Western Europe Women’s Footwear Market: Analyzing Size, Share, and Trends from 2025 to 2035

Overview:

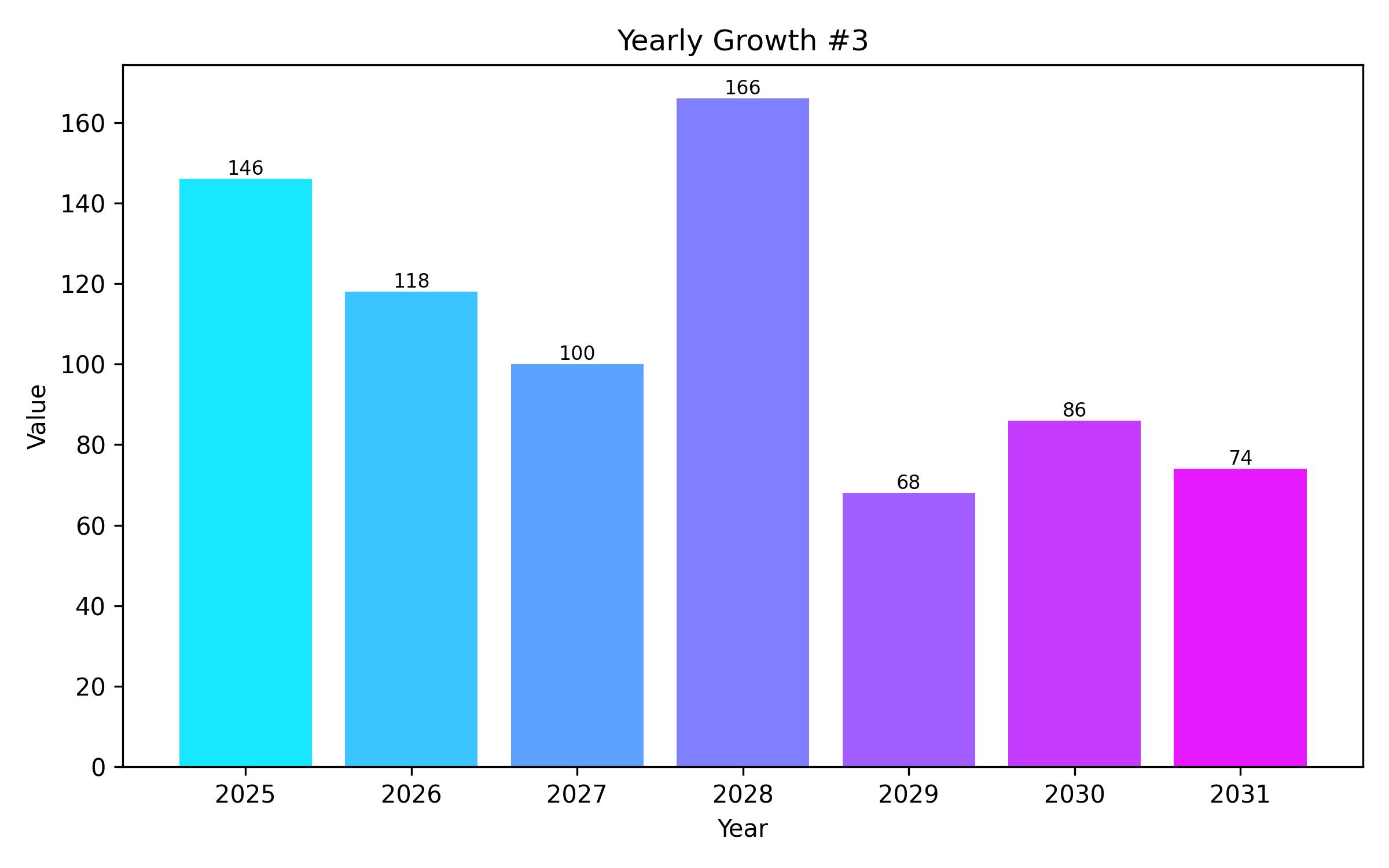

The women’s footwear market in Western Europe is projected to reach a valuation of roughly USD 22.3 billion in 2025. The sector is anticipated to expand at a compound annual growth rate of 3.8% from 2025 through 2035, reaching an estimated value of USD 31.9 billion by the end of the forecast period. This substantial growth is propelled by a confluence of evolving fashion preferences, escalating consumer interest in sustainable products, and a rising demand for both comfort and adaptability in footwear.

Over recent years, the fashion landscape in Western Europe has experienced a significant shift, balancing aesthetic appeal with practical comfort. This has particularly driven demand for athleisure and casual footwear styles. Modern consumers are increasingly prioritizing shoes that not only align with current trends but also offer practicality for daily activities. Consequently, staples such as sneakers, various types of flats, and comfortable boots have become essential components of many Women’s wardrobes across the region, thereby fueling market expansion.

A key catalyst for the growth of the women’s footwear market in Western Europe is the increasing emphasis on sustainability and ethical production practices. As conscious consumerism gains momentum, shoppers are actively seeking brands that provide environmentally friendly and responsibly manufactured footwear options. This trend has spurred the popularity of companies that utilize recycled materials, implement waste reduction strategies, and adhere to ethical labor standards.

In response to this consumer demand, a significant number of brands are adapting their product lines to appeal to environmentally aware customers, further stimulating market growth. The surge in sustainability consciousness is reshaping purchasing decisions and encouraging brands to invest in greener production methods and materials.

The robust growth of e-commerce has also been a pivotal factor in the expansion of the women’s footwear market in Western Europe. Online platforms have become a preferred method for purchasing shoes due to the unparalleled convenience, extensive product variety, and competitive pricing they offer. Consumers can effortlessly compare styles, prices, and availability from numerous retailers and brands through digital channels.

This accessibility has greatly simplified the process of finding optimal footwear choices. Furthermore, the widespread adoption of smartphones and the proliferation of mobile shopping applications have amplified this trend, rendering footwear purchasing more convenient and accessible than ever before, regardless of location or time.

The industry is also influenced by factors such as seasonal demand and demographic shifts. Seasonal changes drive consumption patterns, with specific types of footwear being popular during different times of the year. Additionally, an aging population in some Western European countries may increase demand for comfortable and supportive footwear, while younger demographics continue to prioritize trendy and performance-oriented styles, creating diverse market needs.

Innovation in materials and manufacturing techniques is another significant trend. Advancements in synthetic fabrics, water-resistant treatments, and ergonomic designs are enhancing both the performance and longevity of footwear. Brands are also exploring 3D printing and other digital manufacturing methods to offer customized fit options and reduce production waste.

Moreover, the influence of social media and digital marketing campaigns plays a crucial role in shaping consumer preferences and driving sales. Influencers and online platforms effectively showcase new styles and trends, directly impacting purchasing decisions across different consumer groups.

Finally, while the urban centers remain major markets, there is a growing demand from suburban and rural areas, facilitated by the reach of online retail. This broader market reach is contributing to sustained growth and presenting new opportunities for both established and emerging footwear brands in Western Europe.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 22.3 billion |

| Revenue Forecast for 2035 | USD 31.9 billion |

| Growth Rate (CAGR) | 3.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2018 – 2023 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Product type, base material, sales channel, and country |

| Regional Scope | Western Europe |

| Country Scope | Germany, United Kingdom, France, Italy, Spain, Rest of Western Europe |

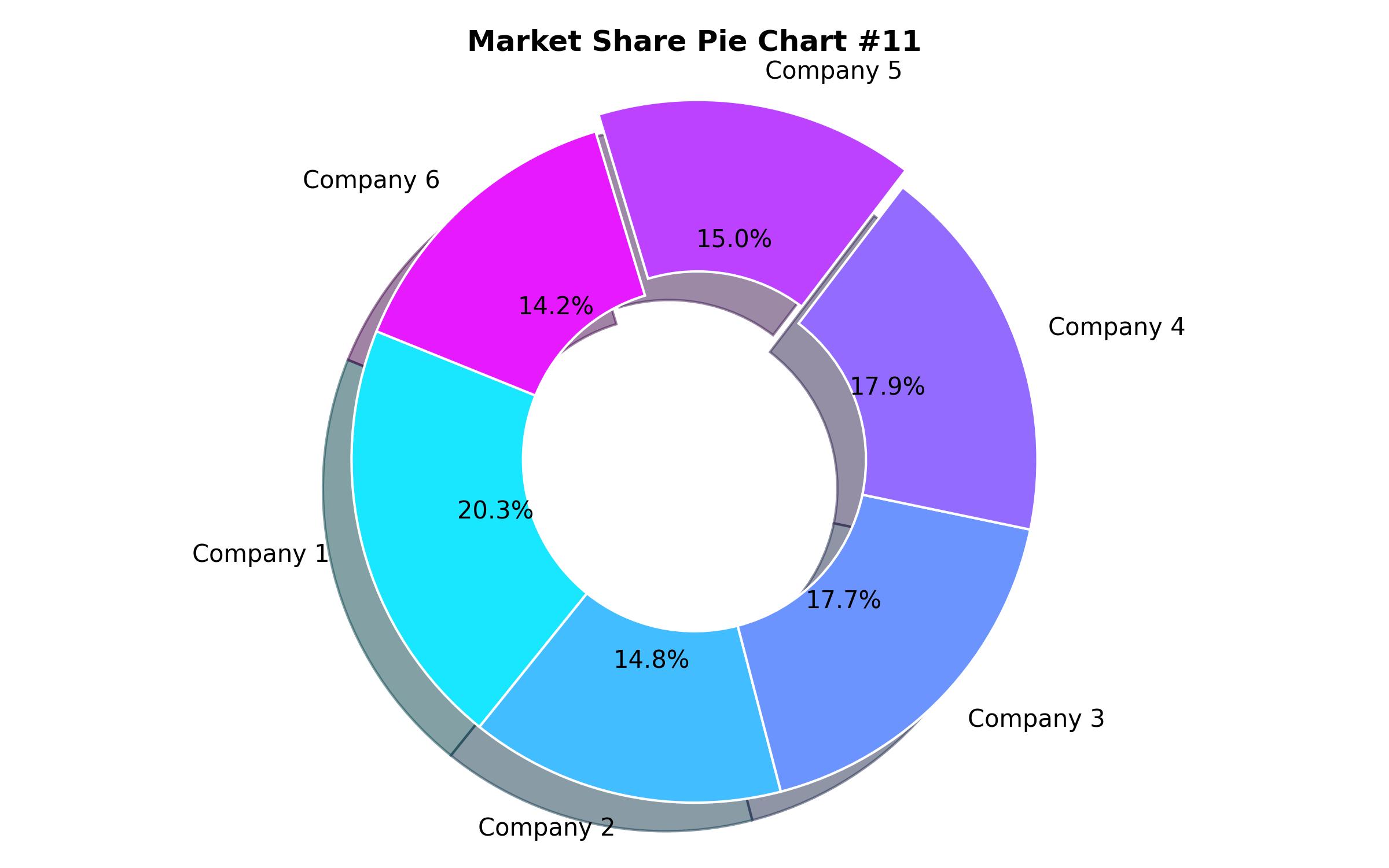

| Key Companies Analyzed | Adidas AG, Puma SE, Deichmann SE, Nike Inc., Skechers USA Inc., Under Armour Inc., Wolverine World Wide Inc., Crocs Inc., ASICS Corporation, The ALDO Group Inc. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Product Type

- Sneakers

- Boots

- Sandals

- Heels

- Flats

- Athletic Shoes

- Casual Footwear

- By Base Material

- Leather

- Synthetic Materials

- Textile

- Rubber

- Other Materials

- By Sales Channel

- Third-Party Online Channels

- Direct-to-Consumer (DTC) Online Channels

- Hypermarkets/Supermarkets

- Specialty Stores

- Departmental Stores

- Other Sales Channels

- By Country

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Western Europe

Table of Content

- Executive Summary

- Market Overview

- Key Market Trends

- Growth Drivers

- Challenges and Restraints

- Forecast Factors

- Market Size and Demand Analysis 2018 to 2024 and Forecast 2025 to 2035

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Product Type

- Sneakers

- Boots

- Sandals

- Heels

- Flats

- Athletic Shoes

- Casual Footwear

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Base Material

- Leather

- Synthetic Materials

- Textile

- Rubber

- Other Materials

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Sales Channel

- Third-Party Online Channels

- Direct-to-Consumer (DTC) Online Channels

- Hypermarkets/Supermarkets

- Specialty Stores

- Departmental Stores

- Other Sales Channels

- Market Analysis 2018 to 2024 and Forecast 2025 to 2035, By Country

- Germany

- United Kingdom

- France

- Italy

- Spain

- Rest of Western Europe

- Country-wise Market Analysis 2024 & 2035

- Competition Analysis

- Market Structure

- Heat Map Analysis

- Competition Dashboard

- Key Players Profiling

- Assumptions and Acronyms Used

- Research Methodology