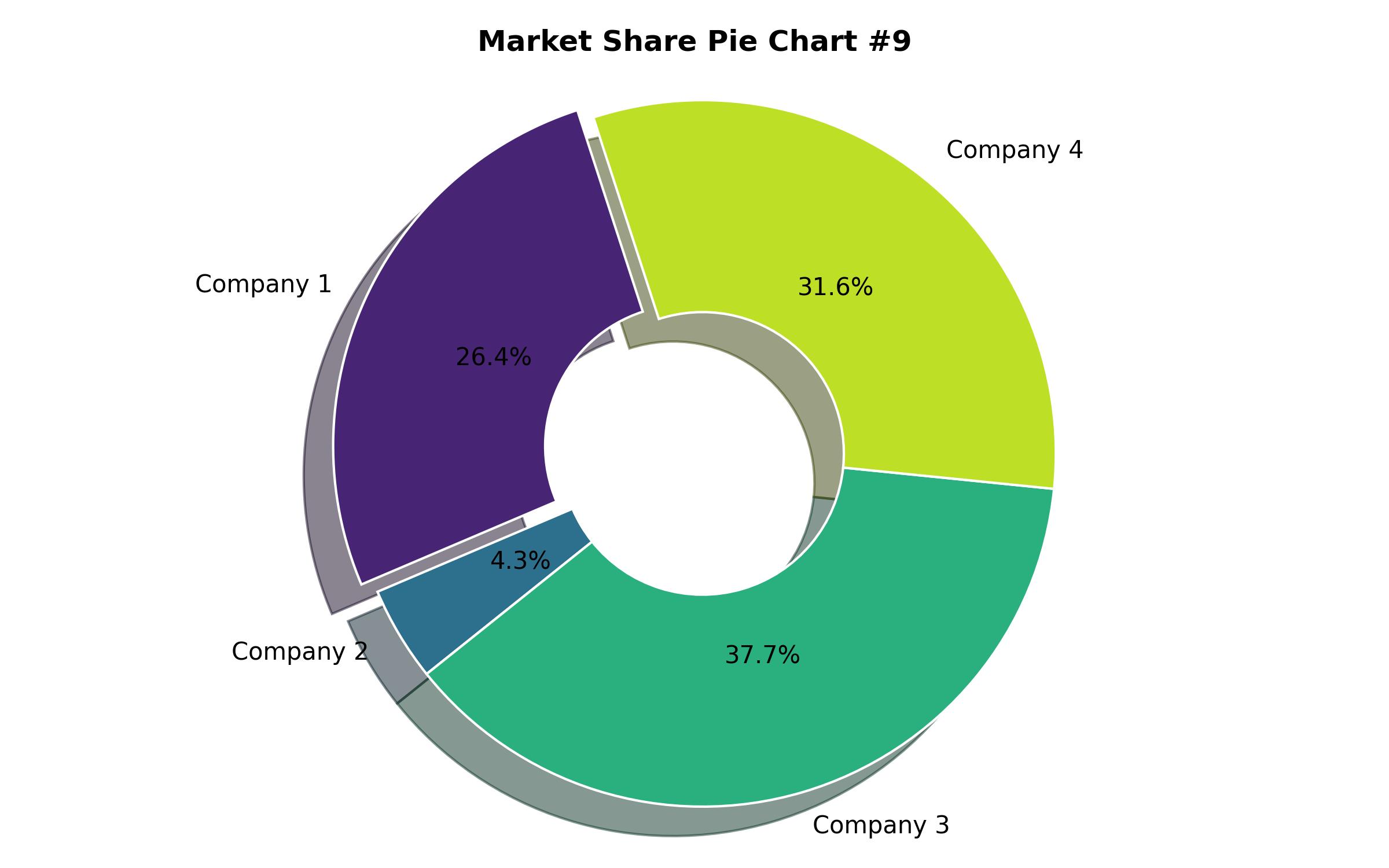

North America is expected to maintain a leading position in the EDR market. This dominance is attributed to a high level of cybersecurity awareness, the concentration of technology companies, and robust regulatory compliance mandates such as HIPAA, CCPA, and NIST. Federal agencies and large corporations in sectors like defense, finance, and healthcare are major adopters, as endpoints in these areas are frequently targeted. Furthermore, vendors are integrating EDR functionalities into broader security information and event management (SIEM) and security orchestration, automation, and response (SOAR) platforms to enhance managed detection and response (MDR) services.

In Europe, the adoption of EDR solutions is accelerating, primarily due to GDPR compliance requirements and the rising incidence of cyberespionage and ransomware campaigns directed at critical infrastructure. The United Kingdom, Germany, and France represent key markets in this region. There is strong demand for cloud-first, hybrid-scalable EDR solutions that can provide protection for both on-premise and virtual endpoints.

The Asia-Pacific region is witnessing rapid growth in digital innovation across banking, manufacturing, and government sectors. Countries such as India, China, South Korea, and Australia have significantly increased investments in endpoint security following notable data breaches. Regional companies are focusing on developing AI-powered EDR solutions that offer localized language support for threat analysis, automated containment, and threat intelligence feeds specific to regional threat landscapes.

Key challenges include alert fatigue from numerous security notifications, a shortage of skilled cybersecurity professionals capable of managing complex EDR tools, and the difficulty of integrating EDR with existing IT and security infrastructures, particularly in multi-cloud environments. Small and medium-sized businesses (SMBs) often face limitations in fully utilizing sophisticated EDR capabilities due to these factors.

Significant opportunities exist in the form of AI-driven automation, aiming to reduce false positives and automate the initial triage of security incidents. The convergence toward extended detection and response (XDR), which consolidates data from endpoints, email, networks, and cloud sources, presents a major growth avenue. EDR-as-a-Service offerings are also gaining traction among SMEs, providing affordable protection options without the need for dedicated Security Operations Center (SOC) teams.

From 2020 to 2024, the rapid shift to remote and hybrid work environments significantly boosted the adoption of EDR solutions across various industries. The expansion of cloud adoption and Bring Your Own Device (BYOD) policies increased the attack surface, creating a critical need for enhanced endpoint visibility and demanding upfront investments in security. Vendors during this period prioritized the development of cloud-based EDR solutions offering rapid deployment, reduced hardware dependency, and streamlined remote management capabilities.

Looking ahead from 2025 to 2035, the market is expected to mature with the introduction of context-aware autonomous response capabilities that integrate endpoint activity with identity and network signals. EDR platforms are likely to offer advanced features such as attack surface reduction, vulnerability prioritization, and real-time remediation through sophisticated predictive analytics. Furthermore, cyber insurance providers may increasingly require EDR deployment as a precondition for coverage, which could further fuel market adoption.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 5.1 billion |

| Revenue Forecast for 2035 | USD 42.5 billion |

| Growth Rate (CAGR) | 22.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Solution, endpoint device, deployment, enterprise size, vertical, and region |

| Regional Scope | North America, Latin America, Europe, South Asia and Pacific, East Asia, Middle East and Africa |

| Country Scope | U.S., Canada, Brazil, Mexico, Germany, UK, France, Spain, Italy, Nordics, BENELUX, India, Thailand, Malaysia, Indonesia, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Northern Africa, Turkey |

| Key Companies Analyzed | CrowdStrike Holdings, Inc., Microsoft Corporation, SentinelOne, Inc., Palo Alto Networks, Inc., Trend Micro Inc., VMware Carbon Black, Sophos Ltd., Elastic N.V., ESET, spol. s r.o., Cybereason Inc., Cisco Systems, Inc., Blackberry (Cylance), Check Point Software Technologies, Malwarebytes Inc., Trellix |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Solution

- Software

- Services

- By Endpoint Device

- Workstations

- Mobile Devices

- Servers

- Point of Sale Terminals

- IoT Devices

- By Deployment

- Cloud-based

- On-premise

- By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

- By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Education

- Others

- By Region

- North America (U.S, Canada)

- Latin America (Brazil, Mexico)

- Europe (Germany, UK, France, Spain, Italy, Nordics, BENELUX)

- South Asia and Pacific (India, Thailand, Malaysia, Indonesia, Australia, New Zealand)

- East Asia (China, Japan, South Korea)

- Middle East and Africa (GCC Countries, South Africa, Northern Africa, Turkey)

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2019 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value in USD Million) Analysis 2019 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Solution

- Software

- Services

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Endpoint Device

- Workstations

- Mobile Devices

- Servers

- Point of Sale Terminals

- IoT Devices

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Deployment

- Cloud-based

- On-premise

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Enterprise Size

- Small and Medium-Sized Enterprises (SMEs)

- Large Enterprises

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Vertical

- Banking, Financial Services, and Insurance (BFSI)

- IT and Telecom

- Healthcare

- Government and Defense

- Retail

- Manufacturing

- Education

- Others

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Latin America

- Europe

- South Asia and Pacific

- East Asia

- Middle East and Africa

- North America Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- South Asia and Pacific Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- East Asia Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Middle East and Africa Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Region-wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- CrowdStrike Holdings, Inc.

- Microsoft Corporation

- SentinelOne, Inc.

- Palo Alto Networks, Inc.

- Trend Micro Inc.

- Other Key Players

- Assumptions and Acronyms Used

- Research Methodology