Global Tire Cutting Machine Market Projected Trends and Growth Trajectory 2025-2035

Overview:

The market for tire cutting machines is set for substantial expansion between 2025 and 2035, driven by the increasing focus on eco-friendly waste handling, greater adoption of recycled rubber applications, and significant advancements in cutting technologies. The market is projected to be valued at approximately USD 1,388 million in 2025 and is expected to climb to USD 1,990 million by 2035, exhibiting a compound annual growth rate (CAGR) of about 3.8% over the decade.

Several factors are critically influencing the market trajectory. A major driver is the global accumulation of waste tires, which necessitates more effective tire recycling and volume reduction methods. Tire cutting equipment is crucial in processing end-of-life tires into reusable materials for applications in sectors such as construction, rubber product manufacturing, and energy generation. For example, shredded tire material is increasingly incorporated into asphalt mixes for road construction, contributing to both environmental protection and enhanced road durability.

However, the market faces challenges, including high operational expenditures and evolving environmental regulations regarding rubber waste disposal. Manufacturers are addressing these issues by developing more energy-efficient and automated machinery designed to maximize processing speed and minimize material loss.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1,388 Million |

| Industry Value (2035F) | USD 1,990 Million |

| CAGR (2025 to 2035) | 3.8% |

Furthermore, the tire cutting machine market is diversified based on required cutting shapes and purposes. Shear cutters are utilized for reducing large tires into smaller, manageable segments. Sidewall cutters efficiently remove tire sidewalls, facilitating the recovery of internal steel and rubber. Granulators and chippers process tires into finer particles suitable for applications like sports surfaces and playgrounds.

Robust rotary tire shredders are employed to break down complete tires into larger pieces, commonly used as tire-derived fuel (TDF). These diverse machines are essential for the efficient breakdown of tire materials for various reuses. The increasing emphasis on material recovery and environmentally conscious waste management is fueling demand from multiple industries, including construction, recreational surfacing, and energy conversion facilities.

In North America, a key market region, the rising adoption of automated systems is particularly noteworthy. AI-powered tire cutting machines featuring robotic components and intelligent sensors are being developed to achieve higher cutting accuracy and faster processing, leading to lower labor costs and improved overall operational efficiency.

Regional Market Trends

North America

North America represents a significant market for tire cutting machinery, boosted by well-established tire recycling infrastructure and demanding environmental statutes. The USA and Canada have enacted policies promoting sustainable tire processing. Major recycling entities are investing in advanced cutting technology to meet the growing demand for recycled rubber goods. The expansion of tire retreading activities for commercial vehicle fleets also supports market expansion.

The development and deployment of highly automated, AI-enhanced tire cutting machinery are notably increasing across North America, utilizing robotic arms and sophisticated sensors for precise cuts, optimized processing times, reduced labor expenses, and improved productivity.

Europe

Europe holds a substantial share of the tire cutting machine market, driven by stringent tire recycling mandates, particularly in nations like Germany, France, and Italy. The European Union’s End-of-Life Vehicles (ELV) Directive necessitates effective tire disposal and material reclamation, spurring the need for advanced tire cutting systems. Italy, with its robust rubber processing industry, heavily relies on these machines to supply feedstock for retreaded tires and other rubber products. European manufacturers are focusing on developing quieter and lower-emission cutting technologies to align with sustainability objectives. Prominent industry players are at the forefront of adopting new technologies.

Asia-Pacific

The Asia-Pacific region is anticipated to record the fastest growth in the tire cutting machine market, fueled by rapid industrial expansion, increased vehicle ownership, and subsequent growth in tire waste. China, India, Japan, and South Korea are leading countries in this market, with China being a dominant force in both production and consumption.

India’s expanding pyrolysis sector is a significant market driver, with increasing production of tire-derived fuel as businesses explore alternative energy sources. Governments are implementing stricter regulations against waste disposal, and companies are investing in advanced technologies for cost-effective, lower-emission tire breakdown processes.

Challenges and Opportunities

Challenge: High Capital and Maintenance Costs

Industrial-grade tire cutting machines, including granulators and shredders, require substantial initial investment and ongoing maintenance expenses. This financial burden limits adoption, particularly for smaller recycling operations. Large-scale tire cutting facilities also face high energy costs.

To mitigate these challenges, governments and private investors are providing financial aid and incentives for recycling projects. Policies that encourage investment in advanced cutting technologies help support the development of circular economies, thereby expanding market reach.

Opportunity: Integration of Smart and Automated Technologies

The emergence of AI-powered tire cutting machines presents significant commercial opportunities. Companies are integrating IoT-based monitoring, predictive maintenance capabilities, and automated blade adjustments. These technological improvements enhance machine accuracy, reduce downtime, and extend equipment lifespan.

Innovative solutions, such as portable tire cutting machines, are also gaining popularity. On-site processing using portable technology reduces transportation costs and increases feasibility in remote locations. Furthermore, advancements in laser cutting technology are being explored to decrease mechanical wear and energy consumption.

Shifts in the Tire Cutting Machine Market from 2020 to 2024 and Future Trends 2025 to 2035

From 2020 to 2024, the tire cutting machine market saw advancements in automation and energy efficiency. The increasing need for recycling waste tires and supportive government policies for a circular economy contributed to the broader acceptance of this machinery across various sectors.

Future trends from 2025 to 2035 are expected to emphasize sustainability-focused innovations, such as AI-powered cutting systems, laser-based tire processing, and eco-friendly hydraulic components. Companies will increasingly develop intelligent tire shredding solutions aimed at maximizing material recovery while minimizing environmental impact. Significant investment in research and development will be crucial for creating highly precise, sustainable tire cutting systems aligned with global waste reduction goals.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Regulations prioritized responsible tire disposal, discouraging landfilling. Government support for recycling was present but inconsistent. |

| Technological Advancements | Manual and semi-automatic machines were prevalent, with limited smart automation features. |

| Industrial Applications | Primary uses were in retreading, pyrolysis, and rubberized asphalt production. |

| Recycling Industry Trends | Growth in shredding for crumb rubber was concentrated in major recycling hubs. |

| End-of-Life Tire (ELT) Management | Increasing ELT accumulation led to disposal challenges and environmental concerns. |

| Environmental Sustainability | Focus was on reducing waste through retreading and incineration, with moderate investment in recycling technology. |

| Production & Supply Chain Dynamics | Global disruptions impacted production and supply, causing price volatility. |

| Market Growth Drivers | Demand was driven by rising vehicle sales and the need for disposal solutions. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | More stringent international rules mandate recycling and eco-friendly disposal. Strict penalties for non-compliance increase machine use. |

| Technological Advancements | AI-driven, fully automated machines improve efficiency. IoT integration for monitoring and maintenance reduces costs. |

| Industrial Applications | Demand grows in advanced clean energy uses, and sectors using recycled rubber. |

| Recycling Industry Trends | Decentralized recycling operations increase demand for portable, compact machines for localized processing. |

| End-of-Life Tire (ELT) Management | Government and company partnerships develop circular economy schemes, boosting investment in high-precision equipment. |

| Environmental Sustainability | Circular economy principles drive innovation, using recycled tire material in sustainable products. |

| Production & Supply Chain Dynamics | Regional manufacturing and local supply chains stabilize production, reducing dependence on distant sources. |

| Market Growth Drivers | Growth is fueled by sustainability projects, renewable energy integration, and demand for high-value material recovery from tires. |

Country-Wise Outlook

United States

The U.S. market for tire cutting machines is steadily growing due to stricter rules against scrap tire disposal and increased investment in rubber recycling. The Environmental Protection Agency (EPA) is tightening sustainability targets, leading producers to adopt advanced processing technology. Demand from the tire-derived fuel (TDF) manufacturing, civil engineering, and rubberized asphalt sectors sustains the market.

Future investments in green infrastructure and the expansion of pyrolysis plant capacities are expected to increase the need for high-capacity, automated tire cutting machines.

The U.S. generates a large volume of scrap tires annually, with much being recycled into TDF, rubber mulch, and crumb rubber. The increased use of tire-cutting machines in specialized recycling plants ensures efficient size reduction, optimizing downstream processes. Innovations in modular and portable systems are also supporting smaller recycling businesses.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.7% |

United Kingdom

The U.K. tire cutting machine market is expanding robustly, supported by government policies aimed at achieving zero waste to landfill. Directives like the End-of-Life Vehicles Directive and Waste Framework Directive are boosting the demand for efficient tire processing technologies. The use of tire-derived materials in infrastructure projects, such as rubberized asphalt in road surfacing, is also promoting market growth.

The construction sector’s growing reliance on recycled rubber products is fueling the demand for tire cutting equipment. Improvements in shredding and granulation technologies encourage the adoption of sophisticated, automated machinery for maximizing resource recovery.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

European Union

The European Union market for tire cutting machines is driven by policies under the Circular Economy Action Plan (CEAP), focusing on sustainable material recovery from end-of-life tires. Germany, France, and Italy are key markets, with strict waste regulations and established recycling industries.

Applications for tire cutting machines are increasing in road construction, playground surfaces, and rubber-modified concrete production. Growing investment in tire devulcanization and pyrolysis technologies is also promoting the demand for precision tire cutting machinery.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.6% |

Japan

The Japanese tire cutting machine market is growing, driven by strong demand for advanced recycling technologies. The country’s focus on sustainable urban development and zero-emission initiatives encourages the extensive use of innovative tire cutting and shredding technologies.

Japan’s significant automotive industry, producing millions of vehicles annually, generates a large volume of scrap tires requiring efficient recycling. Incorporating tire-derived rubber into fields like 3D printing, sports facilities, and industrial applications is expected to increase the demand for precise cutting machinery.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.8% |

South Korea

The South Korean tire cutting machine market is experiencing steady growth, supported by rapidly evolving waste management regulations and increased investment in recycling infrastructure. Government incentives for green manufacturing and the development of eco-friendly urban projects are major market drivers.

The country’s tire manufacturing sector produces a large number of tires each year, necessitating effective disposal systems. The increasing use of rubber-modified asphalt, sound-absorbing materials, and protective flooring is spurring investment in tire cutting and processing equipment. Furthermore, technological progress, particularly in robotic automation, is enhancing machine precision, positioning South Korea as a significant hub for technological advancements in this sector.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.9% |

Segmentation Projection – Tire Cutting Machine Market

Demand from Industrial Recycling Powers High-Capacity Tire Cutting Machines to Lead

High-capacity tire cutters capable of processing over 50 tires per hour dominate the market, driven by the increasing need for large-scale tire recycling operations. Large recycling companies utilize these high-capacity cutters to efficiently process high volumes of end-of-life tires. These machines boost productivity by reducing manual labor and optimizing throughput, making them essential for businesses handling commercial and industrial tires.

As environmental regulations concerning tire disposal become more stringent, recycling companies prioritize machines with automated cutting systems to maximize efficiency. High-capacity units remain in strong demand, especially in regions like North America and Europe, where strict waste management rules require efficient tire processing solutions.

Low-capacity machines remain necessary for small-scale MRO operations

Tire cutting machines with a capacity of fewer than 50 tires per hour are crucial for smaller maintenance, repair, and operations (MRO) facilities. Automotive service centers use these machines for cost-effective disposal of old tires without relying on large-scale recycling plants.

MRO facilities prefer low-capacity, compact machines due to their affordability and ease of use. These machines are well-suited for local garages and small workshops needing to dispose of tires without investing in large industrial shredders. The increasing number of independent repair shops in emerging economies is also contributing to the demand for these machines.

Above 5 HP Machines Reign Because of Improved Cutting Efficiency

Tire cutting machines equipped with motors exceeding 5 HP are leading the market due to their ability to deliver sufficient torque for efficiently processing heavy-duty and large tires. These powerful machines can easily cut through thick rubber and steel-reinforced tires.

Recycling companies handling truck, agricultural, and off-road tires favor this equipment for its durability and reliability under continuous operation. The growing demand for high-efficiency electric-powered tire cutters is also boosting this segment, as industries seek cost-saving and more environmentally friendly alternatives to conventional hydraulic systems.

3 HP to 5 HP Machines Gain Traction for Medium-Scale Operations

Machines with motor power between 3 HP and 5 HP are seeing increased adoption among mid-sized tire recycling businesses and regional MRO facilities. These machines strike a balance between power and cost, making them suitable for companies that need consistent processing capacity without the high energy consumption of larger models.

Demand for mid-range tire cutters is particularly notable in developing countries, where smaller recycling operations are expanding. Manufacturers offer versatile mid-range machines that serve both recycling companies and repair shops requiring efficient tire disposal solutions.

Tire Recycling Companies Drive the Majority of Demand for Tire Cutting Machines

The primary end users of tire cutting machines are tire recycling companies, driven by global sustainability efforts that mandate environmentally sound tire disposal. Businesses are investing in advanced shredding and cutting machines to reclaim rubber for alternative fuels, construction materials, and new tire production.

Stricter enforcement of extended producer responsibility (EPR) regulations is compelling tire manufacturers to support recycling, leading to increased demand for industrial-grade tire cutters. The trend towards fully automated tire processing units will further propel this demand.

MRO Centres Depend On Tire Cutting Units for In-Factory Tire Shredding

Maintenance, repair, and operations (MRO) centers utilize tire cutting machines for the efficient disposal of worn and damaged tires. Automotive service facilities use these machines to manage wasteeffectively before it is sent for recycling.

MRO locations choose equipment balancing portability and efficiency, allowing technicians to reduce tires to transportable sizes. The increasing need for localized tire disposal solutions at automotive workshops, especially in urban areas, continues to drive this sector’s growth.

Competitive Outlook

The tire cutting machine market is characterized by strong competition among both international and local companies driving innovation in recycling technology and industrial efficiency. Market leaders are concentrating on automation, precise cutting, and sustainable practices to address the increasing demand for tire recycling, retreading, and waste management solutions. The market includes established manufacturers and newer entrants, all of whom are contributing to technological progress and market expansion.

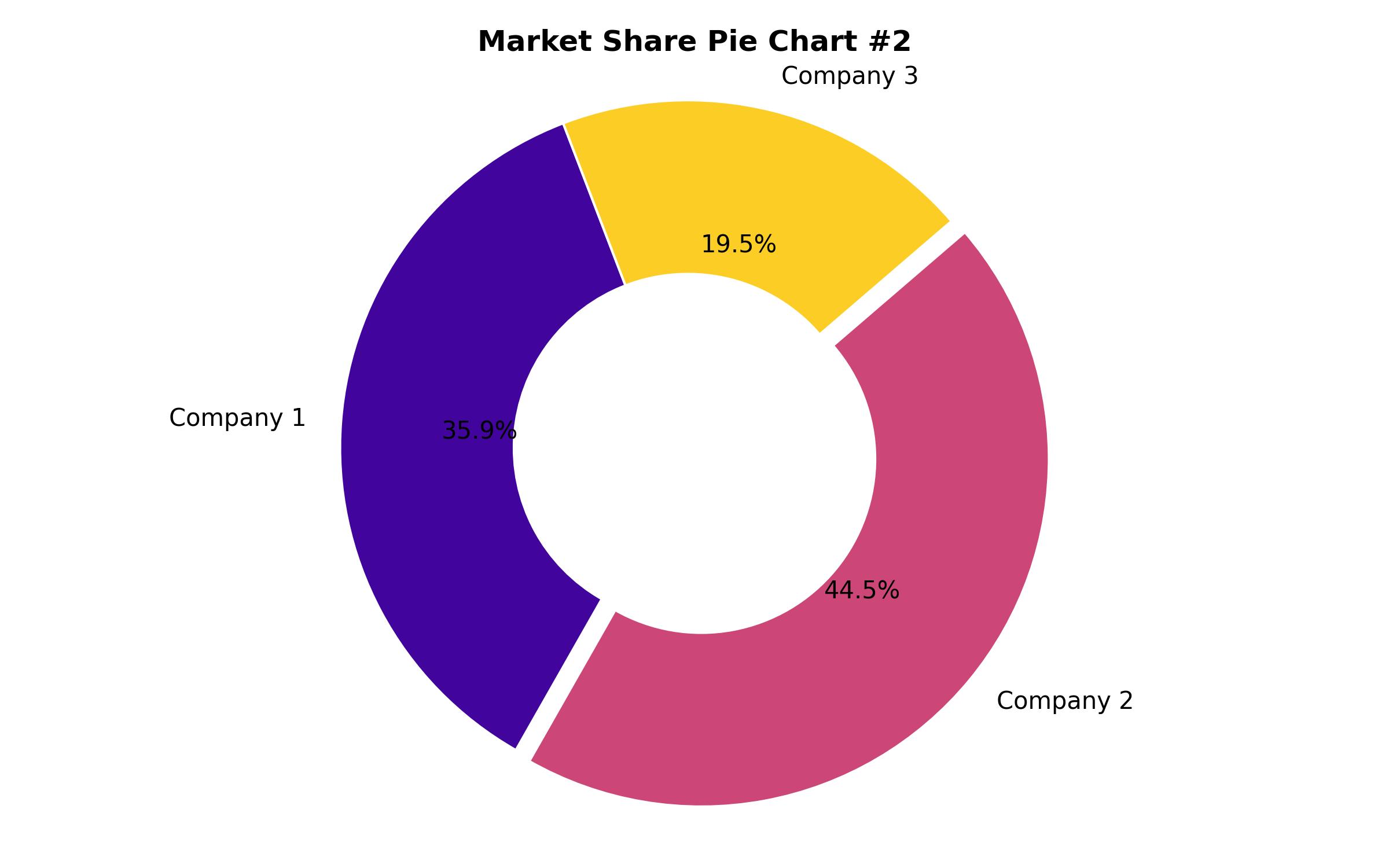

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Eldan Recycling A/S | 11-16% |

| CM Shredders | 10-14% |

| ECO Green Equipment | 9-13% |

| SSI Shredding Systems, Inc. | 7-11% |

| Granutech-Saturn Systems | 6-10% |

| Other Companies (combined) | 40-50% |

Key Company Offerings and Activities

| Company Name | Key Offerings/Activities |

|---|---|

| Eldan Recycling A/S | Develops high-capacity tire cutting machines tailored for large recycling operations. Emphasizes automated, energy-efficient shredding solutions. |

| CM Shredders | Specializes in dual-speed tire cutting systems designed for industrial use. Focuses on developing advanced blade technology for high precision. |

| ECO Green Equipment | Provides modular tire recycling systems with flexible configurations. Prioritizes environmentally sound processing methods. |

| SSI Shredding Systems, Inc. | Manufactures heavy-duty tire shredders for large-scale waste processing. Enhances durability and performance through unique cutting mechanisms. |

| Granutech-Saturn Systems | Designs versatile tire cutting equipment for processing whole tires into usable materials. Integrates hydraulic systems for optimal function. |

Key Company Insights

Eldan Recycling A/S (11-16%)

Eldan Recycling A/S is a leader in the tire cutting machine market, known for its high-capacity, automated equipment. They produce powerful tire shredding and granulation machines for large-scale recycling facilities. Eldan focuses on improving blade durability and automation to enhance processing efficiency and reduce downtime. The company has a strong presence in Europe and distributes its machinery globally, supporting sustainable waste management.

CM Shredders (10-14%)

CM Shredders specializes in tire recycling equipment featuring dual-speed processing technology. Their tire cutting machines are known for their high torque and precision, allowing them to handle various tire sizes and types effectively. CM Shredders is dedicated to advancing blade technology to minimize maintenance needs and operational expenses. They hold a significant market position in North America and are expanding their presence through partnerships in other regions.

ECO Green Equipment (9-13%)

ECO Green Equipment provides modular tire recycling systems with configurations that can be customized for specific processing requirements. The company prioritizes sustainability, incorporating energy-efficient motors and dust suppression systems into their equipment. ECO Green’s machinery is widely used by businesses seeking environmentally responsible tire disposal methods, with operations across North America, Europe, and the Middle East.

SSI Shredding Systems, Inc. (7-11%)

SSI Shredding Systems, Inc. offers heavy-duty tire shredding equipment renowned for its reliability and performance. Their shredders utilize advanced hydraulic and mechanical systems to achieve high shredding efficiency. They serve a diverse range of industries, including automotive recycling, landfill alternative producers, and companies generating alternative fuels. SSI Shredding Systems has a vast customer base in North America and is increasing its activities in the Asia-Pacific region.

Granutech-Saturn Systems (6-10%)

Granutech-Saturn Systems manufactures tire cutting equipment capable of converting complete tires into chips, shreds, and crumb rubber for various recycled applications. Granutech-Saturn Systems incorporates hydraulic and electric drive systems to provide precise operational control. They supply machinery to recycling facilities, cement producers, and tire-derived fuel plants in the European and North American markets.

Other Key Players (40-50% Combined)

Additional companies contribute significantly to the market by offering innovative, cost-effective solutions and maintaining strong local market presence. These businesses collectively account for a notable portion of the market share.

| Report Attribute | Details |

|---|---|

| Market Size in 2025 | USD 1,388 million |

| Revenue Forecast for 2035 | USD 1,990 million |

| Growth Rate (CAGR) | 3.8% from 2025 to 2035 |

| Base Year for Estimation | 2024 |

| Historical Data | 2019 – 2024 |

| Forecast Period | 2025 – 2035 |

| Quantitative Units | Revenue in USD million/billion and CAGR from 2025 to 2035 |

| Report Coverage | Revenue forecast, company market share, competitive landscape, growth factors, and trends |

| Covered Segments | Cutting speed, motor power, end use, and region |

| Regional Scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Country Scope | U.S., Canada, Mexico, U.K., Germany, France, Italy, China, India, Japan, South Korea, Brazil, Argentina, UAE, Saudi Arabia, South Africa |

| Key Companies Analyzed | Eldan Recycling A/S; CM Shredders; ECO Green Equipment; SSI Shredding Systems, Inc.; Granutech-Saturn Systems; Shred-Tech Corp.; BCA Industries; Twin Shaft Shredders; Barclay Roto-Shred; Untha Shredding Technology; Wanrooe Machinery Co., Ltd.; Zhengzhou Yuxi Machinery Equipment Co., Ltd. |

| Customization Options | Free report customization (up to 8 analysts working days) with purchase. Changes to country, regional, and segment scope |

| Pricing and Purchase Options | Customizable purchase options for tailored research needs |

Report Coverage & Deliverables

- Market Trends And Dynamics

- Competitve Benchmarking

- Historical data and forecasts

- Value/Volume analysis

- Company revenue shares and key strategies

- Regional opportunities

This is an indicative segmentation. Please request a sample report to see detail segmentation of this market.

Detailed Market Segmentation

- By Cutting Speed

- High-capacity (more than 50 tires/hour)

- Low-capacity (fewer than 50 tires/hour)

- By Motor Power

- Above 5 HP

- 3 HP to 5 HP

- Below 3 HP

- By End Use

- Tire Recycling Companies

- MRO Centers

- Pyrolysis Plants

- <li>Tire-Derived Fuel (TDF) Producers</li> <li>Rubberized Asphalt Producers</li> <li>Cement Kilns</li>

- By Region

- North America (U.S., Canada, Mexico)

- Europe (U.K., Germany, France, Italy)

- Asia-Pacific (China, India, Japan, South Korea)

- Latin America (Brazil, Argentina)

- Middle East & Africa (UAE, Saudi Arabia, South Africa)

Table of Content

- Executive Snapshot

- Market Overview

- Key Market Trends

- Key Success Factors

- Market Demand Analysis 2019 to 2024 and Forecast, 2025 to 2035

- Market – Pricing Analysis

- Market Demand (in Value or Size in USD Million/Billion) Analysis 2019 to 2024 and Forecast, 2025 to 2035

- Market Background

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Cutting Speed

- High-capacity (more than 50 tires/hour)

- Low-capacity (fewer than 50 tires/hour)

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Motor Power

- Above 5 HP

- 3 HP to 5 HP

- Below 3 HP

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By End Use

- Tire Recycling Companies

- MRO Centers

- Pyrolysis Plants

- Tire-Derived Fuel (TDF) Producers

- Rubberized Asphalt Producers

- Cement Kilns

- Market Analysis 2019 to 2024 and Forecast 2025 to 2035, By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

- North America Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Europe Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Asia-Pacific Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Latin America Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Middle East & Africa Market Analysis 2019 to 2024 and Forecast 2025 to 2035

- Region wise Market Analysis 2025 & 2035

- Market Structure Analysis

- Competition Analysis

- Eldan Recycling A/S

- CM Shredders

- ECO Green Equipment

- SSI Shredding Systems, Inc.

- Granutech-Saturn Systems

- Shred-Tech Corp.

- BCA Industries

- Twin Shaft Shredders

- Barclay Roto-Shred

- Untha Shredding Technology

- Wanrooe Machinery Co., Ltd.

- Zhengzhou Yuxi Machinery Equipment Co., Ltd.

- Assumptions and Acronyms Used

- Research Methodology